Fourth stimulus check | news summary for Friday 9 July

Latest news and information on the third stimulus check in President Biden's coronavirus relief bill, and updates on a potential fourth direct payment.

Show key events only

US stimulus checks live updates

Headlines:

-Wells Fargo will discontinue major personal credit options in the next two months (full details)

-Biden reaffirms his commitment to make the expanded Child Tax Credit permanent. (Full details)

-Department of Labor will hand out $43 million in grants to help train dislocated workers. How to claim the benefit.

-More than 2.5 million people have signed online petition in favour of a fourth stimulus check (full story)

-Two-thirds of California residents to receive a $600 stimulus check after the California Comeback Plan was passed by state legislature: who is eligible and what do you need to do to get one?

Useful information / links

-As of 1 July, millions are eligible for tax credits to reduce the cost of health insurance. Find out more.

-Child Tax Credit: We took a look at the question, is the web portal the best way to apply, what other options do I have? (details)

- You have until Monday 2 August to opt out of the August round of Child Tax Credit monthly payments (find out more)

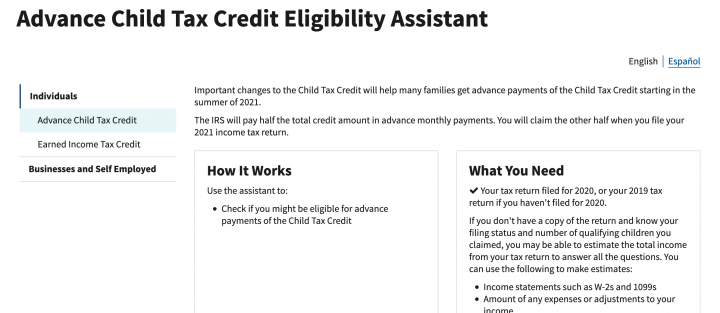

- How to use the IRS's two new online tools; the Child Tax Credit Update Portal and the Child Tax Credit Eligibility Assistant

- Should you update your tax return information? Find out when to contact the IRS

Take a look at some of our related news articles:

Child Tax Credit: online IRS tools

A reminder that the IRS has set up a series of useful online tools for claimants of the expanded Child Tax Credit, as the agency prepares to begin sending out advance monthly payments of up to $300 per child.

The Child Tax Credit Eligibility Assistant allows American households to check whether they qualify for the scheme, while the Child Tax Credit Update Portal enables them to provide and update bank details, check whether they’re enrolled for advance payments, and unenroll from advance payments.

Meanwhile, Americans who don’t file a tax return can claim their CTC by accessing the Child Tax Credit Non-filer Sign-up Tool.

(Image: www.irs.gov)

$3000/$3600 Child Tax Credit: Will President Biden extend it to 2025?

As the US climbs out of the covid-19 depression, Joe Biden is trying to secure both the recovery of his nation and his legacy as President. Coupled with the unemployment benefits, that for many are soon to end in many states, the expanded Child Tax Credit is one of Biden's main weapons in his arsenal to get the country back on its feet.

And while it has been confirmed for the 2021 fiscal year, there is some doubt over whether President Biden can convince his political opponents to support the credit through to his target of 2025.

How much were the first, second and third stimulus checks and when were they sent out?

Since the beginning of the coronavirus pandemic, three federal stimulus checks have been distributed to qualifying Americans.

We take a look at the direct payments approved in April 2020, December 2020 and January 2021.

Fourth stimulus check: What was the unemployment rate when the last relief bill was passed?

Last week the Bureau of Labor Statistics released the United States’ unemployment data for June, which may impact how President Biden chooses to negotiate the next stage of the country’s economic recovery.

The White House has been eager to point out that more than 850,000 jobs were added during the month, but there is concern that the national unemployment rate actually rose slightly to 5.9%. The state of play in the jobs market may impact whether Biden opts to pursue additional relief spending, and could affect chances of a fourth stimulus check.

What will the new Child Tax Credit do?

There is huge optimism amongst Democrats about the positive impact that the expanded Child Tax Credit payments could have once they are introduced next week. From 15 July an estimated 39 million eligible families will receive a monthly payment worth up to $300 per child dependent.

Rep. Alexadria Ocasio-Cortez has highlighted the benefits of the new programme in this video, describing the new Child Tax Credit as "the largest anti-poverty programme in a generation."

High-income individuals get $1,400 stimulus check: Who has received it according to the IRS?

The IRS is continuing to distribute payments as part of the third round of stimulus checks, a process that is expected to continue for the rest of 2021. As the national effort continues were are starting to get an overview of how it has gone

The tax authority have confirmed that 163.5 million payments have been made since the American Rescue Plan was signed into law in March, costing the federal government a total of $389.9 billion. But the report also shows that many high-earners have received a stimulus check payment, but will they have to pay it back?

Economic growth may reduce the need for further stimulus

The federal reserve have revealed that they may be reducing the level of financial stimulus as the US continues to show relatively positive numbers in its economic recovery. Since the start of the pandemic various federal schemes like the batch buying of bonds have been used to provide impetus to the pandemic-ravaged economy.

The more optimistic outlook may also have implications for the prospects of a fourth stimulus check, something that President Biden has been reluctant to comment on in recent months. While many feel like another stimulus check would provide vital short-term support Biden is thought to be concentrating on other legislative priorities.

When will my IRS tax refund arrive?

The tax authority has been under intense pressure throughout the pandemic to oversee a number of programmes designed to provide financial support. The three rounds of stimulus checks have been followed by the introduction of the new Child Tax Credit system, giving the IRS little time to cover their more traditional tasks.

As such there is currently a backlog of 35 million unprocessed tax returns, which is leading to substantial delays in the distribution of tax refunds. For more information on the state of play with outstanding refunds, National Taxpayer Advocate Erin Collins has the latest.

How quickly is the US economy recovering from the pandemic?

The United States is on track to see the largest economic expansion in decades, according to Bloomberg. Economists are projecting that the economy will grow by "6.6%, the second-best year since 1966."

Michigan Vaccine Lottery: how to enter and sign up

Michigan Vaccine Lottery

Michigan's vaccine lottery is in full swing with a $50,000 drawing happening daily through 4 August and the $1,000,000 giveaway happening on 11 July. Read our full coverage for details on how to register.

How would the infrastructure package impact the cost of utlitites?

In an interview with CNBC, Jay Rhame, CEO of Reaves Asset Management, described the infrastructure bill as a "positive catalyst" for the utility sector. Rhame is pleased that the bipartisan infrastructure package, unveiled in June includes funding for power grid reliance, and for EV charging infrastructure.

The investments in "clean energy" were described as a major upside for the sector and applauded the tax credits for wind and solar that were included. The financial expert highlighted that the price of wind and solar has decreased around 75% over the last decade and that today "they are the cheapest sources of new power anywhere in the country."

Interesting in learning more about President Biden's initiative to remove all lead pipes from houses and public facilities? Bloomberg Law has you covered.

After announcing yesterday that the infrastructure package could be brought to the Senate for a vote in late July, roadblocks are making August seem more likely.

That’s why the American Rescue Plan was designed to help people not just all at once, but over the course of a full year so we could continue supporting families, small businesses, state and local budgets to help them weather those ups and downs.

And now that the economy is back on track, we’re making progress on the second phase of our strategy: ensuring long-term growth.

That’s what my Build Back Better agenda, including my Americans Family Plan and the bipartisan infrastructure agreement we reached last month — that’s what they’re all about: long term.

Can other states extend pandemic payments like Maryland has done?

Can other states extend pandemic payments like Maryland has done?

Lawsuits have been filed in four of the 26 states that decided to end federal unemployment programs before they expire 6 September. So far, judges in Indiana and Maryland have placed temporary restraining orders on those states ordering them to continue the payments.

Will more follow? Read our full coverage to find out.

Sec. Pete Buttigieg, who leads the Department of Transportation, continues his media tour promoting the bipartisan infrastructure proposal that should come to a vote in the Senate in the coming weeks.

New York State Controller, Thomas DiNapoli highlighted that incomes in the state have risen above pre-pandemic levels... with one catch... much of the increase came from stimulus checks. Since the direct payments aren't reoccurring there is no way for them to sustainably increase income - once the money is spent, its gone.

Are states using funds from the American Rescue Plan to cut taxes?

The Institute on Taxation and Economic Policy released a blog yesterday calling on states to avoid making cuts to "underfunded services," to provide tax cuts to wealthier residents.

Policy Analyst Marco Guzman highlighted efforts in states like Arizona, Ohio, and North Carolina where lawmakers have or plan to implement "regressive tax cut packages." These pieces of legislation would deprive governments of the revenue needed to "shore up investments in education, infrastructure, and importantly, boost opportunities for those hit hardest by the economic and health crisis."

What is a regressive tax?

A regressive tax is a description used when changes to the tax code or the way taxation is done place a disproportionate burden on low-income earners. As the tax is applied across the board, regardless of income, poorer people will pay more as a percent of their income, compared to wealthier individuals.

Why is Wells Fargo is shutting down all of its existing personal lines of credit?

Why is Wells Fargo shutting down all of its existing personal lines of credit?

Wells Fargo, one of the largest banks in the US, faced backlash by consumers and policymakers this week over their move to “close down all existing personal lines of credit in coming weeks and has stopped offering the product,” CNBC reports.

This news comes as the financial giant tries to rebuild its image after a major account scandal rocked the organization in 2016. The bank was found to have been pressuring branch workers to open more accounts, leading to over 3.5 million fake accounts between 2002 and 2017.

Read our full coverage to find out when the credit will be discontinued.

Bloomberg reports that after the third stimulus check was sent, many Millennials spent at least part of their payment on Pokémon cards.

According to the NOAA, the eight major climate disasters this year, each of which has "caused over $1 billion in damage."

This fact is bolstering the case for some Democrats who would like to see more spending to ensure that America's infrastructure is more resilient in the face of severe weather.

How have teenagers been impacted by doing school from home during the pandemic?

A new survey by the New York Times found that 72% of teens "teenagers reported struggling with their mental health during the coronavirus pandemic."

The survey was conducted by America's Promise Alliance, an organization focused on helping children access the conditions " achieve adult success."

The high rate of mental fatigue and illness could relate to the fact that almost sixty percent "reported learning entirely or mostly online in the 2020-21 school year, and 22 percent said that they had learned about half online and half in person."

Read the full story here.

IRS reminds families with children to file a 2020 tax return to ensure the agency has the information it needs to send payments associated with the Child Tax Credit.

The first payments worth $250 for children between the ages of 6-17 and $300 for children under 6, go out the door on 15 July.

Lower health insurance costs are possible with the American Rescue Plan

Lower health insurance costs are possible with the American Rescue Plan

To help those who lost their jobs, lawmakers included provisions in the American Rescue Plan to make health care more affordable. According to healthcare.gov, the trillion-dollar spending bill widened the eligibility to receive government support for covering the cost of insurance.

Additionally, those who purchased insurance through the Marketplace “may qualify for more tax credits,” which could help bring down the cost for families who may be experiencing financial hardship.

Read our full coverage for more about the eligibility requirements and details on how to apply.

How has the number of unemployment claims changed since the pandemic began?

Initial Claims

Initial claims increased slightly by 2,000 during the first week of July to 373,000.

Insured Unemployment Rate

For the week ending on 26 June, the insured unemployment rate fell a tenth of a percent to 2.4%.

The total number of claims made during this week was "3,339,000, a decrease of 145,000 from the previous week's revised level." This is down very significantly from the April high where more than 18 million workers were claiming insurance benefits.

Read the full report here.

Schumer tells Dems summer recess might have to wait

In a letter to congressional Democrat colleagues House Majority Leader told them that:

“My intention for this work period is for the Senate to consider both the bipartisan infrastructure legislation and a budget resolution with reconciliation instructions, which is the first step for passing legislation through the reconciliation process.

"Please be advised that time is of the essence and we have a lot of work to do. Senators should be prepared for the possibility of working long nights, weekends, and remaining in Washington into the previously-scheduled August state work period."

Not stimulus but could mean more money in your pocket

President Biden is set to sign a sweeping executive order on Friday targeting internet operators and tech giants.

The executive order seeks to encourage competition among service providers by giving customers better information about companies’ service, restricting early termination fees and ban exclusivity. "That lack of competition drives up prices for consumers. As fewer large players have controlled more of the market, mark-ups have tripled,” the White House said in a statement.

Full details at CNN

Moratorium protecting homeowners and renters set to expire

The federal moratorium on evictions and foreclosures is set to expire at the end of this month, which doesn't leave much time. Agencies are scrambling to get help to those who need it before the clock runs out. The American Rescue Plan set up a $46 billion fund to helprenters and a $10 billion fund to helphomeowners. To seek help those in need can check with the Consumer Financial Protection Bureau to get more information.

Roughly 20 percent of tax returns yet to be processed

Underfunded and understaffed after a decade of budget cuts the IRS has been doing a herculean task in 2021. The agency has sent out two rounds of stimulus checks, set up a monthly direct payment system, and has been recalculating tax returns already filed to take into account tax changes mid-tax-filing season, all on top of processing some 136 million tax returns so far.

However, there are still around 36 million the IRS still needs to process before this year's workload is finished.

Watch out for scammers as Child Tax Credit payments approach

The IRS regularly sends out warning about crooks that want to get their hands on taxpayers' data. With the agency about to send out millions to around 39 million families its picked up the pace.

Schumer will push forward with dual infrastructure bills

When the Senate gets back the upper chamber will have a week to work through the details of the $1.2 bipartisan infrastructure bill if it is to go to the floor for a vote the week of the 19th.

It appears that Senate Majority Leader Chuck Schumer will keep the upper chamber especially busy planning to go forward with a reconciliation bill as well that would include what Democrats couldn’t get their Republican colleagues to sign on to and more.

Fast food and restaurant workers to strike 20 June

The current minimum wages is $7.25 per hour, and has been since 2009 despite inflation. For perspective, a worker earning minimum wage working 40 hours per week, 52 weeks a year brings home $15,080. The US poverty threshold is $12,880 for an individual, $17,420 for a family of two. According to the Bureau of Labor Statistics around 1.5 million earned the US minimum wage or less in 2019.

A living wage for the sake of the nation

Nir Kaissar from Bloomberg opines on why business and government need to work to ensure that every worker makes a living wage.

"While Congress and the White House wrangle over spending on infrastructure and social programs, the most pressing problem for the U.S. remains little acknowledged and unaddressed: Tens of millions of people work full time and can’t afford food, clothes, housing, health care and a proper education for their children. Their struggle is sowing division, fanning political and social tensions, and raising doubts in many Americans’ minds about the merits of capitalism and democracy.

$3000/$3600 Child Tax Credit: Will President Biden extend it to 2025?

With the credit scheduled to begin July 15, the Biden administration will face plenty of challenges in achieving their long-term aim of extending it to 2025.

AOC and Schumer raise awareness about the Child Tax Credit

House Majority Leader Chuck Schumer and Representative Alexandria Ocasio-Cortez along with Representative Jerry Nadler were trying to inform people about the 2021 Child Tax Credit. Advance payments on the tax credit will begin 15 July to those who are signed up. Anyone who filed a 2020 tax return or has used the IRS Non-filer tool over the past year are automatically registered to receive the payments if they choose.

The concern is that many families who aren’t required to file taxes due to their low income will not get into the program, one of the key targets for the revamped credit. Studies have shown that it could cut childhood poverty in half for 2021, and beyond if it is extended. The expansion of the tax credit will expire at the end of the year if no action is taken.

Not just New York needs infrastructure to confront climate change

As tropical storm Elsa moves up the East Coast, it’s leaving misery in its wake with drivers stranded on flooded streets and subway riders wading through waist deep water. The West Coast is bracing for another heatwave on its way for the weekend and into next week with temps 25 degrees higher than average. The previous wave brought 116-degree temps to Portland where it melted streetcar powerlines.

Chicago faces its own climate challenges. Although it seems like a place relatively save from climate change, its location which made it such a prosperous city also puts it at peril. Lake Michigan is beginning to experience dramatic changes in the level of its waters. Whether the water is too high or too low, the city will need major infrastructure work to handle more extreme weather events.

Check out the problems that Chicago faces at the New York Times.

Child Tax Credit, an investment in the future

The Internal Revenue Service will begin sending out advance payments on the 2021 Child Tax Credit in less than a week. Those that wish to wait and receive the credit as a lump sum can unenroll, however it is too late to stop the July payment. Whether you choose to wait or receive the advance payments on half the credit and collect the remainder next year with your tax return there is the question of what to do with the extra money.

While many families will find the extra monthly cash helpful to cover expenses, those that can afford to put the money aside for their child’s future may want to consider some options. Putting the money in an account for college, perhaps retirement or in an estate.

Find out what you can do atMarketWatch.

If you got a $1,400 stimulus check, then you'll receive Child Tax Credit automatically

If you received a $1,400 stimulus check, then the IRS all has the necessary information it needs to include you in the new Child Tax Credit scheme, as pointed out by Sen. Debbie Stabenow.

While the American Rescue Plan only temporarily increased the child tax credit, Stabenow said she hoped the enhanced benefit would become permanent: “This is not a permanent change, but I’m hoping that there’ll be so much support and people will see the benefits of it, that we’re going to be able to extend it and eventually make it permanent."

Help available today and tomorrow in Philadelphia to obtain child tax credit and stimulus payments

There are great resources available this Friday and Saturday in Philadelphia offering help to those who don’t normally file taxes to obtian Child Tax Credit payments and Economic Impact Payments.

Congressman Dwight Evan has tweeted the details...

NH senator says "more needs to be done" to get missing stimulus checks out to those still waiting

With several Americans still waiting to receive their third stimulus check, New Hampshire Senator Maggie Hassan has written a letter this week to IRS Commissioner Charles Rettig, in which she calls for more to be done to get those pending payments out.

“It is clear, though, that more needs to be done. I have heard directly from Granite Staters who have yet to receive their third Economic Impact Payment, despite being told that they are eligible,” the senator wrote. “The IRS has told constituents who have not received their payments and whose payment status is unavailable on the Get My Payment portal that this is ‘due to a systemic issue.’”

Hassan called on the IRS to “dedicate additional resources to ensuring that remaining Economic Impact Payments are issued as quickly as possible.”

Sec. Marty Walsh pushes bipartisan infrastructure bill

In a tour of Riverside, CA, Secretary of Labour Marty Walsh and Congressman Mark Takano discussed the future of jobs, the bipartisan infrastructure bill and the enhanced child tax credit with workers and community members.

Fox 11 has the full report...

Widespread voter support for infrastructure bill

Crooked Media takes a look at new polls from Data for Progress that show sweeping support for Biden's infrastructure proposal.

Surveyors polled over 1000 voters between June 30th to July 1st, and found that that they "support each individual component of the proposed bill, with notable support across parties."

Some of the measures with the highest amount of support include, "investments in clean energy technologies, power infrastructure to repair our existing energy grid, expansions to broadband access to rural communities, and public transit to expand public transportation options."

AOC praises the new Child Tax Credit

Democrats are clearly very optimistic about the potential of the reformed Child Tax Credit and have been speaking about it publically in the build up to its introduction on 15 July. Rep. Alexandria Ocasio-Cortez is one of those to take to the stage to encourage families to make the most of the upcoming support.

An estimated 88% of American children should be covered by the programme but, as Ocasio-Cortez says here, you must have provided your details to the IRS to trigger the payment. For most people this is done automatically when their tax return is filed, but those who do not file a tax return will need to use the Non-filers tool instead.

Check the status of your IRS tax refund

Anyone still waiting for their tax refund to arrive, and there are plenty of you, can take advantage of the IRS' handy online tool to track their payment. The exceptions circumstances of the last 18 months has left the tax authority with a 35 million tax return backlog, hampering their progress.

If you think you are in line for a tax refund simply use the Where's My Refund? tool linked below to see whether your tax return has been processed and whether your payment is on its way.

IRS child tax credit: is the web portal the best way to apply, what other options do I have?

From 15 July, and for the rest of 2021, the Internal Revenue Service will be sending out monthly direct payments to an estimated 35 million eligible families as part of the new Child Tax Credit. The lucrative new programme will provide up to $300 per child on a monthly basis.

Any parent or guardian who filed their 2020 tax return or used the IRS Non-Filer online tool should be automatically signed up. But if you still haven’t done either you’ll want to take action now, here’s what to do...

Stimulus check live updates: welcome

Hello and welcome to our daily live blog for today, Friday 9 July 2021, bringing you updates on a possible fourth stimulus check in the US.

We'll also provide you with information on the third round of stimulus checks, which began going out in March as part of President Biden's American Rescue Plan, in addition to news and info on other economic-support programs such as the new, expanded Child Tax Credit.

- Joseph Biden

- Coronavirus stimulus checks

- USA coronavirus stimulus checks

- Covid-19 economic crisis

- Science

- Coronavirus Covid-19

- Economic crisis

- United States

- Pandemic

- Coronavirus

- Recession

- North America

- Economic climate

- Virology

- Outbreak

- Infectious diseases

- Diseases

- Microbiology

- America

- Medicine

- Economy

- Biology

- Health

- Life sciences