Fourth stimulus check | news summary for Tuesday 13 July

Latest news and information on the third stimulus check in President Biden's coronavirus relief bill, and updates on a potential fourth direct payment.

Show key events only

US stimulus checks live updates | Tuesday 13 July 2021

Headlines:

-Gov. Gavin Newsom signs a $100 billion dollar budget that includes a $600 Golden State stimulus check for two-thirds of California residents. (Full story)

-IRS will send first Child Tax Credit payment on 15 July, is it automatic? (full details)

-Democrats continue to push to extend the new Child Tax Credit program. (Full story)

-Child Tax Credit payments will begin 15 July, do they sour the chance of a fourth stimulus check?(Full story)

- How can you contact the EDD to discuss unemployment benefits? (Details)

Useful information / links

-Changes to unemployment benefits in California: how to comply with new requirements.

- Child Tax Credit: We took a look at the question, is the web portal the best way to apply, what other options do I have? (Details)

- You have until Monday 2 August to opt out of the August round of Child Tax Credit monthly payments. (Find out more)

- How to use the IRS's two new online tools; the Child Tax Credit Update Portal and the Child Tax Credit Eligibility Assistant.

- Still, waiting for your tax refund? So are millions of other Americans. Should you update your tax return information? Find out when to contact the IRS.

Take a look at some of our related news articles:

Moderate Democratic Senator Joe Manchin of West Virginia says that he will only vote for an infrastructure package that is "fully paid for."

Senator Mark Warner has told the press that the new $3.5 trillion reconciliation package that includes the elements agreed to by a bipartisan group of Senators, will be paid for in full.

What have Democrats included in their proposed reconciliation bill?

In order to gain more votes on the bipartisan infrastructure bill, more progressive members of the caucus have worked with the White House on a reconciliation package.

The package was announced today 13 July, and the price tag stands at around $3.5 trillion. It has been referred to as "the most significant piece of legislation passed since the Great Depression," by Senator Bernie Sanders. More moderate members have told media outlets including CBS, that the package will be paid for and will not add to the deficit.

The package is expected to include the President's ""human" infrastructure priorities not covered by a bipartisan proposal, such as child care, health care, education and additional climate change-related provisions. "

Where is my $600 second Golden State stimulus check? How can I track its status?

Where is my $600 second Golden State stimulus check?

It’s official, two-thirds of Californians are now eligible to receive a $600 Golden State stimulus check.

On 13 July, Gov. Gavin Newsom signed a law that will allow for the sending of the second round of direct payments. Those who received a check during the first round are not eligible for a second. However, taxpayers in the care of children are able to receive an additional $500 payment.

The first batch of payments is slated for sending in September. Read our full coverage for more details on eligibility and what other measures form part of the historic $100 billion budget.

BREAKING NEWS: $600 Golden State Stimulus Checks will be sent to two thirds of California residents this fall.

Some school districts are finding themselves flushed with cash with funding allocated through the American Rescue PLan. However, New York has reported that some district leaders are finding the conditions for how the money can be spent complicated.

Additionally, some superintendents have found that the funds are unable to be used to cover the costs of some of their top priorities.

$3000/$3600 Child Tax Credits: Will I automatically receive the payments?

$3000/$3600 Child Tax Credits: Will I automatically receive the payments?

In less than two days, millions of families across the United States will begin to receive the Child Tax Credit payments. Under the American Rescue Plan, changes to the quantity received and distribution method were made to the credit.

Rather than a non-refundable $2,000 credit with a minimum income requirement, the new structure is fully refundable, and families will receive monthly payments. For those eligible to receive the payments who have filed their 2019 or 2020 taxes, payments will be made automatically using the information reported during filing.

Read our full coverage for details on how the payments could impact personal income levels across the US.

Senators from all over the political spectrum will work together this week to finalize the bipartisan infrastructure package.

BREAKING: Senate Majority Leader Chuck Schumer says "it's doable that they could "fully pay for" a reconciliation bill." The reconciliation bill is expected to include many of the progressive measures left out of the bipartisan infrastructure package.

Are you struggling to get in touch with the IRS?

Millions of Americans are still waiting for their tax returns. With long wait times when trying to contact the IRS, many have become desperate for answers as to when they can expect the payment.

Washington Post wants to hear from those that are experiencing these challenges.

Who do Americans give credit to for passing the three stimulus checks?

According to the Washington Monthly, it's not President Biden.

The outlet reports that Biden did use the sending of a third stimulus check to garner support for his administration approach to the economic recovery.

Bill Scher reports that this publicity was not done during the Obama years. President Biden said that President Obama was "so modest, he didn’t want to take, as he said, a ‘victory lap.’ I kept saying, ‘Tell people what we did.’ He said, ‘We don’t have time. I’m not going to take a victory lap.’ And we paid a price for it, ironically, for that humility."

Political reporters like Ezra Klien argue that voters need to know what you have accomplished in order to reelect you.

Democrats are evaluating various proposals to cover the costs of the infrastructure and reconciliation packages floating around Capitol Hill.

IRS child tax credit: is the web portal the best way to apply, what other options do I have?

Starting 15 July, the Internal Revenue Service will begin sending eligible families advance payments on the 2021 Child Tax Credit. Any parent or guardian who filed their 2020 tax return or used the IRS Non-Filer online tool should be automatically signed up, but if you still haven’t done either you’ll want to take action now.

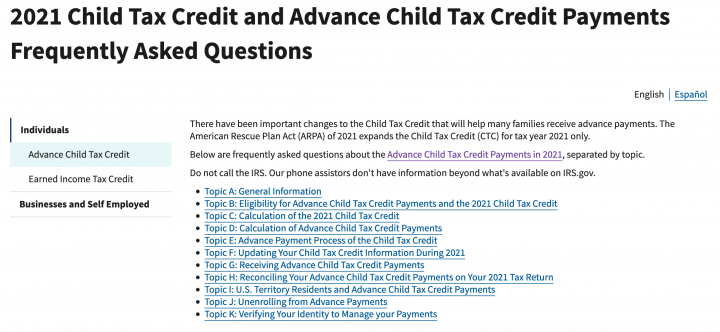

Child Tax Credit FAQs

The IRS has created a useful questions-and-answers page for those who have queries about the new, expanded Child Tax Credit.

You’ll find a host of topics covering issues such as eligibility, calculating your amount and unenrolling from monthly payments.

Visit the IRS’ Child Tax Credit FAQs page

See also: How is the new Child Tax Credit different to a stimulus check?

(Image: www.irs.gov)

$300 Unemployment benefits: In which states have judges forced payments to continue?

The Republican-state led move to end extra unemployment benefits early is meeting legal challenges.

How much were the first, second and third stimulus checks and when were they sent out?

Since the beginning of the coronavirus pandemic, three stimulus checks have been paid out by the US federal government to eligible Americans.

Find out more about the direct payments sent out since early 2020

Newsom officially signs California stimulus checks into law

It had been two months since the California legislature approved the California Comeback Plan but budgetary wrangling delayed the distribution of the $600 stimulus checks. The payments are set to go out to around two-thirds of Californians, and Gov. Gavin Newsom had finally signed the package into law today

Newsom said: "Through this comprehensive plan, the state is taking on the inequities laid bare by the pandemic, expanding our support for Californians facing the greatest hardships, increasing opportunity for every child, confronting homelessness head-on and doubling down on our work to build resilience against the climate change impacts that threaten California’s future."

“[The expanded Child Tax Credit] is the most transformative policy coming out of Washington since the days of F.D.R."

“America is dramatically behind its industrial peers in investing in our children. We have some of the highest child poverty rates, but even families that are not poor are struggling, as the cost of raising children goes higher and higher.”

Child Tax Credit payments are on the way

Lawmakers who voted in favour of the American Rescue Plan are lining up to support the introduction of the new Child Tax Credit system, which will go live from 15 July. The $1.9 trillion relief package was immediately popular because it provided another round of stimulus checks, but there is hope amongst Democrats in Congress that the Child Tax Credit monthly payments will have an even greater impact on American society.

Tax refund delay: how many IRS tax returns remain unprocessed?

Americans waiting for a tax refund are facing long days to receive a payment. The IRS has been under extreme pressure since the start of the pandemic, tasked with implementing a range of federal relief programmes designed to support individuals, families and businesses affected by covid-19.

Millions of people who claimed unemployment benefits during 2020 are due a substantial tax refund from the IRS after the American Rescue Plan retroactively made the jobless support tax-free. But there are long delays for those waiting for their refund as the IRS struggles to work through a huge backlog.

Sen. Schumer promises support in the form of new Child Tax Credit

Democratic Senator Chuck Schumer is the current Senate majority leader and will likely play a big role in the passage of any further covid-19 relief spending. He has been a strong proponent of the Child Tax Credit and appears intent on securing an extension past the initial 12 months of funding.

He said of the Child Tax Credit: "If you're worried next month about paying rent, if you're worried about feeding your kids, if you're worried about getting the money to fix your car... Help is on the way."

Sen. Bennett: Child poverty rate is "a disgrace"

Democratic Sen. Michael Bennett was one of the key figures in pushing for the expansion of the Child Tax Credit and he clearly believes that it is vital to securing the future of America's children. Speaking to MSNBC he calls the United States' high levels of childhood poverty as "a disgrace" and talks up the upcoming relief bill that resutled from a series of bipartisan talks in Congress.

Monthly Child Tax Credit could impact millions of children

Millions of American families take advantage of the Child Tax Credit when filing taxes but that programme is set to change from 15 July. This summer, that once-a-year benefit becomes monthly with regular payments for eligible families. The Biden administration also expects that nearly 90 percent of children will now qualify.

What's the difference between stimulus checks and the new Child Tax Credit?

The IRS is preparing to distribute the first round of the monthly direct payments as part of the new Child Tax Credit. The tax authority is slated to begin sending out the support on 15 July but there is still concern that many potential beneficiaries are unaware of the programme.

The new Child Tax Credit, with monthly payments worth up to $300 per child, has been compared by some to the three rounds of stimulus checks, but in reality there are a number of key differences. We take a look at the two forms of financial relief…

Watch out for scammers trying to take your IRS tax refund

Unfortunately throughout the pandemic fraudsters have been attempting to take advantage of the various federal support programmes and steal the money that should have gone to others. The stimulus checks and additional unemployment benefits have both been targetted by unscruplous thieves, and now it seems that tax refunds are being stolen.

The American Rescue Plan included a provision that retroactively made unemployment benefits received in 2020 tax-free, meaning that millions are due a substantial tax refund. If you think this could be you, check out the IRS' guide to staying safe from scammers...

Will there be problems receiving IRS Child Tax Credit payments?

From 15 July the IRS will be sending out monthly payments to parents as part of the new Child Tax Credit. But there still may be some last-minute hurdles to overcome.

The American Rescue Plan made a series of changes to the Child Tax Credit to greatly expand the programme and make it available to many low- and moderate-income families who previously either couldn’t take advantage of it or only in a limited fashion. But might there be any issues with the introduction that affects the distribution process...

Should you opt out of the monthly Child Tax Credit payments?

Payments as part of the new Child Tax Credit are set to begin on Thursday 15 July, with the monthly instalments replacing the old single-credit system. However there is also the option to opt out of the monthly payments and retain the old Child Tax Credit to put towards your end-of-year tax bill or to claim as a refund.

For more informaiton on how to do it, and what the benefits are, check out Why should some families opt out of the advance 2021 Child Tax Credit payments?

Brown praises upcoming Child Tax Credit

Democratic Senator Sherrod Brown was one of the dirving forces behind the reformed Child Tax Credit programme, which is due to come into effect later this week. From 15 July an estimated 39 million American families will start to receive monthly payments worth as much as $300 per child.

Brown said recently: “The expansion of the Child Tax Credit is one of the most transformative policies to come out of Washington in generations. The CTC is one of the best tools we have to lift children out of poverty and put money in the pockets of working families."

Dollar edges higher amid pandemic concerns, US inflation in focus

The dollar edged higher across the board on Monday as concerns about the pandemic encouraged investors to seek a safe haven, and as they awaited more clues about the global economic recovery.

With markets hyper-sensitive to any talk of early tapering, US inflation data on Tuesday will be closely watched ahead of testimony by Federal Reserve Chair Jerome Powell on Wednesday and Thursday.

"Market caution reigned at the start of the week, weighing on risk sentiment and boosting the US dollar," said Joe Manimbo, senior market analyst at Western Union Business Solutions in Washington.

Reports from around the globe of surging infections of the Delta coronavirus variant also hurt investors' appetite for riskier assets.

Investors will look to US inflation data on Tuesday and Federal Reserve Chair Jerome Powell's economic testimony on Wednesday and Thursday as they gauge expectations for the Fed to dial back on stimulus as soon as this year, Manimbo said.

Any signs that inflation could be more persistent than previously thought could fan expectations that the Fed may exit from current pandemic-era stimulus earlier, supporting the dollar against other major currencies.

Senate faces 'hell of a fight' amid doubts over infrastructure investments

The US Senate returned on Monday to one of its most ambitious agendas in years, with Democratic President Joe Biden seeking trillions of dollars in infrastructure spending and Republicans promising "a hell of a fight" against tax hikes to pay for it.

Senate Majority Leader Chuck Schumer opened the Senate following a two-week July Fourth recess, saying progress was being made on both a bipartisan $1.2 trillion infrastructure plan and the first step toward another measure that would pass with only Democratic votes.

But given the 50-50 split in the Senate, it was uncertain whether the Democratic leader could fulfill his goal of passing both measures through the chamber by sometime in August.

"If and when we succeed, the benefits will reverberate across the country for generations to come," Schumer said.

Work continued on the bipartisan part of the package, which Biden has touted to voters, but the top Republican on the plan, Senator Rob Portman, told reporters he did not know when detailed negotiations would be completed.

Roy Blunt, a member of the Senate Republican leadership, said: "That would be a pretty amazing thing" if a bill winning the support of all Democrats could also capture the 10 Republicans necessary to push it to passage.

Last week, Schumer's Republican counterpart, Mitch McConnell, promised a "hell of a fight" over the expected next phase of the process - a partisan, Democratic initiative - while leaving open the possibility of his support for the emerging bipartisan bill.

How will stimulus spending affect the US economy?

The United States has experienced a period of federal spending unlike any other in the nation's history as the government attempts to reverse the damage done to the economy by the pandemic. The total cost of the various legislative packages introduced so far is thought to be in excess of $5 trillion, but the long term effects are still unknown.

Stimulus spending includes far more than just the three rounds of stimulus checks and covers a whole host of initiatives. It is thought that the spending will now begin to fade away as businesses are able to return to normal.

Democrats reaffirm commitment to extending Child Tax Credit expansion

The American Rescue Plan introduced a crucial overhaul of the Child Tax Credit programme, but many are worried that the single year of funding is not sufficient. Democrats are pushing for an extension, with many calling for the programme to be made permanent. The American Families Plan included a provision which would extend the programme through 2026 but Biden has struggled to find Republican support for the trillion-dollar package.

Unemployment rate leads to calls for fourth stimulus check

Last week the IRS released the June jobs report, which showed that the United States' unemployment rate had actually creeped up slightly to 5.9%. While the US economy added another 850,000 jobs across the month there is concern that jobless people are being left without suitable support.

Scott Santens, author and supporter of a Universal Basic Income, has called on Congress to pass another relief package which includes recurring direct payments. The movement for a fourth stimulus check appears to have lost momentum in Washington but there remains an appetite for more stimulus spending.

Non-filers need to use online tool to receive Child Tax Credit

For the majority of recipients the new-look Child Tax Credit will arrive automatically from 15 July, but there is concern that some low-income households may miss out.

If you do not regularly file taxes then the IRS may not have the required information on file to judge your eligibility and then to make the payment. Here, Sen. Chuck Schumer points the way to register for the Child Tax Credit payments.

What you need to know about the monthly Child Tax Credit payments

The IRS is set to start sending out monthly payments as part of the new Child Tax Credit this week, but tax officials fear that many people are still unaware of the upcoming support. This report from The Recount explains the basics of the new system and how much it could be worth for your family...

How long will the IRS be sending tax refunds in 2021?

This tax season has been busy for the Internal Revenue Service (IRS). With the passage of the American Rescue Plan in March, the IRS had to adapt quickly to changes in the tax code which altered the amount that would be refunded. Additionally, the trillion-dollar stimulus package allocated funds for the sending of a third stimulus check which the tax authority began distributing right as the majority of taxpayers began filing.

For those who submit a paper tax return, getting a refund normally takes between six to eight weeks. However, with changes to the tax code, the sending of stimulus checks, and more people filing returns this year, the IRS has said that delays are expected.

$600 California stimulus checks: why haven't the payments been received yet?

Earlier this month, the California legislature approved a bill to send an additional round of $600 Golden State stimulus checks to those in the state making less than $75,000 a year. Undocumented families and those with children are eligible to receive an additional check worth $500.

Those who received a check during the first round will not receive another payment.

However, differences over how the state should spend its historic budget surplus have stalled distribution.

Read our full coverage for more on what elements of the budget have been agreed to and when for details on when it is expected to be finalized.

In an interview, Speaker Nancy Pelosi describes what "green" elements made it into the final infrastructure bill passed by the House of Representatives.

The Speaker acknowledged that the majority of the bill focuses on an older definition of infrastructure (i.e. roads and bridges), but also highlighted modern investments, such as those that will be made in broadband internet.

In the interview, she also stated that "For our obligation to our children, we have to have a greener infrastructure bill. We cannot have something that is of the past." For Speaker Pelosi, that also includes jobs in emerging green sectors that could help make the US economy more competitive in the coming decades.

Bernie Sanders, current chair of the Senate Budget Committee met with President Biden today to discuss the next steps on the infrastructure and reconciliation packages that will be brought before the Senate in the coming week.

After the meeting, Senator Sanders told the media that he and the President are in agreement and that Biden understands, "that we're seeing an economy where the very, very rich are getting richer while working families are struggling."

Stimulus check live updates: welcome

Hello and welcome to our daily live blog for today, Tuesday 13 July 2021, bringing you updates on a possible fourth stimulus check in the US.

We'll also provide you with information on the third round of stimulus checks, which began going out in March as part of President Biden's American Rescue Plan, in addition to news and info on other economic-support programs such as the new, expanded Child Tax Credit.

- Coronavirus stimulus checks

- USA coronavirus stimulus checks

- Joseph Biden

- Science

- United States Congress

- Unemployment

- Coronavirus Covid-19

- Pandemic

- Coronavirus

- United States

- Benefits

- Virology

- Outbreak

- Infectious diseases

- North America

- Parliament

- Employment

- Microbiology

- Diseases

- Social security

- Medicine

- America

- Labour market policy

- Work

- Biology

- Health

- Politics

- Life sciences