Who qualifies for the $500 dependent credit and who doesn't get the Child Tax Credit?

The 2021 Child Tax Credit raised the age for children that qualify to 17, but taxpayers with older dependents may qualify for a $500 tax credit.

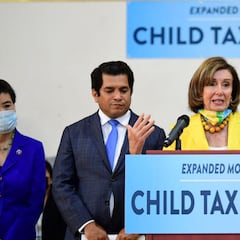

The American Rescue Plan enacted in March greatly expanded tax credits for parents and guardians. Although parents with dependents over 17 years of age might not get in on the advance payment program for those dependents, they may qualify for a tax credit for other dependents and additional tax credits when they file their tax return in 2022.

Parents and guardians with children 17 and younger will receive six monthly installments on the 2021 Child Tax Credit this year, if they meet the income eligibility and other requirements. As well if they haven’t chosen to opt out of the advance payment scheme added to the tax credit for the 2021 fiscal year, and perhaps beyond.

Also see:

- $3.5 trillion reconciliation bill would make changes to the Child Tax Credit permanent

- Deadline to opt-out of August Child Tax Credit payments is coming fast

- Families to receive half of Child Tax Credit in 2021, the rest in 2022

- Child Tax Credit: what is the income limit for joint filers, single filers and heads of household?

However, their older dependents may qualify for a tax credit through the Earned Income Tax Credit, the Child and Dependent Care Tax Credit or a $500 Tax Credit for Other Dependents.

$500 Tax Credit for Other Dependents (ODC)

Eligible families can receive up to $3,000 per child between the ages of 6 and 17. Each child under age 6 could qualify for up to $3,600. The age limits apply to the age of a child at the end of a fiscal year, so if a child turns 18 for example before 1 January of 2022, they will not qualify for the 2021 Child Tax Credit. The credit is fully refundable, so if a family owes less than the amount of the credit, they will receive the excess as a tax refund.

The #IRS Interactive Tax Assistant lets you check if a type of income is taxable, if you're eligible for a credit or if you can deduct an expense. This and much more at https://t.co/5OdM6EQEKl pic.twitter.com/FSOGfkeXg7

— IRSnews (@IRSnews) July 16, 2021

Taxpayers may qualify for a $500 Credit for Other Dependents for each dependent that doesn’t qualify for the Child Tax Credit. These can include any dependent 17 or older, including dependent parents or other relatives. As well dependents living with a taxpayer but not related. This tax credit is not refundable and begins to phase out for individuals earning more than $200,000 a year and $400,000 for joint returns.

Taxpayers will want to check the IRS online tool to determine whether their child or dependent qualifies for the Child Tax Credit or the Credit for Other Dependents. The agency also provides another online tool to see who qualifies as a dependent.

Other tax credits for those with earned income and dependents in 2021

One of the changes to the 2021 Child Tax Credit was that no earned income is required to claim the credit, a big boost for those who may still find themselves struggling to get back to work as the economy recovers. But for those that have managed to get back into the workforce the American Rescue Plan also expanded the tax credit families can claim based on their income and the size of their family. Additionally, the amount a family can claim for cost of hiring services or other expenses incurred so that can have their loved ones taken care of while they work.

More workers without children will qualify for the Earned Income Tax Credit in 2021. Learn more about #EITC and other tax changes for 2021 in this #IRSTaxTip: https://t.co/jz5XgyTZrY #IRS pic.twitter.com/SOjRi7hKAG

— IRSnews (@IRSnews) July 16, 2021

Related stories

Along with changes to increase eligibility the Earned Income Tax Credit (EITC) was increased for the for the 2021 fiscal year. Taxpayers with children can get yp to $6,728, depending on the number of children and their income. In order to claim the credit for one or more children, those dependents must meet certain qualifications. Taxpayers without children can qualify for a tax credit of up to $1,502. For more information NerdWallet has a good explainer about the credit. You can also check the IRS EITC Assistant.

The Child and Dependent Care Tax Credit (CDCC) could provide a credit of up to $8,000 to those who have dependents under their care. The credit for expenses incurred to have some one look after their dependent while they work allows taxpayers to claim up to 50 percent of $8,000 spent for one dependent in 2021, or up to 50 percent of $16,000 for two or more. Children under 13, a spouse or parent who cannot care for themselves or another dependent could qualify. A major change for 2021, the credit was made refundable which could give taxpayers a sizeable refund. For more information check the IRS Frequently Asked Questions about the credit.

#IRS Publication 5349 has multiple tools for year-round tax planning. What you do now may affect any tax you could owe or refund you may expect next year. Learn more: https://t.co/8XagxegVd0 pic.twitter.com/Hs2tjifGGN

— IRSnews (@IRSnews) July 14, 2021

- IRS

- Child benefits

- Covid-19 economic crisis

- Science

- Income tax

- Social support

- Coronavirus Covid-19

- Economic crisis

- Inland Revenue

- Taxes

- Pandemic

- Coronavirus

- Recession

- Tributes

- Economic climate

- Virology

- Outbreak

- Infectious diseases

- Public finances

- Social policy

- Diseases

- Microbiology

- Medicine

- Economy

- Finances

- Biology

- Health

- Life sciences

- Politics