Fourth stimulus check news summary: 14 August 2021

Latest news and information on related benefits from President Biden's coronavirus relief bill, and updates on a possible fourth stimulus check. Saturday 14 August 2021.

Show key events only

Stimulus check & Child Tax Credit: live updates, Saturday 14 August 2021

Headlines

- IRS sends out $15 billion in the second round of Child Tax Credit payments

- Child Tax Credit roll-out linked to drop in food insufficiency, says US Census Bureau report

- Households with children experience 3% drop in food insufficiency following first Child Tax Credit payment

- Prospect of fourth fourth stimulus check could be affected by July jobs data (Full story)

- Nearly 3m signatures now accrued in petition for recurring stimulus checks (Full story)

Useful information / links

- Will the $3.5tn infrastructure package include a direct payment? (Details)

- How many people will get the $1,600 tax refund payment? (Find out)

- California Golden State stimulus check: info on payments for dependents

- How much can stimulus check, Child Tax Credit recipients get from the schemes? (Details)

- When should I get in touch with the IRS if my tax refund hasn't arrived? (Find out)

Have a read of some of our related news articles:

Some August Child Tax Credit payments to go out as paper checks

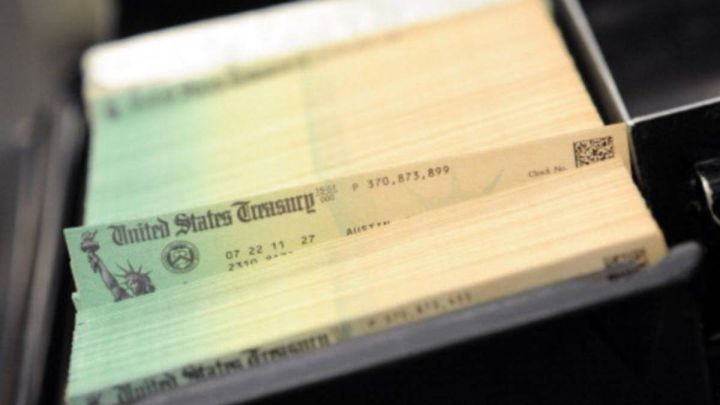

Millions of American families started to receive their advance Child Tax Credit (CTC) payment for the month of August this weekend as direct deposits arrived bank accounts and checks in mailboxes.

The second batch of advance monthly payments, worth about $15 billion, are reaching about 36 million families today across the country. The majority will be issued by direct deposit into recipients' bank accounts.

Some recipients who received direct deposit payments in July will receive the August payments by mail. Due to an issue expected to be resolved by September, a percentage of these recipients – less than 15% – who received payments by direct deposit in July will be mailed paper checks for the August payment. For those affected, no additional action is needed for the September payment to be issued by direct deposit. Families can visit the Child Tax Credit Update Portal to see if they're receiving a direct deposit or paper check this month.

The next payment dates are 15 September, 15 October, 15 November and 15 December.

Pelosi's statement to mark Social Security's 86th birthday

House Speaker Nancy Pelosi issued a statement to mark the 86th anniversary of Social Security, which was signed into law by President Franklin D. Roosevelt on 14 August 1935:

“Eighty-six years ago, both parties came together to make a sacred promise: that after a lifetime of work, every American deserves to retire with dignity and security. Forged in the depths of the Great Depression, this fundamental guarantee has stood as a pillar of economic security, offering peace of mind to millions of hard-working Americans in retirement, with a disability or after losing a loved one.

“As our nation emerges from the pandemic, Democrats remain as committed as ever to defending the transformational progress of Social Security from callous, reckless partisan attacks – as well as strengthening the economic security of American families. That is why we are fighting to enact our Build Back Better agenda, which will deliver more jobs, greater tax cuts and lower health costs for working families. A top priority is to extend the Biden Child Tax Credit, a life-changing victory for families that Democrats secured in the American Rescue Plan and that I often describe as similar to ‘Social Security for children.’

“As Congress advances infrastructure and reconciliation legislation, the House remains committed to realizing the totality of President Biden’s vision, including the essential initiatives that will help us secure a cleaner, stronger, fairer future for all. Today, and every day, let us renew our vow to not only protect Social Security for every generation, but to strengthen the economic security for every family for decades to come.”

At what age are children no longer eligible for the Child Tax Credit?

When the Child Tax Credit was first introduced in 1997 it was simply a single, end-of-year tax credit which allowed families to reduce the size of their tax bill or increase the size of their tax refund. It was provided to eligible households at tax filing time each year and remained largely unchanged until this year.

When the American Rescue Plan was signed into law in March 2021 it brought about the first major overhaul of the Child Tax Credit with monthly payments provided for the first time. But this new structure brought about changes to the age limits which may affect whether or not your familiy is eligible for the support.

Fourth stimulus check: will petitions have an effect on decision-making?

The largest of the fourth stimulus check petitions now has more than 2.76 million signatures, created by restaurant owner Stephanie Bonin. If it reaches 3 million, it will be the largest on change.org. Currently, there are five other ongoing stimulus petitions .

The petition calls on Congress “to make recurring checks automatic if certain triggers are met,” so that people will not have to wait around for the government to act. Those recurring checks would be “$2,000 payments for adults and $1,000 payment for kids."

Biden promises lasting progress from Build Back Better agenda

In recent weeks congressional Republicans have become increasingly critical of the large amounts of federal spending required to fund President Biden's pandemic recovery agenda. The $1.9 trillion stimulus bill in March has been followed by a proposed $4 trillion of spending on two massive infrastructure packages.

However, in a speech from the White House, Biden maintained that the funding is vital to ensure that "it is not short-term stimulus, it's a long-term investment in American families."

US stimulus check: which states are providing their own payments?

Despite calls from progressives within the Democratic Party and from Americans across the country, President Biden has remained unwilling to push for a fourth stimulus check in recent months.

Instead the Biden administration has focused on his infrastructure project, trying to build bipartisan support for the $3.5 trillion package. This proposal includes an extension for the new Child Tax Credit but no fourth stimulus check. With nothing forthcoming from the federal government, some states are choosing to provide their own direct payments for residents.

Do I need to register for the Child Tax Credit?

There is still some confusion about the Child Tax Credit monthly payments, which were first sent out a month ago. Although the vast majority of eligible families will have received the payments automatically, households who are not usually required to file a tax return may have to complete an extra step.

This is because the IRS judges eligibility for the Child Tax Credit on the information provided in tax returns. If they do not have this information then you will need to provide it separately, using the portal below.

IRS Child Tax Credit portal: how can I use it to opt out?

On 15 July the IRS started making payments as part of the reformed Child Tax Credit, which will see parents receive a monthly direct payment for the first time. An estimated 88% of American children will be covered by the expanded programme and it is hoped to halve childhood poverty over the next 12 months.

However parents can also decide to receive the money as a single annual payment if they prefer. They will instead receive their full entitlement as a lump sum tax credit at the end of the year and they will avoid the risk of having to repay the money if they experience an income increase before the end of 2021.

Child Tax Credit payments will cover 61 million children

The IRS have confirmed that the second round of payments has been sent out, with 36 million families having already received the support. The number of children covered represents a tidy increase on the number to have received the first round after the IRS made a concerted effort to register more low-income families in the programme.

Can Child Tax Credit payments affect my tax return in 2022?

The new-look Child Tax Credit overhauls not only the size of the payment on offer but also the way in which the money is distributed. No longer a single end-of-year tax credit, the new programme offers monthly payments for eligible families.

The Child Tax Credit is not considered a form of household income so it will not affect your eligibility for any other federal or state support programmes or any future rounds of stimulus checks. However there are some things you should bear in mind when considering your tax filing for the 2021 tax year.

Second round of Child Tax Credit payments went out on Friday

President Biden confirmed that the IRS would make payments to roughly 40 million American families on Friday, as part of the expanded Child Tax Credit. This represents a sizeable increase on the 35 million who received the first round of payment, suggesting that the IRS has successfully managed to enroll more peopl in the programme.

The White House remains bullish on the impact that the programme will have and the high number of recipient households will be crucial if the programme is to halve childhood poverty, as Biden originally claimed.

How have stimulus checks helped Americans’ cash reserves?

Throughout the pandemic the three rounds of stimulus checks have been amongst the most important, and most expensive, forms of financial support provided by the federal government. By May 2021 the IRS had sent out over $850 billion worth of stimulus checks to eligible taxpayers.

The entitlement on offer for each household depended on their adjusted gross income, with low- and middle-earners getting the majority of the support.

With the cash going to those least likely to have considerable savings, the Center for Retirement Research at Boston College have looked into the affect that the cash infusion has had on Americans’ cash reserves.

Drop in number of households with children that reported food insufficiency

A drop in the number of households with children that reported food insufficiency and trouble paying household expenses may be linked to the child tax credit checks issued last month, according to new Household Pulse Survey (HPS) results.

The Internal Revenue Service last month (July 15) began issuing a monthly Advance Child Tax Credit (CTC) to families with children. About 35 million eligible families received the first monthly payment of up to $300 for each child age 5 and under and up to $250 for each child ages 6 to 17. Payments will continue monthly through December.

Unemployment benefits: will Biden extend the federal payment?

For those relying on the unemployment benefit, what the President decides to do with the payments is very important. The extra payments were first instigated with the CAREs act of March 2020, but the amount has been reduced from $600 to $300 a week. There are many on the progressive wing of the Democrat party who would like to see the payments continue, while Republicans are vehemently opposed to any extension. Back in July, 26 states tried to cut off the federal support early, but many were hit with lawsuits from concerned citizens that forced the payments to continue.

Child tax credit snafu sees August payment delayed for over 4 million taxpayers

If you didn’t get your August advance child tax credit in your bank account today, you’re not alone. Due to “an issue,” a percentage - less than 15% - of folks who got their payment by direct deposit in July will be mailed paper checks for the August payment, according to an Internal Revenue Service news release. Another way to put it: More than 4 million families will have to wait for a paper check. That could be at the end of August. “For those receiving their payments by paper check, be sure to allow extra time for delivery by mail through the end of August,” the IRS says.

Delta gives Democrats a choice to pass more stimulus

President Joe Biden promised a "summer of freedom" as Americans underwent mass vaccination, lockdown restriction were lifted, and the pandemic was put in the rearview.

The Delta variant is challenging that narrative more and more by the day. The only problem is that much of Biden's $2 trillion stimulus in March, designed as another shot of pandemic relief, is set to expire in September. The Biden administration was counting on getting the pandemic under control, but it's far from over — and Democrats on Capitol Hill must make a choice to make on whether to extend some stimulus measures.

Full story via Business Insider

What does the 2020 Census say about the US population?

For the first time in the history of the Census, the number of Americans who identified as white fell for the first time to below 60%. The Census was the first which could be completed through the internet, with the last Census taking place in 2010.

Overall population growth: 7.4% since 2010

US population number: 331 million

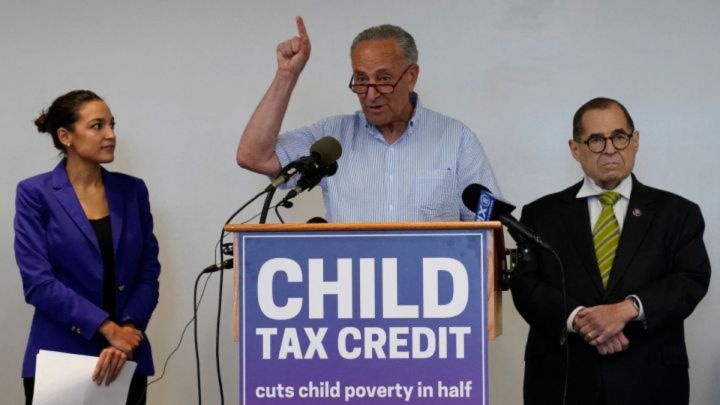

Bipartisan infrastructure bill gains enough votes to pass in US Senate

A $1 trillion infrastructure package that is a top priority for US President Joe Biden secured enough votes to pass the Senate, a victory for the White House and the bipartisan group of senators who spent months negotiating it.

Voting ended 69-30 in favour in the 100-seat chamber. Senate Majority Leader Chuck Schumer hailed the new bill as "the most robust injection of funds into infrastructure in decades".

Child Tax Credit: what is the income limit for joint filers, single filers and heads of household?

Under the Child Tax Credit scheme, parents under the specified income threshold will receive $3,600 for each child under six years old and $3,000 for each child under 17 years of age.

What is the age limit for the Child Tax Credit?

The overhauled Child Tax Credit will provide a monthly payment worth up to $300 per child for those aged younger than six, while children aged between six and 17 will be entitled to a maximum monthly payment of $250.

Dependents aged 18 or over at the end of 2021 will not be eligible for any support from the scheme.

(Photo: Karen Ducey/AFP)

Golden State Stimulus Check: How much will taxpayers with dependents receive?

Californians with dependents are eligible to receive an additional $500 payment as part of a scheme that has been dubbed 'GSSII'.

Fourth stimulus check: will petitions have an effect on decision-making?

Created by restaurant owner Stephanie Bonin, the largest of the stimulus check petitions has more than 2.7 million signatures. If it reaches 3 million, it will be the largest on change.org. Currently, there are five other ongoing stimulus petitions.

The petition calls on Congress “to make recurring checks automatic if certain triggers are met,” so that people will not have to wait around for the government to act. Those recurring checks would be “$2,000 payments for adults and $1,000 payment for kids."

Child Tax Credit payments coincide with drop in reported food insufficiency

The roll-out of the expanded, monthly Child Tax Credit scheme has coincided with a decline in the number of households with children that say they do not have enough to eat, according to research carried out by the US Census Bureau.

In a comparison of the periods of 23 June-5 July and 21 July-2 August, the Census Bureau’s Household Pulse Survey found that there was a 2.6% drop in food insufficiency reported by adults in households with children.

The first batch of monthly Child Tax Credit payments began going out on 15 July. Eligible families are receiving up to $300 a month per child aged below six, and up to $250 a month per child aged six to 17.

Read the US Census Bureau's report in full

(Photo: CHIP SOMODEVILLA/AFP)

Unemployment benefits: Will those fired for not getting vaccinated be eligible for the payments?

Vaccine mandates are becoming increasingly common in corporate America, with workers refusing to get a shot now risking losing their unemployment support.

Child Tax Credit FAQs

You’ll find a useful Child Tax Credit FAQs page on the IRS website.

It has questions and answers on 12 different topics, including eligibility, calculating your Child Tax Credit and updating your information.

Visit the IRS' Child Tax Credit FAQs page

The IRS has also produced this YouTube video explainer on the monthly Child Tax Credit scheme:

Child Tax Credit: other online tools

As well as the Child Tax Credit Update Portal, the IRS has also created a Child Tax Credit Non-filer Sign-up Tool for Americans who do not have to submit a tax return, and the Advanced Child Tax Credit Eligibility Assistant to check whether or not you qualify for monthly payments.

When's the deadline to opt out of September Child Tax Credit payment?

August’s monthly Child Tax Credit has now gone out, but if you want to unenroll from the September payment - and the three that are due to follow it, in October, November and December - you have until 11:59pm EDT on Monday 30 August to do so, the IRS says.

You can opt out of monthly payments by going to the IRS’ online Child Tax Credit Update Portal.

(Image:www.irs.gov)

How are extra unemployment benefits changing in New Jersey and other states?

Extra unemployment benefits are due to end federally on 6 September, but some states will be able to transition their recipients onto a new scheme.

Stimulus checks: every AS English article

In our dedicated stimulus checks section, you’ll find a range of news articles offering updates on a possible fourth direct payment, as well as information on other, similar schemes such as the Golden State Stimulus.

$1 Trillion Infrastructure Bill breakdown: what's in the package?

Needing at least 10 votes from the Republicans to pass the bill through the reconciliation process, the Democrats managed to convince 19 of the GOP to support them. This process should allow the Democrats to pass their larger $3.5 trillion budget plan later this month.

The Infrastructure bill is over 2,700 pages long and includes provisions for improving roads and general infrastructure across the country. Biden had made infrastructure one of his key legislative aims in his presidential campaign. However, only $550 billion of the plan is new investment, to be spent over the next five years.

How much were the first, second and third stimulus checks and when were they sent out?

The US federal government has so far sent out three stimulus checks since the covid-19 pandemic started early last year.

Can Child Tax Credit payments affect my tax return in 2022?

The new-look federal scheme provides monthly direct payments for the first time, but you should be aware of how it will affect your 2021 filing.

Biden: Child Tax Credit a "game changer"

As the second batch of monthly Child Tax Credit payments went out to some 36 households across the US, President Joe Biden described the money parents are receiving as part of the scheme as a “game changer” and a "lifesaver".

“That’s money for diapers, food, rent, school supplies, fees and equipment for a child to join a sports team and dance class,” Biden said.

“Most of all, as my dad used to day, it just gives a parent a little breathing room. The money is a game changer. And so I would argue for some, it’s literally a lifesaver.”

Second Child Tax Credit payment goes out to 36 million households

The IRS says the second monthly payment of the expanded Child Tax Credit was to be distributed to around 36 million families on Friday, with the latest batch of checks amounting to around $15 billion.

The remaining payments dates for the monthly Child Tax Credit are 15 September, 15 October, 15 November and 15 December.

IRS’ full statement on the second batch of Child Tax Credit payments

(Image: www.irs.gov)

Fourth stimulus check: what does the jobs data suggest about a new payment?

Last week's good news about unemployment in the US is bad news for another stimulus check as Biden pivots to other means to help the economy.

Stimulus checks and Child Tax Credit live updates: welcome

Hello and welcome to our live blog for Saturday 14 August 2021, bringing you the latest news on a possible fourth stimulus check, and updates on the expanded Child Tax Credit, which saw millions of families receive their second monthly payment on Friday. We'll also provide information on other economic-aid measures in the United States, such as unemployment benefits.

- Joseph Biden

- Coronavirus stimulus checks

- USA coronavirus stimulus checks

- IRS

- Child poverty

- Covid-19 economic crisis

- Science

- Coronavirus Covid-19

- Unemployment

- United States Congress

- United States

- Pandemic

- Coronavirus

- Inland Revenue

- Poverty

- North America

- Virology

- Outbreak

- Infectious diseases

- Employment

- Childhood

- Parliament

- Microbiology

- Diseases

- Public finances

- America

- Medicine

- Work

- Social problems

- Biology

- Health

- Finances

- Society

- Politics

- Life sciences