Fourth stimulus check news summary: Friday 30 April

News and information on the third stimulus check in President Joe Biden's coronavirus aid package, as well as updates on a potential fourth check. Friday 30 April 2021.

Show key events only

US stimulus checks: latest news

Headlines:

- Boosted by stimulus and vaccine roll-out, US economy accelerates in first quarter of 2021

-Democratic representative Alexandria Ocasio Cortez claims stimulus checks 'almost didn't happen'

- Seventh batch of IRS stimulus check payments takes total amount to 163 million, or about $384 billion of spending

- American Families Plan provides boost to Child Tax Credit (full story)

- No mention of fourth stimulus payments in Biden's Congress speech (full story)

- Biden confirms Child Tax Credit extension through 2025

- US consumer confidence jumped to a 14-month high after stimulus check boost

- You can track your third stimulus check by visiting the IRS' Get My Payment portal

- Stay across all the US vaccine news(live blog)

- US covid-19: 32.34 million cases / 575,921 deaths (live updates from Johns Hopkins University)

Scroll through some of our related articles:

Where is my Golden State Stimulus check? How to claim and track in California

California's Franchise Tax Board is distributing stimulus checks of $600 or $1,200 to eligible residents of the state.

Track your stimulus check with Get My Payment

A reminder that you can track your third stimulus check if it hasn't yet arrived by going to the IRS' online Get My Payment portal.

Does the American Families Plan include new stimulus checks?

The latest instalment of the Build Back Better Plan will extend the direct payments in the Child Tax Credit but there's no fourth stimulus check yet.

What is Biden’s plan to forgive up to $10,000 in student debt?

Student debt reached 1.56 trillion dollars in 2020. Just over half of student debt is held by people under thirty-nine, and people between eighteen and twenty-nine owe nearly a quarter.

One of the first actions Biden took when he came into office was to extend the suspension of principal and interest payments on student debt to 1 October 2021.

Forgiving student debt is broadly popular, with a recent survey showing that around 58% of the public in support. President Biden has stated that he supports debt forgiveness and is considering canceling up to $10,000 worth of student debt per borrower through executive action.

Some political analysts were surprised that Biden did not mention student debt during his first address to Congress this week. The speech focused primarily on two major legislative proposals the administration has sent to Congress, the American Jobs Plan and the American Families Plan. While the American Families Plan does not call for debt cancellation, it would provide two years of free community college to students in the United States.

Read more.

"Canceling $50,000 in studentdebt would erase the entire debt burden for 84% of people."

Calls for Biden to cancel student debt continue to grow. The President has said he is looking into canceling up to $10,000 through executive order.

What does Biden's $2.3 trillion infrastructure plan include?

A new poll from Mammoth finds that 2 in 3 support Biden's multitrillion-dollar infrastructure plan. Republicans are opposed to the proposal but have stated that they are still willing to negotiate a more “traditional infrastructure bill.” Additionally, President Biden has proposed to pay for the plan, in part, by increasing the corporate tax rate, which also received high support in the polling.

A study from the Federal Reserve Bank of New York looking at how stimulus check recipients used their additional income has published their findings. The research team examined rates of spending, saving, and paying down debts and found that savings increased as more checks were sent.

"As the economy reopens and fear and uncertainty recede, the high levels of saving should facilitate more spending in the future. However, a great deal of uncertainty and discussion exists about the pace of this spending increase and the extent of pent-up demand."

Basic Figures on Spending, Saving and Paying Debts

First Check: Spring 2020

-Spend: 29.2%

-Save: 36.4%

-Pay Debt: 34.5%

Second Check: January 2021

-Spend: 25.5% -- decrease compared first check

-Save: 37.1% -- small increase compared to the first check

-Pay Debt: 37.4% -- increase compared to the first check

Third Check: March 2021

-Spend: 24.7% -- decrease compared to first and second check

-Save: 41.6% -- increase compared to first and second check

-Pay Debt: 33.7% -- decrease compared to first and second check

Read the full study here.

$600 Golden State Stimulus in California: what's the deadline to file taxes and claim it?

The California Policy Lab released a report this week that concluded that up to "2.2 million eligible Californians are caught in the federal Stimulus Gap." The gap refers to residents who do not earn a high income high enough to require that they submit a tax return. The missed payments for this group could total more than 5.7 billion dollars. To read more on how the federal government could fill this gap, read the full report here.

Low-income Californians should make sure that they have completed the necessary paperwork to receive a Golden State Stimulus check if they are eligible. Read our story for information on how to claim the benefit.

Biden Tax Plan VS Trump's: What new credits and breaks are being proposed?

During President Biden’s first joint address to Congress this week, he outlined the next set of legislative proposals he has sent to lawmakers. Two proposals, in particular, the American Jobs Plan and the American Families Plan, include changes to the US tax code that could impact millions of families in the United States.

Republican support for these initiatives is scarce as the proposals call to reverse many of the tax cuts passed under President Trump. The two parties have different theories of change regarding taxation, with Republicans believing that lower taxes on the wealthiest earners and businesses help them employ more people and grow their operation.

However, with millions across the country slipping into poverty during the pandemic, Democrats are pushing to increase the corporate tax rate to pre-Trump level and increase taxes for individuals making more than $400,000 a year to cover the costs of their proposals.

Learn more about the differences here.

$600 Golden State Stimulus in California: what's the deadline to file taxes and claim it?

Earlier this month California Gov. Gavin Newsom confirmed that the first wave of Golden State Stimulus checks would be sent out from the middle of April onwards and many are reporting that theirs have already arrived. For the majority of recipients eligibility will depend on 2020 tax returns, provided the filing is made before a deadline.

The tax filing deadline is particularly important for this round of payments because you risk missing out entirely if you don't get your returns filed in time. The payment schedule will also let you know if your payment has gone missing or if it is still being processed.

US offers most generous stimulus checks throughout the pandemic

When the first large-scale economic relief bill, the CARES Act, was signed at the very start of the pandemic it included a $1,200 stimulus check payment for eligible Americans. This form of direct support has been a mainstay throughtout the pandemic with a $600 payment in January and $1,400 third stimulus check agreed last month.

Through two different administrations the US federal government has sent out direct payments on a scale not matched by any other country in the world, as is made clear here by Vox journalist Dylan Matthews.

Stimulus checks spur record-breaking growth

The IRS has made more than 163 million stimulus check payments since the American Rescue Plan was signed into law seven weeks ago and the impact on the economy is already clear to see. The $1,400 direct payments were more targetted than previous rounds with the intention of getting the money to people who are likely to spend it.

That seems to have been the case with a 4.2% rise for consumer spending while the third stimulus checks were being distributed. Not only that but income levels rose at record-breaking pace with a 21.1% increase in March alone.

'Boring' Biden draws a smaller audience

President Biden's first address to a joint session of Congress, often referred to as a State of the Union address, was largely free of the histrionics of his predecessor and fewer people tuned in for it then any of the recent Presidents' first address.

But despite Biden's understated style there were some major announcements on Wednesday with the unveiling of the American Families Plan for the first time. Included in the $1.8 trillion package was funding to extend the Child Tax Credit through 2025.

$3,600 Child Tax Credit: how will it be affected by Biden's American Families Plan?

On Wednesday evening President Joe Biden gave his first address to a joint session of Congress since entering office. The speech, coming on the eve of his 100th day as President, celebrated some of his early successes and outlined his plans for the future.

Key amongst the new announcements was a first look at the American Families Plan (AFP), which is the third instalment of his three-part Build Back Better programme. The AFP aims to provide greater support for working families and represents a marked change in government policy.

There was no mention of a fourth stimulus check, but Biden did announce a significant extension to the new Child Tax Credit provision.

What is in the American Families Plan?

In his first address to a joint session of Congress, President Biden outlined the contents of the third part of his Build Back Better programme; the American Resuce Plan. The $1.8 trillion package will be paid for using a combination of tax increases for the wealthiest Americans and greater funding for the IRS, which is expected to bring in an additional $700 billion in tax revenue.

The new plan included, amongst other things, a significant extension to the Child Tax Credit system which would see the programme last through 2025.

Does the American Families Plan include new stimulus checks?

The key news from Biden's speech on Wednesday was a first real look at the American Families Plan, the spending package that Biden hopes will provide a much-needed support network for working families. The $1.8 trillion package is the third part of Biden’s three-pronged Build Back Better plan, which provides an ambitious base for his presidency.

The new Child Tax Credit will be extended by the new proposal, but many were watching to see if Biden would include a fourth stimulus check in the new announcement.

Biden explains the reason for stimulus spending

In an interview with MSNBC's Criag Melvin, President BIden outlined his thoughts on federal spending after announcing his latest economic package, the American Families Plan. The AFP takes the total cost of federal spending under Biden past $6 trillion, a figure that has some worrying about how it will be funded.

But Biden maintained that the stimulus spending is off-set by the economic benefits that it will reap, and pointed to the American Rescue Plan as proof. The third round of stimulus checks alone is anticiapted to cost over $400 billion, but recent studies show that they spurred a 9.8% increase in the retail sector.

American Families Plan will provide "relief and peace of mind"

The latest installment of the Build Back Better programme, the American Families Plan, was announced on Wednesday evening in Biden's address to Congress. The $1.8 trillion plan will provide a 5-year extension on the new Child Tax Credit system and aims to provide a much-needed safety net for American families.

Sen. Bennet speaks to MSNBC about the Child Tax Credit

One of the most vocal supporters of the new Child Tax Credit programme has been Sen. Michael Bennet, a Democrat who has pushed for additional support for families for years. Here, speaking to MSNBC, he discusses the benefits of the direct payments and the extension included in the American Families Plan.

Golden State Stimulus checks to arrive this weekend

It has been two months since California Gov. Gavin Newsom announced the passage of his state-wide covid-19 relief bill, the Golden State Stimulus plan. The package was designed to provide immediate support for individuals and businesses who were particualrly sturck by the covid-19 pandemic.

Included in the bill was a round of $600 stimulus checks for low-income residents. After initially struggling to organise the distriution effort the payments are expected to begin landing in bank accounts from this weekend.

Will $3,600 Child Tax Credit arrive with third stimulus or fourth?

President Joe Biden announced the third part of his Build Back Better plan on Wednesday with the official unveiling of the American Families Plan. Despite lawmakers urging to make the changes to the Child Tax Credit for 2021 permanent, Biden will have to settle for a temporary extension for now.

Families are eagerly waiting for the monthly direct payments, which were included in the American Rescue Plan, to be introduced as part of the 2021 Child Tax Credit. The legislation set the target of July for the new payment system to be up and running, but there are concerns that while the IRS focuses on stimulus check distribution the Child Tax Credit may be delayed.

What is in the American Families Plan?

On Wednesday evening President Biden gave his first address to a joint session of Congress, during which he outlined his administrations immediate plans and long term goals. While there was no mention of a fourth stimulus check, he did use his speech to announce details of the American Families Plan.

The family-focused relief bill is part of Biden's Build Back Better programme and will provide a variety of new federally-funded initiatives. One big inclusion was the extension of the new Child Tax Credit, which is due to begin in July. Initially the Child Tax Credit expansion was just a 12-month proposal but that will now be extended through 2025.

Biden announces tax hikes for wealthiest 1%

While he was trying to find Republican support for the American Rescue Plan, President Biden was repeatedly warned that his stimulus spending proposal were too expensive. GOP lawmakers said that he would be forced to raise taxes to pay for the stimulus checks, Child Tax Credit, etc., but on Wednesday he announced details of his plan to cover the costs.

He will be sticking to his campaign pledge to not raise taxes for anyone earning less than $400,000 per year and has reserved tax increases for the wealthiest 1%. In fact, he has proposed a tax cut for those earning less than $75,000 which will ensure they pay no income tax on their 2021 earnings. This means that no one who received the full $1,400 from the third stimulus check would be required to pay income tax.

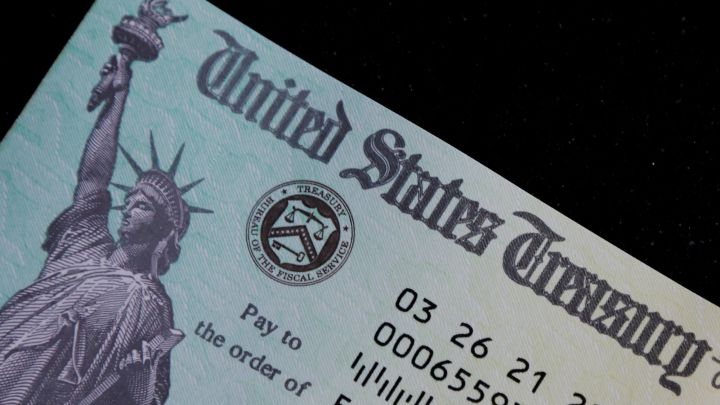

Next wave of stimulus check payments are on the way

The IRS has confirmed that they have sent out another wave of roughly two million stimulus check payments, which are due to land in bank accounts this week. The vast majority of these payments will be the 'plus-up' stimulus checks for people who were underpaid in the past.

These supplementary payments will continue for the rest of 2021 as the IRS works its way through the backlog of tax returns, some of which date back to 2019.

Many Republican voters agree with Joe Biden - 'trickle-down economics' has failed

A majority of Americans support measures favoured by President Joe Biden to substantially redistribute U.S. wealth, according to an Ipsos poll for Reuters released on Thursday, including tax hikes on the wealthy and a higher minimum wage.

The national opinion poll also found that Republican voters were divided over the "trickle-down economics" championed by their party's leaders since President Ronald Reagan some 40 years ago.

In his speech to Congress on Wednesday night, Biden attacked trickle-down economics as an idea that has never worked. The poll was conducted after the speech.

The theory, which asserts that tax breaks and other benefits for corporations and the wealthy will benefit everyone else, has been fiercely debated since Reagan made it a centerpiece of his economic strategy in the 1980s.

Domestic travel key to bars and restaurants making a comeback

Head of Bar Rescue Jon Taffer speaks to Bloomberg about plans afoot to boost the industry

What has the IRS said to do to claim a missing stimulus check and when it's coming?

If you have missed out on a previous stimulus check or are still waiting for the third, time is running out to take action so you can get the money.

What is in the American Families Plan?

The major legislative announcement to come out of Wednesday’s speech was the first official details of the American Families Plan, which includes a variety of spending initiatives and tax cuts aimed at benefiting low- and middle-income families.

It is thought that the AFP will cost around $1.8 trillion, with $1 trillion in new spending and around $800 billion worth of tax credits. Key inclusions will be a $225 billion investment in subsidised child care to support women in the workforce, as well as $225 billion for a paid family and medical leave programme.

Around $200 billion will be put towards a variety of education initiatives, such as providing free preschool for five million children in low-income families.

To pay for the extensive proposal, Biden will forward an additional $80 billion of federal funding to the IRS to help enforce tax checks. The White House estimates that this could bring in an additional $700 billion from high earners and corporations that evade taxes. There will also be an increase to the marginal income tax rate for the wealthiest 1% of Americans, raising it from 37% to 39.6%.

Biden proposals boost global stock market

Biden proposed the sweeping new $1.8 trillion plan in a speech to a joint session of Congress on Wednesday, pleading with Republican lawmakers to work with him on divisive issues and to meet the stiff competition posed by China.

He also made an impassioned plea to raise taxes on corporations and rich Americans to help pay for what he called the "American Families Plan" in his maiden speech to Congress.

He has also proposed nearly doubling the tax on investment income, which knocked stock markets last week.

Stephen Dover, Franklin Templeton's chief market strategist in California, said the effect of the tax package on markets is hard to measure for now.

"If it passes, I think it will have an impact on individual stocks that will pay a higher rate of tax or companies with founders who will pay capital gains and could sell stocks," he said.

Two million more $1,400 stimulus payments to arrive this week

The Treasury Department said in a statement that a total of 163 million stimulus payments have been issued so far worth roughly $384 billion

Full report via Forbes

Dollar set for 4th weekly drop

The U.S. dollar skidded toward a fourth straight weekly decline against a basket of major peers on Friday, as the Federal Reserve stuck to its message of ultra-low interest rates for longer.

The dollar index was on course to end the week 0.2% lower, bringing its losses for April to 2.8%. A four-week losing streak would be the longest since the six-week slide to the end of July, and the monthly loss would also be the biggest since July's 4% slump.

Will there be a fourth stimulus check? What did Biden say in his address to Congress?

In his first 'State of the Union' speech the President outlined plans to extend the Child Tax Credit, but fell short of announcing a fourth direct payment.

$3,600 Child Tax Credit: how will it be affected by Biden's American Families Plan?

The expanded CTC will provide monthly payments for millions of families and the one-year duration looks likely to be extended by the new economic package.

US stimulus checks live updates: welcome

Welcome to our live stimulus-checks blog for Friday 30 April, bringing you the latest news on a possible fourth stimulus check, as well as up-to-date information on the third round of direct payments, which is a part of President Joe Biden's $1.9tn covid-19 relief bill.

We'll also provide info on other measures included in the aid package, such as enhanced unemployment benefits and the expanded Child Tax Credit, which gives households with children up to $3,600 per child dependent.