US stimulus checks: news summary for 10 April

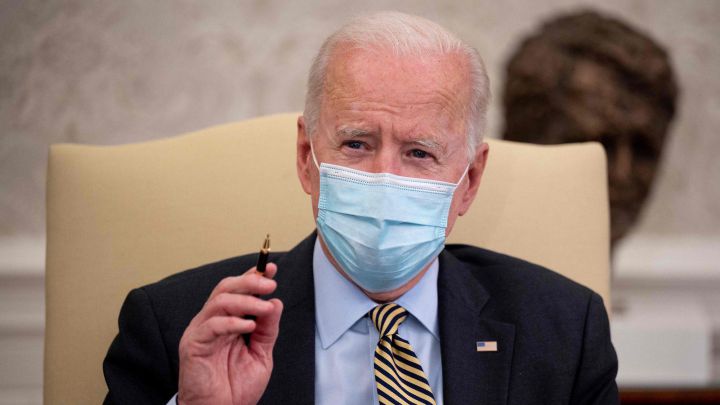

Latest updates on the third stimulus check included in President Biden's American Rescue Plan and news on a possible fourth direct payment.

Show key events only

Stimulus check updates live: Saturday 10 April

Headlines:

- Over 156 million stimulus checks have now been distributed, worth over $372 billion

- Vast majority of stimulus checks (85%) were paid by direct deposit

- Social Security recipients have begun to receive their $1,400 direct payment (full details)

- Veterans Affairs (VA) and Compensation & Pension (C&P) beneficiaries to get their stimulus checks on 14 April

- Second batch of the 'plus-up' stimulus check payments were distributed on Wednesday (full details)

- G20 finance officials poised to back a $650 billion stimulus boost in the IMF's emergency reserves

- Key Democrats in Congress calling on President Biden to embrace recurring fourth stimulus check (full details)

- Track your stimulus check using the IRS' Get My Payment tool (more info)

- US covid-19 cases/deaths: 31.08 million/561,074 (live updates from JHU)

Scroll through our related articles:

Covid-19 stimulus packages included funeral costs reimbursements

On Monday families who lost loved ones to covid-19 can apply to receive $9,000 to retroactively reimburse them for funeral costs. The program is open to families regardless of their income, as long as they show documentation and have not already received similar benefits through another program. People do not need to be citizens to apply. There is no cut-off date as long as someone died of coronavirus after January 2020.

NY City breakdown of Paycheck Protection Program

The Paycheck Protection Program gives small businesses interest-free loans to keep their doors open and employees on the payroll. The amount of time that businesses have to access the funds was recently extended until 31 May, 2021.

Broader definition of infrastructure needed

One of the main attacks by Republicans against President Joe Biden’s American Jobs Plan, his $2 trillion infrastructure bill is that it only includes a limited amount of money for roads, bridges and railroads. The White House is arguing that we need to rethink what we consider infrastructure, that it should include everything that helps workers do their jobs, including having child and elderly care.

Democratic congressional lawmakers push for fourth stimulus check

The federal government has sent out over 156 million Economic Impact Payments over four weeks. Even as the $1,400 direct payments continue to go out there are calls for even more stimulus payments. So far, 74 congressional lawmakers have pushed for recurring checks until the end of the pandemic.

More fraudulent unemployment claims than valid in Colorado

The Colorado Department of Labor and Employment plans to send out letters later this month to individuals and employers ensnared in the massive wave of fraudulent claims for unemployment insurance benefits. The state no longer recommends filing a police report but to instead report the UI fraud on a dedicated CDLE web page, which has separate forms for individuals and for employers. CDLE estimates that 1.2 million fraudulent claims have been filed exceeding the 1 million valid claims filed since March 2020.

You can’t keep a $1,400 stimulus check sent to you by mistake

The IRS is currently sending out “plus-up” payments to taxpayers who are newly eligible for a stimulus check or a larger amount for the third round of Economic Impact Payments as the agency processes 2020 tax returns. Although the IRS didn’t ask for people to return money that was overpaid in the earlier rounds of EIP due to a change in eligibility that isn’t the case when someone receives two $1,400 payments, you can only keep one.

March jobs report tempered by rising unemployment claims

The official jobs report for March showed an unexpected jump in hiring, with the economy adding 916,000 jobs and the unemployment rate dropped to 6 percent. However, the past two weeks have seen first-time unemployment claims rising again after dropping below 700,00 for the first time since the onset of the economic downturn last year. As of late March, there were 18.2 million people on unemployment programs of any kind.

Stimulus is popular but Americans not convinced it will help them

Despite the general popularity of the $1.9 trillion covid-19 relief bill passed by Democrats not all Americans are convinced that the legislation will significantly help them. A new POLITICO-Harvard poll exploring the public’s views on the post-pandemic landscape shows that roughly one in three think the stimulus bill will do much for them.

How long will the IRS send out "plus-up" payments?

The agency has now sent out more than 156 million stimulus payments in the third round, again based on the most recent tax return on file, either for 2019 or 2020. However, this time the agency is in the second week of sending out “plus-up” payments as it processes 2020 tax returns.

IRS sends out second batch of “plus-up” payments

The IRS confirmed that it sent out over 1 million supplemental payments to people whose 2020 tax returns qualified them for additional funds this week. These so-called “plus-up” payments totaled more than $2 billion, meaning the average deposit was roughly $2,000.

The supplemental payments are not a fourth stimulus check. They’re part of the third set of Economic Impact Payments, the $1,400-per-person ones passed in the American Rescue Plan in March.

How to calculate the Child Tax Credit

The IRS continues to send out new batches of stimulus checks weekly for up to $1,400 each, including “plus-up” payments. However, this summer families could start to see another type of direct payment from the government through the expanded Child Tax Credit. Eligible families could receive $300 per child under 6 and $250 per child under 18 per month. You can get a $500 total payment for dependents who are 18 and for full-time college students between 19 and 24 years old.

The calculation for how much money you'll get from the child tax credit is a confusing jumble of variables that includes how many qualified children you have and their ages, with different amounts going to different child age groups. CNET provides a child tax credit calculator that can help make sense of the confusion and tell you how much money to expect in total.

Hedge fund manager sees stimulus creating higher inflation

Morgan Creek Capital hedge fund manager, Mark Yusko likes where the stock market is sitting at the moment. However, he thinks the high levels of liquidity from stimulus are inflating stock valuations. “I think valuations for broad equity markets are egregious — worst that they’ve ever been, worse than 2000,” Yusko told Insider. “When the eventual reckoning happens it’s going to be worse than it otherwise would be or has historically been. The problem is timing that is really, really hard.”

As the economy reopens this summer, Yusko thinks that inflation will spike to higher levels than investors have been anticipating. This will spark a rise in interest rates, which will bring down stock prices most likely sometime in the fall, he said.

IRS won’t restore “Non-filer” online tool to claim $1,400 stimulus check

Last year, the IRS created a “Non-filer” online tool to allow people who aren't usually required to file tax returns to provide their contact information to the agency to claim the first stimulus check payment. Even so, about 8 million low-income people who were eligible for stimulus payments last year never received the money.

The tool went offline in November and the IRS is not planning to restore the online tool an agency spokesman told CNN. Instead the agency encourages people to file a 2020 tax return in order to get the money they're owed from the first two stimulus checks, along with the third one. Filing a return ensures that families may get other benefits they qualify for like the Earned Income Tax Credit or the now expanded child tax credit.

ECB warns against blocking EU stimulus package

Attempts to block the European Union’s Recovery Fund would be an “economic disaster for Europe” European Central Bank board member Isabel Schnabel warned in an interview on Friday. Germany’s constitutional court put the ratification of the EU recovery fund on hold last month, saying it was looking into an emergency appeal against the debt-financed investment plan.

“The increase in public debt is inevitable and sensible in the face of this crisis of the century, as long as the expenditures sustainably boost growth,” Schnabel told German magazine Der Spiegel.

Schools get a windfall in stimulus money, how will they use it?

Roughly $128 billion was approved by Congress in March as part of the $1.9 trillion American Rescue Plan, nearly double the amount sent to K-12 schools from the previous two covid-19 relief packages. The law requires some of the new money must be used to address learning loss, which could include extended school days, tutors or summer school. Other than that restriction, schools have the flexibility to spend the money on a broad range of pandemic-related needs with state education agencies able to decide how to spend about 10% of the funds. They're not required to spend all the money until 2024.

CNN breaks down how much schools are getting and how they could spend it.

Stimulus checks driving aspirational spending

A quarter of households plan to spend their third stimulus check payment of $1,400 according to the Federal Reserve Bank of New York. The bulk of that spending will go toward food and other essential items, but for some of those that have been able to pay down their debts and save they “have this urge to go out and splurge on themselves, almost as a reward for being locked down over the past year,” says consumer savings expert Andrea Woroch. While building wealth is a better option in her opinion “revenge spending” as Woroch calls it is perfectly OK, as long as there’s room for it in your budget.

Will GOP resistance to infrastructure and stimulus pay off?

With their opposition to President Joe Biden’s infrastructure plan, Republicans are doubling down on a core bet they’ve made for his presidency: that the GOP can maintain support among its key constituencies while fighting programs that would provide those voters with tangible economic assistance.

Last month, every House and Senate Republican opposed Biden’s massive $1.9 trillion stimulus plan, even though it delivered significant benefits to working-class white voters, the GOP’s foundational voting bloc, including increased health-care subsidies and expanded tax credits for families with children. That pattern is repeating with the infrastructure plan, even though it directs billions of dollars to rural communities, which are indispensable to Republican political fortunes.

Stimulus check spending

Americans are using a majority of their stimulus money to pay off debts and for savings, according to a survey from the Federal Reserve Bank of New York.

Respondents said in the New York Fed’s Survey of Consumer Expectations that for the third round of stimulus checks, which sent $1,400 to eligible Americans, that they planned to spend around 25% of the total payment, to save about 41% and use the remaining 34% to pay down debt.

These responses show a slight drop in how much Americans planned to spend compared to the first two rounds of relief payments, which also comes with a minor rise in how much is going straight into savings accounts. By comparison, Americans planned to spend 29% of their checks and only save 36% during the first round of checks, which were worth $1,200 in March 2020, according to the survey.

Summer Lin looks into the stimulus spending patterns of Americans.

Biden's budget proposal: defense, immigration, climate

On the back of the stimulus spending already seen there are a number of takeaways from US President Joe Biden's proposed federal budget, which was released on Friday.

Federal discretionary spending is up by 8.4% compared to 2021 levels, excluding emergency funding, to $1.52 trillion, with a focus on health, education and climate. About two-thirds of the massive budget is "mandatory" spending for benefits like Social Security and Medicare.

Biden's request to Congress was to sharply hike spending on climate change, cancer and underperforming schools but it drew howls of bipartisan concern over military spending.

The $1.5 trillion budget, reflecting an 8% increase in base funding from this year, marks a sharp contrast with the goals of Biden's predecessor, Donald Trump.

Federal stimulus aid for New York landlords - Yang

Landlords should qualify for federal stimulus, Andrew Yang says, via Amanda Eisenberg. The Democratic NY mayoral candidate describes some landlords as small business owners and says there are a lot of street vendors who are taking advantage of the city not enforcing the rule.

As mayor, he says he would be in favor of increasing the number of licenses for street vendors.

Are stimulus checks keeping people at home'

Business reopening as vaccination rates continue to climb and people going back to work is good news, right? Obviously, it is, assuming employers can find enough interested and qualified applicants to fill the openings.

But CBS Chicago is reporting that the owners of bars and restaurants are increasingly having trouble making that happen. Multiple restaurant owners are reporting that their former employees were expected to be eager to return to getting a steady paycheck now that the vaccines are more widely available, but many of them are not interested.

Some have left the industry altogether. And few new people are applying for these food and beverage service jobs. The owners are attributing this issue to a combination of big covid relief or enhanced unemployment benefits and a dislike of the new rules imposed on them because of ongoing pandemic restrictions.

Jazz Shaw considers the impact.

Stimulus, jobs, high-speed rail: Californian dreamin'

Even if Congress were to move ahead with President Joe Biden’s $2.3 trillion American Jobs Plan as-is, the California high-speed rail project stands to receive little additional federal support. And absent the large federal bailout state leaders have been hoping for, the rail project still lacks the funding needed to build and run bullet trains from San Francisco to Los Angeles and Anaheim. It’s time for the state to produce the money or downsize its high-speed rail project.

President Biden’s $2.3 trillion plan is a massive amount of spending, but it is modestly sized relative to even more enormously costly infrastructure proposals from other Democrats. Part of the huge price tag comes from the inclusion of many elements not normally regarded as infrastructure, such as home care. Only $621 billion of Biden’s plan is earmarked for transportation, with most of that portion devoted to roads, bridges, electric cars, trucks, and buses.

The entire intercity rail component of Biden’s package totals $80 billion. If that amount was fully devoted to California, and if the state managed to stick to its latest budget for the rail system, it would be enough to finish the San Francisco to Anaheim phase of the project. But the White House fact sheet includes numerous other rail priorities.

Full story:

Does the IRS owe you more stimulus money?

In many cases, the IRS will have issued your check before it processes your 2020 tax return. If you filed your return and your circumstances changed in 2020 in a way that would bring you more stimulus money in this round, such as if you earned less income, or if you had a baby or added a new dependent, you may be owed a 'plus-up' payment from the IRS.

If you're owed a 'plus-up' payment, you shouldn't have to file an amended tax return or do anything else to claim it, other than file your 2020 tax return as soon as possible.

The IRS should send it out automatically once it processes your new return, likely by direct deposit or by paper check, if you don't have your account details on file.

Understand what you need to know, and if you are able to claim more cash.

Stimulus bill 'crippling' restaurants and small businesses

A whopping 6.9 million jobs remained vacant as of 31 January. Meanwhile, 40% of small businesses are struggling to find employees and 18.2 million Americans are receiving unemployment benefits, which suggests that millions of unemployed Americans are deciding to stay home.

The reason is believed by some to be simple: ultra-generous unemployment benefits passed in the first federal “stimulus” legislation under former President Trump and now continued under President Biden through 4 September 2021, make staying home on benefits pay more than a job for many workers.

Indeed, under the original $600 supplement, two in three workers could earn more money - typically 33 percent more - than their previous jobs did, creating a strong reason for people not to go back to work at all. Now, with a $400 supplement, the disincentive is lessened somewhat, but still present for many workers.

Kenneth Schrupp puts forward the case for America's small businesses, and against the lockdown.

Who is eligible for the $10,200 tax break?

The American Rescue Plan passed in March gave an extra bit of help to those who were unemployed in 2020 and collected jobless aid. The law waives federal tax on up to $10,200 of unemployment compensation per person received in 2020.

The waiver is available to individuals and couples who have an adjusted gross income (AGI) of less than $150,000. The IRS updated its guidance and now allows workers to exclude unemployment compensation from AGI calculations.

All you need to know in this handy guide.

US stimulus: the global picture

As well as direct comparisons being made about Biden's stimulus relief bill (on the back of the previous administrations efforts as well), there are also knock-on effects of the spending.

Emerging market exporters may ride the stimulus of other economies with the likes of Mexico, Chile and Brazil standing to benefit the most for relatively high exposure to the US and China, according to research by Bloomberg Economics.

The global economy is set to boom in 2021, yet some developing countries could be caught out of sync. Borrowers face disruption from higher yields, and currency stress and higher commodity prices have forced central banks to turn hawkish before recoveries have gained traction.

US stimulus package vs EU stimulus

The European Union's covid-19 recovery response is robust and does not fall short when compared with the United States' $1.9 trillion recovery plan, European Council President Charles Michel told Les Echos newspaper, via Reuters.

EU member states agreed last summer on a 750 billion euro ($892.2 billion) recovery fund, but with governments still submitting detailed spending plans, frustration is growing in some capitals at the slow speed of disbursing the money.

Some leaders, including French President Emmanuel Macron, have also questioned whether further stimulus is needed after a second and now a third wave of coronavirus infections swept the continent, prompting further lockdowns.

"I know perfectly well that some judge (the fund) to be insufficient, making a comparison with the US recovery plan.

It's not an opinion that I share," Michel was quoted as saying in an interview published by the French newspaper on Saturday.

Michel, who chairs European Union summits, said there had been emergency spending by individual members states since the health crisis began and that Europe's social welfare benefits were more generous than those in the United States.

"They have allowed us to better absorb the shock and will also contribute to the recovery," he said. "When you put all these elements together, my conviction is that the European plan is very robust."

Don’t underestimate the power of conservative media to shape this [spending opposition] into a [cultural] narrative Biden cannot fight

GOP stimulus and infrastructure opposition goes against their base

With their opposition to President Joe Biden’s infrastructure plan, Republicans are doubling down on a core bet they’ve made for his presidency: that the GOP can maintain support among its key constituencies while fighting programs that would provide those voters with tangible economic assistance.

Last month, every House and Senate Republican opposed Biden’s massive $1.9 trillion stimulus plan, even though it delivered significant benefits to working-class white voters, the GOP’s foundational voting bloc, including increased health-care subsidies and expanded tax credits for families with children.

That pattern is repeating with the infrastructure plan, even though it directs billions of dollars to rural communities, which are indispensable to Republican political fortunes.

Ronald Brownstein argues that Republicans are making a risky bet.

Financial support and more

As well as President Biden stimulus relief package, there is much more to be done to bring all Americans into the 21st century and create more opportunities.

Last week, the Texas House unanimously passed HB5 to close the digital divide and expand access to broadband.

In 2020, more families than ever experienced challenges as a result of poor broadband access. We're a step closer to making this bill a law.

Sindya Bhanoo looks at the impact this could have on real families.

Excluded Workers Fund: stimulus approval

The approval this week of the nation’s first-ever Excluded Workers Fund is a bold statement that New York recognizes the humanity in everyone, and that we must secure the basic necessities of all people during a global pandemic. It also acknowledges that immigrants contribute greatly to our tax-base and the backbone of our community.

No one deserves to go hungry or die, or to not have money to bury their loved ones, pay for housing, health care, and other fundamental needs while a pandemic wreaks havoc across the world. It is a matter of compassion, empathy, solidarity, and core human decency.

Since the pandemic first hit in March 2020, thousands of undocumented and nontraditional workers across the state have suffered the injustice of being excluded from every government relief program. Over 192,000 undocumented workers (who records show pay $1.4 billion in yearly taxes) lost their jobs, none of whom were eligible for Pandemic Unemployment Assistance (PUA), according to a report by the Center for NYC Affairs at the New School. The Center also reported that 68% of jobs lost in New York City were among people of color.

Unemployment benefits: will the IRS automatically refund the taxes to beneficiaries?

Last year, over 23 million workers nationwide in the US made unemployment claims, including self-employed workers who qualified for unemployed benefits for the first time. This income needs to be reported on tax returns.

Democrats in Congress passed the American Rescue Plan in March which included $1,400 stimulus checks and a slew of enhanced tax provisions to help struggling Americans. Included in those provisions was a waiver on up to $10,200 of unemployment compensation.

However, President Joe Biden’s $1.9 trillion covid-19 relief bill was enacted in the middle of the 2021 tax season, which meant that the Internal Revenue Service (IRS) had to incorporate new provisions and send out the third round of Economic Impact Payments while processing 2020 tax returns on top of a backlog from 2019.

Greg Heilman provides the detail you need to know.

The stimulus vs inflation question

Worries about sudden inflation spikes are keeping investors and economists up at night. Their concerns aren't baseless: Inflation is indeed rising in the United States, government data for producer prices showed Friday.

The question on everyone's mind remains: Is inflation a temporary sugar rush from stimulus or is it here to stay?

The US Producer Price Index, which measures sale prices for goods and services, climbed 1% on a seasonally adjusted basis in March, the Bureau of Labor Statistics announced Friday. That was a steeper rise than February and greater than economists had expected.

Prices for finished goods increased by the largest amount since the government started tracking that specific measure in 2009.

The biggest driver was a sharp 8.8% jump in gasoline prices.

Anneken Tappe reports on the inflation risks from stimulus spending.

Stimulus relief update: Colorado

Every Coloradan age 18 and younger would have access to a free mental health screening and as many as three free subsequent visits with a mental health professional under a new, bipartisan bill at the state Capitol aimed at helping kids deal with the effects of the coronavirus crisis.

House Bill 1258 represents one of the most aggressive behavioral health initiatives in Colorado history and would come with a one-time allocation of $9 million.

The measure calls for the creation of an online portal where children can fill out an assessment and then connect with providers if needed.

Full details from Jesse Paul:

Arts and culture to see support from covid-19 stimulus relief

Gov. Phil Murphy signed into law a measure that sends $15 million in federal covid-19 money to arts and cultural venues throughout New Jersey.

S-3521 sends $7.5 million to the New Jersey Economic Development Authority (NJEDA) to support for-profit organizations and another $7.5 million to the State Council on the Arts to support nonprofit organizations.

“Our arts and cultural establishments are among the best in the nation, but they have faced difficult challenges over the past year,” Murphy said in a news release. “It’s time we lifted up these organizations and venues to ensure they are still with us as we emerge from the pandemic and look to once again experience the joy they offer.”

All the details from the Examiner below:

Business stimulus relief

It took a month and a half, but a bill containing $10.5 million in covid-19 relief to businesses that had not previously qualified for aid, and a great deal more federally-funded relief spending, has finally passed the Vermont Legislature.

Tuesday, the House made additions to the version the Senate had amended and passed last month. The two chambers agreed that would suffice as the final version of the bill, and the Senate concurred unanimously on Thursday.

When it passed the House the first time on 26 February, the bill, H. 315, carried $70 million in spending. By the time the Senate was finished with it on March 24, it had grown to more than $100 million.

The House subsequently pared that amount back to $97.5 million, and added “link-up” language that extends the unemployment insurance benefits exemption for the 2020 tax year. That language adopts the federal exemption of the first $10,200 of benefits for taxpayers with an adjusted gross income of less than $150,000.

Check out everything that was included:

Third stimulus check: Does the new batch of $ 1,400 include "plus-up" payments?

The Internal Revenue Service (IRS) announced on Wednesday that another 25 million stimulus checks, worth $36 billion, were sent out in the most recent tranche of direct stimulus payments.

Around 24 million of those payments were sent as direct deposit with the remainder sent as paper checks. According to the IRS approximately 85 percent of the payments in the third round have been made via direct deposit, eight percent more than in the second round and 11 percent more than the first round.

Why are people getting more stimulus check payments?

In many cases, the IRS will have issued your check before it processes your 2020 tax return. If you filed your return and your circumstances changed in 2020 in a way that would bring you more stimulus money in this round, such as if you earned less income, or if you had a baby or added a new dependent, you may be owed a 'plus-up' payment from the IRS.

If you're owed a 'plus-up' payment, you shouldn't have to file an amended tax return or do anything else to claim it, other than file your 2020 tax return as soon as possible. The IRS should send it out automatically once it processes your new return, likely by direct deposit or by paper check, if you don't have your account details on file.

Third stimulus check: who is getting extra money, why and how much?

Who is getting an extra stimulus check payment and why?

The IRS is sending supplemental 'plus-up' payments to the stimulus checks already sent out for taxpayers that are newly eligible or that were due a larger stimulus check.

Fourth stimulus check: what reasons are lawmakers giving for supporting or rejecting it?

What are the chances of a fourth stimulus check?

There are growing calls in Congress for recurring payments to be included in President Biden's next spending package, but there will likely be strong GOP resistance to the proposals.

Read more:

How and who has to file an Amended Return to get the $10,200 IRS unemployment tax break?

Anyone who received jobless benefits during 2020 may now be eligible for the earned income tax credit and other federal programmes.

Here's everything you need know about how to claim the support:

California hoping to fully reopen its economy by 15 June

California will fully reopen its economy on 15 June providing that Covid-19 vaccinations are available and hospitalization continues to be stable, Gov. Gavin Newsom has stated. As of yesterday, 22,030,904 doses of the vaccine had been administered. Every Californian aged over 16 will be eligible for vaccination from 15 April.

Tax refunds may be held up by stimulus payments

The Internal Revenue Service is snowed under dealing with sending out stimulus payments and processing tax returns for 2020 which is why this year, some people might receive their refund later than expected. One way to find out the status of your tax refund is to use the IRS tax refund tracker - just fill in the three sections and hit the submit button. You will need to provide your Social Security Number, Filing status and refund amount.

Dr Fauci vaccinated but won't be going to restaurants just yet

Dr Anthony Fauci received the second dose of the Moderna vaccine on 19 January but even though he is now fully inoculated, he has admitted that he is still be extra careful to avoid crowded places. "We feel very comfortable in the house with no masks, and we can have physical contact and things like that," he told Business Insider. "But I don't think I would go into an indoor, crowded place where people are not wearing masks. I don't really see myself going on any fun trips for a while either".

Third stimulus check 'plus-up' payment: can I claim for extra money?

The IRS automatically could send a catch-up, or 'plus-up' payment between now and December 31, 2021, the deadline for sending stimulus checks, or you'll have to claim the money later.

Read more here:

18% of Republicans approve of stimulus bill

Sixty-three percent of Americans, according to a Gallup poll conducted last month are in favour of President Biden's $1.9 trillion relief bill but 18% of Republicans nationwide feel that while some do need the money, others don't making it not only a waste of money but it will be pushed onto tax payers to make up the deficit at a later date.

Biden to discuss Infrastructure bill with Congress on Monday

President Joe Biden will meet with bipartisan members of Congress on Monday as he tries to convince them to back his $2 trillion infrastructure package - the second part of his Build Back Better plan, a three-part agenda to "rescue, recover, and rebuild the country". Getting it past the House and the Senate though is not going to be easy. While the GOP agrees that America's crumbling infrastructure needs funding, they argue it can be done at a fraction of the cost which Biden is proposing and add that raising taxes would harm the economy.

Third stimulus check: how many Americans have already received the payments?

The IRS has confirmed that another round of $1,400 direct payments has been sent, but how many were distributed and who is yet to receive their stimulus check?

Read more:

Murphy signs $15M bill in federal relief for New Jersey arts and cultural venues

Gov. Phil Murphy has signed S-3521 which will bring $15 million in federal Covid-19 aid to New Jersey's arts and cultural venues. The New Jersey Economic Development Authority is set to receive $7.5 million with the remaining half designated to the State Council on the Arts to support nonprofit organizations. The bill is part of a five-bill, $100 million relief effort aimed at helping New Jersey’s small businesses recover from the year-long pandemic.

Murphy explained in a statement: “Our arts and cultural establishments are among the best in the nation, but they have faced difficult challenges over the past year. It’s time we lifted up these organizations and venues to ensure they are still with us as we emerge from the pandemic and look to once again experience the joy they offer.”

K-12 schools ready to start spending stimulus money

US schools are set to receive around $128 billion in stimulus aid as part of last month's American Rescue Plan, CNN reports. Some of that money will be channeled into making up for education time and learning lost during the pandemic, to fund summer schools or extra tutoring. The money can also be spent on things like sanitation supplies, technology, mental health services and ventilation systems.

Stimulus check live updates: welcome

Hello and welcome to our daily live blog on Saturday 10 April.

We'll be with you throughout the day bringing you the latest information related to both the third stimulus check, which sees qualifying Americans get up to $1,400, and also on the possibility of a fourth, potentially recurring direct payment.