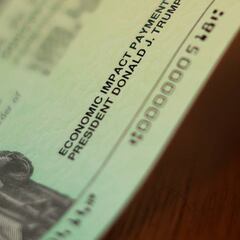

Second stimulus check: are college students eligible for payment?

A sum of $600 per qualified dependent will be added on to a family's share, but when is it possible for you to qualify for a stimulus check of your own?

Though a second stimulus check of up to $600 per person is on its way to millions of Americans, about 13 million young people aged 17 to 24 who are listed as dependents on their family's taxes are not eligible to receive stimulus money, due to a tax code definition of "child dependent."

$600 per qualified dependent

The same was true of the first stimulus payment in 2020. If you do count as a child dependent, you still don't get your "own" money, but a sum of $600 per qualified dependent will be added on to your family's share.

This can get complicated, and may leave you wondering: When is it possible for me to qualify for a stimulus check of my own?

Some young adults could retroactively get the original stimulus payment of up to $1,200, as well as the second stimulus payment of up to $600.

The first stimulus payment sent out under the March CARES Act allocated up to $1,200 for qualifying American adults, and $500 for the dependents listed on their 2019 tax returns, so long as they were age 16 or younger. The second stimulus payment, which is currently being sent out under the $900 billion bill passed in December, allocates up to $600 per qualifying American adult and $600 for the dependents listed on their 2019 tax returns, who were age 16 or younger at that time.

While the amount of money has changed from the first payment to the second, the rules for who qualifies as a child dependent have not.

To qualify for your own stimulus check, you need to have filed your 2019 taxes independently, which means no one else claimed you on their taxes as a dependent. You also had to have an adjusted gross income (AGI) of under $75,000 to receive the full amount. (The sum decreases as your AGI goes up, and this time around, if you make over $87,000 as a single taxpayer, you aren't eligible for a check.)

Dependent college students are not eligible

College students who were 23 or younger at the end of 2019 and who didn't pay at least half of their own expenses that year could be claimed as a dependent on their parents' 2019 tax return. Those students are not eligible to receive the payment.

There are two different sets of rules for who counts as an adult or a dependent under current tax law, according to Janet Holtzblatt, a senior fellow at the Urban-Brookings Tax Policy Center.

One is the support test. If you're unmarried, you don't claim children as your own dependents, your parents provide you with financial support equal to or greater than half of your annual income and you made less than $4,200 in 2019, then your parents can still claim you as their dependent.

Another is the residency test: If you're a full-time student under the age of 24 who resides with an adult taxpayer more than half of the year (unless you're living on a college campus), you can be claimed as a dependent, no matter how much money you make.

Good news for some

When the 2021 tax season opens, many young adults could qualify for a combined $1,800 ($1,200 from the Cares Act and $600 from the second round of economic impact payments). This is because the stimulus payment is actually an advance credit.

"College students may now also be able to claim the stimulus payment in the form of a recovery rebate credit as long as they are not claimed as a dependent," said Lisa Greene-Lewis, a certified public accountant and tax expert for TurboTax.

Related stories

The IRS also encouraged young adults to determine if they are eligible for the economic impact payment.

"College students in particular should be careful not to overlook these payments if they’re supporting themselves and can’t be claimed as a dependent on someone’s tax returns," IRS Commissioner Chuck Rettig said last year. "A few minutes of research could really help students."