Will the changes to the Child Tax Credit be extended and made permanent?

As millions of families begin to receive the advanced payment of the Child Tax Credit, many wonder if the current structure will be made permanent.

As more than 35 million families receive their first payment of the Advanced Child Tax Credit, Democrats on Capitol Hill move to make the new structure of the credit permanent.

Through the American Rescue Plan, Democrats were able to make changes to Child Tax Credit, including:

- Increasing the value from $2,000 to $3,000 for children between 6-17 and $3,600 for those under 6;

- Distribute half the value of the credit as monthly payments from July to December;

- Increasing the eligibility of children to seventeen;

- Removing income requirements to receive the full value of the credit; and more.

These changes increase the quantity distributed and will expand eligibility to 24 million more children. Many of the children whose families were unable to claim the credit before were ineligible because they made too little.

Experts believe that the new structure will help to cut child poverty rates in the United States in half. For these decreases to be sustained, the modifications must be made permanent.

The recovery legislation that policymakers will consider this year marks a historic opportunity to help drive an #EquitableRecovery, including cutting childhood #poverty nearly by half. https://t.co/07G6Jy8M5g pic.twitter.com/3Dxtlv3yLI

— Center on Budget (@CenterOnBudget) June 25, 2021

President Biden had included a provision to extend the current structure through 2025 in his American Families Plan.

The American Families Plan, combined with the American Jobs Plan and the American Rescue Plan, form the President's Build Back Better economic agenda. The American Rescue Plan was passed in March, but the other two pieces of legislation have faced serious opposition, threatening their viability.

As Senate Budget Committee Chairman, I want to give you an update on what's in the budget bill we're working on and why it is the most consequential legislation considered by Congress since the 1930s.

— Bernie Sanders (@SenSanders) July 15, 2021

https://t.co/lrQN1C6SIb

After negotiations over the American Jobs Plan collapsed, a bipartisan group of Senators worked together and with the White House to develop a more targeted proposal focused on traditional investments in physical infrastructures, such as roads and bridges.

However, progressive members of the Democratic party have withheld their support of the bipartisan package, saying they would like to see more money directed at working-class families and combat climate change.

In parallel to the bipartisan discussions, some Democrats began work on a reconciliation bill, the details of which were made public last week.

A reconciliation bill is created through an option process wherein “Congress changes existing laws to conform tax and spending levels to levels set in a budget resolution.” This process is handled by the Senate Budget Committee, which is led by Bernie Sanders.

This type of bill only requires a simple majority to pass, meaning that if all Democrats, plus the Vice-President, vote in favor, it will pass.

Other bills require a 60 vote majority to overcome the filibuster and become law.

The American Rescue Plan was passed through budget reconciliation as it received zero votes from Republicans.

Building on the public support for the Child Tax Credit, funding to make the changes permanent has been included in the $3.5 trillion reconciliation bill. President Biden supports the bill. In a meeting with Senators, Biden urged the group to be “be unified, strong, big and courageous,” in their own support.

What else does the bill include?

Sen. Sanders released a statement on 15 July detailing the provisions included in the package saying that it aims to “address the needs of our working families by asking the wealthy and large corporations to pay their fair share of taxes.”

Children and Families

In 2019, the United Nations released a report ranking high-income countries on how “family-friendly” their policies were. The United States ranked last on most indicators, including maternal and familial leave and childcare enrollment. The report highlights that the US “is the only OECD country without nationwide, statutory, paid maternity leave, paternity leave or parental leave.”

To catch up with the benefits offered by other comparable nations, the proposal includes a provision to create a federal leave policy. The details of the amount of time provided have yet to be released.

Policymakers will soon consider economic recovery legislation that, if enacted, would represent the most sweeping effort to strengthen families’ economic security in more than 50 years. #EquitableRecovery https://t.co/5uLTlVpDiI pic.twitter.com/bkLNHZhSG1

— Center on Budget (@CenterOnBudget) July 14, 2021

Additionally, the package would ensure that a family never “pays over 7 percent of their income for child care.” Axios also reported that the bill would contain funding to provide universal pre-K to three and four-year-olds.

For students on the older side of the spectrum, the reconciliation bill makes historic investments in community colleges, allowing those interested in attending for free.

Seniors

For those over the age of 65, the bill will expand Medicare to cover eyeglasses, hearing aids, and dental care. Currently, many Medicare members must cover the costs out of pocket, which can be difficult for many seniors who live on a fixed income.

Climate Change

One of the major measures on climate that cut was the development of a Civilian Climate Corp. The White House included the creation of the organization in the American Jobs Plan, describing it as a “$10 billion investment [that] will put a new, diverse generation of Americans to work conserving our public lands and waters, bolstering community resilience, and advancing environmental justice.”

The proposal also allocates funding to speed up the transition away from fossil fuels while creating good-paying jobs in the clean energy sector.

When will the reconciliation package be voted on?

Related stories

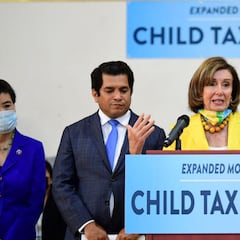

Speaker Pelosi is eager to bring the reconciliation bill to a vote in the House. Last week, the Speaker stated that she sees the proposal as "a victory for the American people." With a majority in the House, Democrats should have no trouble passing the bill. However, its passage in the Senate is uncertain as it would require all Democrats to vote in favor.

This week, debate on the bipartisan infrastructure package, and many believe that Senate Majority Leader Chuck Schumer will bring the reconciliation bill up for a vote.

- Bernie Sanders

- Covid-19 economic crisis

- Science

- United States Congress

- Coronavirus Covid-19

- Economic crisis

- Taxes

- United States

- Pandemic

- Coronavirus

- Recession

- Tributes

- North America

- Parliament

- Economic climate

- Virology

- Outbreak

- Infectious diseases

- Public finances

- Diseases

- Microbiology

- America

- Medicine

- Economy

- Finances

- Health

- Life sciences

- Biology