Fourth stimulus check and child tax credit news summary: 4 July 2021

Updates and information on the third stimulus check in President Biden's coronavirus relief bill, and news on a possible fourth direct payment.

Show key events only

US stimulus check and Child Tax Credit news | 4 July 2021

Headlines:

- IRS reveals that stimulus checks have gone to some earning more than $200,000(Full story)

- Labor Dept confirms US added 850,000 jobs in June, but the national unemployment rate increased slightly

- Two-thirds of Californian residents are in line to receive a $600 stimulus check from the California Comeback Plan Who qualifies & When are payments expected?

- Florida's Freedom Week Tax Holiday will end on Wednesday 7 July, What products are included?

- How will the June unemployment rate affect the likelihood of a fourth stimulus check? (Full details)

Useful information / links

- Child Tax Credit: 2 August is the next deadline to opt out of the monthly payments (Full details)

- Prepare for the monthly payments with the Child Tax Credit Update Portal and Child Tax Credit Eligibility Assistant

- Should you update your tax return information? Find out when to contact the IRS

- Some families may need to file taxes or use the Non-Filer tool to qualify for CTC payments

- Track your stimulus check with IRS Get My Payment tool

Related news articles:

Fourth stimulus check: What was the unemployment rate when the last relief bill was passed?

The Labor Department has recently released the latest employment data for June. The mixed results may strengthen calls for a fourth stimulus check to aid the recovery.

IRS offers CTC online tool

The Internal Revenue Service has launched an online tool for families who may be eligible for Child Tax Return but don't file tax returns.

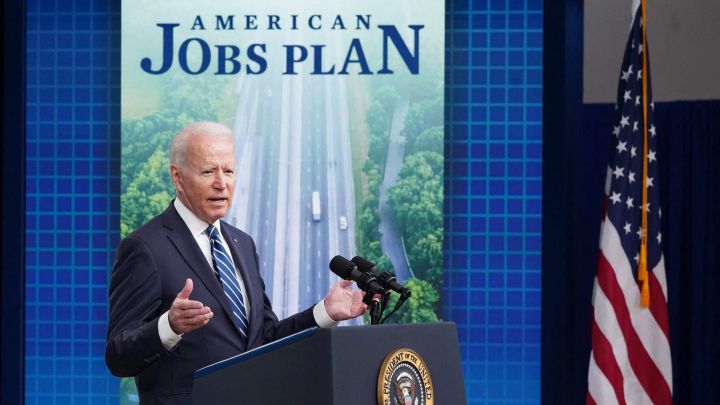

Biden outlines the benefits of the new-look Child Tax Credit

Although the IRS is still yet to make a payment as part of the overhaul of the Child Tax Credit, the White House is very optimistic about the positive impact of the new system. Parents can receive up to $3,600 for children under the age of six, with $3,000 on offer for those aged between six and 17.

It is a huge increase on the previous programme's offer but will only last for a single year unless Biden is able to pass the legislation to extend it. A five-year extension is currently included in the American Families Plan but it has faced tough resistance from some within the Republican party.

High-income individuals get $1,400 stimulus check: Who has received it according to the IRS?

Last week the IRS announced that 163.5 million payments have been made since the American Rescue Plan was signed into law in March, costing the federal government a total of $389.9 billion. The third round of stimulus checks was supposed to provide support for struggling households but the IRS has confirmed that some earning more than $200,000 received a payment.

Why has this happened, and how much of the near-$400 billion in federal spending has gone to high earning households?

$3,000/$3,600 Child Tax Credit: Why might it be beneficial to opt out?

From 15 July the IRS will begin automatically distributing payments worth up to $300 per child to tens of millions of families across the United States.

The payments are part of the reformed Child Tax Credit, included in the recent American Rescue Plan stimulus package. The White House anticipates that the new Child Tax Credit could halve the number of children in poverty over the next 12 months but some may choose to opt out of the monthly payments. Why would they choose to get the money as a single tax credit, and how can you decide how your payments are structured?

The case against more stimulus checks

Despite the fact that they have been a central part of the US' economic response to covid-19, and that they have cost the federal government close to $400 billion, not everyone is convinced about the efficacy of the stimulus checks. This short explainer from Vox outlines some of the benefits and also some of the drawbacks of the stimulus checks.

Child Tax Credit will not affect eligibility for federal benefits

When the new Child Tax Credit system is introduced on 15 July it will represent a considerable windfall for families, with up to $300 per child on offer in the form of monthly payments. But despite the generous payments, it will not affect your ability to claim other forms of federal benefits because the Child Tax Credit is not counted as a form of income.

For more information on the monthly payments, check out this guide on How to prepare for the Child Tax Credit

Fourth stimulus check: What was the unemployment rate when the last relief bill was passed?

New data from the Bureau of Labor Statistics shows that the United States’ unemployment picture has improved slightly in June, which may impact how President Biden chooses to negotiate the next stage of the country’s economic recovery.

But while more than 850,000 jobs were added during the month, there is concern that the national unemployment rate actually rose slightly to 5.9%. Will that apparant stagnation of the economic recovery be enough to convince Congress that more support is needed, and perhaps to approve a fourth round of stimulus checks as some economists have suggested.

Need more information about the Child Tax Credit?

The new-look Child Tax Credit is set to begin from 15 July but some families are still unsure about exactly what the new system will provide. Essentially, it will see parents of those aged below six receive a monthly payment worth up to $300 per child, with $250 for children aged between six and 17.

Still waiting for a stimulus check or tax refund payment?

The IRS has been under intense pressure throughout the pandemic, administrating many of the federal relief programmes designed to help support Americans through covid-19. However after such a busy 15 months it was recently announced that the IRS is still working through a backlog of around 35 million unprocessed tax returns.

Understandably this has led to a delay in some other areas, with stimulus check distribution and tax refunds suffering in particular. If you want to track the status of your payments, use the IRS' app, with full details below...

Child Tax Credit 2021 on July 15th: how to prepare with the eligibility assistant

From 15 July the IRS will be sending monthly payments for the new-look Child Tax Credit. For the next six months eligible families we be sent a payment of up to $300 per child, a far-cry from the previous system. The remaining balance of the annual credit will be claimed and sent with the taxpayer’s refund next year.

However some may choose to save up all the payments so they can get a single tax credit at the end of the year to reduce their tax bill. Here's everything you need to know about opting out of the monthly Child Tax Credit payments.

US stimulus spending pushes global consumption

Although they were introduced in part to provide short-term relief for struggling Americans, the three rounds of stimulus checks passed to date have also had a huge impact on the country's spending power. Designed to 'stimulate' the economy, the checks have been shown to have had a positive effect on spending patterns over the last 15 months.

This has left the United States playing a key role in the global post-pandemic recovery. While most sections of the economy were brought to a grinding halt last spring, the influx of cash from the federal government is getting it back up and running.

The decades-long road to the expanded Child Tax Credit

In a special report courtesy of CNN, Rep. Rosa DeLauro outlines the long journey she has undertaken to see the new CHild Tax Credit system introduced later this month. From 15 July the programme will see an estimated 88% of children receive a monthly payment of up to $300. The move is expected to halve the number of children in poverty over the next 12 months.

As it stands the direct payments are only set to last for six months, although there already plans in place to see it extended. President Biden has included a measure to extend the new Child Tax Credit through 2025 in his American Families Plan, opting to prioritise it over another round of sitmulus checks.

Restaurant Revitalization Fund winds up

The Biden administration has ended a federal program that provided aid for restaurants hurt financially during the covid-19 pandemic after high demand depleted funds, leaving nearly two-thirds of eligible applicants without assistance.

Read the full report from USA Today

Central banks looking for stimulus exit strategies

According to a report in Bloomberg, central banks worldwide are starting to look into how to rein in the emergency stimulus measures put in place during the height of the covid-19 pandemic. In the US, the Federal Reserve has announced plans to slow its asset-purchase drive while Brazil, Mexico, Turkey, the Czech Republic and Russia have increased interest rates.

The EU and Japan are likely to keep providing aid, the report states, but even in those economies there is a wary eye on the spread of the Delta variant and a recent shift toward risk-averse policy.

Read the full story

Pennsylvania gets tax credit scholarship boost

Pennsylvania’s funding cap for tax credit scholarships got the single biggest boost in program history when lawmakers approved an annual budget last week, according to a report in the Pittsburgh Post-Gazette.

The compromise comes after Republican leaders negotiated a plan that prioritizes education spending and saves three quarters of the state’s $10 billion in economic stimulus and tax surplus for future projected deficits.

Aside from a $300 million increase to basic education funding, the educational improvement tax credit (EITC) program got a $40 million infusion of cash to provide an extra 13,000 scholarships for students seeking a private education.

Read the full story

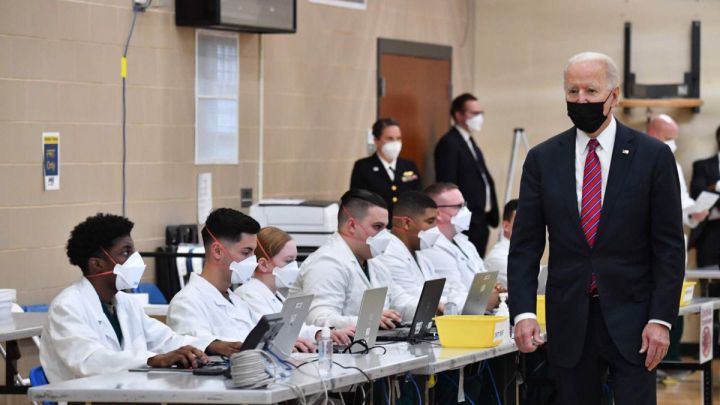

Biden misses Covid-19 vaccination target

At the start of April, President Biden set a target to have 70% of all Americans over the age of 18 fully vaccinated by Independence Day on 4 July. Those words came after his promise to have 100 million doses administered within his his first 100 days in office was successfully achieved.

A couple of weeks ago, the White House recently acknowledged that the 70% mark would probably be missed. Today, according to CDC data,172,941,345 US adults over the age of 18 have had at least one dose of the vaccine (67%) but the figure for adults who are fully vaccinated stands at 150,038,726 - 58.1%.

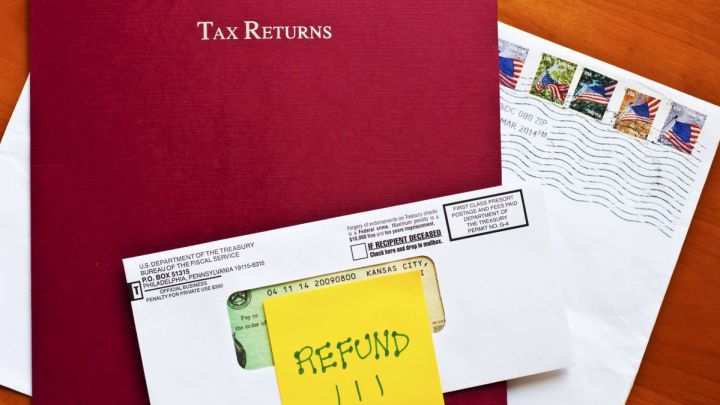

Average 2020 tax refund was almost $3,000

Americans received an average tax refund of $2,827 for the past tax year (2020), according to a new report from the National Taxpayer Advocate (NTA). The IRS received around 148 million individual returns during the 2021 filing season, which started on 12 February and ended on 17 May. The report noted that 35 million tax returns required manual processing.

There was an increase of 8% in the number of individual income tax returns received during the 2021 filing season, compared to the 2018 filing season. That increase could be attributed in part to tax returns filed by taxpayers who typically have no filing requirement but who filed tax returns this filing season so they could receive their economic impact payments.

Was the stimulus package really a 'blue state bailout'?

When New Jersey’s tax revenues plummeted once the state shut down to stop the spread of the coronavirus, Gov. Phil Murphy pleaded with then-President Donald Trump and Senate Republicans for help.

“State and local aid is a huge game-changer,” Murphy said last August.

But those pleas were ignored, as Trump said he opposed sending help to “Democrat-run states and cities that have suffered greatly through bad management” and Senate GOP Leader Mitch McConnell of Kentucky called the request nothing more than a “blue-state bailout.”

Jonathan Salant investigates for NJ.com

Budget boost for tax credit scholarships

Pennsylvania’s funding cap for tax credit scholarships got the single biggest boost in program history when lawmakers approved an annual budget last week.

The compromise comes after Republican leaders negotiated a plan that prioritizes education spending and saves three quarters of the state’s $10 billion in economic stimulus and tax surplus for future projected deficits.

Aside from a $300 million increase to basic education funding, the educational improvement tax credit (EITC) program got a $40 million infusion of cash to provide an extra 13,000 scholarships for students seeking a private education.

Christen Smith brings you more.

Don't fall for Child Tax Credit scams

Thieves are using the Advance Payments of the Child Tax Credit as bait to get people to give up their personal information.

Take two minutes to watch this video where the IRS explain what to watch out for.

Stimulus petition edges closer to three million target

Almost three million people have collectively signed online petitions calling for another round of US stimulus payments.

"We need immediate checks and recurring payments so that we can keep our heads above water," Stephanie Bonin, one of the larger petitions' creators told Newsweek.

Bonin's petition is called "$2000/month to every American #moneyforthepeople #covid19" and is directed at the House and Senate. Some Democrats in Congress have urged President Joe Biden's administration to push for a fourth round of checks.

Five smaller petitions on change.org for monthly checks have also gained traction over the past month, according to Newsweek.

Jobs recovery stalls, and big questions asked

The pandemic has had a very uneven effect on American society with some people now finding themselves in a more comfortable position that they were at the start of 2020. Currently the labour market is fairly tight, meaning that those looking for jobs have a lot to choose from as businesses around the country are looking to reopen.

Because of that imbalance between the ‘supply’ and ‘demand’ of the jobs market, employed Americans are feeling confident enough to leave their jobs in search of something better. In June the monthly rate of people voluntarily leaving their jobs rose from 164,000 to 942,000. These people would then be classed as unemployed, distorting the figures slightly.

Or that, at least, is President Biden's hope as doubts pile in.

Millennials respond over stimulus checks

The article from the New York Times below quickly had the targeted readers responding with their thoughts.

Here, Detroit-based journalist Tatiana Walk-Morris says the government relief doesn't come close to being the solution for many.

Stimulus and benefits not the answer for millennials

Many millennials were thrust into adulthood circa 2008, during what was, at the time, the worst economic downturn since the Great Depression. Then, barely a decade after that meltdown, the coronavirus pandemic cratered commercial activity and sent unemployment soaring. With savings tapped out and retirement accounts drawn down, this generation is experiencing déjà vu, along with fresh worry that their window for achieving financial security in retirement has already begun to close.

Many dread the thought of starting from scratch - whether it’s replenishing an emergency fund or retirement account. Others simply don’t know where, or how, to begin.

It can be daunting for anyone to recover from a financial hit. Younger workers have the advantage of time to rebuild savings and retirement accounts, but they also have lower earnings - and many also have student loan debt. But there are a number of steps people can take - no matter their current financial situation - to get back on track.

Martha C White has some useful advice to help you get through this.

Talking of stimulus...it's July 4th!

From information on fireworks displays and parades, to shops and banks opening hours, to historical facts you may not know.

We provide you with a selection of useful articles related to Independence Day in the US...

IRS walk you through Child Tax Credit changes

As any regular, or even occasional follower of this feed knows more than most, there have been some significant changes to the Child Tax Credit under President Biden's administration.

These will benefit many families as they receive advance payments starting very soon.

In this short video, the experts talk you through what you should know.

Global stimulus approaching its end game

Central banks are starting to tip-toe away from the emergency stimulus they deployed to fight the pandemic-driven global recession.

A report from Bloomberg considers the next steps.

Slashing child poverty with expanded Child Tax Credit

July 15, 2021, could wind up being one of the most important days in the history of American anti-poverty policy. On that day, most parents in the United States will begin receiving monthly checks of up to $300 per child — no strings attached.

What’s technically happening: The child tax credit (CTC), a policy that has existed in some form since 1997, has been expanded, both in its size (going from $2,000 per child per year to $3,000 for children ages 6 through 17, and $3,600 for children under 6) and in its reach.

But calling this a “tax credit expansion” makes it seem less momentous than it is. It’s really a one-year test of an idea known as a child allowance, a policy that has been adopted in most rich countries besides the United States.

Dylan Matthews reports for Vox on the upcoming changes.

Child Tax Credit scammers: know what to watch for

If you are expecting to receive a Child Tax Credit or tax refund from the IRS, it may be worth checking out their anti-fraud advice linked below.

With the federal government dishing out hundred of billions of dollars in various pandemic-era financial relief programmes, unscruplous criminals are looking to get between you and your money.

What are the reasons for the increase in the unemployment rate in June?

On Friday the Labor Department released their new unemployment report, which addresses the state of the US jobs markets as well as tracking the post-pandemic recovery.

From the outset the findings appear to be a bit of a mixed bag for President Biden, who has placed so much emphasis on rebuilding the American economy during his first six months in office.

Get more details on the background to the job announcement.

Stimulus payments: tips and 'how to' advice.

The American Rescue Plan was signed into law back in March but the $1.9 trillion stimulus bill still has more financial relief programmes to come. On 1 July a new system giving unemployed Americans free or extremely discounted health insurance went live to boost the Affordable Cares Act.

On 15 July the new Child Tax Credit will begin sending out monthly payments to an estimated 39 million American families. The payments will be worth up to $300 per child and there are already efforts in place to extend it beyond its initial 12-month duration.

Where's my tax refund from the IRS?

With the tax authority struggling to work through a busy filing season, millions of Americans are being forced to wait longer than normal for the tax refunds to arrive. The IRS advised all filers to utilise e-filing when completing their 2020 tax returns but even those who used the online system are experiencing delays.

If you are still waiting for yours, why not try the IRS' Where's My Refund? online portal? Simply enter the required details on the help page and you will see the status of your payment.

Free health insurance for unemployment recipients: eligibility and how to get it

Today is Independence Day, and also the fourth day from which recipients of unemployment benefits in the United States will be eligible for zero-premium healthcare plans with little or no financial outlay required.

The unemployment financial aid will be provided through the Affordable Care Act (ACA) marketplace, which recently survived a Supreme Court challenge from a number of Republican-led states. The new cost-free programme was included in the $1.9 trillion American Rescue Plan, signed into law by President Biden.

Will Gittens brings you all you need to know.

Enhanced Child Tax Credit: Sen. Bennet answers your questions

Although there is less than two weeks to go until the IRS starts sending out monthly payments, many families are still unsure about what the reformed Child Tax Credit would mean to them. To help straighten out any confusion, Democratic Sen. Michael Bennet has hosted a webinar on the upcoming payments.

Bennet said of the new programme: “This means direct monthly help to cover groceries, for a college fund, maybe even a summer camp, and we want to make sure everyone eligible for the monthly benefits receives them."

Fourth stimulus check: who in Congress is supportive?

The White House appears intent on pushing for a new large-scale infrastructure bill and is also aiming to extend the new Child Tax Credit. However many lawmakers are still convinced that a fourth round of stimulus checks is required to keep the covid-19 recovery going.

This article from CBS lists some of the attempts made by Democrats in Congress to push Biden to consider introducing another round of direct payments.

Will unemployment benefits be extended after June rates show no change?

On 2 July, the Bureau of Labor Statistics has released information showing that the June unemployment rate held steady at 5.9%.

The American Rescue Plan included a measure that would allow for the sending of federal pandemic-related unemployment benefits through 6 September 2021. After a lackluster jobs report for April, moderate job growth in May, and a plateau in the unemployment rate in June, some look to the September deadline and wonder if it should be moved back.

While the slow job growth could be caused by the economy’s inability to absorb all workers who lost their jobs throughout the pandemic, there are a few other reasons as well.

Maite Knorr-Evans reports.

Stimulus checks live updates: welcome

Hello and welcome to our live stimulus checks blog for today, Sunday 4 July 2021. And a Happy Independence Day to you and yours!

We'll be bringing you updates on a possible fourth direct payment, in addition to the latest information on the third round of checks, which has seen around $395 billion go out to eligible people in the US.

As well as this we'll be providing news on other economic-aid schemes such as the expanded Child Tax Credit, which will see monthly payments of up to $300 distributed to qualifying households and details of economic aid for Californians on low-to-middle incomes in the proposed new state budget.

Basically, everything you need to know, we have you covered.

- Coronavirus

- Recession

- North America

- Economic climate

- Virology

- Outbreak

- Infectious diseases

- Diseases

- Microbiology

- America

- Joseph Biden

- Medicine

- Economy

- Biology

- Health

- Life sciences

- Coronavirus stimulus checks

- USA coronavirus stimulus checks

- Covid-19 economic crisis

- Science

- Coronavirus Covid-19

- Economic crisis

- United States

- Pandemic