$600 stimulus check in California: who qualifies and how to track

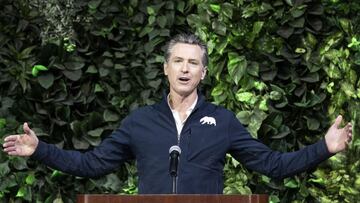

Gov. Gavin Newsom announced details of a new covid-19 relief bill that would see Californians receive direct payments worth up to $600, if eligible.

It was announced last Wednesday that lawmakers in California had agreed details of a $9.6 billion covid-19 relief package which includes a new round of $600 stimulus checks for the state’s low income earners. The plan was announced by Gov. Gavin Newsom and made official on Tuesday, providing a tweaked version of the Golden State Stimulus plan he proposed last month.

Aside from the stimulus checks, billions of dollars have been designated for grants for small businesses and to provide emergency accomodation for the state’s many farmworkers who are forced to quarantine after testing positive for the coronavirus.

“Those that have been left behind in the federal stimulus, California is not going to leave you behind,” Newsom said on Tuesday.

Anthony Rendon, Speaker of the State Assembly, said the package would “help those who are hurting most,” adding: "We are building an economic foundation for the recovery of jobs, small businesses and, indeed, our everyday lives.”

California state stimulus check: eligibility requirements

It’s official:

— Gavin Newsom (@GavinNewsom) February 24, 2021

- $600 stimulus checks

- $2 billion in grants to restaurants, hair salons & more

- $24 million in aid to agricultural workers

- $35 million for food banks and diapers

- $100 million in financial aid for

community college studentshttps://t.co/Z1PIpBOUGA

The $600 per person direct payments constitute the largest section of the package, costing $2.3 billion in total. This will see stimulus check payments sent to around 5.7 million people, some of whom were missed out from previous payments under former President Trump.

The details of the eligibility for a California stimulus check were set out:

- Those earning less than $30,000 per year

- Households who received the Earned Income Tax Credit for 2020

- Anyone unable to receive recent federal payment because they do not have a Social Security Number, but who have an Individual Tax Identification Number and income of less than $75,000

- Households in the CalWORKS public assistance programme

- Those who qualify for the Supplemental Security Income/State Supplementary Payment

- Recipients of the Cash Assistance Program for Immigrants

GOP Sen. Andreas Borgeas, who helped build bipartisan consensus for the proposal, said of the announcement: “This path toward victory proves that when legislators cross the aisle and work together on our most pressing needs we can get things done.”

It’s official — nearly 6 million $600 stimulus checks will be going out to Californians. pic.twitter.com/UGUoCsnMnE

— Gavin Newsom (@GavinNewsom) February 24, 2021

California stimulus checks: when will they arrive?

While bill was originally announced by Governor Newsom in January, it wasn't signed into law by Newsom until Tuesday.

California Assembly Speaker and Democrat, Anthony Rendon, spoke at a press conference:

“This legislation will aid some of the people who have kept us going through the hardest times of this pandemic.

“Lower-wage workers have often been confined in service jobs with high levels of exposure. This will give them an additional tax rebate to help them make ends meet.”

Those qualifying through ITIN will receive their payment as an additional tax refund after they file their 2020 tax return this year. Payments for CalWORKS households are expected by mid-April - and will be placed on debit cards - and the timing for the delivery for SSI/SSP and CAPI recipients is still under discussion with federal officials. The expectation is that people will receive their payment as quickly as a month after filing their taxes, assuming they have direct deposit, although it could take up to seven weeks if awaiting a check in the mail.

As yet there is no information on how you'll be able to track your stimulus check but you can keep track of any developments via this live feed.

Small business and farm workers offered extra protection

Today we took action to provide CA families & businesses urgent relief from the #COVID19 recession. Our package of immediate actions includes $7.6B:

— Office of the Governor of California (@CAgovernor) February 24, 2021

✅relief for small biz

✅direct cash support to individuals & households

✅child care

✅community college financial aid

& more pic.twitter.com/JwoaC7ReD6

The new stimulus package also provides additional support for other economic victims of the pandemic. Tax breaks worth around $2 billion will allow 750,000 small businesses to deduct up to $150,000 in Economic Injury Disaster Loans, or loans issued under the Payment Protection Plan, from their state taxes.

There are also more favourable conditions for the hospitality industry, with nearly 60,000 restaurants and bars allowed to waive annual license fees for two years.

Senate President Pro Tempore Toni Atkin said she hopes this will be a vital lifeline for struggling businesses: “People are hungry and hurting, and businesses our communities have loved for decades are at risk of closing their doors.”

There is also $24 million funding boost for a programme with provides accommodation for food processing and farm workers who have contracted the coronavirus. As essential workers they have been forced to work throughout the pandemic and in many cases are unable to truly quarantine if they become infected.

Related stories

Gov. Newsom said of this new effort: [The farmworker housing programme has] been underutilized, and we recognize that… The purpose of this new appropriation is to maximize its effectiveness."

Stimulus checks: stay up to date

For all the latest updates as they happen on stimulus checks in California, Maryland and federally, follow our dedicated live feed.