Third stimulus check: why is my payment being mailed by post?

The IRS announced that 15 million paper stimulus checks were sent out by mail last week. Your $1,400 stimulus payment could arrive in the mail.

With the third round of economic impact payments now underway, over 120 million stimulus payments have now been sent out either by direct deposit or through the post as a paper check or EIP prepaid debit card. Out of the first batch of 90 million $1,400 stimulus payments, around 150,000 were issued as paper checks and mailed out by the United States Postal Service (USPS). In their latest update, the Internal Revenue Service (IRS) announced last Wednesday that the second batch of $1,400 stimulus payments has now been processed and is ready to be sent out - 37 million payments worth a total of nearly $83 billion; 15 million payments have been sent out as paper checks (with a total value of nearly $34 billion) and approximately 5 million prepaid EIP debit cards (with a total value of around $11 billion).

Follow the latest news on US stimulus checks

Over the coming weeks the government will be sending out additional waves of payments either through direct deposit or the mail. The IRS updated the Get My Payment tool for the third round of stimulus checks, where you can track your payment.

Could a fourth stimulus check happen in April?

IRS finally receives SSA stimulus check information

Who are included as social security recipients for third stimulus check?

Can you get both the Golden State Stimulus and a $1,400 stimulus check?

IRS 'Get My Payment' tool provides stimulus check status and updates

Why is your payment being sent by post?

The IRS is trying to get out all the stimulus payments out quickly and on time - the vast majority of payments have been transferred automatically to individual's bank accounts through direct deposit but that method is not always possible. If you haven't signed up for direct deposit with the IRS, providing them with all of your banking information or the agency doesn’t have your current, valid bank account details, then you will most likely receive your payment in the form of a traditional paper check or in some cases, a EIP debit card.

This could be the case if your banking information the IRS has on file isn’t accurate. If the IRS sent you a direct deposit but there was any kind of error the agency will send you a payment in the mail to expedite it. This happened in the second round of payments when payments were sent to temporary accounts set-up by tax preparation companies for filers. However, those companies are working to avoid it happening this time round.

Criminals take every opportunity to defraud unsuspecting victims, especially people in need. #IRS urges you: Watch for schemes that may emerge around the 3rd round of Economic Impact Payments. https://t.co/dwDsBkf1Xr #COVIDreliefIRS pic.twitter.com/xa03LNsxE1

— IRSnews (@IRSnews) March 27, 2021

How to find out if you will receive your payment in the mail?

The easiest way to check your payment and when it is due to arrive is by using the IRS Get My Payment tool where you can track your payment. The tool will let you know how and when you will receive your payment. The IRS will continue to issue the EIP stimulus payments throughout 2021. The IRS only updates the Get My Payment tool information once per day, typically during a two-hour period overnight, so refreshing throughout the day won’t give you any new information.

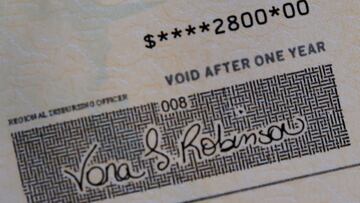

If your payment is being sent by mail you will want to keep a close eye on your mailbox. You can also use the USPS free service Informed Delivery which lets you know what mail to expect. The Get My Payment tool will not tell you whether you are receiving a paper check or an EIP debit card. To stop people from mistakenly throwing out their EIP cards for believing them to by junk mail, the IRS provided an example of what the EIP Cards look like and the white envelope in which they are sent

A large number of Economic Impact Payments will be mailed, so #IRS reminds taxpayers to watch the mail carefully in the coming weeks for a paper check or a prepaid debit card. If you’re waiting for your payment, see https://t.co/6aL9Y7oNMx #COVIDreliefIRS pic.twitter.com/wK5MY4iQew

— IRSnews (@IRSnews) March 27, 2021

Messages that you might encounter on the Get My Payment tool

“Need More Information”: The IRS issued your payment but it was returned to the IRS because the post office was unable to deliver it. You will need to update your information with the agency so they can reissue the payment.

If you want the IRS to send the payment as a direct deposit, you can provide the IRS with a routing and account number for a bank account, a reloadable prepaid debit card, or other financial product.

If your mailing address has changed, you can also notify the IRS of your new address. There are a few ways to do this:

- Include the new address when you file your 2020 taxes

- Use Form 8822, Change of Address or Form 8822-B, Change of Address or Responsible Party - Business and send them to the address shown on the forms.

- Send a letter with your full name, old and new addresses, Social Security number, Individual Taxpayer Identification Number or Employer Identification Number, and signature to the IRS address on your last tax return.

"Payment Status Not Available": This message appears when the IRS hasn’t processed your EIP yet, the agency doesn’t have enough information to issue you a payment or you aren’t eligible for a payment.

Related stories

The eligibility requirements for the third round of payments were tightened, so make sure to check if you are eligible for a payment. Individuals with adjusted gross incomes above $80,000 and couples filing jointly earning more than $160,000 will not be eligible for any stimulus money.

Third stimulus check: latest updates

You can get the latest information on the third stimulus check, and updates on the possibility of a fourth direct payment, by following our dedicated live blog.

- Coronavirus

- Recession

- Economic climate

- Virology

- Outbreak

- Infectious diseases

- Public finances

- Microbiology

- Diseases

- Medicine

- Coronavirus stimulus checks

- Economy

- Finances

- Biology

- Health

- Life sciences

- USA coronavirus stimulus checks

- IRS

- Covid-19 economic crisis

- Science

- Coronavirus Covid-19

- Economic crisis

- Inland Revenue

- Pandemic