Fourth stimulus check summary: 30 May 2021

Latest updates and info on the third stimulus check in President Biden's coronavirus relief package, and news on a potential fourth check.

Show key events only

US Stimulus check news: live updates

Headlines:

- President Biden proposes $6 trillion budget to Congress for 2022 fiscal year (what benefits could it provide directly to families?)

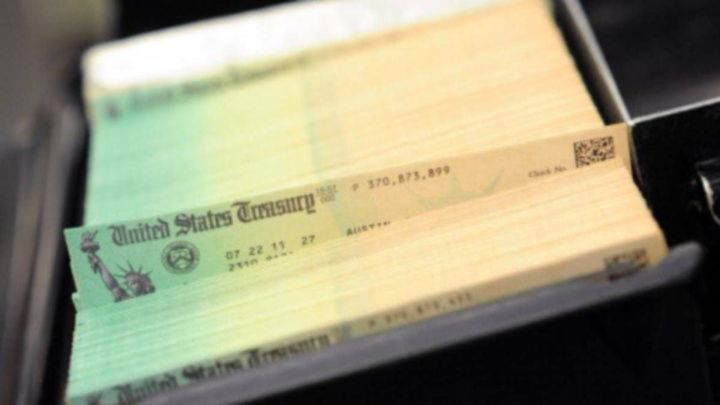

- Another 1.8 million 'plus-up' stimulus checks have been sent out by the IRS this week, bringing the total number distributed to 167 million

- Cherokee Nation announces a $2,000 two-part stimulus check as part of their Respond Recover and Rebuild plan (read more)

- Consumer spending falls as stimulus check boost wears off

- Biden's new budget proposal does not include a fourth stimulus check (read more)

- Global house prices rise on back of stimulus strategies

- Florida confirms state will end $300 weekly unemployment booster in June (full story)

- Child and Dependent Care Credit 2021... all you need to know

- Payments for the 2021 Child Tax Credit are just around the corner (full story)

- The IRS tax return deadline of 17 May has now passed; however some states have issued extensions (read more)

- California sends out $600/$1,200 stimulus checks as part of the Golden State Stimulus scheme

- You can track your third stimulus check by using the IRS' online Get My Payment portal

Keep up to date with the latest US and global vaccine newswith our covid-19 vaccine live feed

Take a look at some of our related articles:

New round of stimulus checks send: How to claim mine if it is missing?

New round of stimulus checks send: How to claim mine if it is missing?

On 26 May the IRS announced that it had sent 1.8 million more stimulus checks, bringing the total amount distributed to 391 billion dollars.

Who will be eligible to receive benefits from Biden’s $6 trillion plan?

Who will be eligible to receive benefits from Biden’s $6 trillion plan?

The two economic proposals released by the White House are worth more than $6 trillion. Our team took a look at what benefits families and individuals could expect if enacted.

Cherokee Nation stimulus check: who gets it and how much is it worth?

Cherokee Nation stimulus check: who gets it and how much is it worth?

The American Rescue Plan, passed by Congress in March, provided a $20 billion federal boost for the US' tribal communities. Of these funds, some will go on an additional round of direct payments for citizens.

Read our full coverage for more details on the value and eligibility.

$116 million California Vaccine Lottery: how to enter and sign up

$116 million California Vaccine Lottery: how to enter and sign up

On Thursday California Gov. Gavin Newsom announced the introduction of an enormous cash lottery aimed at convincing more of the state’s residents to get the covid-19 vaccine. The US’s most populous state is offering the largest cash incentive in the country, with ten lucky Californians set to receive a $1.5 million jackpot.

So far more than 20 million Californians are at least partially vaccinated, but there are still roughly 12 million residents who are eligible for the life-saving shots who are yet to sign up. The hope is that the California Vaccine Lottery, with a combined prize pot of $116.5 million, will convince anyone yet to be vaccinated to get the shot.

Read our full coverage here.

Urban Institute reports on how immigrant families were unable to take advantage of federal aid. Some states, like California, have allowed immigrant households to claim benefits passed through state stimulus packages.

Brookings Institute, the prominent non-partisan think tank, reports on student loan debt. In a new report, Brookings researchers propose innovative programs that could be implemented to make higher education more affordable. Full details here.

$3,000/$3,600 child tax credit: how and when to opt out from the stimulus

$3,000/$3,600 child tax credit: how and when to opt out from the stimulus

Beginning in July, 88 percent of children in the US could automatically receive a monthly payment or their parents could opt to defer that payment to next year when they file a 2021 tax return. The direct payments will be part of the Child Tax Credit, enhanced in the American Rescue Plan for the 2021 fiscal year.

The Internal Revenue Service (IRS) is setting up two online portals for parents that the agency has said will be ready by 1 July, the exact date has not been confirmed yet. One of the portals will serve to let parents opt out of the direct monthly payment system which will begin 15 July. The other will allow parents to update their information.

Read our full coverage here.

The Tax Foundation reports on a piece of the American Jobs Plan that could actually threaten jobs around the country if a system to tax multinational corporations is not established.

President Biden speaks to economic growth predictions that show the US economy could grow six percent this year.

Who will be eligible to receive benefits from Biden’s $6 trillion plan?

Who will be eligible to receive benefits from Biden’s $6 trillion plan?

The two economic proposals released by the White House are worth more than $6 trillion. Our team took a look at what benefits families and individuals could expect if enacted.

In conjunction with the American Rescue Plan, the American Jobs Plan and American Families Plan form President Biden’s Build Back Better (BBB) economic agenda. While on the campaign trail, candidate-Biden argued that returning to “normal” was not enough after the pandemic. For many across the United States, the pandemic has exposed the deep inequities that left many families economically vulnerable throughout the crisis.

Within months of being in office, the White House released the two proposals to build a more resilient country while also acknowledging that many families were struggling before the pandemic.

Read our full coverage for what benefits families could expect if the proposals are approved.

Businessweek reports on consumer spending this Spring. They report that as mask mandates were lifted, and some semblance of normalcy returned, those in the US are spending.

Newsweek reports on how incomes dropped from March to April after the third round of stimulus chcks were spent.

How to receive your unemployment tax refund

How to receive your unemployment tax refund

The American Rescue Plan passed by Congress in March included a $10,200 tax waiver per person on unemployment compensation received in 2020. Curious how to claim it?

The US tax authority, the IRS, has stated that an additional tax return does not need to be filed if one was sent before the legislation passed. The agency has identified over ten million taxpayers who will have their returns adjusted automatically and sent in the coming months.

Read our full coverage to find out when the returns are expected.

Transportation Secretary Pete Buttigieg shares his thoughts on the Republican's counter-proposal to the American Jobs Plan which would cut the size of the legislation in half.

Read our coverage to know what programs, investments, and initiatives the American Jobs Plan aims to make.

Worried about rising prices? Market Watch reports on how federal stimulus and the reopening of the economy are leading to an increase. ininflation. Full details here.

The Sun: Americans could get fourth Covid stimulus checks automatically in in July

AMERICANS could find a fourth stimulus check in their bank accounts from July as families will soon receive their child tax credit payments, reports the Sun.

Optimism about the impact of Child Tax Credit

The new-look Child Tax Credit is scheduled to begin on 15 June, when monthly payments will begin going out to an estimated 39 million American families. The reformed programme is a significant departure from the previous system, which offered just a single tax credit to be claimed at the end of each tax year.

“The child tax credit is a lifeline to the middle class,” Democratic Rep. Rosa DeLauro told Congress recently. “It provides children and their families with additional payments throughout the year that helps them with the cost of food, child care, diapers, health care, clothing and taxes.”

"Secret" stimulus checks for homeowners, as pointed out by The Sun

The Sun reports on the possibility for American homeowners to get their hands on a "secret" stimulus payments, as long as they are willing to ask for it.

This "secret" stimulus is available in the form of financial assistance to help homeowners pay their mortgage, taxes, insurance and utilities, which they will be able to claim through the Homeowners Assistance Fund.

To be eligible for the payment, a homeowner must have a mortgage balance of less than $548,250, reports The Sun.

To apply, you must contact your state housing agency.

See the full story.

New round of stimulus checks send: How to claim mine if it is missing?

On 26 May the IRS announced that it had sent 1.8 million more stimulus checks, bringing the total amount distributed to 391 billion dollars. See full story on how to claim yours if it's missing.

Over 50% of the US population have received one dose of the Covid-19 vaccine

As of today, Sunday 30 May 2021, a total of 167,157,043 people in the United States have received at least one dose of one of the three Covid-19 vaccines. Meanwhile, 40.5% of the nation, 134,418,748 people, have received both doses and are now fully vaccinated.

Read more about the US vaccine rollout on our daily Covid-19 blog here

Cherokee Nation stimulus check: who gets it and how much is it worth?

On Thursday Principal Chief Chuck Hoskin, the leader of the Cherokee Nation, signed legislation that will provide an additional round of stimulus checks to citizens of the Oklahoma-based tribe.

Read more about the Cherokee Nation $2000 stimulus payment here

Almost 2.5 million have signed petition for recurring $2,000 monthly payments

The Change.org petition set up last year by Denver resident Stephanie Bonin asking Congress to support families with a $2,000 payment for adults and a $1,000 payment for children with continuing regular checks for the duration of the crisis is close to reaching 2.5 million signatures. As of today, the moneyforthepeople petition has gained 2.247.511 signatures.

38% say their household income still negatively affected by pandemic

According to TransUnion's latest Consumer Pulse Study, an online survey of 2,995 adults was conducted between February and March 2021, US consumers continue to be negatively impacted over a year after the start of the pandemic.

35% of the those who took part said that their income has remained steady and that they had not been financially affected by the crisis; 27% said that their income had decreased but were hopeful that the situation would recover and improve while 22% said that their income that has decreased, and are doubtful their finances will recover.

Biden's proposed tax hike encounter resistance among Dems

Washington Post economics reporter Jeff Stein was a guest on The Hill's Rising programme last week and spoke about the difficulty which President Joe Biden will encounter from members of his own party to push through his $2 trillion infrastructure package. Biden plans to finance his major overhaul of US infrastructure by raising taxes of the country's top earners to 39.6%.

Stein however, note that a number of Democrats have balked at the idea of raising the top tax bracket. "It's really kind of amazing how much opposition there is among Democrats themselves to Biden's tax hikes. When you put it all together, while most Democrats are supportive of the spending side of the White House agenda, the taxes that Biden wants to pay for these measures... at best there's maybe support for about half of that right now among Biden's own party," he explained.

How to sign up for the California Vaccine Lottery

Fortunately, there is no complicated registration process to contend with to be entered into the draw, simply ensure that you get your first vaccine dose and you will be automatically signed up. The lottery draw will be taken from the state’s vaccine registry.

The only vaccinated Californians who will not be entered into the draw are incarcerated residents, and some state employees (California State Lottery, California Department of Public Health, the Government Operations Agency, California Health and Human Services Agency, the governor’s office) and their families.

$116 million California Vaccine Lottery: how to enter and sign up

On Thursday California Gov. Gavin Newsom announced the introduction of an enormous cash lottery aimed at convincing more of the state’s residents to get the covid-19 vaccine. The US’s most populous state is offering the largest cash incentive in the country, with ten lucky Californians set to receive a $1.5 million jackpot.

So far more than 20 million Californians are at least partially vaccinated, but there are still roughly 12 million residents who are eligible for the life-saving shots who are yet to sign up. The hope is that the California Vaccine Lottery, with a combined prize pot of $116.5 million, will convince anyone yet to be vaccinated to get the shot.

Upon announcing the lottery, Newsom said: “We’re putting aside more resources than any other state in America, and we’re making available the largest prizes of any state in America for those that seek to get vaccinated.”

US inflation surges to 13-year high and consumers are paying the price

A key barometer of inflation rose again in April and hit a 13-year high, reflecting a broad surge in consumer prices as the U.S. fully reopens for business and massive government stimulus sloshes through the economy.

The PCE index climbed to 3.6% in April from a year earlier, marking the strongest reading since 2008 and putting inflation well above the Federal Reserve’s 2% goal.

A separate measure of inflation that strips out food and energy also surged to the highest level since 1992.

Why more stimulus may equal worse growth

An abundance of research tells us that as government spending increases, an economy suffers worse economic growth measured by real GDP per capita.

When are weekly unemployment benefits in Florida ending? Deadline and reason

Florida announced Monday that the state will join 22 other states ceasing participation in Federal Pandemic Unemployment Compensation program (FPUC), the $300 weekly extra payment to those receiving unemployment benefits. Unlike the majority of those states, it will keep other federal unemployment benefits.

Three weeks ago, Montana began a trend among Republican-led states of announcing that they would no longer participate in some or all of the federal unemployment programs set up under the CARES Act last year to help the millions of Americans thrown out of work due to the covid-19 pandemic.

Those programs have been twice extended, most recently under the American Rescue Plan which finances that economic assistance to the jobless until 6 September.

Florida announced Monday that the state will join 22 other states ceasing participation in Federal Pandemic Unemployment Compensation program (FPUC), the $300 weekly extra payment to those receiving unemployment benefits. Unlike the majority of those states, it will keep other federal unemployment benefits.

Three weeks ago, Montana began a trend among Republican-led states of announcing that they would no longer participate in some or all of the federal unemployment programs set up under the CARES Act last year to help the millions of Americans thrown out of work due to the covid-19 pandemic.

Those programs have been twice extended, most recently under the American Rescue Plan which finances that economic assistance to the jobless until 6 September.

$54 million stimulus to fix Nevada unemployment system

Nevada lawmakers considered whether to spend $54 million in federal stimulus money on a long-term fix of the state's outdated unemployment system.

The statewide shutdown in March 2020 crippled Nevada's unemployment system, which suddenly saw an unprecedented number of people applying for benefits.

DETR officials said a complete modernization could cost as much as $54 million but would bring the systems into the 21st century and better prepare the state for the next financial crisis.

"What Nevadans get in the future is a sort of future-proof disaster response program that is able to handle the ups and downs of unemployment," said DETR director Elisa Cafferata.

Biden agrees extension to mortgage forbearance programme

The CARES Act only provided one year of mortgage forbearance, meaning that the programme was due to expire in March 2021. However in February President Joe Biden announced that he was extending the pandemic housing assistance for an extra four months, meaning that homeowners were able to request forbearance support until July.

This means that anyone yet to apply for the programme has until 30 June 2021 to request the mortgage relief to take advantage of the scheme. The Biden administration claimed that the February extension will provide support for 2.7 million homeowners across the country, while 11 million recipients of government-backed mortgages will be eligible for the assistance if required.

Stimulus mortgage program: how to apply to pause mortgage payments

Having trouble with mortgage payments as a result of the pandemic?

Read our coverage by William Gittins on how to apply to pause payments.

How does the Child Tax Credit work?

The Child Tax Credit was last adjusted in 2017 with the Tax Cut and Jobs Act. This saw the credit expanded to $2,000 per child, but only $1,400 of that was refundable. Further more, in order to claim the refundable portion of the credit a filer had to show earned income of more than $2,500. Above that the taxpayer could claim only a portion of the refundable part of the credit until their income allowed for the whole of the refundable portion.

Now that the earnings floor has been removed and the credit is fully refundable, it is expected that childhood poverty could be reduced by half in 2021. But the measure will be temporary with the changes set to expire at the end of year. President Biden has said that he wants to extend the expansion until 2025, when the changes made in 2017 will expire as well, dropping the credit back to $1,000. The hope is that the enhanced credit will prove so popular that voters will want the changes to be made permanent. Congressional Democrats, for they part, want to make the credit permanent starting this year as part of the American Families Plan.

US consumer confidence holds steady

US consumer confidence hovered at a 14-month high in May as optimism about job prospects tempered concerns about rising inflation and diminishing government financial support.

Though the survey from the Conference Board on Tuesday suggested the pace of economic growth remained robust in the second quarter, the recovery from the pandemic recession, which started in February 2020, is bumpy.

The housing market, one of the star performers, is showing signs of fatigue, with new single-family homes sales dropping in April amid a dearth of properties, which is boosting prices at the fastest pace in more than 15 years.

$3,000/$3,600 Child Tax Credit: what to know about the stimulus coming in 15 July

The IRS is preparing a new online portal where parents can choose whether to receive advance payments or hold off until they file taxes in 2022.

New round of third stimulus checks sent: how many batches are left?

The IRS continues to make payments as part of the third round of stimulus checks, and will do so for the remainder of 2021. As they work their way through a backlog of tax return information from the 2020 they are finding new eligible recipients, and issuing 'plus-up' stimulus checks to some who were underpaid.

If you feel like you are still owed a stimulus check from the third round of payments it is not too late to get the money. Here's everything you need to know about the latest payments...

What is the Homeowner Assistance Fund?

The Homeowner Assistance Fund (HAF) is part of the 2021 American Rescue Plan and was brought in to prevent mortgage delinquencies and defaults, foreclosures, loss of utilities or home energy services, and displacement of homeowners experiencing financial hardship after 21 January 2020. Funds from the HAF may be used for assistance with mortgage payments, homeowner’s insurance, utility payments, and other specified purposes. The law prioritizes funds for homeowners who have experienced the greatest hardships, leveraging local and national income indicators to maximize the impact.

Who has been pushing to pass a fourth stimulus check?

There was no mention of a fourth stimulus check in Biden's new budget proposal, but that does not mean that there are no plans to implement another round of the direct payments. In Congress there are a number of Democratic lawmakers who have publicly given their support to another stimulus check.

Some want another single round of direct payments, but many are in favour of a new system which would see payments go out on a monthly basis. These 'recurring stimulus checks' would be costly, but there is a clear appetite for them in Congress.

Read more on who is keen for a fourth round of stimulus here

2021 Delinquent Tax Property Auctions: how to find, list, and purchase

In some states, when a homeowner falls behind on their property taxes or utility bills, the government can bundle the debt and sell it to an investor. The state uses the money from the sale to pay the overdue taxes, and then the homeowner pays the investor. If they cannot pay back the investor, their house can be foreclosed on, seized, or auctioned. Each state regulates the market on these assets known as tax liens in a different way.

Pelosi's statement on Biden's budget

House Speaker Nancy Pelosi issued a statement on President Biden’s budget for 2022. The 2022 budget proposal totals $17.6 billion — an increase of $2.5 billion, or 17%, on 2021's figures. It also includes the American Jobs Plan and the American Families Plan.

“A federal budget should be a statement of our national values. President Biden’s budget is an unequivocal declaration of the value that Democrats place on America’s workers and middle class families, who are the foundation of our nation’s strength and the key to Build Back Better.

“The Biden budget makes historic investments in the American workforce and economy. It does so by seizing a once-in-a-generation opportunity to create millions of good-paying Americans jobs, supercharge America’s global competitiveness and power growth for generations to come. After years of severe underinvestment, as our nation recovers from pandemic and economic crisis, now is the time to launch an ambitious and powerful blueprint for success with the American Jobs and Families Plans. We will lower prescription drug costs and strengthen Medicare, Medicaid and the Affordable Care Act, while taking transformative action for families to lower child poverty and make improvements in housing, child care and other vital lifelines for families.

“Congressional Democrats look forward to working with the Biden-Harris Administration to enact this visionary budget, which will pave the path to opportunity and prosperity for our nation. The Biden Budget is a budget For The People.”

Working American Women will pay cost of the Covid-19 pandemic

According to a study, published in the Journal of the American Medical Association late last year, the Coronavirus pandemic could cost the United States up $16 trillion. That's four times the size of the damage done by the 2008 house price crash and recession which followed.

In an opinion piece in today's Newsweek, Emily Peck counts the cost of the Covid-19 crisis and takes a look at who will eventually pick up the bill. She notes that over 4.5 million fewer women are employed now than at the start of the pandemic. Most of them, when they return to the workforce will probably earn less than they did before. That means they will pay less Social Security and have less disposable income from savings once they retire.

Collectively, women in the US who left the workforce in 2020 could take a financial hit of $885 billion for two years out of work, the Newsweek study, conducted by economist Michael Madowitz of the Center for American Progress shows.

Read the full piece on women workers in the US post-pandemic here

Stimulus check boost encourages first-time homeowners

It seems like the unprecedented levels of federal stimulus distributed over the course of the pandemic, along with the relatively low interest rates, has encouraged more people to dip into the housing market and take advantage of the favourable conditions. Case-Shiller's national house-price index has risen at an annual rate of 13%, the fastest rate of increase for 15 years.

This report from the Economist claims: "Lower interest rates have encouraged people to take out bigger mortgages, and trillions of dollars of fiscal stimulus have let people spend more on housing."

Optimism about the impact of Child Tax Credit

The new-look Child Tax Credit is scheduled to begin on 15 June, when monthly payments will begin going out to an estimated 39 million American families. The reformed programme is a significant departure from the previous system, which offered just a single tax credit to be claimed at the end of each tax year.

“The child tax credit is a lifeline to the middle class,” Democratic Rep. Rosa DeLauro told Congress recently. “It provides children and their families with additional payments throughout the year that helps them with the cost of food, child care, diapers, health care, clothing and taxes.”

Who has been pushing to pass a fourth stimulus check?

Despite being excluded from the recently announced federal budget, Democratic lawmakers are continuing to fly the flag for a fourth stimulus check, perhaps even one that provides recurring payments.

In recent months the White House has received three letters from Democrats in Congress urging the inclusion of recurring stimulus checks in future relief bills. A letter from Senate Democrats pointed out that six in ten Americans didn’t think that the $1,400 direct payments would last them even three months. This is confirmed by recent data that shows that the stimulus check-induced economic boost is wearing off.

What is in the California Comeback Plan stimulus package?

Gov. Gavin Newsom is eager to see his state reopen as swiftly as possible but in the meantime he is looking to provide further economic relief for residents and businesses who have been hit hardest by the pandemic. He passed the Golden State Stimulus bill earlier this year, and recently announced the California Comeback Plan, which will provide an additional round of stimulus checks to an estimated two-thirds of the state's residents.

Do you know how much the Child Tax Credit is worth to your family?

There has been a lot of talk about the new-look Child Tax Credit in recent weeks as Biden looks to extend the intitial 12-month programme beyond that timeframe. However the new system has not even began yet, and over half of potential recipients do not know if they are eligible.

The new Child Tax Credit programme will provide monthly payments worth up to $300 for children aged younger than six, or $250 for those aged between six and 17.

Child Tax Credit expansion will provide "space to breathe"

The White House has placed a lot of hope on the new Child Tax Credit programme, which will reportedly halve the number of American children in poverty over the next year. For now, the expansion will only last for 12 months but Biden's American Families Plan would extend that to the end of 2025.

The impact of the new direct payments should not be underestimated. Speaking to left-wing advocacy group Bridge Project, parents reveal how much the monthly payments will help their families through the pandemic.

How do stimulus checks impact spending?

Consumer spending in March shot up after the third round of stimulus checks began to be distributed. Some economists show that these levels of spending were not seen in April and should not be expected in May. Market Watch reports. that "Consumer spending rose 0.5% in April" and that the slow growth relates to the fact that "incomes sank 13.1% in the absence of any further federal support".

US stimulus checks live updates: welcome

Welcome to our live US stimulus checks blog for Sunday 30 May.

Throughout the day, we’ll be bringing you all the latest information on a possible fourth direct payment as well as updates on the third stimulus check, which the IRS has been distributing since the $1.9tn American Rescue Plan was signed into law in early March.

- Coronavirus stimulus checks

- USA coronavirus stimulus checks

- Joseph Biden

- Chicago

- Nancy Pelosi

- Covid-19 economic crisis

- Unemployment compensation

- Seattle

- Illinois

- New York

- Science

- California

- Florida

- Coronavirus Covid-19

- Economic crisis

- Unemployment

- Pandemic

- Coronavirus

- Recession

- United States

- Money

- Economic climate

- Virology

- Outbreak

- Infectious diseases

- Employment

- North America

- Diseases

- Microbiology

- Payment methods

- Medicine

- America

- Economy

- Work

- Health