Child Tax Credit: Can I choose to receive $3600/$3000 rather than $300/$250 per month?

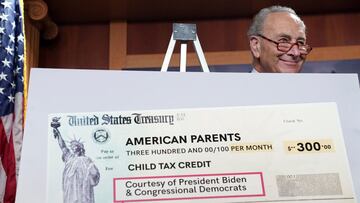

The new credit began on July 15 and will be dispatched in six payments, with the final six months arriving as a lump sum at the end of the tax year.

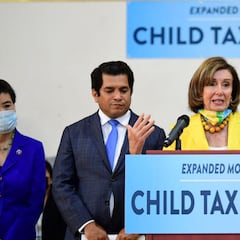

The IRS said more than 35 million families received their first payment of the Child Tax Credit over the weekend. Depending on how much money your family earned in the 2020 tax year, you could be eligible to receive the credit. Per child it is up to $300 a month and there are hopes, and plans, that it will be extended much further than the end of the 2021 tax year.

But can you receive all the money as a lump sum?

Short answer, yes, long answer, no.

Today, help is here. And my Build Back Better Agenda keeps this tax cut for working families in place for years to come.

— President Biden (@POTUS) July 15, 2021

And so I say to my colleagues in Congress: the expanded Child Tax Credit for working families is something we should extend — not end.

How does the system of payments work?

Since July 15 families across America have started to receive the first payment of their credit. For each child under six, those eligible will receive $300 a month, and for children between the ages of six and seventeen, $250 will be sent. There is no limit on the number of children in an eligible family and unless you opted out, it is totally automatic.

This is the system until December, when the last payment will arrive December 15. Families will the need to wait until the end of the tax year before receiving the other half, which will be a lump sum of up to $1,800 per child.

Let's not understate it: the expanded and improved #ChildTaxCredit is a major, historic change.

— Congressman Jamaal Bowman (@RepBowman) July 16, 2021

In my district alone, 124,400 children will benefit from it — more than 75% of our kids.

Visit https://t.co/uwCsSDZeJl for more info and to sign up if eligible!

Is it possible to receive it all as a lump sum?

Technically yes, but not immediately.

If you have opted out of the credits then you are still eligible to claim the rest of the money you are owed at the end of the tax year in April. It will come as a tax refund and it is the only time you can get it as a lump sum. For example, if you opt out today, you would receive up to $3,300 per child as one month, $300, would have already been sent to your bank account.

By opting out of the payments, families may “avoid owing tax to the IRS if you unenroll and claim the entire credit when you file your 2021 tax return.”

This may change if President Biden's plan for the Child tax Credit succeeds. The Democrats want to extend the credits until 2025 and if they are successful in this then the credit will continue to be paid in monthly installments throughout 2022. Alternatively, they can choose to wait and receive the whole credit they are eligible for the following year.

But as of today there is not a way to immediately receive the full amount.

More Child Tax Credit news:

- Will the changes to the Child Tax Credit be extended and made permanent?

- Will the Child Tax Credit prevent a fourth stimulus check?

- Why should some families opt out of the advance 2021 Child Tax Credit payments?

- Why do I get $300/$250 from Child Tax Credit and not $3,600/$3,000?

Why not now?

Related stories

Due to the way the plan is set up, monthly payments can only be distributed in 2021. Also, if your 2021 tax returns are over the threshold for payments you may have to pay the credit back. It would be a risk if the IRS was giving families thousands of dollars in lump sums which it then demanded back in April.

If the President's recovery plan is accepted by congress before the end of the year then the monthly payments would resume, unless your family decides they would rather receive the whole credit.