Fourth US stimulus check summary: 15 September 2021

Latest news on President Biden's covid-19 relief bill and related benefits, and updates on a possible fourth stimulus check. Wednesday 15 September 2021.

Show key events only

Stimulus checks and Child Tax Credit latest news

Headlines

- Fourth federal stimulus check not in $3.5tn reconciliation bill (Full story)

- Some US states sending out their own stimulus payments (More info)

- Overview of the three stimulus checks passed by Congress. (Details)

- Will the Child Tax Credit be extended to 2025? (Full story)

- Conservative Dems oppose extension of new Child Tax Credit (Full details)

- Many jobless Americans seek out other federal aid available to the unemployed (Full story)

Useful information / links

California Golden State Stimulus checks:

- How to track your Golden State Stimulus check

- When can I expect my $600 Golden State Stimulus in California will arrive? (Details)

- What state programs exist for Americans who have lost unemployment benefits? (Full details)

- IRS to distribute third Child Tax Credit payment on Wednesday (Find out how you can opt out of monthly CTC)

Some of our related news articles:

Sen Manchin thinks you should work to receive Child Tax Credit

Columnist Helaine Olen gives her take on Senator Joe Manchin’s idea that people should have to have a job in order to receive the enhanced Child Tax Credit. Prior to the changes made in the American Rescue Plan a household could not begin to receive the tax credit unless they had $2,500 in eared income. At over $13,000 a household could access the full $2,000 of the Child Tax Credit pre-American Rescue Plan, it is now up to $3,600 per child under 6 and $3,000 per child 6 to 17. As per Ms Olin’s opinion...

“The belief that people receiving aid from the government do not — but should — work both plays to and encourages stereotypes that people living in poverty are lazy, irresponsible and looking to get something for nothing. It serves to rationalize letting those in need go without, their economic failures viewed as a failure of morals.

“Yet the temporary child tax credit signed into law this year by President Biden demonstrates the opposite.” Read the full opinion column here

At a time of massive and growing income & wealth inequality and as the top 1% has more wealth than the bottom 92%, now is the time to demand that the wealthy and large corporations pay their fair share so that we can begin to address the long neglected needs of working families.

How much the 1% really pay in taxes

Democrats want to pass a spending package of $3.5 trillion over the next 10 years, but they need a way to pay for it. One source would be undoing the 2917 tax cuts given to the wealthy and corporations. Since 1945 the wealthiest Americans, the 0.01 percent, have seen their effective tax rate cut in half while the average taxpayer has barely seen a change.

Which states have new stimulus payments in September?

Although a fourth stimulus check doesn’t look likely in September, some states are sending certain residents a little extra money this month.

How much were the first, second and third stimulus checks and when were they sent out?

Three stimulus checks have been sent out by the US federal government since the beginning of the covid-19 pandemic.

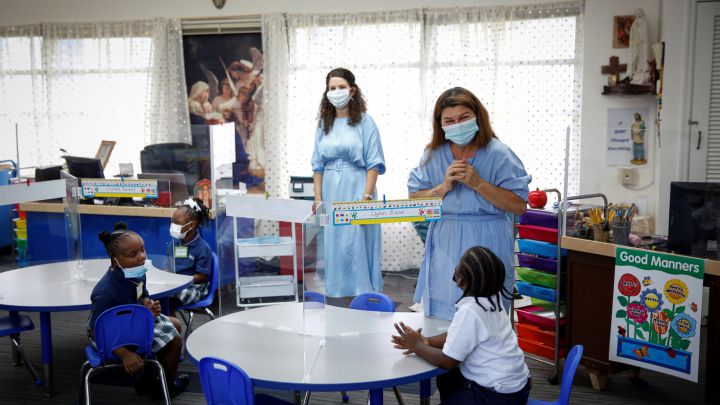

Pandemic precautions are needed for businesses to survive, says Democrat

Rep. Debbie Wasserman Schultz said Tuesday that adherence to public health guidance and increased vaccination rates are needed to keep small businesses afloat during the coronavirus pandemic.

“We have to get a handle on this virus, and we have to make sure more people are vaccinated and we have to make sure that we still engage in those all-important social distancing, mask wearing and public health guidelines," Wasserman Schultz said at The Hill’s “Small Business Recovery: Miami” event.

Sanders says $3.5 trillion is a compromise "that has already been made"

As Democrats seek to find a way to pay for their extensive plans, in a way that still allows their agenda to get through Congress, members have been taking to the airwaves to announce their plans for the bills.

The key battle shaping up is between the Democrat left, headed by Bernie Sanders, and the Democrat right, headed by Joe Manchin. Neither are known to have a good relationship with the other and want very different things from the bills.

Neither is accepting the other's cost, but Biden will need all 50 of his senators playing the same tune if any bill is to be passed.

How can I enroll a child born in 2021 for the Child Tax Credit payments?

The Child Tax Credit Update Portal allows taxpayers to make sure their household information is correct, check payment status and unenroll from the monthly checks. The portal is regularly updated with a new option soon to change the number of dependents or other changes in information since your last tax return, be it 2020 or 2019. These changes should happen in the early fall, according to the IRS.

Even if this update isn't implemented until November, the money missed out will be included in the lump-sum in 2022 after filing a 2021 tax return.

If your child is born in 2022 then you will not be eligible for any money, as per the American Rescue Plan. However, if the credit is extended, as Biden hopes to do in the reconciliation bill, then families will then become eligible to receive it.

AOC to introduce legislation to continue pandemic unemployment benefits

The New York Representative will introduce legislation extending all federal pandemic unemployment programs into next year. The programs expired earlier this month and no extension is included in the infrastructure plans currently moving through Congress.

“I’ve been very disappointed on both sides of the aisle that we’ve just allowed pandemic unemployment assistance to completely lapse, when we are clearly not fully recovered from the cost effects of the pandemic,” Ocasio-Cortez said in a town hall on Tuesday. "I simply just could not allow this to happen without at least trying.”

Ocasio-Cortez's legislation extends the pandemic programs from September 6 when they expired to February 1, 2022, meaning workers who saw a lapse in their benefits will be paid retroactively if the legislation is enacted.

Does the infrastructure bill do enough to prevent climate change?

The disruptive and devastating weather this summer has damaged thousands of people's access to electricity. As these weather events will become more and more common.

A ten-minute debate from NPR has experts discussing whether the environmental provisions set out in the infrastructure bill, at this stage not finalized, will be adequate to prevent more Americans from losing out in the coming years.

Transport Workers Union comes out in support for Democrat agenda

The TWU, representing more than 150,000 workers, has been holding a discussion with their support for Biden's agenda.

President of the TWU John Samuelsen said, "This bill will create and sustain hundreds of thousands of good, union jobs.”

The trade union had previously supported Gavin Newsom as governor of California.

Child Tax Credit no.3 is here

Families should be expecting the payments to arrive in their bank accounts before the weekend, while those who are sent mailed checks will need to wait up to three weeks.

The checks have been credited with preventing millions of children falling into poverty during the pandemic.

What's included in the Democrats' plan for the Child Tax Credit and energy tax credit extension?

The House of Representatives Ways and Means Committee have released new details on various aspects of the $3.5 trillion reconciliation bill, including those related to energy tax credits and the expanded child tax credit.

This bill comes after the passage of a trillion-dollar infrastructure package in the Senate. The bill was negotiated between a bipartisan ground of Senators and the White House. This bill is a narrower piece of legislation than the American Jobs Plan, a sweeping infrastructure package that the Biden administration has proposed.

Many conservative Democrats and centrist Republicans worked together on the legislation after rejecting President Biden's broad definition of infrastructure. The group chose to drop the elements of the plan focused on human infrastructure, which would have made targeted investments in workers that fuel the economy.

Two of the most anticipated questions circulating around reconciliation bill on whether it would include an extension to the Child Tax Credit, which is set to return to its earlier rendition after this year.

Democrats propose expansion to Child Tax Credit. When could the plan be approved?

The Democrats’ proposal to increase the social safety net through their $3.5 trillion reconciliation budget bill is taking shape.

The House Ways and Means Committee which is responsible for writing up the tax provisions released a 645-page portion of their proposal.

Included in the newly released section is a four-year extension of the changes to the Child Tax Credit for the 2021 fiscal year. As well, more children will now be eligible to receive the monthly advance payments with the requirement for a child to have a Social Security Number dropped.

Stimulus lifts millions out of poverty, new government data shows

In one of the worst years ever for the economy and labor market, America's poverty rate dropped, per one measure that takes into account pandemic-era aid, the government said Tuesday.

The poverty rate typically cited each year focuses solely on cash income. But an alternate rate that includes major aid programs took on new significance given the flood of pandemic-era stimulus injected into the economy.

That measure fell to 9.1% — the lowest rate since the government started publishing this estimate in 2009.

Government stimulus compared with two most recent economic emergencies

A report released earlier this week examines poverty in the United States and compares the effectiveness of government stimulus in response to the two most recent economic emergencies: the 2009 financial crisis and the 2020 coronavirus pandemic.

When will the third child tax credit payment be deposited in my account?

The third of the six advance monthly Child Tax Credit payments will hit bank accounts 15 September.

The payments were authorized through President Biden’s American Rescue Plan which greatly expanded and increased the tax provision, but only for the 2021 fiscal year. An extension is being floated currently in the House.

The parents of roughly 60 million children will get another boost to household finances to help cover the day-to-day expenses that come with raising a family. The payments come at an especially inauspicious time with job growth slowing in August as the covid-19 variant Delta creates new barriers for workers to reenter the workforce and enhanced federal pandemic unemployment benefits being cut off at the start of the month.

How many monthly Child Tax Credit payments are remaining?

Back in March the American Rescue Plan introduced a complete overhaul of the Child Tax Credit, which has proved extremely popular since going live in July. The programme now offers a monthly direct payment for the first time, and made it far more generous than the programme which had gone before.

But how many of these payments are left, and are there any plans in place to see the temporary programme expanded in the near future?

Will the Child Tax Credit be extended to 2025?

Since July, nearly 90 percent of families in the United States with children received Child Tax Credit payments worth $300 for children under six and $250 for those between the ages of six and seventeen. Official statistics suggest that the first round of payments alone was enough to lift around 3.3 million children out of poverty.

These new findings show just how a few hundred dollars can mean the difference between keeping food on the table and ensuring the basic needs of children, and their parents, are met. As such there is a growing movement in Congress to see the programme extended further.

Would a fourth stimulus check be a good idea?

In response to the underwhelming August jobs report, some have suggested that greater financial investment is needed from the federal government to prevent the US recovery stagnating. Many have called for a fourth stimulus check to provide a boost in consumer spending and provide impetus for small businesses.

However in this short video from Vox, some leading economists make the case against additional direct payments.

How has the Child Tax Credit impacted household income in the US?

The White House had hoped that the expanded Child Tax Credit would offer additional support for American families as they struggle through the economic fallout of the pandemic.

The early signs suggest that it is having the desired effect and has been linked to an increase in household income for July, the first month in which the payments were sent.

Currently, the beefed-up programme is only funded for one year but after the positive early figures there are hopes amongst Democrats in Congress that it can be extended further.

More Dem support for the Child Tax Credit extension

After President Biden unveiled further details of his Build Back Better legislative plan, there has been a notable effort on behalf of many Democrats in Congress to throw their support behind one key element of the proposals. The Child Tax Credit expansion has been popular since it was first introduced in July and Biden is pushing for the programme to be extended through 2025. Here, Democratic Sen. Cory Booker describes it as "one of the most transformative policies since FDR."

"We shouldn’t let taxes go up on working families. We shouldn’t let child poverty continue to stain the conscience or drag down our economy.

"And so, I say to my colleagues in Congress: [The Child Tax Credit] for working families is something we should extend, not end, next year."

Back in Spring the Biden administration unveiled the American Families Plan, which included popular items like the extension of the Child Tax Credit's through 2025 and the introduction of a new paid family leave programme.

WIthout any Republican support in the Senate, Biden will have to rely on the passage of a huge $3.5 trillion reconciliation bill to fund various extra programmes that were left out of the recent bipartisan infrastructure package. But will a fourth stimulus check be included in the proposal, and how much could it cost?

Build Back Better plan will extend Child Tax Credit programme

Today the IRS will begin send out the next round of monthly payments as part of the expanded Child Tax Credit. The American Rescue Plan, signed into law in March, provided funding for one year of payments but without an extension they would come to an end next year.

However Biden's Build Back Better agenda would see the support extended through 2025, as long as the Democrats can push it through the Senate. Without any Republican support for the package, Biden will be hoping that the $3.5 trillion reconiliation package passes later this month, or risk seeing the Child Tax Credit payments come to an end.

Is federal jobless aid available for long-term unemployed workers?

At the start of this month the federal programmes that provided income support to American workers since the start of the pandemic finally expired. The sudden cliff-edge deadline has seen an estimated 7.5 million unemployed workers lose all benefits, but there may be a way to apply for extra support.

How much would another round of stimulus checks cost?

After last month's underwhelming jobs report, there have been some suggestions that another financial injection is needed from the federal government to give the stagnating economic recovery a boost. One of the most popular suggests is for a fourth stimulus check, which proponents hope will bring about an uptick in consumer confidence.

However, as is outlined here by the Washington Post's Jeff Stein, those payments are very expensive and a single round can cost upwards of 10% of the entire federal government's annual budget in a typical year.

How much were the first, second and third stimulus checks and when were they sent out?

There have been three rounds of federal stimulus aid in the US since the start of the pandemic under two different administrations. We take a look back.

Child Tax Credit round three coming Wednesday

Each child under six at the end of the year could be eligible for up to $3,600, and those six through 17 at the end of 2021 could be eligible for up to $3,000.

To find out if your family is eligible, use this link to access the IRS portal.

Biden rallies Democrats with tax proposals

President Biden has reiterated his support for increasing taxes on the wealthy as the Democrats try to steer their $5 trillion policies through the Capitol. They need the support of all 50 Democrats in Congress, but the votes of Senators Joe Manchin and Kristen Sinema are not assured, as both want the bills to be reduced in size.

Manchin in particular is cautious of such large spending and wants it to be affordable in his eyes. Biden's plan is to increase taxes for the richest strata of society, and keep taxes low for the middle class.

How many jobs are available in the United States?

In July, the number of job openings broke records by reaching almost 11 million. After the pandemic led to a massive wave of layoffs, businesses are beginning to hire.

With federal unemployment benefits having ended in early September, many wonder if more people will choose to make their reentry into the labor market. However, with slow job growth reported in August, many wonder if the pandemic continues to be a barrier in decreasing unemployment.

What does the fall in poverty tell us about the link between employment and poverty?

As has been reported today, the US poverty rate reduced during 2020. This was despite the global pandemic and historic job losses. However, this information could give good pointers into how employment doesn't equal a reduction of poverty, especially in an era of high living costs and people holding multiple jobs.

It shouldn't be a surprise that giving money to the needy prevents poverty. Not "absolutely incredible" as Jeff Stein puts it. But with pandemic support receding, the chances of an increase in poverty are raised. Will these lessons be learned from the pandemic how to keep people out of poverty?

Even if governments are criticized for high inflation or for racking up public debt, the hard fact is the pandemic support has saved millions of Americans lives from poverty in 2020.

Which states have new stimulus payments in September?

Which states have new stimulus payments in September?

Although a fourth stimulus check doesn’t look likely in September, some states will be sending certain residents a little extra money this month.

Stimulus checks and Child Tax Credit live updates: welcome

Hello and welcome to our live blog on Wednesday 15 September 2021, offering you the latest updates on a possible fourth stimulus check, plus information on the enhanced Child Tax Credit.

We'll also provide you with news on other relief measures in the US, such as unemployment benefits and California's Golden State Stimulus checks scheme.

- Joseph Biden

- Coronavirus stimulus checks

- USA coronavirus stimulus checks

- Child benefits

- Unemployment compensation

- United States Senate

- Covid-19 economic crisis

- Science

- Social support

- Unemployment

- United States Congress

- Coronavirus Covid-19

- Economic crisis

- United States

- Pandemic

- Coronavirus

- Employment

- North America

- Parliament

- Economic climate

- Virology

- Outbreak

- Infectious diseases

- Social policy

- Diseases

- Microbiology

- America

- Medicine

- Work

- Economy

- Society

- Politics

- Biology

- Health

- Life sciences