Fourth stimulus check news summary: Saturday 1 May

Information and updates on the $1,400 third stimulus check in President Biden's coronavirus relief package, and news on a possible fourth check. Saturday 1 May 2021.

Show key events only

US stimulus checks: latest news, Saturday 1 May 2021

Headlines:

- Around 163 million third stimulus checks now sent out, at a total value of around $384bn

- Over 730,000 'plus-up' stimulus checks distributed as part of latest IRS payment run

- American Families Plan proposes extension of expanded Child Tax Credit through 2025 (full details)

- Biden makes no mention of fourth stimulus check in speech to Congress (full story)

- Golden State Stimulus payments going out in California (when will mine arrive?)

- Stimulus checks boost consumer spending in US

- Change.org petition for recurring stimulus checks surpasses 2 million signatures

- Track your third stimulus check with IRS' Get My Payment tool

- Follow all the latest US vaccine news (live blog)

- US covid-19: 32.38 million cases / 576,719 deaths (live updates from Johns Hopkins University)

Take a look at some of our related articles:

Paid family leave included in American Families Plan

The US is an outlier among developed nations when it comes to paid family leave. At least 183 countries allow a working mother to take paid time off to be with a newborn or young child. Fathers also receive paid leave in at least 79 countries. However, in the US there is a patchwork of state and company policies. President Biden has called for permanent paid leave to be part of his American Families Plan.

IRS wants everyone to benefit from stimulus programs

People who didn't file a 2019 tax return and don't file a 2020 tax return will miss out on their $1,400 stimulus check and any money due to them from the previous two stimulus checks if they didn't receive those either. Not to mention the raft of tax credits that will be made available to parents and childless low-income workers.

With the IRS' Free File, anyone who earns less than $72,000 can do their taxes for free online.

What ID can I use to cash stimulus checks?

If you want to cash your stimulus check you can do so at banks even where you are not an account holder or member, but you will need to bring ID.

How is $600 Golden State Stimulus check paid? Direct deposit or paper check?

Eligible Californians are receiving a one-time stimulus check of $600 or $1,200 as part of a statewide relief package passed in February. Whether you get your Golden State Stimulus payment via direct deposit or as a paper check in the mail depends on the information you provided when you filed your 2020 state tax return.

Petition for recurring $2,000 stimulus checks surpasses 2 million

Newsweek - An online petition calling for Congress to deliver monthly stimulus checks of $2,000 until the end of the pandemic has now surpassed 2 million signatures, with the goal of hitting 3 million.

The Change.org petition, created by Stephanie Bonin, a restaurant owner in Denver, is addressed to the US House of Representatives and Senate. It asks the two legislative bodies of Congress to pass a bill that allocates monthly recurring "$2,000 payments for adults and $1,000 payment for kids" for the duration of the coronavirus pandemic.

"We need immediate checks and recurring payments so that we can keep our heads above water," the petition read. "Congress needs to make sure that we won't be financially ruined for doing our part to keep the country healthy."

Wall Street bullish despite Biden tax plan

NPR - President Biden wants to raise taxes on corporations and wealthy investors. His top market regulator has promised a tougher approach. And leading Democrats who control Congress are proud adversaries of moguls and money managers.

So, how has the stock market responded?

With a rally that has sent the S&P 500 to an 11% surge in Biden's first 100 days, the best performance by the various versions of the index since Franklin Delano Roosevelt started his first term in 1933, according to an NPR analysis of S&P data.

"The stock market is on fire," says Greg Valliere, chief U.S. policy strategist at AGF Investments. "It has astonished veteran observers, and it may have a ways to go."

Fourth stimulus check: does the American Rescue plan budget for another direct payment?

Biden is pushing for a sweeping change of the American social safety net with $1.8 trillion investment in American families, including more monthly direct payments for parents through 2025.

Rural communities will benefit greatly from new tax credits

Rural communities — both nationally and in most states — will benefit disproportionately from the American Rescue Plan’s temporary expansions of the Earned Income Tax Credit (EITC) and Child Tax Credit. However, the expansions will expire after 2021 if Congress does not extend them.

The EITC and Child Tax Credit are powerful anti-poverty tools, especially in rural (non-metro) communities, but prior to the Rescue Plan they had two major flaws.

The EITC for workers not raising children in the home was extremely small. And 27 million children received less than the full $2,000-per-child Child Tax Credit because their parents earned too little. The American Rescue Plan addressed both of these flaws on a temporary basis.

$1,400 third stimulus check: what is "IRS TREAS 310 - TAX EIP3"?

After President Biden signed a $1.9 trillion relief bill into law, stimulus checks of up to $1,400 began arriving in Americans' bank accounts the following week. For those receiving it through direct deposit they saw the payments identifying reference as "IRS TREAS 310 - TAX EIP3".

When will the IRS finish making stimulus payments?

The IRS has been given until the end of December to send all the payments in the third round of stimulus checks. The agency has already sent out 163 million payments so far, including “plus-up” payments to top up amounts paid to people who were eligible for a larger stimulus check than the one received. At the current pace the IRS looks set to finish the job ahead of schedule.

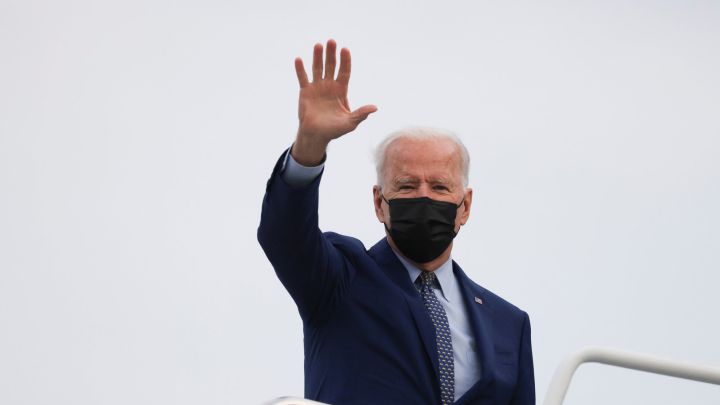

Biden proposed extending payments to families but not stimulus checks

On Wednesday President Joe Biden gave his first address to a joint session of Congress. The key announcement from the evening’s speech was a first real look at the American Families Plan, the spending package that Biden hopes will provide a much-needed support network for working families. The $1.8 trillion package is the third part of Biden’s three-pronged Build Back Better plan, but there was one notable omission: stimulus checks.

Stimulus checks major boost to US household income

US consumer spending rebounded in March amid a surge in income as households received additional covid-19 pandemic relief money from the government, building a strong foundation for a further acceleration in consumption in the second quarter.

Consumer spending, which accounts for more than two-thirds of US economic activity, increased 4.2% last month after falling 1.0% in February, the Commerce Department said. The increase was broadly in line with economists' expectations.

The government's generosity and expansion of the covid-19 vaccination program to include all American adults is lifting consumer spirits, with a measure of household sentiment rising to a 13-month high in April.

SALT tax break may delay stimulus bills

The state and local tax deduction, or SALT tax break allows people to deduct payments like state income and local property taxes from their federal tax bills. Previously unlimited, the deduction was capped at $10,000 as part of the 2017 Tax Cuts and Jobs Act, which was President Donald J. Trump’s main domestic achievement.

However, the move also struck many Democrats as punitive, because its greatest impact was felt by a very specific kind of taxpayer: People who live in heavily Democratic areas. Now lawmakers from states that were most affected by the cap in deductions are calling for it to be repealed as part of the Biden administrations next stimulus bills.

When are the plus-up payment coming? Is it separate from the third stimulus check?

Tax Day has been pushed back, but many in the US have already filed, knowing that their 2020 income would make them eligible for larger stimulus payments. Given that the $1,400 stimulus checks were approved in the middle of the 2021 tax season, the IRS sent out a third stimulus check before they had time to process taxpayers’ 2020 returns.

For those who are but are now eligible for a larger amount based on their recently-processed 2020 tax return, the IRS is sending out supplementary 'plus-up' payments

What to do if "Your tax return is still being processed" message appears

The IRS has processed 105 million tax returns this tax season and sent out over 77 million refunds to tax payers so far. However, with the IRS stretched to the limit this year you may need to be patient if you are still waiting for your refund.

Full lowdown on what to do if "Your tax return is still being processed" message appears

What is Biden’s plan to forgive up to $10,000 in student debt?

Student debt reached 1.56 trillion dollars in 2020. Just over half of student debt is held by people under thirty-nine, and people between eighteen and twenty-nine owe nearly a quarter.

Biden has made statements publicly supporting the cancellation of up to $10,000 in student debt through executive action… when could it happen?

Biden Tax Plan VS Trump's: What new credits and breaks are being proposed?

During President Biden’s first joint address to Congress this week, he outlined the next set of legislative proposals he has sent to lawmakers. Two proposals, in particular, the American Jobs Plan and the American Families Plan, include changes to the US tax code that could impact millions of families in the United States.

To get the US economy back to pre-pandemic levels Biden plans to implement new tax credits and reverse some of the tax cuts passed under President Trump.

$3,600 Child Tax Credit: how will it be affected by Biden's American Families Plan?

On Wednesday evening President Joe Biden gave his first address to a joint session of Congress since entering office. The speech, coming on his 100th day as President, celebrated some of his early successes and outlined his plans for the future.

Key amongst the new announcements was a first look at the American Families Plan (AFP), which is the third instalment of his three-part Build Back Better programme. The AFP aims to provide greater support for working families and represents a marked change in government policy.

Although he didn’t mention sending Americans a fourth stimulus check, he did propose extending the Child Tax Credit for an additional four years. The expanded Child Tax Credit will provide monthly payments of up to $300 for millions of families.

Buffett credits stimulus with bringing back US economy

Warren Buffett said on Saturday that the US economy is faring far better than he might have predicted early in the coronavirus pandemic and that the improvement is benefiting his conglomerate, Berkshire Hathaway Inc (BRKa.N).

Speaking at Berkshire's annual meeting, Buffett said the economy has been "resurrected in an extraordinarily effective way" by monetary stimulus from the Federal Reserve and fiscal stimulus from the US Congress.

"It did the job," Buffett said, adding that 85% of the economy is running in "super high gear."

The annual meeting was held in Los Angeles, where the 90-year-old Buffett joined Berkshire's 97-year-old vice chairman Charlie Munger, to answer more than three hours of shareholder questions.

Berkshire scrapped for a second year its annual shareholder weekend in its Omaha, Nebraska, hometown, an extravaganza that normally attracts around 40,000 shareholders. Saturday's meeting was broadcast on Yahoo Finance.

Many of Berkshire's dozens of operating units have been rebounding as anxiety over covid-19 lessens, more people get vaccinated, stimulus checks are spent, business restrictions are eased, and confidence about the economy grows.

IRS tax deadline advice

With the 17 May deadline fast approaching, the Inland Revenue Service has published some guidance notes if you are struggling to pay your taxes by then.

Does the American Families Plan include new stimulus checks?

On Wednesday President Joe Biden gave his first address to a joint session of Congress, an occasion traditionally used to outline the priorities of an incoming administration.

As has been the case for much of the first 100 days of Biden’s presidency he focused on bold spending proposals with an agenda to fundamentally change American society.

The key announcement from the evening’s speech was a first real look at the American Families Plan, the spending package that Biden hopes will provide a much-needed support network for working families. The $1.8 trillion package is the third part of Biden’s three-pronged Build Back Better plan, but there was one notable omission: stimulus checks.

Will Gittens brings you all the latest news and how that could affect you.

Stimulus checks: where do they come from anyway?

If this is a question that you've asked yourself over the last year, you'll probably find the video below rather interesting.

This economy right now, 85% of it is running in a super high gear

It's responded in an incredible way [to fiscal stimulus]

Investing with stimulus

With the $1.9 trillion American Rescue Plan in full flow, some people are considering their options with their checks. This latest policy initiative, vaccine progress and economic developments create winners and losers in the capital markets.

Stimulus checks to individuals represent one of the largest line items, costing approximately $400 billion. Consequently, stimulus checks are likely to provide a one-time boost to the economy, but not nearly enough to create a lasting increase in inflation. Based on the pandemic relief bill passed last March, it is likely that some portion of the stimulus checks will end up invested in equity markets.

Are you looking to invest?

Covid-19 vaccine in the US live updates: India variant, side effects, Pfizer, alcohol after doses...

As well as the huge focus on stimulus payments and how President Biden's adminstration can turn around the economy and lives of every American for the better, vaccinations and health plans must go hand in hand.

Follow all the latest news and developments in our daily live blog.

Did you know that the Emergency Broadband Benefit program, funded by the covid-19 relief bill, begins on 12 May and will provide up to $50 monthly internet discounts for eligible families?

This video explains more.

Corporate tax increases for stimulus bill

Brian Deese, as director of the National Economic Council, plays a critical role in formulating and explaining the Biden administration’s economic proposals. In a call with a small group of journalists on Thursday, he made the case for both the American Jobs Plan and the American Families Plan — and in the process laid out how Democrats can debunk scare tactics about raising corporate taxes.

Regarding President Biden’s jobs plan, Deese argued that there is “a large and well substantiated body of research” that investing in infrastructure is among the best methods to secure long-term economic growth. He urges Americans not to mush Biden’s different plans together. The rescue plan was about immediate needs; the jobs plan is about “sustained productivity.”

Things get dicey when it comes to paying for the investment of trillions of dollars. Rather than explicitly borrowing to pay for the infrastructure plan or to rely on dynamic scoring, the administration settled on a scheme to pay for the eight-year spending over a 15-year time period by raising the corporate tax rate to 28 percent.

Jennifer Rubin looks at how the plan would strengthen tax laws that discourage companies from shifting operations overseas.

Biden's spending needs confidence

President Joe Biden's major public - and prime time - push this week for his sweeping $4 trillion economic agenda was only one piece of the White House push to lay the groundwork to move his agenda.

Behind the scenes, the White House ramped up its bipartisan outreach on Capitol Hill - an expansion of an effort that has been underway since Biden laid out the first piece of that agenda last month, according to a White House official.

During the same week that Biden publicly rolled out the $1.8 trillion final piece of that proposal before a joint session of Congress and made two trips outside of Washington, Biden's legislative affairs and policy teams conducted 110 calls to bipartisan members, chiefs of staff and staff directors, the official said.

Full story from CNN's Phil Mattingly:

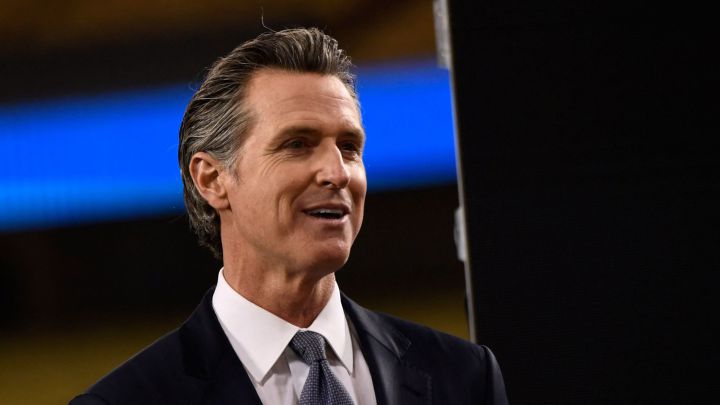

Stimulus sees $6 billion for small businesses: California

California will extend more than $6 billion in tax breaks to small businesses that received federal aid to weather the economic downturn during the coronavirus pandemic.

Gov. Gavin Newsom signed a bill on Thursday that allows business to write off expenses on their state taxes if they were paid for with Paycheck Protection Program loans that were later forgiven, mirroring how the money is treated for federal tax purposes.

“It’s been a hell of a year — the stress, the anxiety, the fear that so many people have had to struggle with,” Newsom said during a signing ceremony at a sushi restaurant in the San Fernando Valley.

Stimulus boost makes front pages

As CNN's Situation Room host, and owner of one of the coolest names in journalism, Wolf Blitzer, highlights, some of the main front pages have been leading with the positive news surrounding economic forecasts.

Spend, spend, spend is the hope and expectation.

Stimulus relief, vaccines, healthcare...

Another reminder, this time from Rep. Veronica Escobar, of the key accomplishments made over the last three months or so by the Biden administration.

Stimulus checks boost consumer spending

US consumer spending rebounded in March amid a surge in income as households received additional covid-19 pandemic relief money from the government, building a strong foundation for a further acceleration in consumption in the second quarter.

Other data on Friday showed labor costs jumped by the most in 14 years in the first quarter, driven by a pick-up in wage growth as companies competed for workers to boost production. The White House's massive $1.9 trillion fiscal stimulus and rapidly improving public health are unleashing pent-up demand.

"While we aren't completely out of the woods yet, today's report shows the beginning of an economic rebound," said Brendan Coughlin, head of consumer banking at Citizens in Boston. "Assuming no setback in the continued rollout of the vaccines, US consumers are well-positioned in the second half of the year to stimulate strong economic growth across the country."

Consumer spending, which accounts for more than two-thirds of US economic activity, increased 4.2% last month after falling 1.0% in February, the Commerce Department said. The increase was broadly in line with economists' expectations.

Personal income boost

The data was included in Thursday's gross domestic product report for the first quarter, which showed growth shooting up at a 6.4% annualized rate in the first three months of the year after rising at a 4.3% pace in the fourth quarter. Consumer spending powered ahead at a 10.7% rate last quarter.

Most Americans in the middle- and low-income brackets received one-time $1,400 stimulus checks last month which were part of the pandemic rescue package approved in March. That boosted personal income 21.1% after a drop of 7.0% in February.

A chunk of the cash was stashed away, with the saving rate soaring to 27.6% from 13.9% in February. Households have amassed at least $2.2 trillion in excess savings, which could provide a powerful tailwind for consumer spending this year and beyond.

The government's generosity and expansion of the covid-19 vaccination program to include all American adults is lifting consumer spirits, with a measure of household sentiment rising to a 13-month high in April.

Stimulus plus: Billy backs Biden business

In case it passed you by late yesterday, actor Billy Baldwin was proud to share a list of the achievements completed in the first 100 days of Joe Biden's presidency.

Check out the IRS' third-stimulus-check FAQs section

If you have any unresolved queries about the third round of stimulus checks, you may find the answer to your question in the FAQs section that the IRS has put together on its website.

You'll find a wide range of infosplit across 10 separate topics such as 'General Information', 'Eligibility and Calculation of the Third Payment', 'Requesting My Payment' and 'Receiving My Payment'.

IRS Questions and Answers about the Third Economic Payment

(Image: www.irs.gov)

Child Tax Credit calculator

Forbes Magazine has created a useful Child Tax Calculator that parents can use to work out how much they are eligible for as part of the expanded scheme, which sees qualifying households get up to $3,600 per child over a 12-month period.

Take me to the Forbes Child Tax Credit calculator

Further reading: American Families Plan provides Child Tax Credit boost

Unemployment benefits: What state has the best payments?

With unemployment benefit amounts ranging widely across states, many are left asking which states provide the “best” benefits for out-of-work Americans.

It's a question whose answer depends heavily on what one defines as “best.” We took a look at three factors: size of the benefit, cost of living, and eligibility period to compare benefits across the states.

How is $600 Golden State Stimulus check paid? Direct deposit or paper check?

Whether you get your Golden State Stimulus payment via direct deposit or as a paper check in the mail depends on the information you provided when you filed your 2020 state tax return.

US unemployment benefits federal tax waiver: how to claim

As part of the $1.9tn coronavirus stimulus bill signed into law in March, qualifying Americans will get a tax break on the first $10,200 of unemployment compensation they received last year.

What ID can I use to cash stimulus checks?

When going to a bank to cash your stimulus check, whether you are a customer of that institution or not, it is important to bring photo ID for the bank to prevent people from cashing checks that were not issued to them. Some banks may require two sets of identification; a good recommendation is to call the branch you aim to visit to check their requirements.

How to claim your missing stimulus check

If you qualified for the first or second stimulus check but did not receive it, you can claim your missing money in your 2020 federal tax return, by seeking what's known as a Recovery Rebate Credit.

Taxpayers who did receive their first or second stimulus check but didn't get the full amount they were entitled to can also use this to claim back the difference in their tax return.

You'll find in-depth information on claiming a Recovery Rebate Crediton the IRS website.

Recovery Rebate Credit: IRS video explainer

The agency has also produced a handy video explaining how to get your first or second stimulus check via a Recovery Rebate Credit:

When will the IRS finish making stimulus payments?

The American Rescue Act gives the IRS until late December to send all the payments in the third round of stimulus checks, but the agency is likely to finish the job before then.

Explore AS English's stimulus checks section

You'll find a wide range of articles providing updates and information on the third round of stimulus checks, a possible fourth stimulus check, the Golden State Stimulus check and more in our dedicated section on direct payments.

What is Biden’s plan to forgive up to $10,000 in student debt?

Biden has made statements publicly supporting the cancellation of up to $10,000 in student debt through executive action… when could it happen?

What to do if "Your tax return is still being processed" message appears

With the IRS stretched to the limit this year, you may need to be patient.

Full lowdown on what to do if "Your tax return is still being processed" message appears

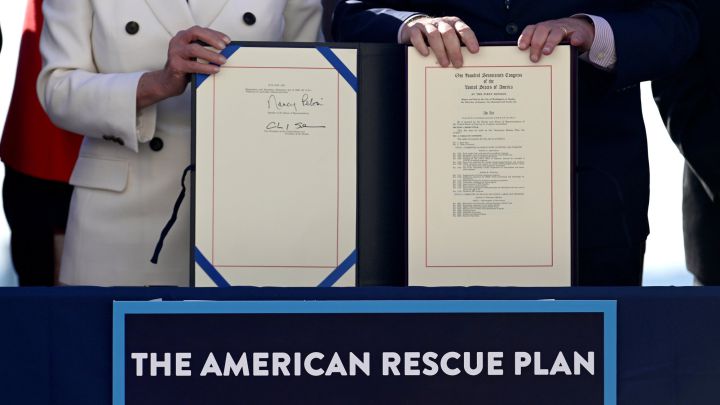

Over 730,000 'plus-up' stimulus checks in latest IRS payment run

The IRS is sending out supplementary 'plus-up' payments to third-stimulus-check recipients who had already got their check, but are now eligible for a larger amount based on their recently-processed 2020 tax return.

In a statement on Thursday, the agency said it had distributed over 730,000 'plus-up' stimulus checks in its latest payment run, at a total cost of around $1.3bn.

Full details on the latest batch of 'plus-up' payments

(Photo: Erin Scott/Reuters)

$1,400 third stimulus check: what is "IRS TREAS 310 - TAX EIP3"?

The third stimulus check is arriving in the bank accounts of direct-deposit recipients with the identifying reference "IRS TREAS 310 - TAX EIP3".

Biden Tax Plan VS Trump's: What new credits and breaks are being proposed?

To get the US economy back to pre-pandemic levels Biden plans to implement new tax credits and reverse some of the tax cuts passed under President Trump.

$3,600 Child Tax Credit: how will it be affected by Biden's American Families Plan?

The expanded Child Tax Credit will provide monthly payments of up to $300 for millions of families and its one-year duration is in line to be extended as part of the American Families Plan.

$600 Golden State Stimulus in California: what's the deadline to file taxes and claim it?

Earlier this month California Gov. Gavin Newsom confirmed that the first wave of stimulus check payments would be sent out from the middle of April onwards and many are reporting that theirs have already arrived. For the majority of recipients eligibility will depend on 2020 tax returns, provided the filing is made before a deadline.

Where is my Golden State Stimulus check? How to claim and track in California

California's Franchise Tax Board is distributing stimulus checks of $600 or $1,200 to eligible residents of the state.

Find out more about who qualifies, how you can claim your payment and when it will arrive

Track your stimulus check with Get My Payment

If your third stimulus check hasn't yet landed, you can track its status using the IRS' online Get My Payment portal.

Does the American Families Plan include new stimulus checks?

On Wednesday President Joe Biden gave his first address to a joint session of Congress, an occasion traditionally used to outline the priorities of an incoming administration. As has been the case for much of the first 100 days of Biden’s presidency he focused on bold spending proposals with an agenda to fundamentally change American society.

The key announcement from the evening’s speech was a first real look at the American Families Plan, the spending package that Biden hopes will provide a much-needed support network for working families. The $1.8 trillion package is the third part of Biden’s three-pronged Build Back Better plan, but there was one notable omission: stimulus checks.

US stimulus checks live updates: welcome

Hello and welcome to our live stimulus-checks blog for Saturday 1 May, as we bring you the latest updates on the third round of stimulus checks - including 'plus-up' payments - and news on a potential fourth direct payment.

We'll also have information on the expanded Child Tax Credit and enhanced unemployment benefits, as well as the Golden State Stimulus payments being distributed in California.

- Joseph Biden

- Coronavirus stimulus checks

- USA coronavirus stimulus checks

- Covid-19 economic crisis

- Child poverty

- Science

- Coronavirus Covid-19

- Economic crisis

- United States Congress

- Unemployment

- United States

- Pandemic

- Coronavirus

- Recession

- Poverty

- North America

- Economic climate

- Virology

- Outbreak

- Infectious diseases

- Parliament

- Employment

- Childhood

- Microbiology

- Diseases

- America

- Medicine

- Economy

- Work

- Social problems

- Biology

- Health

- Politics

- Society

- Life sciences