Relief checks news summary | 28 April 2023

Negotiations over the debt ceiling continue this week and discussions on the future of interest rate hikes may be dominated by the collapse of another bank.

Show key events only

Inflation Relief: Latest Updates

Headlines | Friday, 28 April 2023

- First Republic Bank on the verge of collapse as FDIC reportedly prepares to take it over

- In March, personal income increased $67.9 billion, or around 0.3 percent

- GDP growth slowed in Q1 2023, increasing only 1.1 percent

- Median home selling prices increased 2.6 percent in March

- Fed looks set to implement one more rate hike at next meeting in May

- The rate of families with an unemployed member fell three percent from 2021 to 2022 to 4.7 percent

- Workers in Alaska, New Jersey, and Wyominghave been hit hardest by layoffs this year

- Federal Tax Day has passed for most, but counties in eight states got a extension

- Housing prices continue to fall, is it a good time to buy?

- Various states will continue to issue inflation relief checks and generous tax refunds in April

Related stories:

Deposits at large banks experience slight dip

Deposits at commercial banks dipped in the week ended April 19, signaling no fresh worries about bank safety of the kind that drove sharp outflows in the week immediately following the collapse of Silicon Valley Bank, according to data released by the Federal Reserve.

Deposits at large banks fell to $10.61 trillion from $10.74 trillion a week earlier, on a non-seasonal basis. Deposits at small banks totaled $5.36 trillion, compared with $5.39 trillion.

The seasonally adjusted measure of deposits, which take into account typical outflows of deposits including tax season, rose, suggesting the actual outflow seen at banks may not have been as large as usual.

(REUTERS)

Who is to blame for SVB and Signature Bank collapse?

Government regulators have released a set of reports that studied the failures of Silicon Valley Bank and Signature Bank in March.

The report spread the blame between bank managers who underestimated risks, to supervisors from the Federal Reserve and FDIC who could have done more to press for changes.

The Federal Reserve also cited a set of federal bank regulations that were loosened at the end of last decade. Fed officials recommend that some of these rules be changed, to avoid future failures.

70% of Americans surveyed 'stressed' about personal finances

Personal finances are giving stress to many Americans, and the reasons they cited include inflation, economy-wide instability, interest rates, and the lack of savings.

People were able to save at the beginning of the pandemic, but as they transition into post-pandemic life, they are seeing their savings dwindling.

Big banks in competition to buy First Republic

The FDIC is reported to be poised to take over beleaguered First Republic Bank.

In an exclusive story, The Wall Street Journal reports that big banks such as JP Morgan and PNC Financial are already waiting in the wings, vying to buy the regional lender and snag their well-heeled customers.

The FDIC could place First Republic under receivership as soon as this weekend.

The Social Security Administration continues to send monthly benefits to retired workers in 2023.

The SSA is also responsible for sending Supplemental Security Income benefits, disability and survivor benefits. This report tells us when to expect the payments for the month of May.

The FDIC is reported to be preparing to place First Republic Bank under receivership. The Bank’s stock plunged after it revealed that they had lost $100 billion in deposits in the first quarter of the year.

According to Reuters, the FDIC decided that there was no more time to look for ways for the private sector to rescue the regional bank; thus, the move to put it in receivership.

The FDIC is expected to put First Republic Bank into receivership as time runs out for a rescue of the bank. What does the mean for unsecured deposits?

Potential FDIC receivership of First Bank drives stock price ever lower

First Republic Bank has been limping along for weeks. But after reporting that over half of deposits had been removed from the bank, its shares began a new precipitous dive this week as investors lost more confidence.

Regulators have been working to find a solution for the failing bank, but as time runs out the likely end will be FDIC receivership. That news drove its share price down as much as 54% in postmarket trading. For reference, it started the week at $16 a share but they were trading at $3.14 at the end of trading on Friday.

When planning out retirement, there is the matter of saving up enough money to keep enjoying the lifestyle to which you’ve become accustomed. For some though, moving to a new locale, can not only give them the opportunity to do activities that they couldn’t in their previous abode, but also make those hard-earned savings go a bit further. Some choose to go abroad while others stay stateside.

Here’s a look at the most affordable places in the United States to retire in 2023.

MIKE SEGAR / REUTERS

Time has reportedly run out to rescue First Republic, FDIC set to move in

Banking regulators generally wait unitl Friday after markets have closed to put a failing bank into receivership. This helps sort out matters over the weekend while avoid excess disruption to the banking system as a whole.

In March, US regulators to charge of Silicon Valley Bank and Signature Bank during the same weekend. They also put into place emergency measures to shore up the US banking system as a whole.

Reuters reports that the Federal Deposit Insurance Corporation (FDIC) is preparing to put First Republic Bank into receivership after time ran out to find a solution to rescue the floundering financial institution. First Republic has seen its value plummet this week after it reported that around 40% of deposits held at the bank had been withdrawn.

The Child and Dependent Care Credit is designed to ease the burden of childcare for working people. If you have to pay to ensure a child or dependent is looked after while you are at work, you will most likely be able to claim the credit.

The credit can cover up to 35% of work-related care expenses with the lowest amount offered standing at 20% of care costs. The upper limit of the cost covered is $3,000 for one qualifying person or $6,000 for two or more qualifying persons.

Fed’s preferred inflation measure, PCE, core numbers still running hot

The Bureau of Economic Analysis (BEA) released its report on Personal Consumption Expenditure (PCE) for March, which saw consumer spending flat but core inflation still running hot. The readings indicate that the Federal Reserve will most likely raise interest rates once again next week when policymakers meet for their May session.

This measure of inflation in the US economy is preferred by the Federal Reserve as the cost of housing is not included in the basket of goods, which also change more often, giving a better picture of costs for consumers.

"The Fed is in a tough spot. The economy is cooling, but inflation is still too high. The components of inflation that the Fed worries will be most persistent, labor-intensive services, are especially sticky,” chief economist at Comerica Bank in Dallas Bill Adams told Reuters.

Many Americans are saddled with student loans that they have been paying off for years. Over 40 million borrowers are paying off their debt, with the average balance standing at more than $37,000, according to Education Data.

The government of President Joe Biden has begun rolling out programs to ease this burden, and for those who wish to take advantage of these benefits, there are some dates to watch out for so as to avoid missing crucial deadlines for actions that need to be taken.

Read more in our full coverage on when one can expect the Supreme Court to announce its decision.

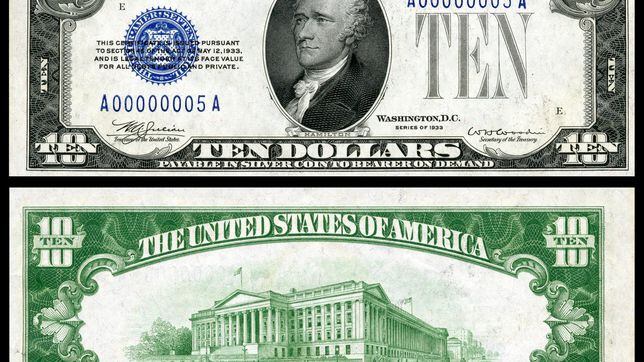

Digging through collections of remembrances stored in attics, garages, storage sheds and so forth, you may come across something valuable. Not just sentimentally, but worth some real mula. With the right eye, and knowledge of what you are looking at, you may find old stamps, coins or bills that, while on face value seem almost worthless, are in fact coveted by collectors who will pay wads of cash.

First Republic Bank appears to be headed for FDIC receivership

All eyes will be on what will happen to First Republic Bank, which has been struggling to stay afloat this week. Before it reported its first quarter earnings on Monday, the bank’s shares were trading at $16. However, after sharing that it had lost 40% of its deposits its valuation began to plummet.

First Republic’s clients are mostly high net worth individuals along with their businesses, who have been worried about the security of their money at regional financial institutions that isn’t secured by the Federal Deposit Insurance Corporation (FDIC). It now appears that the beleaguered bank may follow the path of Silicon Valley Bank and Signature Bank into FDIC receivership.

Trading in its stock was halted several times as it dropped around 40% on Friday, now down over 97% from its peak in February.

Democrats passed a sweeping covid-19 relief bill in 2021 named the American Rescue Plan to keep the recovery from the pandemic going. In conjunction with previous packages passed under the previous administration, these helped the US economy experience it’s fastest rebound from a recession in history.

However, the disruptions caused by pandemic and households flush with cash caused imbalances that helped drive up prices. After the third round of federal stimulus checks, those worth $1,400 per eligible American, the federal purse strings were tightened and other programs to help families cope were allowed to expire.

So, states and local communities stepped up using pandemic relief funds and bumper tax revenue to send their own relief to residents. Most have wound down now as inflation wanes but there are still some that are sending payments to help ease the hardship families are still facing. Here’s a look at where payments are still being issued.

When it comes to retiring on Social Security alone, finding a city with a lower cost of living is crucial. The affordability of a city can vary based on individual circumstances and lifestyle choices.

Taking into account the monthly income of a retiree in the US,here are four of the best cities in the country to live solely on the Social Security check-

Mass layoffs are continuing in the United States.

With inflation cutting into purchasing power, general uncertainty in the market, and the Federal Reserve hiking interest rates, some stock prices are starting to fall. While 2022 saw the second-largest increase in new jobs in the history of the country, 2023 could tell a completely different story.

The initial response to these economic conditions from the tech sector was mass layoffs. Now, the world’s largest employer, Walmart, will follow suit by closing down various locations to cut costs and improve its financial performance.

This report gives a complete list of Walmart supermarkets that will close in 2023 in each state

Personal income inched up again in March

Personal income and the personal savings rate rose a third of a percent in March.

Personal savings currently stands at 5.1 percent, the highest rate in recent months.

Personal consumption also increased by 0.1 percent, which is a lower rate than had been seen in recent months, particularly after the holidays.

When looking at disposable income, meaning how much money people have to spend, when accounting for the way inflation impacts income, there was an increase of 0.3 percnet in March. However, in terms of spending, real consumer spending fell slightly, in part because of "a decrease in spending on goods of 0.4 percent that was partly offset by an increase in spending on services of 0.1 percent."

Thanks to the payments schedule, Supplemental Security Income (SSI) is issued on the first of each month, but not always. It wasn’t a matter of April Fool’s, but because 1 April fell on a Saturday this year, the payments were issued a day early 31 March.

During the remainder of 2023 the same will happen two more times, payments in July and October will be pushed up to the month before, or June and September respectively.

At what age must you retire to get the full amount of your Social Security benefit?

According to the SSA, the minimum retirement age is 62, which results in an average payment of $1,700. However, those who wait can receive more than $3,000 a month if they wait to apply until the reach the FRA, which currently depends on the year one was born.

To receive the full benefit amount for which you qualify, you must request retirement at age 67, which is full age for everyone born in 1960 or later. For those born before, age is between 66 and 67.

There are two main indices used to track price changes in the US economy: the Bureau of Labor Statistics’ Consumer Price Index (CPI) and the Bureau of Economic Analysis’s Personal Consumption Expenditures Price Index (PCE).

Different in their methodologies, both of these indices provide important information to policymakers, economists, and private sector actors. In February, for example, the PCE tracked an increase in inflation of five percent. Meanwhile, over at the BLS, the CPI recorded an average price increase of six percent across goods and services.

Average weekly 30-yr fixed mortgage rate up slightly, 15-yr ticks down

Average weekly 30-year fixed rate mortgage rate rose for a second week, while the 15-year fixed rate dropped. The average 30-year fixed mortgage rate advanced 0.04% to 6.42% for the week ending 27 April.The average 15-year fixed mortgage rate decreased 0.05% to 5.71%.

Regulators worried about regional banks' stability 4 months before March crisis

Four months before the second-largest bank failure in US history, key banking regulators worried about the dangers large regional lenders posed to financial stability, according to an exclusive report by Reuters.

Federal Deposit Insurance Corporation officials told an advisory panel on bank failures in November that "large portions" of regional banks' deposit balances were uninsured and warned of "knock-on effects" for other banks.

FDIC chairman Martin Gruenberg said at the meeting that after the financial crisis of 2008 regulators had fixated on making the biggest banks safe.

Officials had yet to do the same for regional banks, some of which had grown to considerable size and complexity, said Gruenberg.

Banking regulators have come under criticism for failing to stave off the crisis triggered by a run on Silicon Valley Bank, most of whose deposit base was uninsured. The Fed and FDIC are expected to release reports on Friday on their supervision of Silicon Valley and Signature Bank.

The November meeting shows, however, that FDIC officials were aware of challenges they could face in handling regional bank failures but key issues remained unresolved ahead of March's failures.

(REUTERS)

On Wednesday, the Republican-controlled House of Representatives voted to pass the bill to raise the debt limit, cut spending, and reverse key pieces of President Joe Biden’s agenda.

While the bill does not include cuts to Social Security or Medicare to address the debt ceiling, it does include a measure against Medicaid and food stamps.

This report tells us how the bill could affect these two benefits.

Buoyed by tech shares, markets have best day in months

Meta's positive quarterly earnings and softer-than-expected gross domestic product figures helped prop up markets, leading them to their best day in months.

Meta’s shares are up 170% since November, when it hit a low of $89. according to CNBC.

First-quarter GDP rose at a 1.1% annual rate, about half of economists’ 2% forecast, leading some investors to believe that the Federal Reserve could soon wrap up its tightening campaign.

How much you receive from Social Security depends on several factors, such as age. This is an important consideration in determining your monthly checks.

A worker can start receiving their Social Security retirement benefits at age 62, but if they begin receiving benefits before full retirement age, their benefits are reduced. If the worker decides to wait until they are 70 years old, they will receive more money.

Hello and welcome to AS USA's live blog on inflation relief and economic news.

Tax season has wrapped up, and millions are waiting for their returns. Those who have received an extension have until mid-October to submit their return.

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/LRQFLZKMBBK5TJXIVTSBEFWATI.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/7KJD6RL64HCUM5LHSJCRUFLNZA.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/4KOUDCGBPJIWXOV7P2PZYNWVOM.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/Z4R7572C5YIVXJU6DEOGZEB664.jpg)