Fourth stimulus check news summary: 13 August 2021

Latest updates and information on related benefits from President Biden's coronavirus relief bill, and news on a potential fourth stimulus check.

Show key events only

Stimulus check & Child Tax Credit: live updates

Headlines

- Strong jobs recovery in July could impact hopes of a fourth stimulus check (Details)

- An estimated 40 million Child Tax Credit payments are being sent out today, Friday 13 August

- Labor Department confirms one million Americans gained employment last month (Details)

- Will the $3.5 trillion infrastructure package include a fourth stimulus check? (Details)

- Petition for recurring stimulus checks surpasses three million votes (Details)

Useful information / links

- How many people will get the $1,600 tax refund payment? (Find out)

- California Golden State stimulus check, information on payments for those with dependents. (Find out)

- How much can you get from stimulus checks and the Child Tax Credit? (Find out)

- When should I contact the IRS if my tax refund hasn't arrived yet? (Find out)

Take a look at some of our related news articles:

How much were the first, second and third stimulus checks and when were they sent out?

Three stimulus checks have so far been sent out by the US federal government since the coronavirus pandemic began in early 2020.

Biden promises "long-term stimulus" from federal spending

In a white House speech, President Biden promises that the raft of spending measures he is looking to push through would have a significant long-lasting effect on the American economy. In recent weeks there has been growing criticism from Republicans who argue that excessive spending risks overheating the US economy and undoning the progress made during the recovery.

How does the Child Tax Credit work?

In this short informational video for The Recount, documentary filmmaker Griffin Hammond runs through the Child Tax Credit. Although the IRS has sent out the second monthly payment today there is concern that many families are missing out on the support because they are not fully aware of what is on offer.

Are stimulus checks and the Child Tax Credit payments leading to an increase in inflation?

Many conservative policymakers and economists blame the various rounds of stimulus checks and now the Child Tax Credit payments for driving up prices across the country.

Since last June, the Consumer Price Index, which measures fluctuations in price, has increased six percent. This is the largest year-over-year increase in thirteen years. But, many economists monitoring these fluctuations are not shocked, as prices of many goods hit their lowest levels in many years in 2020.

How to request a track for your IRS tax refund

The tax agency is months behind on the distribution of tax refunds for the 2020 financial year, with millions of people thought to be waiting for payments. The ongoing effort to send out stimulus checks and introduce the new Child Tax Credit programme has added substantially to the IRS' workload and some of their more typical responsibilities are being delayed.

If you are still waiting for a tax refund, you can track the status of your payment online by going to the IRS' Where's My Refund? online portal.

Child Tax Credit helps tackle food poverty

A survey from the US Census Bureau found that instances of financial insecurity fell in the six months after families received the first round of Child Tax Credit payments last month. The evidence is good new for those hoping that the programme will be extended next year because it shows that the additional support is paying dividends.

The report from NPR says: "The pandemic has dramatically increased the number of children in the country who experience hunger. According to the nonprofit Feeding America, 13 million — or 1 in every 6 children — don't know where their next meal will come from."

Can Child Tax Credit payments affect my tax return in 2022?

The Child Tax Credit is not considered a form of household income so it will not affect your eligibility for any other federal or state support programmes or any future rounds of stimulus checks. However there are some things you should bear in mind when considering your tax filing for the 2021 tax year, with some families choosing to opt out of the monthly payments in favour of a single end-of-year credit.

Child Tax Credit reduces number of Americans reporting food shortages

Early evidence suggests that the expanded Child Tax Credit is already having the desired affect and is helping families stay above the poverty line. After the first round of payments went out last month, the number of households with children reporting that they sometimes or often did not have enough to eat in the past week dropped by 24%.

According to a recent survey a massive 47% of recipients reported spending their tax credit payment on food. Diane Whitmore Schanzenbach, director of the Institute for Policy Research at Northwestern University, said: “It is great news that the estimated rate of hunger among those with children is at a pandemic low."

IRS Child Tax Credit portal: how can I use it to opt out?

The IRS is sending out the second round of advanced Child Tax Credit payments today, after President Biden's $1.9 trillion stimulus bill implemented a complete overhaul of the programme. The new system sees the money made available in the form of a monthly direct payment for the first time.

However parents can also decide to opt out of this system if they prefer. They will instead receive their full entitlement as a lump sum tax credit at the end of the year and they will avoid the risk of having to repay the money if they experience an income increase before the end of 2021.

Do I need to do anything to receive Child Tax Credit payments?

The White House's official Twitter account is answering some common questions about the new Child Tax Credit, which they are attempting to extend to more families in the coming months. Most eligible families will get their payments automatically but some who do not typically file taxes will have to provide their details to the IRS to trigger the payments.

July 2021 job report: how will this affect stimulus checks?

Last week the Labor Department released their monthly report revealing the number of people to have found work in the US, as well as average hourly earnings. The unemployment rate dropped to 5.4%, a decrease of 0.5% from June. However, there are still 5.8 million fewer jobs compared to February 2020, just before the beginning of the pandemic.

This is good news for the US' economic recovery but how will the positive figures affect the likelihood of a fourth stimulus check?

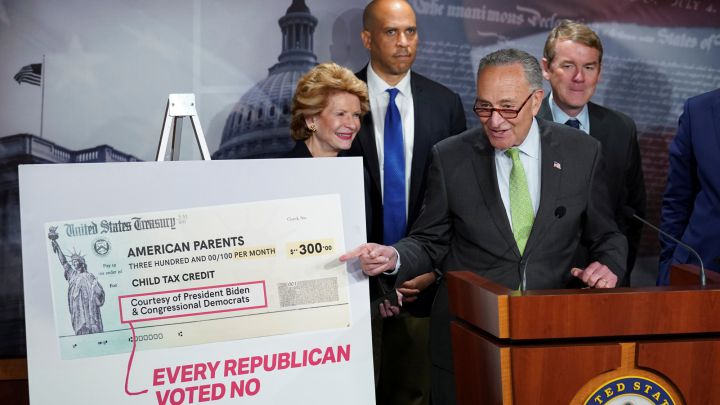

The Hill discusses potential Child Tax Credit expansion

The second round payments went out today but the White House is already making a concerted effort to extend the programme beyond its initial 12-month duration. Progressive Democrats are eager to see an extension included in the infrastructure package but it is facing considerable Republican oppostion.

President Biden reiterated his intention to extend the Child Tax Credit through 2025, in a recent speech from the White House. However he faces a tough task to keep his Senate caucus together throughout the passage of the infrastructure package and cannot afford to lose a single one of his 50 seats.

Second round of Child Tax Credit payments goes out today

On Friday, 13 August the next wave of drect payments for the Child Tax Credit will be sent out by the IRS, with an estimated 40 million households in line for the support. That is a substantial increase on the 35 million who received the first round of payments and reflects the White House's ongoing effort to get more low-income families signed up for the support.

What is behind the Taliban's rapid advance in Afghanistan?

The US is sending 3,000 troops to assist in the evacuation of Kabul as the Taliban step up their assault. The insurgent group has captured the second-largest city in Afghanistan, Kandahar, this morning.

The Afghan army seems powerless to stop the Taliban and there is an expectation that it is only a matter of time before the Taliban conquer the country, prompting the extra number of troops.

The US priority is getting foreign nationals and members of the NATO mission to Kabul airport. This includes thousands of Afghan interpreters who worked for the mission.

Useful video for understanding the history of the Child Tax Credit

Journalist Griffin Hammond has posted a short video to twitter explaining the basics of the Child Tax Credit.

Each family eligible for up to $360 a month depending on the age of their child, but this benefit isn't a new idea. The benefit has been around since the 1990s, but Biden has expanded it during the pandemic.

Do experts believe the Pfizer vaccine is less effective against the Delta variant?

News that the Pfizer and Moderna vaccines are not as effective against the Delta variant as previously thought could threaten the economic growth of the US. A recent study found Pfizer's vaccine was only 42% effective at dealing with Delta. It was more promising news for Moderna, as their vaccine was still 76% effective.

The chances of a new stimulus check are increased the more severe covid-19 gets. It threatens if businesses can stay open and the general economic recovery of the nation, meaning further checks may come in the future if the economy was to worsen.

Number of people access the Child Tax Credit increases for August

The second monthly payment of child tax credits reached the households of nearly 61 million children, the Treasury Department said. That is a 2.7% increase from July, indicating that new sign-ups are outpacing taxpayers’ decisions to opt out of the regular payments.

Find out why it may be beneficial to opt out here.

$3000/$3600 Child Tax Credit: what are the IRS warnings about payment scams?

"Cyber criminals use every opportunity to try to scam people out of money," the IRS has said, "with the Advance Payments of the Child Tax Credit going out to eligible taxpayers, the IRS warns folks to be aware that thieves may use these payments as bait."

The statement says the IRS will never:

- contact taxpayers by email, text messages or social media channels to request personal or financial information,

- leave pre-recorded, urgent or threatening messages,

- ask for payment in the form of giftcards, wire transfers or cryptocurrency.

Make sure you are aware as the money comes into your family's accounts over the next few days.

Can Child Tax Credit payments affect my tax return in 2022?

While some people may be considering to opt out of the Child Tax Credit, don't do so if you think it affects your tax return.

The CTC is not considered an income, so it is not taxable. However, if you do choose to opt out of the next payment, the rest of the CTC will be sent to you as a tax rebate at the end of the financial year.

Round one of Child Tax Credit payments cut hunger rates, data shows

With the second round of the CTC being sent today, a lot of our focus will be on it.

The percentage of American families with kids who report not having enough to eat fell dramatically after the first CTC payments were distributed last month, according to new data from the U.S. Census Bureau.

The government’s finding shows that the monthly payments are having a major and immediate impact on millions of households, potentially bolstering President Joe Biden’s push to extend the tax credit past the end of this year, when it is set to expire.

40 million families to receive Child Tax Credit payments today

The next round of payments as part of the expanded Child Tax Credit is set to be sent out on Friday, with an estimated 40 million households in line for the money. The first round covered 35 million housholds but the IRS has undertaken a major public relations offensive to get low-income families registered for the programme.

Speaking from the White House ahead of the distribution of the second payments, President Biden told those gathered: "The money is a game-changer and, for some, I would argue, a life-saver."

Fourth stimulus check: which entities are pushing for a new payment?

Discussions in Washington are continuing regarding the fate of President Biden’s huge infrastructure proposal but there is one glaring omission from the legislation.

Biden has shown no sign of considering including a fourth stimulus check in the multi-trillion package, opting to favour less direct forms of financial stimulus. However many in Congress and across the United States would like to see another stimulus check and they will retain hope of convincing Biden of the merits.

Child Tax Credit "will put more money in your pocket"

In recent weeks the Biden administration has faced some criticism from Republicans for his ambitious financial policy, which they say risks overheating the recovering US economy. However the President has made clear that he believes that the government intervention will pay dividends for Americans.

In a speech from the White House on Wednesday Biden said that Child Tax Credit payments will help to "put more money in your pocket and make that money go further."

Pandemic unemployment benefits: who will lose aid in September and why?

Throughout the pandemic the federal government has provided various programmes, such as the stimulus checks, to offer additional support for struggling Americans.

The government has also funded additional unemployment compensation programmes to serve the millions of Americans who lost their jobs as a result of covid-19. First introduced in the CARES Act back in March 2020, the pandemic-era unemployment benefits were extended by President Biden a year later.

Where's my tax refund payment?

The IRS is reporting considerable delays in the distribution of tax refunds for the 2020 financial year. The tax agency has been under enormous strain since the start of the pandemic to distribute additional support in the form of stimulus checks and the new Child Tax Credit.

Unfortunately, this has caused delays in their usual work and millions of refunds are yet to be sent. If you are waiting for one, the IRS offers this handy Where's My Refund online tool which allows potential recipients to track the status of their payment.

Pelosi and Waters discuss Child Tax Credit expansion

Earlier today Speaker of the House Nancy Pelosi and Democratic Rep. Maxine Waters were in a school in Los Angeles to talk to families about the prospects of the Child Tax Credit being extended further. Pelosi admits that it may not be possible for the White House to secure a permanent extension of the monthly payments, but maintains that there is little chance of it being removed at the end of its intitial 12-month funding.

This will be a relief for the 40 million families who are expected to receive the second round of Child Tax Credit payments on Friday, 13 August.

Stimulus check news: welcome

Good morning and welcome to our dedicated stimulus check and Child Tax Credit live feed, bringing you all the latest developments from Washington as President Biden celebrates passing his trillion-dollar infrastructure proposal before Congress breaks for summer.

We'll endeavour to stay across all the news and reaction as it happens so that you can find the information you need without having to go searching for it.

- Joseph Biden

- Andrew M. Cuomo

- Recession

- USA coronavirus stimulus checks

- Covid-19 economic crisis

- Science

- Unemployment

- Coronavirus Covid-19

- Economic crisis

- Recession

- Coronavirus

- Pandemic

- North America

- Employment

- Economic climate

- Infectious diseases

- Virology

- Outbreak

- Diseases

- Microbiology

- Medicine

- America

- Work

- Economy

- Biology

- Health

- Life sciences