US unemployment benefits federal tax waiver: how to claim

As part of the $1.9tn coronavirus stimulus bill signed into law this month, qualifying Americans will get a tax break on the first $10,200 of unemployment benefits they received in 2020.

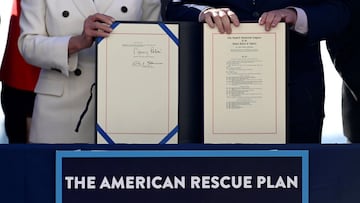

Eligible Americans have been given a tax break on unemployment benefits as part of President Joe Biden’s coronavirus relief bill, which was signed into law on 11 March.

Tax forgiveness on first $10,200 of unemployment benefits received in 2020

Under the terms of the $1.9tn package, people in the US who earned under $150,000 in 2020 will not face federal income taxes on the first $10,200 of unemployment benefits paid to them over the course of the year. Normally, jobless benefits are considered taxable income by the Internal Revenue Service (IRS).

This waiver does not apply to the income taxes that some states also levy on unemployment benefits, though. Over half of the country’s states do so, according to CNBC; they must also decide whether or not to offer a tax break.

Relief bill also extends benefits schemes, gives jobless weekly supplement

Among its other measures for the out of work, Biden's bill has also extended programs such as the Pandemic Emergency Unemployment Compensation scheme, which gives jobless Americans a further 13 weeks of benefits beyond the 26 weeks that states typically provide, and the Pandemic Unemployment Assistance program, which offers benefits to workers not eligible for regular unemployment insurance.

The aid package additionally includes a $300 weekly supplement provided to claimants on top of their basic unemployment pay.

How to claim the tax break on unemployment benefits

You can claim your unemployment-benefits tax waiver in your 2020 income tax return. To do so, you’ll need the information in your Form 1099-G, which shows how much you received in unemployment benefits over the course of the year.

In Line 7 of Schedule 1 in your tax return (Form 1040), put your total unemployment benefits for 2020. Then, in Line 8, state how much of the amount in Line 7 you qualify not to be taxed on.

For example, if you received $14,000 in unemployment benefits last year - according to the Century Foundation, this was the average figure paid out to claimants in the US - write $14,000 in Line 7 and $10,200 in Line 8. You’ll only have to pay federal income tax on $3,800 of the benefits you got.

IRS explainer on claiming unemployment-benefits tax break

Don't submit amended return if you filed before waiver announced - IRS chief

Speaking on Thursday, IRS Commissioner Chuck Rettig said the body will automatically refund eligible Americans who have missed out on the benefits tax break because they had already submitted their 2020 tax return before the scheme was announced.

Related stories

"Do not file an amended return at this time," Rettig said, per Bloomberg. "We believe that we will be able to handle this on our own. We believe that we will be able to automatically issue refunds associated with the $10,200."

Third stimulus check: live updates

You can get the latest information on the third round of stimulus checks with our dedicated live blog.