US financial news summary | 21 May 2023

US Financial News: Latest Updates

Headlines | Sunday, 21 May 2023

- President Biden and Speaker McCarthy will meet at White House on Monday to negotiate debt ceiling increase

- The impact of a default could present greater challenges for some states over others.

- Treasury Secretary Janet Yellen says that the US could hit the debt limit by 1 June. What role has Sec. Yellen played in the negotiations?

- A look at the countries who own most of the US debt

- Can President Bidenuse the Fourteenth Amendment to increase the debt limit?

- GOP push for work requirements for SNAP and Medicaid

Read more from AS USA:

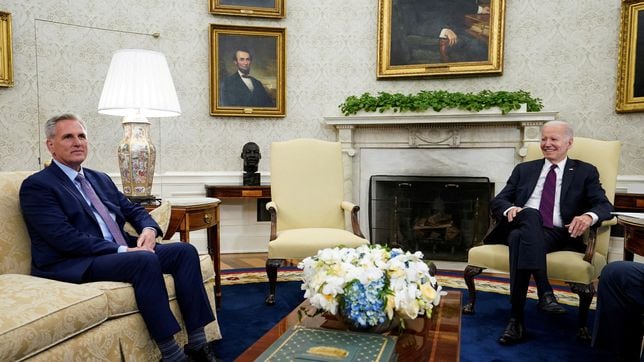

Biden and McCarthy will have another face-to-face on debt ceiling negotiations

Returning from his meeting with G7 partners in Hiroshima, Japan, President Biden spoke with Republican Speaker of the House Kevin McCarthy. The President called the conversation “productive” and the two will sit down together on Monday in the White House.

Staff level discussion were due to resume on Sunday at 6 pm ET. McCarthy when asked about the his hopes for the negotiations after talking to Biden said: "Our teams are talking today and we're setting (sic) to have a meeting tomorrow. That's better than it was earlier. So, yes."

Congress must pass legislation to raise the debt ceiling or suspend it by 1 June, X Date, according to Secretary Janet Yellen. That is the day when the US will no longer be able to pay its bills which would mean a default on the national debt and economic calamity.

The US is home to some of the richest cities in the world, here are the top 5, according to the Bureau of Economic Analysis First Half 2023 GDP report.

The US is on the brink of default if the debt ceiling is not raised. Economic disaster may come to pass, with some states suffering more than others.

One dollar might not seem like much, but if you are have the right one, and its twin, you may be able to get up to $150,000 from that printing error.

Parts of the country continue to help residents with the increased cost of living. These are the places that will deliver aid checks in May and June.

Dado Ruvic / REUTERS

Looking to make $100 an hour and can watch TikTok for 10 hours straight? Applications being accepted

Three (lucky?) people are being sought to watch TikTok for ten hours a day, or it would seem more from the offer, with a renumeration of $100 per hour, no limit… The TikTok Watching Job is back in version 2.0, to earn $1,000 for ten hours of your life, but “no cap.”

In order to be considered, one only needs to send a short blurb of why you are the best to participate in the Ubiquitous influencer marketing campaign.

Montana bans TikTok, users concerned. And will it be effective?

There has been growing concern around the world of the potential for the Communist Party in China using data mined from TikTok on everyday citizens and especially those within government to be used for nefarious ends. This has led several governments to implement bans on government employees and politicians from having the app on their personal devices used for administrative purposes or other government devices.

Montana has gone one step further, than the 32 other US states that have taken action to restrict the app on government devices, banning TikTok from all use in the state. Failure to comply would result in a $10,000 fine. That penalty would be paid not by the users but by those that allow the service to be provided on people’s devices such as Google Play and Apple’s App store.

The ability of a single state to restrict access to the app has been called into question, and users in the state have already filed a legal complaint. According to the lawsuit, “Montana can no more ban its residents from viewing or posting to TikTok than it could ban the Wall Street Journal because of who owns it or the ideas it publishes.”

Month after month, the Social Security Administration (SSA) sends out monthly benefits to retired workers. In addition, SSA is responsible for sending Supplemental Security Income (SSI) benefits, disability and survivor benefits.

While the May payments continue, it is worth knowing who will receive their money in the first days of June.

Read our full coverage for the payment schedule.

White House releases a statement on the need to reach a bipartisan agreement to raise the debt ceiling

On Tuesday, the President appointed a senior team to negotiate with the Speaker’s team. The President and Speaker agreed that any budget agreement would need to be bipartisan. Last night in DC, the Speaker’s team put on the table an offer that was a big step back and contained a set of extreme partisan demands that could never pass both Houses of Congress. The President has over and over again put deficit reduction proposals on the table, from limits on spending to cuts to Big Pharma profits to closing tax loopholes for oil and gas. Let’s be clear: The President’s team is ready to meet any time. And, let’s be serious about what can pass in a bipartisan manner, get to the President’s desk and reduce the deficit. It is only a Republican leadership beholden to its MAGA wing — not the President or Democratic leadership — who are threatening to put our nation into default for the first time in our history unless extreme partisan demands are met.

Earlier this month, Treasury Secretary Janet Yellen notified Congress that the United States could default on its debt soon. Yellen stressed that it is impossible to predict with certainty the exact date the US will run out of cash but that Day X could be as soon as 1 June.

“If Congress fails to increase the debt limit, it would cause severe hardship to American families, harm our global leadership position, and raise questions about our ability to defend our national security interests,” Yellen told lawmakers.

Read our full coverage for the details on which government programs would be impacted by the default and the economic repercussions more widely.

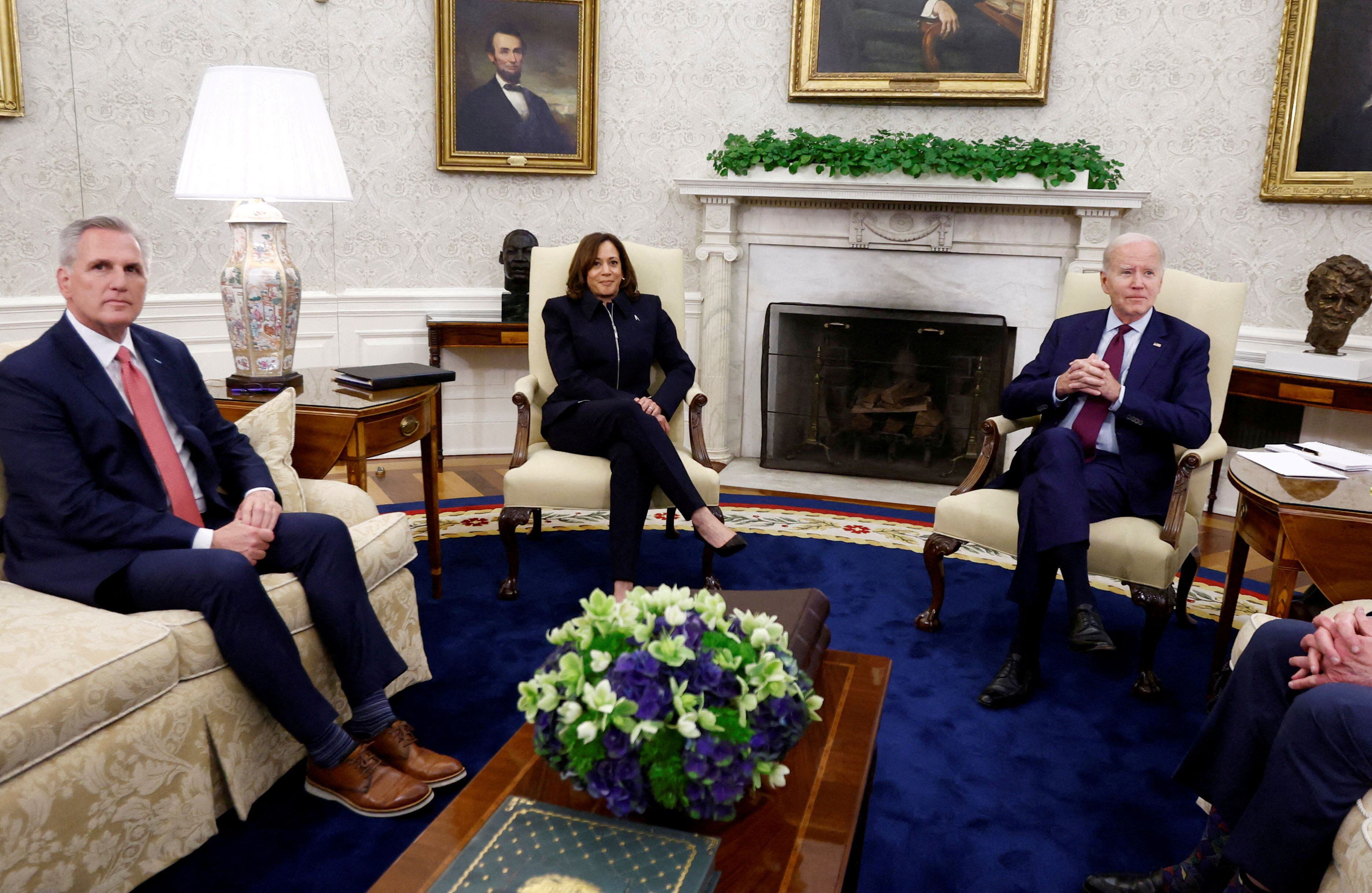

As the clock ticks down to US default no plan for negotiators to meet

GOP negotiators returned to the White House on Friday after earlier walking out on negotiations to raise the debt ceiling. However, neither of the two meetings resulted in any progress to avoid the US defaulting on its debt, nor were there plans on when negotiators would meet again.

Lawmakers have less than two weeks to reach an agreement before the X-date is reached, the day the Treasury will no longer be able to pay all of the nation’s bills. Secretary Janet Yellen has set that date for 1 June.

Republicans are pushing for deep spending cuts in order to secure their votes to increase the limit set at which the government can borrow. They want to reduce spending to 2022 levels, a bill passed along party lines in the GOP-controlled House would reduce a wide swath of government spending by 8% next year.

Some of the sticking points are caps on spending and new or expanded work requirements on programs like SNAP and Medicaid pushed for by Republicans.

US Representative Patrick McHenry, a Republican negotiator, told reporters at the US Capitol that party leaders were "going to huddle as a team and assess where things stood."

Federal Reserve Governor provides economic updates

Despite heightened uncertainty, due to banking-sector stress, geopolitical instability, and the aftermath of the pandemic, I expect the economy to grow in the second quarter. The pace of growth, however, will be slower than what we observed in the first quarter, when real GDP increased at an annual rate of 1.1 percent.

Last year, after inflation reached historical levels, several states across the US approved the sending of stimulus checks and tax refunds for their residents to provide economic relief in the face of high prices.

Little by little, the states that are sending money is decreasing. However, residents of some cities and counties in the United States may be eligible for to participate in pilot guaranteed income programs that have been set up and that will issue payments of $500 or more each month.

Read more in our full coverage on where those payments will be sent.

EVELYN HOCKSTEIN / REUTERS

As the clock ticks down to US default no plan for negotiators to meet

GOP negotiators returned to the White House on Friday after earlier walking out on negotiations to raise the debt ceiling. However, neither of the two meetings resulted in any progress to avoid the US defaulting on its debt, nor were there plans on when negotiators would meet again.

Lawmakers have less than two weeks to reach an agreement before the X-date is reached, the day the Treasury will no longer be able to pay all of the nation’s bills. Secretary Janet Yellen has set that date for 1 June.

Republicans are pushing for deep spending cuts in order to secure their votes to increase the limit set at which the government can borrow. They want to reduce spending to 2022 levels, a bill passed along party lines in the GOP-controlled House would reduce a wide swath of government spending by 8% next year.

Some of the sticking points are caps on spending and new or expanded work requirements on programs like SNAP and Medicaid pushed for by Republicans.

US Representative Patrick McHenry, a Republican negotiator, told reporters at the US Capitol that party leaders were "going to huddle as a team and assess where things stood."

President Biden speaks to the possible impacts of a debt default

According to economists, 8 million Americans could lose their jobs if our nation failed to pay its bills. The consequences would be catastrophic for folks across the country and the globe. Default is not an option.

Hello and welcome to AS USA's live blog on finance and economic news.

Earlier this week, the US Department of Housing and Urban Development reported that new permits for building houses have fallen by over twenty percent compared to April 2022. As interest rates have gone up, interest in constructing new housing units has slowed. With less supply on the way, bringing prices down could become much more challenging.

Negotiations in Washington over the debt ceiling will continue this week, with just fifteen days until the United States risks defaulting on its debt. Republicans have demanded cuts to social spending, but so far, the White House has been unwilling to cave on these points. We will bring you the latest on this as the day goes on.

Last week, the Bureau of Labor Statistics reported a 0.4 percent increase in the Consumer Price Index in April, leading to a year-over-year increase of 4.9 percent. Unemployment fell to 3.4 percent in April, providing important data points to the Federal Reserve as officials there evaluate additional rate hikes.