Third stimulus check news summary: 23 February 2021

Information on the third stimulus check included in US President Joe Biden's covid-19 relief bill proposal on Tuesday 23 February 2021.

Show key events only

Stimulus relief bill live updates - Tuesday 23 February 2021

Headlines:

- House Budget Committee formally approves $1.9 trillion American Rescue Plan (back story)

- Gov Newsom signs $600 California stimulus check legislation (who qualifies for a check?)

- Democrats hopeful of getting stimulus bill through House by end of week

- IRS tax return could decide your third stimulus check entitlement (full story)

- Senate Democrats target inclusion of a boost in the federal minimum wage as part of stimulus bill.

- US consumer spending in January up on previous year's thanks to stimulus check boost

- Child tax credit expansion and stimulus check boost could halve child poverty in the US, study explains

- Get the latest stimulus check news in Spanish (las noticias sobre los cheques de estímulo en español)

- US covid-19 cases/deaths: 28.21 million / 501,315 (live updates)

Stimulus talk positivity dips dollar

The growing likelihood that Congress will pass President Joe Biden's $1.9 trillion stimulus plan has stoked fears about a possible spike in inflation. As those expectations have risen, so has the popularity of the so-called reflation trade, which this month has pulled the dollar lower.

But in testimony before the US Senate Banking Committee, Powell said the central bank would keep its policies in place as it focused attention on getting Americans back to work.

"The economy is a long way from our employment and inflation goals, and it is likely to take some time for substantial further progress to be achieved," said Powell.

Powell in 2020 said the central bank would be willing to allow inflation to run higher than its target rate for periods of time in order to average 2%.

While Powell did not allay the inflation fears, the central bank's overall support for the economy may have kept the dollar afloat on Tuesday.

"For the dollar, the jury remains out with regards to which direction the next major move will be, though for now, inflation concerns may be offset by hopes for a quicker US economic recovery, as vaccine distribution is expected to ramp up in the coming weeks," said Ronald Simpson, managing director, global currency analysis for Action Economics.

Non-expiry: is this the best stimulus idea for Democrats?

Congress has been flapping around with economic aid such as unemployment insurance since the outbreak of the covid-19 pandemic. Federal lawmakers have been picking arbitrary end dates for much-needed support, more or less guessing at the end of the pandemic for nearly a year.

And it appears that in the latest relief package, set to pass Congress in the coming weeks, they’re about to make the same mistake again: Instead of phasing out benefits when the economy gets better, Congress is setting up yet another cliff later this year.

Congress has made important changes to the unemployment system to respond to the pandemic: Initially, it added $600 in federal weekly unemployment benefits through the end of July 2020; that dried up for a while but was reinstated at the end of December, this time adding $300 a week through 14 March.

The federal government has also expanded unemployment to gig workers, contractors, freelancers, and others who are generally ineligible for such benefits, and has added on extra weeks once regular benefits expire.

Emily Stewart looks at another idea on the table...

Pelosi-McConnell stimulus spat

House Speaker Nancy Pelosi was quick to respond on the back of Christal Hayes' report regarding Mitch McConnell's belief.

He was said to be arguing that most Republicans think the $1.9tr relief bill is too expensive, to which Pelosi points to the majority of American citizens who would take a different view.

This is a common debate over whether politicians are in a position of power to represent their party and lobbyists, or all the people of the country.

$600 stimulus check in California: who qualifies and how to track

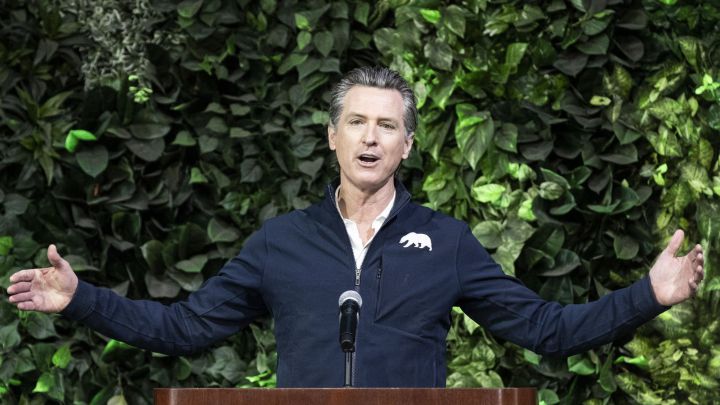

Newsom signs California stimulus checks into law

It was announced last Wednesday that lawmakers in California had agreed details of a $9.6 billion covid-19 relief package which includes a new round of $600 stimulus checks for the state’s low income earners. The plan was announced by Gov. Gavin Newsom and made official on Tuesday, providing a tweaked version of the Golden State Stimulus plan he proposed last month.

Aside from the stimulus checks, billions of dollars have been designated for grants for small businesses and to provide emergency accomodation for the state’s many farmworkers who are forced to quarantine after testing positive for the coronavirus.

“Those that have been left behind in the federal stimulus, California is not going to leave you behind,” Newsom said on Tuesday.

AOC thinks GOP minimum wage proposal is "legislated poverty"

As House Democrats are pushing forward with their stimulus bill which includes raising the minimum wage to $15 per hour by 2025, alternatives are being presented from both side of the aisle.

GOP Senators Mitt Romney and Tom Cotton presented a bill that would raise the minimum wage to $10 per hour ove the next five years. At the same time it would ensure businesses cannot hire undocumented people living in the US.

From the other side of the aisle, Senator Joe Manchin is preparing an amendment to the covid-19 relief bill that would see the minimum wage raised by just a dollar more than his Republican colleagues.

How to claim $1200 income tax credit in California

Where do you claim you California stimulus payment?

California lawmakers have approved the Golden State Stimulus bill which could see individuals able to claim up to $1200. Here is how to claim it.

Read the full story:

Valerie Jarrett defends size of stimulus package with “what would you cut?”

The most controversial part of the $1.9 trillion covid-19 relief bill working its way through Congress is the provision to raise the minimum wage to $15 per hour by 2025. Valerie Jarrett, an member of former President Obama’s administration, argues that it raising the minimum wage would be good for the American economy.

The current minimum wage of $7.25 per hour has no changed since 2009. A person who works full-time all 52 weeks of the year earns just over $15,000, a little more than the US poverty rate. Jarret argues that these people can’t help the US economy with their wages because they are just too low. By raising the minimum wage people would go out and spend money that they can’t right now, helping to support and grow the US economy.

At the same time millions of Americans could be pulled out of poverty and hunger, in addition to creating more stability for families struggling to keep a roof over their heads.

Third stimulus check passing: do all Democrats support the $1.9 trillion covid-19 relief bill?

Which Democrats oppose the stimulus bill?

As Democrats push forward with the $1.9 trillion covid-19 relief bill, the hardest opposition they may face are Democratic Senators on minimum wage hike.

Read the full story:

GOP upset Biden isn’t talking to them

Since meeting with 10 Republican senators regarding the breadth and scope of a new covid-19 relief bill there has been little negotiation between Democrats and Republicans. The Republican proposal fell far short of what Biden feels needs to be done to meet the moment. One of the non-starters in the GOP proposal was the exclusion of $350 billion in funding for state and local governments.

The GOP sight that some states are actually experiencing surpluses at the moment. However many state and local governments of both parties support the funding to keep frontline workers on the payroll and to tackle difficulties presented by the covid-19 in their communities.

The Democrats plan to push forward with their bill along party lines and pass the $1.9 trillion package quickly. Democrats want to get the bill to Biden’s desk before 14 March when pandemic unemployment benefits are set to expire.

Vaccine supply expected to get big increase

Covid-19 vaccine makers told Congress on Tuesday that U.S. supplies should surge in the coming weeks due to manufacturing expansions and new vaccine authorizations. Pfizer Chief Business Officer John Young said it was plausible that there could be a surplus of vaccine in the United States sometime in the second quarter of this year.

So far around 75 million doses have been shipped, but Pfizer and Moderna expect to provide the US government with a total of 220 million by the end of March. On top of those doses Johnson & Johnson says they could supply up to 20 million doses of their single-dose option by that time as well. The Johnson & Johnson vaccine is expected to get a green light from the FDA in the coming weeks.

Around 44.5 million people in the United States had received at least one dose of two-shot vaccines developed by Pfizer and BioNTech or Moderna, as of Tuesday morning.

GOP counter-proposal for raising the minimum wage

US Senators Mitt Romney and Tom Cotton today announced plans to introduce the Higher Wages for American Workers Act, a counter-proposal to the Democrats’ push for a $15 per hour minimum wage increase by 2025. The Romney-Cotton legislation would gradually raise the federal minimum wage to $10 over the next five years from the current $7.25 per hour. After that future minimum wage increases would be indexed to inflation every two years.

Another proposal is being pushed by moderate Democratic Senator Joe Manchin, who is working on an amendment to the relief bill that would limit the minimum-wage increase to $11. The House of Representatives is expected to vote on their version of the $1.9 trillion bill by the end of this week which currently has a provision for raising the minimum wage to $15 per hour. After that it will be the Senate’s turn to have a go at the bill to make amendments.

Wisconsin to upgrade unemployment systems

Across the US unemployment agencies in the states faced historic increases in claims because of the coronavirus pandemic and many states IT systems couldn’t handle the deluge. The result was delays in getting benefits to tens of thousands of unemployed lasting weeks or even months as the systems had to be reprogrammed to process the new pandemic unemployment programs put into place. Some states implemented upgrades using money from the CARES Act in the spring, but others are still catching up.

Wisconsin’s bill will allow the state Department of Workforce Development to find outside contractors that can upgrade the state’s long-neglected computer systems to the tune of $80-plus million. It would briefly suspend a requirement that the unemployed wait a week before qualifying for unemployment until March 13. If the bill is signed those who lost their jobs in recent weeks will be able to retroactively claim benefits for the first week they were out of work.

Powell goes to the Hill to discuss stimulus’ effects

Tuesday saw Federal Reserve Chairman Jerome Powell begin two days of congressional testimony to answer questions on the state of the US economy and what effect the $1.9 trillion stimulus bill will have on it. While Republicans have been stressing the possibility of it sending inflation soaring, Democrats want to focus on the economic inequality among Americans that has been worsened by the pandemic.

Although the official unemployment rate for January was 6.3 percent according to the Bureau of Labor Statistics, Powell estimates that the real unemployment rate is likely closer to 10 percent due to a decrease in labor force participation.

Schumer tells Senate Democrats to stay united on Stimulus

Senate Majority Leader Charles Schumer warned Senate Democrats that failure to pass a $1.9 trillion covid-19 relief bill would be a political disaster. Schumer has to contend with at least three centrist Senators in the Democratic caucus that have expressed reservations about the size of the package, they are Jon Tester, Kyrsten Sinema and Joe Manchin.

“I made a pitch today to our entire caucus and I said that we need to pass this bill. The American people, the American public demands it and everyone is going to have things that they want to see in the bill and we’ll work hard to see if we can get those things in the bill,” Schumer told reporters after his call with the Senate Democratic caucus Tuesday.

After stimulus Democrats to focus attention on infrastructure

Even though House Democrats’ haven’t passed the covid-19 bill yet, which includes extending unemployment benefits and $1,400 stimulus checks, committees in the Senate have been instructed to start work on the next Biden administration initiative. Senate Majority Leader Charles Schumer told reporters after a Democratic caucus call that committee chairs will start drafting legislation to "out-compete China," including investments in tech and infrastructure.

Democrats are looking at spending $3 trillion on the infrastructure package which they plan to pass through reconciliation, although Schumer pledged that the bill would be bipartisan.

Dems' stimulus package "dramatically more money than is required" - McConnell

Senate Minority Leader Mitch McConnell has branded President Joe Biden’s $1.9tn coronavirus relief bill as "dramatically more money than is required", as Democrats pursue their bid to push through the aid package - which includes a third round of stimulus checks - without Republican backing.

"The Democrats continue to try to move ahead with a partisan covid package," McConnell told reporters on Tuesday. "You know the history, but it’s worth recounting, that every covid package we passed last year, we did on a bipartisan basis. There was almost no opposition to most of those bills, and I was hoping the new administration, particularly given the president discussed so frequently being a moderate, would choose to take a different path.

"Particularly when you look at the numbers: a 50-50 Senate, a narrow majority in the House… I would think looking at that, your conclusion would be: maybe we ought to start on a bipartisan basis. But alas that is not the case.

"As you know, 10 of our member actually went down [to the White House] and met with the president and talked about a more narrow, targeted approach. The message was that they were not interested in doing it that way. They’re going to try to muscle this through on a totally partisan basis.

"And I think I can safely speak for most of my members that we think this is dramatically more money than is required at this particular juncture. It also includes a number of things that have absolutely nothing to do with covid relief. And so it will be controversial."

Watch: Newsom press conference as California stimulus checks approved

You can watch the press conference given by California Governor Gavin Newsom today, as he announced the signing of a coronavirus relief bill that includes stimulus checks for qualifying Californians:

How to claim your stimulus check on 2020 tax return

How to claim your stimulus check on 2020 tax return

Didn’t get your second stimulus check? Never fear, you can claim your missing payment as part of your 2020 tax return through Recovery Rebate Credit.

Full lowdown:

"Zero" GOP votes for relief bill expected in House

A "senior House Republican" has told CNN reporter John Harwood that they do not expect President Biden's $1.9tn coronavirus relief bill to get a single GOP vote when it is put to a vote in the lower chamber, likely at some point this week.

Because the Democrats have a majority in the House, this would not prevent the legislation from making it through the chamber.

The Dems also have a wafer-thin advantage in the Senate - it is a 50-50 split, but Vice-President Kamala Harris has a tie-breaking vote. However, as they prepare to push their package through the upper house via the 'budget reconciliation' process, they will need to ensure the bill has the support of every single Democratic senator, including more moderate ones such as Joe Manchin.

Manchin opposes Biden's proposed increase of the national minimum wage to $15, and is working to limit this rise to $11 an hour. He has also stated his support for limiting stimulus-check eligibility to only the country's lowest earners.

Will there be a fourth stimulus check after the third one?

Will there be a fourth stimulus check after the third one?

Congress is edging closer to approving a stimulus check of up to $1,400 for qualifying Americans - the third such direct payment since the coronavirus pandemic began. But could there be another one after that?

Full story:

Psaki won't say if Biden would sign relief bill with $11-an-hour minimum wage

White House press secretary Jen Psaki refused to confirm whether President Joe Biden would sign a coronavirus stimulus bill including a minimum wage increased to $11 an hour rather than the $15 an hour he is seeking.

"The President proposed $15 because that’s what he feels is right for the American worker, American workers I should say, and the men and women who are working hard, just trying to make ends meet and that’s why that number was in his package," Psaki told CNN’s Kaitlan Collins on Tuesday.

Moderate Democratic Senator Joe Manchin is working on an amendment to the relief bill - which is expecting to pass the House of Representatives in the coming days - that would limit the minimum-wage increase to $11.

California package "isn't the end of our efforts" - state senator

California State Senator Toni Atkins has vowed that the multi-billion-dollar stimulus package signed into law in the state on Tuesday won’t be "the end of our efforts".

The $7.6 billion of economic relief includes grants for small businesses and stimulus checks of at least $600 for qualifying Californians.

"These bills help Californians pay their bills, and provide bread-and-butter relief to the small businesses that make our communities great," Atkins wrote on Twitter.

"This is what we can do right now to help, but it isn’t the end of our efforts."

California governor signs $7.6bn stimulus bill

California Governor Gavin Newsom has signed a $7.6 billion stimulus package that will include a round of stimulus checks of at least $600 for eligible people in the state.

The package also includes over $2bn in grants for small businesses.

“The backbone of our economy is small business; we recognize the stress, the strain that so many small businesses have been under," Newsom said at a news conference on Tuesday. "And we recognize as well our responsibility to do more and to do better to help support these small businesses through this very difficult and trying time.

“The $7.6 billion of direct relief that we’re providing today not only helps support small businesses, but supports […] some 5.7 million Californians with direct stimulus check relief."

Biden's new Paycheck Protection Program: who can claim it?

Biden's new Paycheck Protection Program: who can claim it?

President Biden has announced changes to the PPP system which aim to make it easier for small and minority-owned businesses to claim federal loans.

Full details:

$1200 income tax credit in California: who qualifies?

Who can get a $1,200 stimulus check from the Golden State Stimulus bill?

Later today Gov Gavin Newsom will sign a $9.6 billion stimulus bill designed at supporting low income earners across California. The package includes a round of $600 stimulus checks for residents who earn less than $30,000 per year, but some may be able to receive even more.

Some groups who were missed out of previous rounds of federal stimulus checks may be eligible for a retroactive payment. To find out if you are eligible, and how much you could be entitled to, check out our handy explainer.

Read more:

American Rescue Plan will provide vital support for tourism sector

Rep. Dina Titus of Nevada has praised President Biden's stimulus bill for providing much-needed support for the tourism and travel sectors which have been devastated by the covid-19 pandemic and the associated restrictions. Nevada relies heavily on tourism to support the hospitality trade, particularly in popular destinations like Las Vegas and Lake Tahoe, and Titus believes the bill will help bring back jobs.

In response to the strain felt by the hospitality sector in recent months many states have introduced their own legislation to mitigate the damage. California's Golden State Stimulus bill provides tax breaks and removes licensing fees for hospitality businesses across the state. It is also hoped that the third stimulus check will help to boost the sector by increasing cunsumer's spending power in the short-term.

Democrat official unhappy with Biden's stimulus check delay

The American Rescue Plan has finally been introduced in Congress this week but many are wondering why it has taken until a month into Biden's presidency for this to happen. As Brianna Westbrook, executive committee member of the Arizona Democratic Party, points out Biden promised to pass a new round of stimulus checks as soon as he took office.

Initially he was hoping to find some bipartisan agreement in Congress but despite meeting with GOP lawmakers he felt their counter-proposal, which included stimulus checks worth just $1,000, was not acceptable. In the end Biden settled on a $1,400 direct payment but this too was seen as a disappointment for many. The White House has argued that, when combined with the $600 stimulus check from January, the new payments completes a payment for $2,000.

Small businesses support Biden's stimulus bill

As the House of Representatives prepares to pass the American Rescue Plan, it seems that there is fairly widespread support for the package amongst business owners. The $1.9 trillion bill includes support for small businesses, tax breaks and billions worth of infrastructure spending that aims to kick-start the American economy.

The $1,400 stimulus checks may also prove to be a key inclusion, with recent studies showing that the $600 payments sent in January boosted consumer spending by 20% compared to the previous year. Research carried out by Affinity Solutions found that 88% of stimulus check recipients spent their $600 almost immediately, providing a much-needed boost for businesses.

$600 California stimulus check: when are they being sent and how can you track?

Tax authorities prepare to send $600 California stimulus checks

Governor Gavin Newsom is expected to sign the Gold State Stimulus bill into law today, which will provide billions in state funding to provide a round of $600 stimulus checks for around 5.7 million residents. Newsom said of the plan:

“Through the Golden State Stimulus, Californians who have been impacted by this pandemic will get help to provide for their families and keep a roof over their heads.”

However while the stimulus checks are certainly on their way distribution may take some time with the state's tax authority also processing millions of tax returns. Like with the IRS payments, the stimulus check payments appear likely to be staggered over the coming months.

Read more:

Tax Return 2021: how to check my tax number on the IRS site

How to check your IRS tax number online

It's easily done - last year's tax returns seem like a very long way away and many will be unsure about some of the details needed to file. Your Taxpayer Identification Number (TIN) is a unique code that links you to your tax return information and previous filings. Most are provided by the IRS but some, such as Social Security Numbers, come from other federal bodies.

There are five main types of TIN, but it can be difficult to know which you need. Here's everything you need to know to find your tax numbers, and how to know which one you need to complete your filing.

Read more:

House Republicans unlikely to vote for Biden's stimulus bill

As the House prepares to vote on the American Rescue Plan it seems increasingly unlikely that Biden will get any degree of bipartisan support for his proposal. In the Democrat-led House he does not need any Republican votes to pass the bill, but it is a sign that there is great division in Congress over the new proposal. However outside the Capitol there appears to be fairly widespread support for the proposal which would see stimulus checks worth $1,400 sent to eligible Americans

In January a counter-proposal was put forward by a great of ten Republican Senators, but it was deemed insufficient by the White House. Their bill would have cost around $900 billion (less than half of what Biden is aiming for), and reduced the size of the stimulus checks to just $1,000 per person.

Earned Income Tax Credit can boost IRS tax rebate

With tax season 2021 way underway it is worth checking if you are eligible to receive the Earned Income Tax Credit, which can knock thousands off your tax bill or provide you with a healthy tax rebate after you file. The IRS say that over $60 billion was distributed through the programme last year, and Biden's new stimulus bill includes a proposal to widen the eligibility even further.

The financial relief is aimed at low and moderate earners, and the amount you are entitled to may be boosted if you claim children or other dependents on your IRS tax return. California residents who claim the state's own Earned Income Tax Credit (CaliEITC) are also eligible for the $600 stimulus check agreed by the state legislature yesterday.

Schumer: Stimulus bill will "deliver urgent, bold relief"

Senate Majority Leader Chuck Schumer has called on Congress to pass President Biden's stimulus bill to provide urgently-needed relief to millions across the US. Biden wants to pass a large-scale relief bill that will address the short-term priorities for millions of low income Americans as well as facilitating a more long-term economic recovery.

Central to that is the third round of stimulus checks, worth $1,400, which look likely to open eligibility to more people than ever before. Previous stimulus checks have not been available to those classed as adult dependents on IRS tax returns, but changes to the eligibility requirements could see an extra 13.5 million people able to get the federal support.

Third stimulus check: when will Congress pass it?

Congress set to vote on stimulus check proposal

The American Rescue Plan was approved by the House Budget Committee on Monday as the Democrats look to push through President Joe Biden’s stimulus bill. The $1.9 trillion package has been the subject of much discussion in recent weeks and is finally drawing near to a vote in the House of Representatives.

The bill, which includes a new child tax credit system and a third round of stimulus checks owrth $1,400, will then go to the Senate for a second vote. However the bill is expected to face strong opposition with GOP lawmakers eager to add amendments which could reduce the amount of support offered.

Read more:

When will I get my $600 California stimulus check?

On Monday the California state legislature passed a $9.6 billion covid-19 relief bill which includes tax breaks for small businesses, support for the hospitality sector and a round of stimulus check payments worth $600. The bill will be signed into law by Gov Gavin Newsom later today but you are unlikely to recieve the money for some time.

The Franchise Tax Board has suggested that eligible Californians will probably have to wait between 45 days and 60 days for their stimulus checks, and will likely receive it after they get their state tax refunds. The $600 payments will be available for anyone earning less than $30,000 per year and widens the eligibility to many who have been excluded from previous federal stimulus checks.

Tax Filing 2021: how much can I discount per child?

Families can claim thousands of dollars in credits on their 2021 tax returns

Tax filing can always be a confusing process but this year there are numerous changes to the IRS tax credit system which could be worth thousands of dollars to your family. Currently the Child Tax Credit, the Child and Dependent Care Credit and the Earned Income Tax Credit all offer considerable deductions and rebates for eligible Americans.

However Congress is also working on legislation that would enhance these credits, as part of the American Rescue Plan. For example the new Child Tax Credit could be worth up to $3,600 a year for each eligible child, a huge increase on the previous provision. There are also plans to switch the annual credit to a direct payment, similar to the $1,400 stimulus checks also included in the bill.

For more information on what is available and how to apply, read more:

What's the easiest way to file tax returns with the IRS?

Tax season 2021 has begun and the IRS are already predicting some pandemic-related delays with the tax filing process. Due to the extra precautions needed this year they advise Americans to take advantage of e-filing if possible, to help speed up the procedure.

The IRS have confirmed that they do not intend to push back the national deadline, as they were forced to do last year, but could soon be experiencing a backlog as they attempt to distribute the third round of stimulus checks at the same time. When the new relief bill is signed into law they will have to oversee the organisation and distribution of over 160 million stimulus checks, meaning that the tax returns delay may be about to get even longer.

Stimulus checks worth $600 pass California state legislature

The package known as the Golden State Stimulus proposal is set to be signed into law today, providing a stimulus check worth $600 to around 5.7 million Californians. The bill was passed by the state legislature on Monday and Gov Gavin Newsom has confirmed that he intends to sign it into law later today.

While Congress has struggled to agree on the terms of a new federal relief bill, lawmakers in California have managed to get this new bill finalised in a matter of days. Aside from the $600 stimulus checks, the bill also provides billions in financial support for the state's struggling hospitality sector and small businesses. There are billions worth of tax breaks which it is hoped will prevent businesses going under.

Stimulus check proposal could be passed by the House on Friday

After weeks of negotiations there is at least some significant movement on the covid-19 relief bill proposed by President Biden last month. The $1.9 trillion American Rescue Plan has been criticised by Republicans but the Democrats will have enough votes to pass the bill.

Rep. Richard Neal has told reporters that he believes the House of Representative will pass the stimulus bill this Friday, paving the way for a Senate vote next week. The bill will include a third stimulus check worth $1,400, but the exact eligibility requirements are yet to be finalised. As it stands anyone earning less than $75,000, or $150,000 for couples who file jointly, will be able to receive a stimulus check from the IRS. Amendments may well be introduced in the Senate.

House Budget Committee passes Biden's stimulus bill

The third stimulus check appears to be drawing closer after a House of Representatives Budget Committee approved President Biden's American Rescue Plan, allowing the Democrats to use reconciliation to ensure it is passed by the Senate.

The vote (19-16) releases the $1.9 trillion of federal funding that is required for Biden's proposal, and paves the way for the bill to be introduced on the House floor later this week. But before the $1,400 stimulus checks can be signed into the law the bill must also pass the Senate, where GOP lawmakers may attempt to make amendments to the proposal.

IRS aware of issue with tax return online tool

Millions of Americans will be filing their tax returns at the moment but may experience some difficulties if they try to use the “Where’s My Refund” tool on the IRS' website. The tool allows filers to check on the status of refunds and rebates that they have claimed as part of the tax return filing.

This tool will be particularly important this year as the IRS offer the chance the claim any missing stimulus check payments on your tax return. The payment, known as a Recovery Rebate Credit, can be use to apply for either the previous $1,200 or $600 stimulus check payments.

For more information on how to request a missing stimulus check payment, check out Tax returns could decide your stimulus check entitlement.

$600 stimulus check California: how will I get it, cash, credit card or bank transfer?

California $600 stimulus check to be passed today

After the $9.6 billion state relief package was passed in the state legislature on Monday, Gov Gavin Newsom has announced that he intends to sign it into law later today. The bill includes a round of stimulus checks worth $600 for residents who earn less than $30,000 per year, and offers retroactive payments for those who have been missed out of previous payments.

The money should be arriving in the coming weeks, but how will you get your California stimulus check: cash, credit card or bank transfer?

Read more:

California stimulus checks pass state legislature

On Monday California lawmakers approved a relief bill that would see 5.7 million people recieve stimulus checks worth at least $600. The support is part of a state-wide coronavirus relief package aimed at helping lower-income people who have been hit hardest by the pandemic.

The state Legislature passed the bill by a wide margin on Monday and Gov. Gavin Newsom has pledged to sign it into law next Tuesday. Those who are eligible for the California stimulus checks will likely receive it between 45 days and 60 days after receiving their state tax refunds, according to the Franchise Tax Board.

"We need to acknowledge that this pandemic has not hit us all equally," said state Assemblyman Joaquin Arambula, a Democrat from Fresno.

Yellen supports $1,400 stimulus checks

Preisdent Biden's Treasury Secretary Janet Yellen has reaffirmed her commitment to the $1,400 stimulus checks included in the new covid-19 relief bill. The $1.9 trillion American Rescue Plan includes a third round of direct payments, but has been met with criticsm from Republican lawmakers who claim that the bill is too expensive.

"That really helps to make sure that pockets of misery that we know exist out there that aren't touched by more targeted things, that help is provided there as well," Yellen said at a virtual event hosted by The New York Times.

"I believe we're going to be better off for it, and that it's the right thing to do."

IRS extends tax returns deadline for Texans

The IRS have announced that they will extend the tax return deadline for residents of Texas as the state looks to recover from the winter storms that left millions without electricity and running water for days. The national deadline remains 15 April, but Texans will have untill 15 June to file their tax returns.

In recent weeks the IRS had said they would not be extending the deadline, despite some concerns that they may be unable to handle both tax season and the distribution of the third stimulus checks which will likely be passed in the coming weeks. The IRS have administrated both previous round of stimulus check payments and hope to begin making payments within a week of the bill being signed.

Stimulus bill minimum wage and the arcane Senate rule

Senate Democrats will soon find out if they can proceed with including a boost in the federal minimum wage in the next round of coronavirus stimulus.

To avoid a Republican filibuster of the the legislation, Democrats are using a process known as reconciliation with a simple majority of votes, instead of the sixty votes required under current filibuster rules. But there are rules as to what can be included using the process, which require provisions to have a significant impact on the budget.

Under the so-called Byrd Rule, the Senate parliamentarian decides what can be included in a reconciliation bill.

"The meeting between with the Senate parliamentarian, the Senate rules referee, about if the minimum wage can be included in covid is slated for Wednesday," NBC's Leigh Ann Caldwell reported Monday evening, citing two Dem aides.

"A decision on min wage inclusion could come as early as Wednesday night or Thursday morning."

Bob Brigham reports for RawStory.

Stimulus bill rates analysis

Short-dated US Treasury debt yields risk turning negative as the US government curbs sales of Treasury bills, but analysts are looking at the progress of the stimulus bill to assess whether any dip in yields could be a temporary issue, Reuters report today.

Bill yields last turned negative in March 2020 amid market turmoil prompted by the pandemic spreading to the United States. If borrowing rates fall too far it could disrupt key funding markets and hurt the almost $5 trillion money market fund industry, making funds hesitant to accept new investments.

The US Treasury Department, slashing its cash balance after amassing liquidity to pay for fiscal stimulus, which was delayed, said earlier this month it plans to cut its cash balance to $500 billion in June, from $1.7 trillion at year-end. That could pressure bills - US government debt issues with maturities of one year or less - into negative territory.

But those projections do not account for new fiscal spending and if the Biden administration passes a larger bill than expected, and one that necessitates a lot of cash out the door fast, then cuts to bill issuance - and possible negative yields - may not prove lasting.

Full report on impact to yields from Biden's new bill.

California approve $600 stimulus checks in covid-19 package

Californians who qualify for a $600 state stimulus payment could see the money arrive as soon as a month after filing their tax returns under a $7.6-billion covid-19 economic relief package approved Monday by the state Legislature.

Crafted by Gov. Gavin Newsom and legislative leaders last week, the pandemic assistance plan also includes more than $2.1 billion in grants and fee waivers for small businesses. Those companies can soon apply for the grants, followed by an approval process that state officials estimate would take 45 days.

An additional $2 billion in tax breaks for businesses is expected to be acted on by the Legislature this week, which would bring the total package to $9.6 billion.

More stimulus bill criticism

Utah's 4th congressional representative Burgess Owens is another vocal opponent of the content of Joe Biden's latest bill.

We must act swiftly to put an end to this pandemic and to stem the suffering felt by so many millions.

What's in the stimulus relief bill?

Rather than listen and react to the cherry-picked selection of elements inside the new relief bill making its way through Congress, make sure you know what it covers.

Here NPR provides you with a summary of the key aspects:

Stimulus bill interogation

A consistent claim from those on the other side of the aisle is that Democrats are looking to push through other elements of their agenda in this latest stimulus relief package.

As Congressman Cawthorn states: policies on immigrants, Planned Parenthood and those behind bars are also included in a bill set out to help the country slip out of this economic disaster.

Anti-stimulus

Of course, not everyone is in favour of blanket checks being issued around the country as Leo Terrell makes clear here.

The civil rights attorney and former public school teacher, who now makes appearances on Fox News, has pointed to Biden's bill just being a handout to the Democratic governors and mayors.

We should point out that the relief bill does not differentiate depending on your politics, unlike Mr Terell.

Crossing Jordan

With the stimulus checks seen by most as a necessary help for millions of needy Americans, Jeff Sites has his focus set on beating the out-spoken Republican Jim Jordan in the next election.

Stimulus bill missing fitness focus

The $1.9 trillion American Rescue Plan is designed to help reopen the US economy and shore up families’ finances. Although there is money in the bill to help small businesses one provision that is missing is money to specifically target gyms and fitness centers nearly half of which have closed since the onset of the pandemic.

Representative Mike Quigley is trying to get a measure in to the covid-19 relief bill to salvage the health and fitness industry which helped him personally overcome mental stress through working out like many other Americans.

Stimulus bill minimum wage aid in restaurants

Democrats are pushing through legislation based on President Biden’s $1.9 trillion American Rescue Plan which is designed not just to fight the covid-19 pandemic and help struggling Americans with measures such as the $1,400 stimulus checks. But the bill also has provisions to create a more equitable society including gradually raising the minimum wage to $15 per hour.

This has been one of the more controversial portions of the bill with two Democratic Senators saying that they will oppose the bill should their party try to bypass the Senate parliamentarian should he decide that the provision doesn’t meet the requirements to be included in the bill under the rules.

House Democrats’ proposed Raise the Wage Act would increase the minimum wage over the course of five years, in addition to phasing out the subminimum wages for tipped workers in the states where it still exists. Arguments against the proposal center around it being detrimental to businesses and that it would put many low-income workers, especially in the food service industry out of work. Mother Jones looks at a new report by One Fair Wage which shows some evidence to the contrary.

Biden and Harris mark devastating covid milestone

The White House took a moment to pay respect to the more than 500,000 Americans that have perished so far in the covid-19 pandemic.

The President and Vice President, accompanied by their spouses, stood outside the White House which was illuminated by five hundred candles.

The White House flag was lowered to half-staff and will remain until sunset on Friday along with all flags on federal buildings.

PPP amendment sees Biden target mom-and-pop businesses

President Biden announced changes to the Paycheck Protection Program to target more federal pandemic assistance to the nation’s smallest businesses. These are primarily owned by women and people of color who have been more severely affected by the consequences of the pandemic-driven economic downturn.

On Wednesday the administration is establishing a two-week window in which only businesses with fewer than 20 employees can apply for the forgivable loans. The White House is also setting aside $1 billion to direct toward sole proprietors, such as home contractors and beauticians.

Third stimulus check: Will the IRS tax returns affect my direct payment?

IRS tax return impact on third stimulus check

It's a busy time for the IRS as it looks like they will soon have to oversee the organisation and distribution of the third round of stimulus checks. We are also in the midst of tax season 2021, which is administrated by the IRS, so they will be stretched over the coming months.

However this does have one big advantage, as both are controlled by the IRS you may be able to claim for missing stimulus checks on your tax return filing. Also, the details you submit on your tax return this year could decide if you get the full $1,400 payment.

We dig into the detail of what you need to know:

Tax return extension for storm-hit Texans

For weeks the IRS had been insisting that they would not be extending the tax return deadline past 15 April, the date by which point all tax filers must have submitted their documents. Last year the covid-19 pandemic forced them to push the deadline back, and the winter storms in Texas have done the same now.

The new deadline is on 15 June, two months later than the original date to give residents and the battered Texan infrastructure time to recover from the ordeal of the past two weeks. Aside from Texas' unique situation, there have been growing calls for the IRS to extend the tax return deadline nationally, to prevent them being overloaded when the new stimulus checks are agreed.

It is the IRS who will administrate and distribute the third stimulus checks, as they did for the two previous rounds of payment.

Stimulus bill crucial to tackling hunger crisis

Since taking office President Joe Biden has made clear that he wants a long-term plan to return the economy to its pre-pandemic levels, but accepts that there is a more immediate priority for millions of Americans.

Recent studies showed that over 27 million Americans have struggled to put food on the table during the pandemic, with childhood poverty also on the rise

The Biden administration hopes that the stimulus check, unemployment benefits and improved child tax credits included in his American Rescue Plan will help turn the tide for those who are suffering. The third stimulus checks will be particularly important and lawmakers hope to have them signed into law in the first half of March.

This would provide up to $1,400 per person for low income families.

Third stimulus check: Why do some progressives want payments of $1,400?

Stimulus checks: progressive steps

Democrats in the House of Representatives are hoping for swift passage of President Joe Biden’s stimulus bill following its official tabling in the chamber on Monday. The $1.9 trillion American Rescue Plan includes a third stimulus check and is designed to offer immediate relief to those who have been hit hardest by the covid-19 pandemic.

The stimulus bill has faced stiff opposition from the Republicans in recent weeks but the Democrats should have few problems passing the package in the House, a chamber where they hold a comfortable majority.

In fact, Rep. Ted Lieu of California revealed on Twitter that he expects the proposal to be passed before the end of the week, which could see the stimulus checks begin distribution in mid-March.

Will Gittens reports on how progressives are getting behind the targeted $1,400 checks.

Stimulus bill vote error not costly for Democrats

As we have said, the House Budget Committee voted in favour of a covid-19 relief bill worth $1.9 trillion, which includes a third stimulus check, support for small businesses and billions of dollars to support the national vaccination effort. It is a positive step for the Democrats, but was not helped by the actions of one lawmaker who accidentally voted against the proposal!

Rep. Lloyd Doggett of Texas was reportedly getting off a plane at the time when the vote was being taking and misheard what was being voted on. Understandably, Doggett may well have had other things on his mind as his state battles against the winter storm that has left millions without water and electricity.

Luckily the Dems had a comfortable margin and his slip-up was not costly.

'Stimulus check threshold shouldn't be changed'

In an interview with CNN's State of the Union, Rep. Pamila Jayapal said she wants the stimulus check allowance currently included in Biden's American Rescue Plan to remain the same. The Congresswoman, who also serves as the chair of the Congressional Progressive Caucus, sees the stimulus checks as a quick way to get support to those who may otherwise have missed out.

The stimulus bill entered the House yesterday and one Democrat lawmaker has already said that they expect it to be passed before it then goes to the Senate for further debate and a vote.

There seems to be little appetite amongst the Democrats, who control both Houses, to alter the eligibility requirements.

$1.9t stimulus bill passes House Committee

President Joe Biden’s $1.9 trillion stimulus bill made it through a key House committee on Monday on what was a nearly party-line vote, bringing the pandemic aid plan closer to passage later this week.

After days of committee hearings hammering out the details of the relief package, the House Budget Committee formally approved legislation that would provide billions of dollars to unemployed Americans, schools and businesses.

As drafted, it would also codify a series of liberal priorities, including a gradual increase in the federal minimum wage. The committee advanced it on a 19 to 16 margin, with every Republican opposed.

Full story below:

US stimulus relief bill: welcome

Hello and welcome to our live blog for Tuesday 23 February on stimulus checks, California state stimulus, IRS tax filing season and more.

We'll be here all day bringing you the latest updates as they unfold in the US. Who's eligible for what, when to expect checks and help with how to file your tax returns.

- Recession

- Taxes

- Inland Revenue

- Pandemic

- Coronavirus

- Economic climate

- Tributes

- Virology

- Outbreak

- Infectious diseases

- USA coronavirus stimulus checks

- Public finances

- Microbiology

- Diseases

- America

- Medicine

- Economy

- Health

- Life sciences

- Coronavirus stimulus checks

- Joseph Biden

- Nancy Pelosi

- IRS

- Covid-19 economic crisis

- Science

- Coronavirus Covid-19

- Economic crisis

- Biology