$3000/$3600 Child Tax Credit: Can I just get one month and opt out?

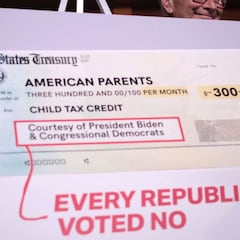

The first payment of the Advanced Child Tax Credit has been sent to over 35 million families. Some are wondering, is there still time to opt out?

The IRS announced that the first round of payments for the Child Tax Credit was sent to more than 35 million families, totaling more than $15 billion.

When the federal government began making stimulus check payments, they encouraged families to provide the agency with direct deposit information so that the checks could be received more quickly. This effort has paid off, and its success is reflected in the 86 percent of Child Tax Credit payments sent through direct deposit.

VP Kamala Harris on child tax credit payments: "This tax cut will be issued in monthly payments ... if the struggle to make ends meet is monthly, the solution has to be also." pic.twitter.com/f8O1mO6Pdh

— Aaron Rupar (@atrupar) July 15, 2021

Why are families opting out?

The next payment will be made on 13 August, and there is still time to opt out should families choose to do so. Through the Child Tax Credit Update Portal, families can manage their payments, including an option to forgo future payments. Those who would like to opt out, including the August payments, must do so by 2 August.

Child Tax Credit: Opt-Out Deadline and Payment Schedule

|

Payment month

|

Deadline Date

|

Payment Date

|

|

July

|

28 June 2021

|

15 July 2021

|

|

August

|

2 August 2021

|

13 August 2021

|

|

September

|

30 August 2021

|

15 September 2021

|

|

October

|

4 October 2021

|

15 October 2021

|

|

November

|

1 November 2021

|

15 November 2021

|

|

December - Final Payment

|

29 November 2021

|

15 December 2021

|

Families used to receiving the payments as one lump sum or those who will owe a substantial amount of money when they file their taxes have considered opting out.

The IRS states that the payments are an advanced tax credit, meaning that “every dollar you receive will reduce the amount of Child Tax Credit you will claim on your 2021 tax return. This means that by accepting advance child tax credit payments, the amount of your refund may be reduced or the amount of tax you owe may increase.”

By opting out of the payments, families may “avoid owing tax to the IRS if you unenroll and claim the entire credit when you file your 2021 tax return.”

What features will be added to the Child Tax Credit Update Portal later this year?

Related stories

Through the Update Portal, families can also change or add a bank account number to receive the payments through direct deposit.

….and more than half of parents think the new Child Tax Credit payments will help them financially.https://t.co/5KxUbcTpug pic.twitter.com/tjD4nWfket

— CBS News Poll (@CBSNewsPoll) July 18, 2021

The IRS has released a timeline for the features that will be added to the portal in the coming months. By early August, users will be able to make changes to their addresses. Also, by late summer, users will be able to make changes to their marital status or the number of dependents they are in the care of.