Inflation Checks by state, Student Loan & SSA updates | Summary news 20 October

Relief from rising prices is being sent by certain states in the form of one-off payments and Social Security benefits will receive a major COLA increase.

Show key events only

Inflation Relief Checks: Latest Updates

Headlines: 20 October 2022

- A guide to all inflation relief checks going out across the country

- Key dates for the inflation relief check in California

- Social Security recipients could see on average $1,752 more in 2023 thanks to the COLA

- Which states are offering inflation relief payments?

- A record number of taxpayers requested an extension this year

- California to offer gasoline relief as residents pay $2.00 more per gallon compared to other states

- States move to count the amount forgiven in student loans as taxable income

- The biggest COLA increases in US history: 8.7%

Related news:

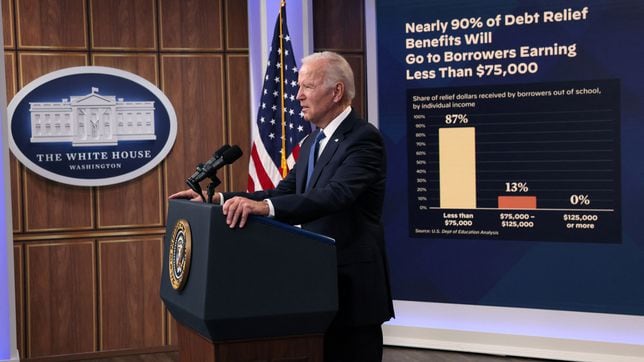

The White House announced a forgiveness plan knocking up to $20,000 off the debt burden of those with a student loan debt. A White House report said that 95% of student debt borrowers would benefit from the forgiveness, while close to 45% of recipients would see their debt written off entirely.

Here's how to make the most of the student loan forgiveness.

The tax system in the United States operates at different levels, known as tax brackets, to ensure that low earners pay a smaller proportion of their income. The theory is that groups with less disposable income should not be required to contribute as much.

The highest rate of income tax in the United States is 37%, and for 2023 that rate will only be applied to individuals earning more than $578,125 and joint filers who earn more than $693,750.

Here’s the full breakdown of income tax brackets for 2023,

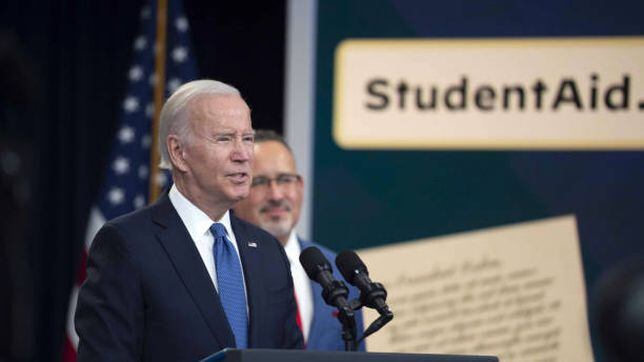

President Biden explains the process for student debt cancellation

Less than eight weeks ago, I announced my administration’s plan to forgive up to $10,000 in federal student debt and up to $20,000 if you received a Pell Grant for folks earning less than $125,000 a year.

Today, I’m announcing how millions — millions of people, working- and middle-class folks, can apply for — to get this relief. And it’s simple, and it’s now. It’s easy. It’s fast.

At the end of my remarks, I’m going to officially launch this new ap- — new application site at StudentAid.gov. StudentAid.gov.

You’ll be able to fill out your name, Social Security number, date of birth, and contact information. No forms to upload. No special log-in to remember. It’s available in English and in Spanish, on desktop and mobile.

It takes less than five minutes. And if you have any questions, you follow up — we will be able to follow up with you.

FILE PHOTO: A "For Sale" sign stands in front of a home that has been sold in Toronto, Canada, June 29, 2015. REUTERS/Mark Blinch/File Photo / Mark Blinch / REUTERS

FILE PHOTO: A sign stands in front of a home that has been sold in Toronto

Those who purchased their house and selected a fixed-rate mortgage may be in better luck after the US Federal Reserve has moved to increase interest rates by more than three percent over the last six months.

Most homebuyers opt for a 30-year-fixed rate mortgage that locks them in at a higher rate than what may be available to those interested in a variable-rate loan, but in the long term, the average rate paid tends to be lower.

Currently, the average fixed rate on a mortgage in the US stands at 6.9 percent, the highest rate since the early 2000s. Just a year ago, the average stood at 3.05 percent, highlighting the dramatic steps the Federal Reserve has taken in an attempt to quell inflationary pressure in the market.

Read more on the impact of the rate hikes in our full coverage.

Gavin Newsom supports windfall tax on oil and gas companies

Govenor of California, Gavin Newsom, announced his support for a windfall tax on oil and gas companies.

This tax would be tacked onto additional profits made by oil and gas producers in the US that go over and above what they earned last year. This decision comes as gas prices in the Golden State have raked in record profits.

The revenue collected through the new tax, if passed into law, would distribute the funds back to drivers in the state.

Great news: Thanks to POTUS, the application for federal student loan debt relief is now available, and millions of working-and middle-class folks are eligible. Take a few minutes to apply today:

https://studentaid.gov/debt-relief/application

The SSA announced a record cost-of-living increase for 2023, but the average beneficiary won’t be able to deduct the whole amount when filing taxes.

The amount of student debt in the US has been a problem for young Americans for years. Back in 2006 it was $461 billion, by no means small, but it was a trillion dollars lower than it is now. At the end of 2021 student debt was tallied to be worth over $1.75 trillion. This staggering number has prompted action from the federal government.

In terms of per capita number the debt makes for scary reading. In 2021 the mode average student loan debt per borrower was $39,351, which means an average monthly payment of $393, according to recent statistics from EducationData.org. The median debt is $17,000 and 56 percent of people owe less than $20,000.

Finally President Biden's widespread student loan forgiveness initiative has now gone live. The White House announced in August that Pell Grant recipients could get up to $20,000 discharged on their federal student loans, non-Pell Grant recipients as much as $10,000.

The measure applies to individuals that made less than $125,000 and families that earned $250,000 in either 2020 or 2021, roughly 40 million borrowers.

Learn more about the applicaiton process to trigger that support.

Households across the nation reeling from rising prices that receive Social Security benefits will get a big boost to their finances come the new year. The Social Security Administration announced its 2023 COLA and it was a whopper. At 8.7 percent, it is the fourth largest in the history of the annual cost-of-living adjustments and the biggest since 1981.

The average recipient of retired worker benefits will see a monthly payment of $1,827 an increase of $146. That will translate into an extra $1,752 over the course of 2023. The Social Security Administration will begin sending out notices in the mail to beneficiaries of exactly what their monthly payments will be next year.

Named after a section of the US Internal Revenue Code, a 401(k) is a retirement savings and investing plan offered by many American employers. Contributions are automatically taken out of a worker’s paycheck and invested in funds selected by the employee from a list given to them by the plan administrator.

With traditional 401(k) plans, the funds are withdrawn from the pre-tax amount of a paycheck and the employee gets a tax break upfront. However, they will be liable to pay income taxes on them when they withdraw down the road. A Roth 401(k) plan works the other way around, you pay in with after-tax money and then in retirement you don’t pay tax on qualified withdraws.

Mortgage rates continue to soar in the US

A number of states are offering inflation relief payments - one-off checks - to help with the price rises witnessed in many key sectors throughout 2022. The Federal Reserve is attempting to stem the price increases by raising interest rates and discourage borrowing, but this is having damaging consequences for the housing market.

With borrowing becoming more expensive, anyone looking to take out a mortgage is being hit with mortgage rates far higher than were seen last year. This is having the knock-on effect of reducing demand for the homes and cooling the housing market considerably.

Mortgage rates in the US have been climbing as the Federal Reserve raises interest rates increasing the cost for Americans seeking to buy a home.

Here's a look at where mortgage rates stand for Thursday 20 October 2022.

“Inflated costs for everyday necessities have forced many to cut corners or make impossible choices, and pain at the pump has been compounded by the return of the commute for many Californians.

"As the holidays approach, my team members are thrilled to be able to get these payments into the hands of those who have been struggling, so they can enjoy a measure of relief.”

California has begun issuing inflation relief payments. Golden Staters will receive the payment via direct deposit or debit card. Here’s when to expect them

“We know it’s expensive right now, and California is putting money back into your pockets to help. We’re sending out refunds worth over a thousand dollars to help families pay for everything from groceries to gas."

Each year the federal tax brackets are adjusted to reflect the general rate of price increase, and to avoid a phenomenon known as 'bracket creep'. The adjustment is usually fairly minor but this year, with inflation running above 8%, many were expecting a signficant change to the tax brackets, one that could see you paying less taxes next year.

The IRS has released the updated 2023 federal income tax brackets...

Biden breaks down the student loan forgiveness payments

While campaigning for the 2020 presidential election, Joe Biden promised to offer widespread student loan forgiveness for the majority of borrowers. It has taken more than 18 months, but the online portal to claim the relief went live last week and it looks to have given the Democrats a much-needed boost going into the midterm elections next month.

Biden breaks down the figures for student loan forgiveness on Twitter...

President Biden has offered widespread student debt relief for more than 40 million Americans and the application process is now open.

During the pandemic trillions of dollars was spent by the federal government to ensure that Americans were able to cover the cost of essentials and to keep the economy from slowing to a complete standstill.

More than 9 million individuals and families have been contacted to inform them of key tax benefits and the IRS has just issued letters to inform them of the vital relief payments that they are missing out on.

Hello, and welcome to AS USA

Hello, and welcome to AS USA's blog on inflation relief payments. We’ll keep you up to date on measures that have been approved in states around the US to help residents cope with the high price of food and gas.

The Social Security Administration announced a historic cost-of-living adjustment increase for 2023 of 8.7% which will give beneficiaries around the nation a much needed boost to monthly payments. The 2023 COLA will affect pensions for other government workers and VA disability benefits too.

While there is no nationwide direct payment nor tax rebate to help Americans cope with inflation, some state initiatives have already been sent out and others are just making their way to residents.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/G2IEHA7EQJORLA2OMAFAA3DWP4.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/UAN5RE5OPBFCXDKCJIUHQQMJWI.jpg)