Fourth stimulus check news summary: Saturday 15 May 2021

News and information on the third stimulus check in President Biden's coronavirus relief package, and updates on a possible fourth check. Saturday 15 May 2021.

Show key events only

US stimulus checks live updates: Sunday 16 May 2021

Headlines:

- Over 165 million third stimulus checks distributed by the IRS, worth a total of $388 billion (full details)

- 460,000 'plus-up' stimulus checks in the agency's latest payment run

- IRS tax-filing deadline on Monday 17 May (how do I seek an extension?)

- Automatically-triggered stimulus checks reportedly under consideration (find out more)

- One million stimulus check payments sent to recent tax returns filers

- Governor Gavin Newsom plans to expand California's Golden State Stimulus payment program (full story)

- Expanded Child Tax Credit monthly payments set for July start (find out more)

- IRS sending out benefits tax-break refunds in two batches (full details)

- Track your third stimulus check by going to the IRS' Get My Payment tool

Have a read of some of our related articles:

What has the White House said about a fourth stimulus check?

This week the IRS issued another one million stimulus checks as part of the third round of direct payments. That batch took the total amount distributed to an estimated 165 million stimulus checks and the process is set to continue for the rest of the year.

Although they are still waiting for tax returns to be filed before they send some of the remaining payments, the vast majority of eligible Americans have now received theirs. As such, attention is already turning to the prospect of a fourth stimulus check, something that has garnered support both in Congress and across the country.

Here’s what the White House has said about that prospect…

Job fears, price spikes mean heartburn for Biden White House as economy revs up

High unemployment. Rising prices. Gas lines. They're a bad memory for Americans old enough to remember the 1970s - but they're also likely causing a few sleepless nights in the White House, as the United States' economic recovery from the unprecedented coronavirus recession hits some bumps.

The jolts are dampening consumer confidence, ramping up inflation fears, and helping Republicans build their case against President Joe Biden and his ambitious plans to revamp the US economy with trillions in new spending.

As the 1970s show, high joblessness and rising prices the United States saw in April can be a potent political force. Republicans crafted a "misery index" out of the two factors to attack then-president Jimmy Carter. After hitting 75% approval ratings early in his presidency, the Democrat was trounced in a 1980 landslide.

Support for Biden remains strong and US equity markets remain near record highs.The White House says there's bound to be surprises as the United States emerges from an unprecedented pandemic.

"We must keep in mind that an economy will not heal instantaneously," Cecilia Rouse, the chair of the White House Council of Economic Advisers told reporters Friday. "It takes several weeks for people to get full immunity from vaccinations, and even more time for those left jobless from the pandemic to find and start a suitable job."

Rouse, speaking to reporters at the White House, said a mismatch between supply and demand due to the pandemic and the economic snap-back had pushed inflation higher but that the mismatch should prove temporary.

"I fully expect that will work itself out in the coming months," she said.

Photo by Tasos Katopodis/Getty Images

Tax Deadline 2021: how to file an extension

Tax Day 2021 is 17 May but for those who need a little more time the IRS allows for an extension until 15 October, but you’ll need to act now.

What ID can I use to cash stimulus checks?

If you want to cash your stimulus check you can do so at banks even where you are not an account holder or member, but you will need to bring ID.

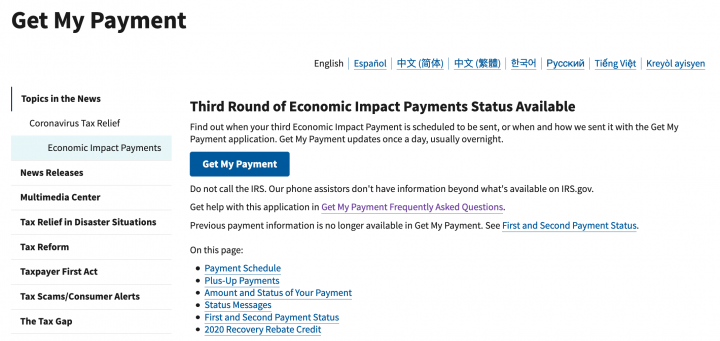

Use Get My Payment to track your stimulus check

If your third stimulus check hasn't arrived yet, you can track its progressing by visiting the IRS' online Get My Payment tool.

More information about Get My Payment

(Image: www.irs.gov)

Stimulus checks: every AS English news article

If you take a look at our dedicated stimulus-checks news section, you’ll find a host of articles offering updates and information on a possible fourth direct payment, on the third stimulus check currently being distributed, and more.

$50 stimulus to pay internet bill eligibility: who can get it?

The Emergency Broadband Benefit program gives eligible Americans $50 off their monthly internet bill.

How filing a tax return could help you get third stimulus check plus-up payments

The majority of eligible Americans have now received their third stimulus check payments and the IRS has moved on to sending out the ‘plus-up’ payments; supplementary stimulus checks for those who were initially underpaid.

For example, those who experienced a loss of income during 2020 may have been excluded from the payment on the basis of the 2019 tax returns, but that could change with their most recent tax filing. The IRS is committed to sending these payments out for the rest of the year, find out if you could be in line for one...

How effective are stimulus checks according to Biden?

There has been a lot of speculation about the prospect of a fourth stimulus check, despite the fact that the IRS is still distributing the third round of the direct payments. The fate of another round probably rests in the hands of President Joe Biden, but his administration has given mixed signals in recent weeks.

White House Press Secretary Jen Psaki has told reporters that it would be down to Congress to propose another round, but Biden has been enthusiastic about the positive impact that the payments have had.

File your taxes to get Child Tax Credit payments

This year there is an extra incentive to get your IRS tax returns in on time because the monthly Child Tax Credits payments will be based on your latest filing. The new programme is set to begin in July with payments worth up to $300 per month for each child claimed as a dependent on your tax returns.

Retail spending stalls after stimulus check boost

The US retail sector has reported a disappointing month in which consumer spending dipped signficantly after experiencing a record-breaking surge in March. The increase at the start of 2021 was attributed to the impact of both the second and third rounds of stimulus checks, which provided a total of $2,000 for eligible Americans.

IRS unemployment refund update: how to track and check its state

The American Rescue Plan provided a $10,200 tax-free allowance for the estimated 40 million Americans who received unemployment benefits during 2020.

But because the legislation was only approved in March over 10 million unemployment benefits recipients had already filed their taxes, paying tax that they were not oblged to pay. The IRS is currently in the process of sending out tax rebates to correct the error, here’s how to check when yours will arrive...

"We believe stimulus checks were partially responsible for this, as their issuance increased consumer demand on our platform at the same time as in-store dining rates accelerated in many markets.

"We anticipate consumer behavior will shift further as markets continue to reopen, [and] the impact of stimulus fully wears off."

California Golden State Stimulus

Where is my California Golden State Stimulus? How to check when it will arrive

For California residents...

The Golden State has its own parallel stimulus check system running, based on 2020 State Tax Returns. Here's how to check when your payment will be madeif you're eligible.

Are you owed an income tax refund with your 2021 IRS filing?

There are only two days to go until Tax Day 2021, but it is not too late to claim missing tax refunds from the 2017 tax year. The IRS say they have over $1.3 billion in outstanding refunds to pay to more than one million Americans who are yet to file since then.

In many instances the IRS may need the updated details provided on each years' tax returns before they can make the payment. To find out if you could be eligible for the tax refund make sure to get your returns filed before Monday 17 May, and check out the IRS website for further details.

How to claim the Golden State Stimulus check

For California residents, there is still time to claim your $600 Golden State Stimulus check provided by the state's recent stimulus package. Gov. Gavin Newsom approved legislation that will see a round of state-wide direct payments sent out, but you will need to submit your tax returns for 2020 to be eligible for the money.

The first wave of payments has already been sent out, and the state's tax authority advises that those who file their returns after 23 April will be waiting up to 45 days for a bank payment, or up to 60 days for a paper stimulus check.

Tax Day on Monday, 17 May: how much do you pay if you don’t file taxes on time?

Tax Day is nearly upon us again and individuals who file taxes have until Monday 17 May to complete their tax returns for 2020 to avoid facing fines. The IRS can issue fines for a variety of things, from submitting your returns late to having a tax payment bounce.

Rebecca Thompson, director of the Taxpayer Opportunity Network, has warned that those who do not file on time or apply for an extension "will get hit with penalties for failing to file and failing to pay.” The penalties are not fixed amounts and can accrue interest over time if you do not complete the process swiftly. Here's everything you need to know...

File your taxes on time to get Child Tax Credit payments

The new-look Child Tax Credit was one of the most hotly-anticipated features in the American Rescua Plan and the new system is set to be introduced from July onwards. The programme will provide monthly payments worth up to $300 per child to American households, but you will need to file you taxes to ensure you get the full amount on time.

The IRS will base eligibility for the direct payments on the information provided in tax filings, as was the case with the stimulus checks. If you have had a change of situation over the last year your filing will be vital to make sure you get the full entitlement.

How do stimulus checks affect your IRS tax returns?

The deadline for filing your tax returns for 2020 is drawing near but there is still uncertainty about how some of the recent pandemic federal programmes will affect the filing. You need to get your returns completed by 17 May 2021, but you do not need to include the stimulus checks payments.

All three rounds of stimulus checks have essentially been advanced tax credits, meaning you do not need to declare them.

Experts explain Biden's American Jobs Plan

White House National Climate Advisor Gina McCarthy and United States Secretary of Labor Marty Walsh have held a web chat to explain the ins and outs of Joe Biden's American Jobs Plan.

How many people are getting an unemployment tax break refund?

Millions of Americans received unemployment benefits in 2020 and a fair number of them filed a tax return prior to the passing of the American Rescue Plan which provided unexpected tax relief on those benefits.

The American Rescue Plan passed in March had a last-minute addition in some horse trading. Although those still receiving unemployment benefits wouldn’t get the extra $400 per week on top of other jobless assistance until September, it was dropped to $300, they got a waiver on up to $10,200 per person claimed while receiving unemployment compensation in 2020.

Delaware State University uses stimulus funds to cancel student debt

While the subject of a blanket canceling of student debt in the US after the economic ravages of the covid-19 pandemic has been a thorny one between Republicans and Democrats, Delaware State has wiped $730,000 in student deficit using funds from Joe Biden's American Rescue Plan.

Income tax and stimulus checks IRS reminder

Low-income Americans who aren't usually required to file taxes could be leaving a lot of money on the table if they don't file a 2020 return thanks to changes made by the latest pandemic relief package, CNN reports.

Many may still be waiting on a stimulus payment because the Internal Revenue Service didn't have their information on file. Plus, the expanded child tax credit means that families could be sent more money this summer -- but only if they file a return.

Accessing those benefits is the reason the IRS wants everyone to file this year, even though people with income under a certain threshold aren't required to do so because they won't owe any tax.

This year, tax returns are due Monday, May 17, a month later than usual due to the pandemic.

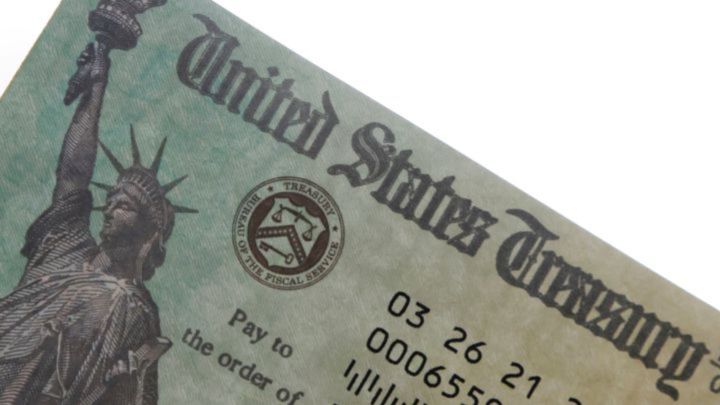

How much were the first, second and third stimulus checks and when were they sent out?

Since April 2020, the US federal government has sent out three stimulus checksto qualifying Americans: two under former President Donald Trump, and one under the current commander-in-chief, Joe Biden.

We take a look back over the direct payments issued since the covid-19 began

What states are ending federal unemployment in June?

The governors in a number of US states have said they will be ending additional unemployment benefits in June.

Every AS English news article on stimulus checks

In our dedicated stimulus-checks section, we have a range of news articles offering updates and information on a possible fourth direct payment, on the third check currently being sent out, and more.

$1,400 third stimulus check: what is "IRS TREAS 310 - TAX EIP3"?

The third round of stimulus checks, which has so far seen around 165 million payments made since the American Rescue Plan was signed into law in early March, is arriving in the bank accounts of direct-deposit recipients with the identifying reference "IRS TREAS 310 - TAX EIP3".

New House bill seeks to make more single parents eligible for expanded Child Tax Credit

Three progressive Democrats this week tabled a bill that seeks to ensure more single parents are eligible for the expanded Child Tax Credit (CTC), which gives households up to $3,600 per child.

Representatives Katie Porter, Ayanna Pressley and Don Beyer introduced the Single Parent Penalty Elimination Act in the House on Thursday, which proposes raising the CTC income eligibility limit for Americans who file taxes as heads of household, a status commonly used by single parents.

While married joint filers who earn up to $150,000 a year qualify for the full CTC, only heads of household with an annual income no higher than $112,500 are eligible for the total amount.

“No child should receive less nutritious food or less secure housing just because their parent isn’t married,” Porter said.

“There’s no discount for single parents at grocery stores, child care centers, or doctors’ offices, yet the child tax credit gives less help to single parent families. I’m proud to introduce legislation today that would eliminate this unfair penalty and give relief to kids in need, regardless of their parents’ marital status.”

The expanded CTC sees qualifying households get up to $3,600 a year per child under the age of six, and up to $3,000 per child aged between six and 17. Recipients can opt to be paid their CTC as a lump sum in 2022, or get the first half of their total amount in monthly payments this year.

See also: When will the Child Tax Credit monthly payments start?

Newsom presents California Comeback Plan

Governor Gavin Newsom on Friday presented the $100bn California Comeback Plan, which includes the expansion of the Golden State Stimulus payment scheme to a larger proportion of the state's population.

Paid for by a $75bn budget surplus and just over $25bn in federal relief funds, the plan would focus on the following five areas outlined by the governor: "providing immediate relief for those hit hardest by the COVID-19 pandemic"; "confronting the homelessness and housing affordability crisis"; "transforming public schools into gateways for opportunity"; "building infrastructure for the next century"; and "combating wildfires and tackling climate change".

"Every Californian has been impacted by this pandemic, and the sacrifices we’ve all made this past year have resulted in a historic surplus - I’m here to announce that we’re investing it in you," Newsom said.

"California’s economic recovery will leave nobody behind, that’s why we’re implementing the nation’s largest state tax rebate and small business relief programs in history, on top of unprecedented investments we’re making to address California’s most persistent challenges. This is a jumpstart for our local economies, and it’s how we’ll bring California roaring back."

$1,000 stimulus check for Florida first responders: how many people will get it?

ICYMI: Florida Governor Ron DeSantis this month announced that around 174,000 first responders in the state are to be given a $1,000 'pandemic bonus', which he told a news conference should arrive "throughout the summer".

Millions of Californians can expect another stimulus check

California Governor Gavin Newsom this week proposed expanding the Golden State Stimulus payment scheme to a greater number of residents of the US state, as part of a $100bn spending drive called the California Comeback Plan.

Newsom also wants to send additional $500 payments to eligible Californian families with children.

Full details on the stimulus checks proposed as part of the California Comeback Plan

See also: Families with kids stand to receive extra $500 stimulus checks

(Photo: Justin Sullivan/AFP)

Tax Filing 2021: what happens if I don’t file before the deadline?

The IRS can issue financial penalties for late tax returns. Failure to file may also affect upcoming stimulus check and Child Tax Credit payments.

$50 stimulus to pay internet bill eligibility: who can get it?

The Emergency Broadband Benefit program gives qualifying Americans a $50 discount on their monthly internet bill.

US retails sales stall in April

US retail sales unexpectedly stalled in April as the boost from stimulus checks faded, but an acceleration is likely in the coming months amid record savings and a reopening economy.

The Commerce Department said on Friday the unchanged reading in retail sales last month followed a 10.7% surge in March, an upward revision from the previously reported 9.7% increase. Economists polled by Reuters had forecast retail sales would rise 1.0%.

Many qualified households received additional $1,400 checks in March, which were part of the White House's $1.9 trillion covid-19 pandemic rescue package approved early that month.

Retail sales account for the goods component of consumer spending, with services such as healthcare, education, travel and hotel accommodation making up the other portion. Households have accumulated at least $2.3 trillion in excess savings during the pandemic, which should underpin spending this year.

Coming on the heels of news this month that hiring slowed in April amid a shortage of workers, the weak sales could cause anxiety about the economic recovery. Though more than a third of Americans have been fully vaccinated against covid-19, fears about the virus linger and schools have not fully reopened for in-person learning, keeping many workers at home.

Excluding automobiles, gasoline, building materials and food services, retail sales dropped 1.5% last month after an upwardly revised 7.6% increase in March. These so-called core retail sales correspond most closely with the consumer spending component of gross domestic product. They were previously estimated to have shot up 6.9% in March.

Consumer spending, which accounts for more than two-thirds of US economic activity, expanded at a 10.7% annualized rate in the first quarter, adding 7.02 percentage points to the economy's 6.4% annualized growth pace.

Much of the surge in consumer spending last quarter occurred in March, which set a higher growth base for consumption heading into the second quarter.

(Reuters)

$10,200 unemployment tax break refund: how to know if I will get it

If you claimed unemployment compensation in 2020 and are owed a refund, you’ll want to keep an eye out with the IRS beginning payments this week.

See also: Unemployment benefits federal tax waiver: how to claim

What happens if you file an extension for the tax deadline in 2021? Are there penalties?

As Tax Day approaches, find out how you can apply for an extension to the deadline if you need one.

Track your stimulus check using Get My Payment

You can track the status of your third stimulus check by accessing the Internal Revenue Service's online Get My Payment portal.

Take me to the Get My Payment tool

More information about Get My Payment

IRS questions-and-answers page on the Get My Payment tool

(Image: www.irs.gov)

The Internal Revenue Service (IRS) has now sent out around 165 million third stimulus checks at a total value of approximately $388 billion, the agency said in its most recent payment update earlier this week. Nine batches of third stimulus checks have gone out since the American Rescue Plan was signed into law on 11 March, with almost one million checks distributed in the latest payment run.

Full details on the IRS' latest third-stimulus-check payment run

(Photo: Nicholas Kamm/AFP)

US stimulus checks live updates: welcome

Welcome to our daily rolling blog bringing you news on a possible fourth stimulus check in the US, in addition to updates on the third direct payment currently being distributed by the IRS.

We'll also have information on other economic-relief programs such as the expanded Child Tax Credit, with monthly payments of up to $300 due to start going out in July, and the Golden State Stimulus payments in California, whose governor, Gavin Newsom, has proposed enlarging the scheme to include more residents of the state.

As Tax Day approaches, we'll additionally be providing info on filing your 2020 return and how to seek an extension if you need one.

- Joseph Biden

- Coronavirus stimulus checks

- USA coronavirus stimulus checks

- Gavin Newsom

- Covid-19 economic crisis

- Science

- United States Congress

- Unemployment

- California

- Coronavirus Covid-19

- Economic crisis

- United States

- Poverty

- Pandemic

- Coronavirus

- Recession

- Economic climate

- Virology

- Outbreak

- Infectious diseases

- North America

- Parliament

- Employment

- Microbiology

- Diseases

- Medicine

- America

- Economy

- Work

- Social problems

- Biology

- Health

- Politics

- Society

- Life sciences