Third stimulus check news summary: 15 March 2021

Information on the third stimulus check included in US President Joe Biden's covid-19 relief bill on Monday 15 March 2021.

Show key events only

US stimulus check news: Monday 15 March

Third stimulus check calculator: how much for adults, kids & couples?

Stimulus check calculator

After President Joe Biden signed the American Rescue Plan into law, stimulus payments began going out to American families.

Find out how much you can expect.

The US-China stimulus spin

This will be an interesting story line to watch for in the coming days and weeks as the ripples of a stronger US economy are felt.

Biden's stimulus roadshow

US President Joe Biden is joining top messengers already crisscrossing the country to highlight the benefits of the massive covid-19 rescue plan. In a bid to waste no time in the promotion of the $1.9 trillion relief plan, Biden is now looking for building momentum for the rest of his agenda and anxious to avoid the mistakes of 2009 in boosting that year’s recovery effort.

Even veterans of former US President Barack Obama’s administration acknowledged that they did not do enough at the time to showcase their massive economic stimulus package.

Biden's stimulus plan could transforn US poverty

'In some ways, the credit resembles much debated proposals to set up a universal-basic-income program, which would send cash to families every month to help them get by. Such a program never seemed possible in the United States, but lessons from the 2008 financial crisis, the Trump Presidency, and the pandemic have changed what policymakers are willing to try.

“It signals a turn in the way that we approach alleviating poverty and supporting the unpaid care work of women that makes the economy move."

Sheelah Kolhatkar investigates how this new bill could really change the way that poverty in the US is addressed.

What triggers the Additional Child Tax Credit?

Parents with children will still need to file for tax credit on 2020 income-tax filing

The American Rescue Plan expands the Child Tax Credit making it fully refundable for taxpayers in 2021. This year’s tax return on 2020 income, the old rules still apply.

Read the full story:

Stimulus package keeps states in check

The American Rescue Plan Act includes an important and novel provision: for every dollar that a state government spends on net tax cuts, it will lose a dollar of the federal fiscal aid it receives from the Act’s Coronavirus State Fiscal Recovery Fund. That’s sound policy.

Read the analysis from the Center on Budget and Policy Priorities.

Stimulus bill has already saved thousands of jobs, millions more could be created

President Biden signed the American Rescue Plan the day after it was passed by Democrats in Congress. That same day American Airlines canceled a planned furlough of 13,000 employees set to take effect 1 April.

Since then other companies have followed suit in canceling planned furloughs while other companies can now call employees back to work.

Currently the US is 9.5 million jobs short of pre-crisis levels, but some independent economic forecasts have projected the covid-19 relief bill may create as many as 7 million jobs.

Backlash at banks over delayed stimulus deposits

After President Joe Biden signed the $1.9 trillion American Rescue Plan into law on Thursday, the IRS wasted no time in starting to disburse the first round of $1,400 stimulus checks to some of the 160 million Americans entitled to the payment.

However some of the nation’s biggest banks say they will not be processing the payments this weekend, instead announcing they will begin to do so on the 17 March.

While the official payment date for the $1,400 stimulus checks has been established as 17 March, the likes of Wells Fargo and Chase have faced heavy criticism for not releasing those payments already being deposited by the IRS this weekend.

New unemployment benefits (PUA) tracker: how to check my status

How to track PUA status

Federal pandemic unemployment programs have been extended again as the pandemic passes the one-year anniversary. Find out how you can track your payments.

Read the full story:

$1400 third stimulus check: will I get it in the bank or in the mail?

IRS confirms stimulus check payments: in the bank or in the mail?

After taking months to get the package through Congress, President Joe Biden is not wasting any time to get the third round of stimulus checks out to those in need. The White House confirmed that the first wave of payments began landing in bank accounts over the weekend. Today Biden confirmed that his administration have set the target of getting 100 million payments sent in the next ten days.

Trying to get the money distributed in the middle of a busy tax season will be no mean feat, and the IRS will use three different methods to get the money out to the people. So will your stimulus check payment arrive in your bank account or in the mail?

Read more:

American Rescue Plan to be overseen by Gene Sperling

President Biden has named Gene Sperling as the White House authority for overseeing the implementation of the American Rescue Plan, who will look to ensure that the $1.9 trillion goes to support those in need.

In a White House address Biden spoke of the need to make sure that "every last dollar" is accounted for, across the myriad health, economic and social programmes included.

The third stimulus checks, unemployment benefits and child tax credit systems are huge projects demanding hundreds of billions of dollars, and Sperling will be tasked with ensuring that the rollout is a swift one.

Sen. Blumenthal praises "revolutionary" child tax credit increase

Democratic Senator Richard Blumenthal is optimistic about the huge boost for the child tax credit provision included in the new stimulus bill, which he says will "lift countless kids out of poverty".

The new package will see the top amount increased to $3,600 per child per year, compared to $2,000 on the old system. Not only that but eligibility has been expanded to allow 69 million households to benefit from the Child Tax Credit expansion in 2021.

Not only that but the new bill allows for the vital support to be distributed in advanced, monthly payments, rather than as a refund/reduction on the annual federal taxes. Lawmakers hope this will provide a more consistent source of funding.

What tax year is the third stimulus check based on?

What tax year is the third stimulus check based on?

Just days after the American Rescue Plan was signed $1,400 direct stimulus payments began to be sent out to eligible recipients. President Biden has announced that his administration will send out 100 million of the stimulus checks within the next ten days, but many are unsure about how the entitlement is calculated.

The situation is not helped by the fact that the third stimulus checks were finally signed into law during the middle of tax season 2021 as Americans look to get their tax returns filed. The exact date of when you filed your taxes for the year could decide how much money you get.

Read more:

Stimulus checks could be withheld for those with outstanding debts

For the first time, stimulus checks could be taken by debt collectors to pay back outstanding debts without the recipient having any choice in the matter. In the past debt collection companies were not able to claim the federal payments from those in debt but that protection will no longer be available for all.

The rules vary for different types of loan, with those who have defaulted on student loan repayments not in danger of having their funds seized. However not all have this protection and some of the most vulnerable may be left without any stimulus check support from this round of payment.

Rep. Watson criticises stimulus checks as insufficient

new data from the Census Bureau suggests that the majority of Americans will use the $1,400 stimulus check to pay for essentials like food and utilities, while many will use the money to pay off debts.

The study found that 58% of respondents will use the money for food, while 44% expect to use the cash to cover their utility bills. With Americans spending the money on such essential ongoings, Rep Bonnie Watson has suggested that the one-off payments are not sufficient considering how infrequently the bills are passed. In 12 months, Congress has passed legislation providing stimulus checks worth a total of $3,200 for eligible Americans.

Child Tax Credit: when will a refund be issued on tax return?

When will the IRS issue tax return refunds?

The IRS have confirmed that they have already started distributing refunds on tax returns for millions of Americans, which will initiate the first payment for the new Child Tax Credit.

The tax authority have said that refunds were sent out from the first week of March for those who filed online, choose to receive any potential refunds by direct deposit, and who had no errors in their filing.

Here's everything you need to know to check on the status of your Child Tax Credit payment, and any other tax refunds you may be eligible for.

Read more:

Biden sets stimulus check distribution target

The President's official Twitter account has posted to big goals for the administration, that aim to tackle the two main issues that the US is currently facing. He is expected to comfortably surpass his target of distributing 100 vaccine shots in his first 100 days in office, with that mark potentially reached within just 60 days.

While the health crisis is the most pressing issue he has also pledged to address the economic consequences and the third round of stimulus checks are the most direct response to that. He will aim to get the first 100 million payments in banks accounts within ten days, doing so at a time when the IRS is also processing 2020 tax returns.

Stimulus check money could be invested in stocks and bitcoin

A poll of 235 individuals who expect to receive stimulus checks found that around 10% plan to invest at least some of the direct payment into bitcoin and stocks. If that number does materialise, it will see around $40 billion of the $380 billion ploughed into stocks and bitcoin investments.

It is thought that the remarkable price flurry for so-called 'meme stocks' that happened earlier this year was fueled in part by the $600 stimulus checks that were distributed in early Janaury.

Research shows benefits of child tax credit

A new study carried out by the National Bureau of Economic Research has suggested that the revised child tax credit system included in the American Rescue Plan could help reduce childhood povert in the US. The new provision gives up to $300 a month for each eligible child and is not capped by income tax payments, unlike the previous system.

Wealth disparity has been a major problem as the pandemic continues to disrupt the economy and destory livelihoods for millions. Biden will hope that the child tax credits, along with other programmes like the stimulus checks and additional unemployment benefits can help address the worrying trend.

$1,400 third stimulus check: are dependents eligible?

Are dependents eligible for the third stimulus check?

As part of the $1.9tn coronavirus relief bill signed into law by President Joe Biden on Thursday, qualifying Americans will get a stimulus check of up to $1,400. As an added bonus the rules have been changed to allow those classed as dependents to get the money as well.

However, Americans will only qualify for this additional credit if the individual or couple claiming them as a dependent meet the income eligibility criteria for the third stimulus check - and these thresholds have been narrowed.

Read more:

Churches criticised for asking for stimulus check donations

Some churches have reportedly asked their congregations to consider donating some or all of the money received in the third stimulus check to the "ministries". The $1,400 direct payments are intended to provide short-term financial relief for struggling Americans and help to stimulate the economy.

The funding drive has been criticised by Stella Parton, sister of country star Dolly, who called the practice "shameful".

"Shots in arms and money in pockets, that's important. The American Rescue Plan is already doing what it was designed to do, make a difference in people's everyday lives."

LIVE: White House speech on stimulus checks, child tax credit and vaccination effort

President Joe Biden is now giving a White House address on the progress of the American Rescue Plan. He is expected to give an update on the status of the $1,400 direct payments going out to Americans.

Democrat representative backs recurring stimulus checks

Rep. Ro Khanna, member of the House of Representatives from California's 17th district, has voiced support for recurring direct payments, arguing that the $1,400 per person recently agreed is not sufficient. The Democrat wants a flat $2,000 sent to eligible households for the next three months to help fund the economic recovery.

He is not the first to make such a suggestion and a group of more than 50 progressive lawmakers signed a letter earlier this year calling for the White House to consider recurring stimulus checks. However it seems unlikely that it would get sufficient support in Congress, considering how much resistance there was to the American Rescue Plan.

Child tax credit change will benefit the poorest families

The American Rescue Plan aims to address the growing wealth disparity in the US and Biden hopes that the new-look child tax credit will provide a much-needed boost to low-income families in particular. As a tax credit, in the past the poorest families actually received less money because the payments were limited for those who pay little or no tax.

The new stimulus bill sees that changed so all eligible families will be able to receive the full amount, regardless of taxes. The amount on offer is also upped to as much as $3,600 per child and the money will arrive as a monthyl direct deposit, more similiar to the stimulus check distribution.

Tax return delays could affect third stimulus check and child tax credit

Last week the White House announced that the first wave of payments for the new $1,400 stimulus checks would be sent out over the weekend, but despite that promising sign millions may be forced to wait for the direct payment.

Not only are the IRS in charge of sending out the stimulus checks and overseeing child tax credit claims, they are also in the middle of tax season. With just a month until the tax return deadline of 15 April the IRS is experiencing a backlog of filings to process, reportedly three times higher than last year. There are fears that this could disrupt the stimulus check and child tax credit distribution.

White House issues ....The American Rescue Plan Passed – Now What? guide

After passing the American Rescue Plan last week, President Biden and the White House launch a guide to the ins and outs of the bill

'Get my Payment' tool active via IRS portal

People can now check on the IRS website to see when they are expected to receive economic relief payments from the covid-19 bill signed into law last week.

The “Get My Payment” tool went active over the weekend and is the best way to track payment status.

IRS offers tips on tax related fraud

The IP PIN is key to avoiding online tax fraud and is known only to the unique user and the IRS and helps the body verify identity when fiing electronic or paper tax return.

Democrats push to make covid relief bill aid to the poor permanent

U.S. Senate Democrats will push to make permanent two provisions of President Joe Biden's covid-19 relief bill that provide emergency enhanced benefits for the poor through food assistance and child tax credits, two leading lawmakers said on Sunday.

Senate Majority Leader Chuck Schumer said that making enhanced child tax credits permanent is an important goal for Democrats, as they seek to move forward with bold new initiatives that also include legislation to upgrade U.S. infrastructure.

Senator Kirsten Gillibrand, Schumer's fellow New York Democrat, called separately for enhancements for a nutrition program aimed at women, infants and children in the $1.9 trillion bill to be extended indefinitely.

Biden's legislation temporarily increased the value of the program's cash vouchers for fruits and vegetables from $9 per month for children and $11 for women to $35 per month for both.

The bill also expands the U.S. federal child tax credit for one year from a partially refundable $2,000 per child to a fully refundable $3,600 credit for children under 6 and $3,000 for children aged 6 to 17, a move that experts say will significantly decrease child poverty in the United States.

"That's one of the most important things we can do. We can change America, if we make them permanent," Schumer told MSNBC.

"It will be so good for these kids, their families, but for all of America and our economy."

Futures buoyed by optimism over U.S. stimulus boosted economic growth

U.S. stock index futures climbed on Monday on optimism over a stimulus-fueled snapback in economic activity ahead of the Federal Reserve's policy-setting meeting this week.

The Dow notched five consecutive record highs last week as approval of one of the largest fiscal stimulus in U.S. history and vaccine rollouts fueled demand for economy-linked stocks such as banks, energy, materials at the cost of tech names with lofty valuations.

The reopening optimism has also raised bets on a rise in inflation and, in response, a tapering of the Fed's easy monetary policy that triggered a spike in U.S. bond yields in recent weeks and roiled equities.

Democrats hope to expand the definition of infrastructure

US President Joe Biden and his fellow Democrats hope to expand the definition of infrastructure beyond existing transportation architecture to include items aimed at tackling climate change and its effects, echoing the $2 trillion, 10-year "Build Back Better" proposal floated during his campaign.

That includes investments in electric vehicle charging stations, zero-emission buses and zero-carbon electricity generation by 2035, and directing dollars to minority neighborhoods and contractors, part of a pledge to increase racial equity.

Democrats have signaled they want to invest billions in creating and refurbishing affordable housing in any package and expand broadband internet access to all Americans, particularly in rural communities.

U.S. House of Representatives Speaker Nancy Pelosi said on Friday that she had directed senior Democrats to begin working with Republicans on a “big, bold and transformational infrastructure package."

Republicans and influential trade groups like the U.S. Chamber of Commerce support large-scale infrastructure spending, but not Democratic efforts to inject climate change or equality policy into a spending bill.

Representative Peter DeFazio, who chairs the House Transportation and Infrastructure Committee, said in an interview his “tentative timeline” is for the committee to complete action on its portion of an infrastructure bill before the end of May.

He said a proposal could be divided between reconciliation to raise revenue and direct funds and traditional legislative procedures to set policy.

U.S. Congress launches probe into multibillion-dollar 'clean coal' tax credit

The U.S. Congress is investigating a multibillion-dollar subsidy for chemically treated coal that is meant to reduce smokestack pollution, after evidence emerged that power plants using the fuel produced more smog not less.

The outcome of the probe could play a big role in whether lawmakers vote to renew the subsidy, on track to expire at the end of this year.

The Government Accountability Office, the investigative arm of Congress, is examining the refined coal tax credit program which generates at least $1 billion a year for U.S. corporations, according to GAO analysts that contacted Reuters requesting information.

Three U.S. Democratic senators called for the investigation after a Reuters Special Report series in December 2018 revealed that many power plants burning the fuel, which supporters call "clean coal", pumped out more pollution than previously.

Biden's next spending push to focus on infrastructure

With a $1.9 trillion covid relief package finally passed, U.S. President Joe Biden's next big spending push is already on the horizon - repairing the nation’s ailing bridges, roads and airports and investing billions in new projects like broadband internet.

Biden may sketch the outline of the plan, promised on the campaign trail, in a joint address to Congress this month and provide details in April, giving lawmakers several months to work on the bill before an August recess, people familiar with the White House plans said.

The White House has added infrastructure experts to the administration in recent weeks, and called in lawmakers and companies to discuss the topic

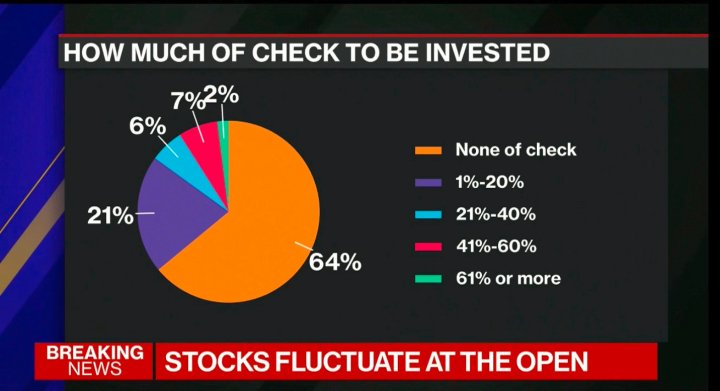

Bloomberg survey on plans to invest stimulus checks

Bloomberg has conducted a survey of stimulus check recipients to ask them how much of their $1,400 payment they plan to invest.

As the survey found, 1 in 50 recipients plan to invest between 61% or more of their check in the stock market.

Survey results:

- 64% of those polled said they plan to invest none of the payment

- 21% of those polled said they plan to invest 1-20% of the payment

- 6% of those polled said they plan to invest 21-40% of the payment

- 7% of those polled said they plan to invest 41-60% of the payment

- 2% of those polled said they plan to invest 61% or more of the payment

$3000/$3600 child tax credit per child: can I apply?

Child Tax Credit: eligibility and how to apply

Expanding CTC for one year from a partially refundable $2,000 per child to a fully refundable $3,600 or $3,000 is a move that experts say will significantly decrease child poverty in the United States. Nearly 11 million, or one in seven, US children live in poverty, the Center for American Progress, a progressive think tank, estimates.

These changes put more money in families’ pockets and also extend the credit to children who are left behind by the current credit. According to a report by the Institute on Taxation and Economic Policy (ITEP), approximately 83 million children live in households that would benefit from the new CTC legislation.

Find out more:

Why are banks holding people's stimulus checks?

While the official payment date for the $1,400 stimulus checks has been established as 17 March, the likes of Wells Fargo and Chase have faced heavy criticism for not releasing those payments already being deposited by the IRS this weekend.

The banks are in their right to hold back on releasing the payments until the official 17 March payment date outlined by the US Treasury. But why have these big banks not made an effort to start disbursing those payments that have already been transferred by the IRS – as has been the case with digital banks like Chime?

According to the Huffington Post, part of the reason is because Chase and Wells Fargo are set to gain from delaying the processing of payments at the expense of their customers who are eagerly awaiting the money.

"Sluggish check processing only works to banks' advantage because of the increased 'float' created by a massive influx of government cash. They can juggle the delays to boost outgoing loans to other customers, and to boost their profits," the HuffPost noted.

It’s absolutely essential that the president spend some time walking through the provisions of this bill and what it means to communities across the country...

I think that was a failure in the aftermath of the Recovery Act in 2009, and frankly that was a failure of people like me.

Stimulus checks changing lives

The checks are flowing and the emotional reactions are being captured. Improved vision for this American is essential for her work, but has been unaffordable until now, she says.

"It will change my life."

Stimulus tax: it may not be sexy, but it could get messy

The third round of stimulus checks and the measure exempting the first $10,200 of 2020 unemployment income from federal taxes for people earning less than $150,000, will likely require the IRS to modify its IT systems with about a month before tax returns are due on 15 April.

Biden's package also creates new headaches for tax professionals - many whom were already struggling to prepare returns this year because they still have questions about relief measures in last year’s stimulus packages.

“We’re literally building the freakin’ plane in the middle of the flight,” said Adam Markowitz, an enrolled agent and vice president at Howard L. Markowitz PA CPA. “And there are lots of ways to crash.”

Bitcoin attraction for stimulus checks

The guys at Squawk Box look at the excitement that can build up at the weekend, as stimulus checks get closer to the bank accounts of eager investors.

Reading stimulus

Did you know that tucked into the massive $1.9 trillion covid relief bill signed by President Joe Biden last Thursday is about $200 million for public libraries?

It's one of the reasons Republicans have criticized the bill, which they argue is too big and includes funding for things that have nothing to do with fighting covid or the resulting economic crisis.

But librarians say they've come to the rescue for those hit the hardest by the pandemic, becoming the only way many without internet access are able to get their kids online for school -- or access medical services, make vaccine appointments or register for federal aid like stimulus checks and unemployment benefits.

Read on...

Stimulus $30 billion for transit

President Biden’s sweeping stimulus package includes the largest single infusion of federal aid that public transportation has ever received, allowing agencies to scrap plans for draconian cuts.

Transit reporter for the New York Times, Christina Goldbaum, steers the conversation in a clear direction.

"Help is Here Tour" - more on Biden's stimulus address

President Joe Biden and his allies are hitting the road this week to promote the $1.9 trillion pandemic relief bill he signed in law last week as the right prescription for a country humbled by the covid-19 pandemic.

Biden and a slate of advocates including Vice President Kamala Harris and first lady Jill Biden are being deployed to politically important states and to television as part of what the White House is calling the "Help is Here Tour" to tout measures that include a $1,400 check for most US households.

"I promised the American people, and I guess it's becoming an overused phrase, that help was on the way," Biden told a White House ceremony on Friday. "We've delivered on that promise."

The bill was Biden's first legislative priority on taking office in January and his fellow Democrats used narrow majorities in the House of Representatives and Senate to pass a large measure of what Biden originally proposed without Republican support.

Find out more:

Stimulus checks thrown into stock market

According to a survey conducted by Deutsche Bank suggests that half of investors aged 25-34 with a brokerage account will put half of whatever they receive from President Joe Biden’s $1.9tn stimulus package into the stock market.

What will you be doing?

How to do stimulus right

According to the head of the Trades Union Congress, Frances O'Grady, and supported by MP Jack Dromey, the key a “Biden boost” for Britain’s covid-battered economy, is required. She argues that it should be along the lines of the US president’s ambitious $1.9tn (£1.4tn) stimulus plan.

In an exclusive interview with The Independent to mark the anniversary of the job-protecting furlough scheme, which she played a key role in constructing, Ms O’Grady said: “We need the ambition of the US scheme but also the values.

“It’s not just morally right; it’s economically literate. If I’ve learned anything in life, if you give to the rich, they’ll hold on to the money. If you give to ordinary people, they’ll spend it and boost demand.”

Full story:

FT does stimulus

The Financial Times had a look over the American Rescue Plan before it was signed into law.

Here's a reminder of how it was assessed.

Biden's Monday stimulus

Later today we'll be hearing from the president on his new bill and how he sees it delivering for American families and providing a necessary boost for the wider economy.

Child Tax Credit: 'a game changer'

"Businesses, I think, really for the first time, are recognizing the benefit, the essential benefit, of having a strong child care system in their community."

"Families are, I think, just making a heroic effort to make ends meet and to care for their children. This could a game changer in addressing child poverty."

How child poverty has been a key focus in the new stimulus bill.

Watch out: stimulus scammers about!

The Better Business Bureau is warning Americans of potential scams as the stimulus checks in the third round of relief payments start hitting bank accounts this weekend.

This type of behaviour was also seen in previous payments, so make sure that you are aware of what to watch out for.

Next up, Biden tax hike to balance books?

While the White House has rejected an outright wealth tax, its current thinking does target the wealthy.

President Joe Biden is planning the first major federal tax increase since 1993 to help pay for the long-term economic programme designed as a follow-up to his pandemic-relief bill, according to people familiar with the matter.

Unlike the $1.9-trillion Covid-19 stimulus act, the next initiative, which is expected to be even bigger, will not rely just on government debt as a funding source.

While it has been increasingly clear that tax hikes will be a component — treasury secretary Janet Yellen has said at least part of the next bill will have to be paid for, and pointed to higher rates — key advisers are now making preparations for a package of measures.

How stimulus plan can save mothers' lives

"How shameful that we have the highest maternal mortality rate in the industrialized world."

It’s easy to overlook amid the hundreds of pages of the $1.9 trillion stimulus plan President Biden signed into law Thursday, but a short section aims to combat America’s maternal mortality crisis by expanding health coverage for new mothers.

Under current law, all states provide Medicaid coverage to low-income women who are pregnant. More than 40 percent of babies born each year in the United States are to mothers enrolled in the public health program.

But coverage runs out 60 days after delivery, causing many women to become uninsured shortly after giving birth.

Sarah Kliff looks at the expansion of Medicaid.

$1,400 third stimulus check: what is "IRS TREAS 310 - TAX EIP3"?

Knowing your IRS TREAS 310 - TAXEIP3

Direct-deposit recipients whose stimulus checks have already appeared in their accounts have reported that the payment has been labeled on their bank statement using the reference "IRS TREAS 310 - TAXEIP3".

The first half of this description refers to the fact that it is the IRS and the US Treasury who are responsible for sending out stimulus checks, while "EIP3" is an abbreviation of "third Economic Impact Payment", the official name given to the check.

If you're trying to get your head around IRS TREAS 310 and TAXEIP3, we're here to help.

Household equity and stimulus checks

Bloomberg's Dani Burger considers the effect of the latest round of payments and the current household quity situation in the US.

Stimulus relief team: former Harris aide Lily Adams joins Treasury

Lily Adams, a veteran of Vice President Kamala Harris’ presidential bid, is joining the Treasury Department to help promote the $1.9 trillion American Rescue Plan and the administration’s broader plans to combat income inequality.

Why it matters: Touting Biden’s stimulus package will be a government-wide effort, with a coordinated communications strategy. Treasury is taking the lead on implementing it, and Adams will play a key role.

- Adams will help calibrate that campaign, underscoring the close linkage between the White House and Treasury.

- Treasury Secretary Janet Yellen has been receiving strategic communications help from Natalie Wyeth Earnest, who served as assistant secretary for public affairs for President Obama. She plans to leave this spring.

- As principal deputy secretary for public affairs, Adams will join a team led by Calvin Mitchell, the current assistant secretary. Alexandra LaManna serves as the department's spokesperson.

Read more:

World stocks react to US stimulus rollout

Stocks were mixed Friday, with two major US stock indexes closing at records while the tech sector was hammered. Interest rates spiked to their highest in more than a year.

World shares inched higher while US bond yields hovered near a 13-month peak on Monday on bets economic growth would accelerate even though investors became wary of the Federal Reserve and other key central bank meetings in the days ahead.

The $1.9 trillion stimulus bill President Joe Biden signed into law last week and the rollout of covid-19 vaccinations stoked a bullish mood, but the focus was gradually turning to the outlook for monetary policy.

"The Federal Reserve is expected to rigidly stick to its easing plans, despite (Fed Chair Jerome) Powell & Co likely becoming significantly more upbeat on the outlook," said AFS analyst Arne Petimezas in Amsterdam.

"However, the risks are towards a hawkish surprise. The $1.9 trillion stimulus has been adopted without much ado and the Biden administration has now set its sight on a big figure infrastructure bill," he added.

Stimulus check teething issues

As we've seen, the first stimulus payments as part of the $1.9 trillion American Rescue Plan started appearing in people's bank accounts this weekend. But some people claim that their checks have gone to the wrong account.

After checking the status of their payment on the Get My Payment tool on the IRS website, some taxpayers noticed that the last four digits of their bank account numbers did not correspond to their account, meaning that their payments went somewhere else.

It's a technical issue which the IRS experienced in the first two rounds of payments and one which will eventually be resolved but in the meantime, some face a longer wait for their checks.

Full story:

Could IRS tax filing deadline be extended?

This year, the tax filing deadline is on 15 April but there have been called for it to be extended, like it was last year, to accommodate the changes which might have affected filing taxes returns relating to last year, since the American Rescue Plan became law last week.

Benefits included in the bill could affect 40 million taxpayers, Bloomberg reports.

Democrats push for 'permanent' stimulus benefits

US Senate Democrats will push to make permanent two provisions of President Joe Biden's Covid-19 relief bill that provide emergency enhanced benefits for the poor through food assistance and child tax credits, two leading lawmakers said on Sunday.

Senate Majority Leader Chuck Schumer said that making enhanced child tax credits permanent is an important goal for Democrats, as they seek to move forward with bold new initiatives that also include legislation to upgrade US infrastructure.

Senator Kirsten Gillibrand, Schumer's fellow New York Democrat, called separately for enhancements for a nutrition program aimed at women, infants and children in the $1.9 trillion bill to be extended indefinitely. Biden's legislation temporarily increased the value of the program's cash vouchers for fruits and vegetables from $9 per month for children and $11 for women to $35 per month for both. The bill also expands the US federal child tax credit for one year from a partially refundable $2,000 per child to a fully refundable $3,600 credit for children under 6 and $3,000 for children aged 6 to 17, a move that experts say will significantly decrease child poverty in the United States.

"That's one of the most important things we can do. We can change America, if we make them permanent," Schumer told MSNBC. "It will be so good for these kids, their families, but for all of America and our economy."

Nearly 11 million, or one in seven, US children live in poverty, the Center for American Progress, a progressive think tank, estimates. Making the provisions permanent could prove difficult, with many Republicans opposed to any expansion in US welfare services that is not accompanied by work requirements for benefit recipients.

The Democratic-controlled House of Representatives can pass legislation on a simple majority and has begun to move bills that reflect party priorities such as police reform, gun control and measures to enhance voter participation. But the 100-seat Senate, which is split 50-50 between Democrats and Republicans, requires 60 votes for most legislation.

Schumer said Democrats would try to work with Republicans to enact 'bold change' but warned that his caucus would consider other means, including possible changes to Senate rules, if Republicans continue to oppose Democratic legislation. "But if we can't, if they vote 'no' on everything in terms of the kinds of change that America needs, then our caucus will have to get together and figure out how to get it done," Schumer said. "Everything will be on the table and failure is not an option."

Stimulus Relief bill and families

A married couple with two kids under the age of 6 could potentially receive more than $20,800 in monthly payments, stimulus checks and tax breaks in 2021.

Read more on how parents could benefit from the American Rescue Plan.

Stimulus checks and plenty more

Presdident Joe Biden tweeted this morning about the successes that took place just last week:

- Passed the American Rescue Plan

- Began sending out stimulus checks

- Announced every adult will be eligible for a vaccine by May 1

- Averaged more than 2 million vaccinations per day

The President is pleased with early progress...

Stimulus payments could be seized to pay off outstanding debts

Some people could see their $1,400 stimulus payment vanish from their bank accounts to pay off oustanding debts, loans, credit or overdrafts.

There is nothing stipulated in President Biden's relief bill which would stop debt collectors from claiming stimulus money to pay off personal debts. Most at risk are those who have a judgement against them - these give creditors the right to take a portion of your paycheck or money from your bank account to collect a debt.

Read more on what could happen.

Third stimulus check: which banks are not releasing it yet and why?

Banks questioned over stimulus checks

Around 160 million Americans are believed to be eligible for these payments and many of them have been desperately awaiting further support as the covid-19 pandemic has shaken their financial foundations to the ground, however, it has been suggested that some of the nation’s biggest banks are in less of a hurry to hand over said money.

"The goal is to get these payments out at fast as possible," stated one IRS official after Biden put pen to paper, and taxpayers are able to check progress from Monday (see below). But there could be a delay depending on which bank you are with as some said they would not be doing any processing over the weekend.

Read more:

US economy gaining traction?

On eight of the last 14 days, the Transportation Security Administration cleared more than a million people per day to board airplanes, the first such stretch during the pandemic outside of the Christmas and New Year's holiday weeks.

The numbers of people eating at restaurants has begun rising, data from reservation site OpenTable shows. While still low overall, in states like Texas and Florida patronage at reopened restaurants is more than 80% of a year ago, just before the pandemic - a sign people are willing to return to in-person activities as they become available.

Shift work at a broad set of industries jumped in the first week of March to nearly 90% of the pre-pandemic level, according to time management firm UKG, the highest reading in its labor index since last spring's jobs crash. Data on small businesses provided by time management company Homebase have also seen a steady rise in employment this year.

Beyond private business, school re-openings should mean the rehiring of bus drivers, cafeteria workers and others furloughed last year, and may speed the return to work of mothers and fathers unable to leave the home.

For trade show company Freeman, whose business was decimated by covid-19, the future seems to be falling into place.

Chief executive Bob Priest-Heck surveyed about 300,000 exhibitors and other customers in February and found about 78% plan to attend in-person events in the fall - compared with 60% in a survey just a month earlier and about equal with a normal year.

Event bookings for the 12 months beginning in July are already at $1.2 billion, an encouraging base to build towards the company's pre-covid annual revenue of around $2 billion, and a signal to plan more staffing. As it stands the firm expects to bring back at least 1,400 of the roughly 4,000 let go during the pandemic, and more as needed.

"Bookings are really materializing in the fall," Priest-Heck said. "I think we are going to have a really strong recovery ... We have massive, massive ramp-up plans."

#DirectDebit trending in the US

With stimulus checks starting to be received in numerous bank accounts over the weekend, the hashtag #DirectDebit was trending on Twitter.

Are you sharing your stimulus check news on social media?

Stimulus check payments: Treasury Dept plan

The US Treasury Department has issued a thread with useful information for Americans waiting for the next payment instalment after the approval of the American Rescue Plan.

Highlights:

Those eligible will AUTOMATICALLY receive these payments without having to take any action.

The first batch of relief payments will go to all taxpayers who provided direct deposit info for their 2019 or 2020 tax returns. This will be followed by a second batch to taxpayers who didn't provide that information but for whom the IRS has payment info from other programs.

They may receive checks in the mail, prepaid debit cards in the mail, etc.).

Check out the full thread:

Stimulus check live updates: welcome

Good morning as we begin our live blog on Monday 15 March 2021.

We will be bringing you all the latest stimulus bill news throughout the day following confirmation that as the first batch of relief payments began hitting banks accounts over this weekend.

Stay with us for everything you need to know, including reactions and opinions to the developing situation.

- Coronavirus

- Recession

- United States

- Economic climate

- Virology

- Outbreak

- Infectious diseases

- North America

- Parliament

- Microbiology

- Joseph Biden

- Diseases

- Medicine

- America

- Economy

- Biology

- Health

- Nancy Pelosi

- USA coronavirus stimulus checks

- Covid-19 economic crisis

- Science

- United States Congress

- Coronavirus Covid-19

- Economic crisis

- Pandemic

- Life sciences