Fourth stimulus check | news summary for Friday 23 July

Latest updates and information on related benefits from President Joe Biden's coronavirus relief bill, and news on a potential fourth stimulus check. Saturday 24 July 2021.

Show key events only

Headlines

- IRS confirms another 4 million tax refunds have gone to recipients of unemployment benefits (Details)

- Will the more contagious delta variant affect additional unemployment benefits? (Details)

- How to register for the Child Tax Credit if you haven't yet had your payment (Details)

- Sen. Bernie Sanders has tabled a $3.5 trillion reconciliation package, including making the new Child Tax Credit permanent (Details)

- Senate blocks Biden's bipartisan Infrastructure bill, paving the way for the reconciliation process

Useful information / links

Could a Fourth Stimulus Check arrive in August? (Details)

Child Tax Credit | Who qualifies for the $500 dependent credit and who doesn't get the Child Tax Credit? (details) | Can I just get one month and opt out? (Details)

US Congress 101 | What is a reconciliation bill and how is it different from a normal bill? (Details)

Unemployment | Which states have ended supplementary unemployment benefits? (Details)

Golden State stimulus check | When will it arrive?

Still waiting for your tax refund? Find out when to contact the IRS

Have a read of some of our related news articles:

Which states are paying $1000 “thank you” stimulus and to whom?

There are widespread calls for a fourth stimulus check but certain groups in some states may be about to get their own direct payment, as a result of the hardship they have endured during the pandemic.

As a way to show appreciation for their efforts, and to help retain teachers and staff, school districts and states have been approving one-time “thank you” bonuses, using federal funding to provide what is essentially another stimulus check. This however is causing some to raise the question of whether it is a proper use of the funding.

Sen. Warnock on the new Child Tax Credit's impact

Looking back, the victories of Reverand Raphael Warnock and Job Ossoff in the Georgia Senate runn-off elections had an enormous impact on the US' economic recovery. The two victories handed the Democrats control in the Senate and allowed President BIden to push through the American Rescue Plan, which included the third stimulus check and a complete overhaul of the Child Tax Credit.

Little over a week after the new credit was finally introduced, Sen. Warnock is on the phone to Georgia residents to find out how the monthly payments have affect their families.

Can a fourth stimulus be approved before August?

Despite President Biden's focus on the fate of his enormous infrastructure package, there are many in Washington and across the country who believe that a fourth stimulus check is needed to provide further support.

It has been four months since the last and largest round of stimulus checks for up to $1,400 for each eligible American were approved and evidence suggests that it may be time for another. After those payments hardship rates fell sharply, but the effects of those Economic Impact Payments appear to be fading.

Need help registering for the Child Tax Credit?

For most people the Child Tax Credit should have arrived automatically over the last week but households not usually required to pay taxes may have to complete another step to trigger the monthly payments. The IRS is basing eligibility for the support on information provided in either the 2019 or 2020 tax returns, which non-filers will not have done.

To do so, they simply need to complete the IRS' Non-filer Tool to get the payments started. If you're unsure about how to do so all the information is available below...

Should you opt out of the Child Tax Credit monthly payments?

The first round of payments from the new Child Tax Credit were sent out last week but some families may decide not to receive the monthly support. As is explained here in this report from YahooFinance, taking the monthly payments could leave you forced to repay some of the money if you experience an income gain during the rest of 2021.

For more information about opting out of the monthly payments, check out Child Tax Credit: Can I just get one month and opt out?

How many stimulus checks have been sent since March 2020?

One of the most popular, and most expensive, financial relief programmes introduced by the federal government in the last 18 months is the stimulus checks. These direct payments have provided a direct cash injection to help pay for essentials and revive the flailing economy.

The IRS is still in the process of sending out payments as part of the third round of stimulus checks, which is already the largest of the three rounds of payments. But how many stimulus checks have been sent in total?

Sen. Brooker calls for Child Tax Credit to be made permanent

Payments for the new Child Tax Credit only began going out last week but there already widespread calls from Democrats to see it extended. New Jersey Sen. Cory Booker has been a long-time supporter of the support for families and is pushing for the programme to be made permanent.

Speaking to NPR's Mary Louise Kelly, Brooker said: "This child allowance will put us in line with other peer nations who understand, if you invest in children, your entire country will flourish."

Recurring stimulus checks could have protected renters

The federal government has extended an eviction moratorium throughout much of the pandemic which prevents renters from being evicted for failing to keep up with payments. The pandemic has taken huge toil on personal finances but basic income advocate Scott Santens argues that the moratorium would not have been neccessary if a recurring stimulus check had been introduced.

Programmes like the moratorium and stimulus checks provide a short-term safety net for struggling households but he argues that recurring monthly payments would have offered greater security.

Child Tax Credit: When will I get the August payment?

The first round of payments for the Child Tax Credit was sent to 35 million families and saw the IRS send out more than $15 billion. Around 86% of the payments were made through direct deposit, and the tax agency encourages families to provide bank information to get the funds more quickly.

The IRS developed the Child Tax Credit Update Portal to assist families in managing their payments. Through this portal, families can opt out of the payments and update their personal details; how long until the next payment arrives?

Scammers are targetting your IRS tax refund

Since the start of the pandemic the federal government has introduced various forms of financial relief to help Americans through the pandemic. After the stimulus checks and additional unemployment benefits came a new tax break which exempted jobless support recipients from paying tax.

Much of that money is now being sent out in the form of a tax refund but criminals are attempting to scam the rightful beneficiaries out of that cash. Here, the IRS runs through some of the most common scams...

How to get your Child Tax Credit payments

The IRS began sending out the first round of monthly Child Tax Credit payment last month, sending out support to an estimated 35 million American families. However there is concern that some households, who do not usually file taxes, may be missing out.

Non-filers will need to provide their information to the tax agency using the IRS' online portal. If you're not sure how to do so, the IRS is running Tax Prep Days this weekend to make more families eligible for the Child Tax Credit support.

How will the economy handle the end of stimulus and other challenges?

The Economist discusses the challenges going forward; countries unwinding their stimulus packages, supply shortages caused by bottlenecks in the supply chain and the most worrying of all, the Delta covid-19 variant causing a surge in new cases around the globe.

Additionally, why the fracking industry is no longer trying to get every last drop out of the ground but instead has the mantra “keep it in” and bitcoin miners in China are pulling up stakes to get out of Dodge.

Mayors using stimulus money to provide basic income

Mayors for a Guaranteed Income is a coalition of mayors from across the country advocating for a guaranteed income, direct, recurring cash payments. Several are using federal stimulus money from the American Rescue Plan to provide monthly checks to low-income resident of between $500 and $1,000 with no strings attached.

In conjunction with a University of Pennsylvania-based research center they are collecting data to see if such programs reduce inequality and produce more jobs. They plan to use their findings to lobby the White House and Congress to enact such programs on a national level, starting with extending the 2021 Child Tax Credit which will send parents up to $300 per child per month. The program expires at the end of December if nothing is done.

Eliminate the federal gas tax?

One of the snags slowing completion of the bipartisan infrastructure bill is how to pay for all the infrastructure. Republicans had floated the idea of raising the gas tax and pegging it to inflation. The gas tax hasn't changed in nearly 30 years and has lost 40 percent of its purchasing power since.

Democrats were strongly opposed to this idea, and it appears so too is the National Review. In a recent article Brian Riedl argues that instead of increasing the gas tax it should be lowered from 18.4 cents to just 3 cents per gallon to only cover infrastructure projects on federal lands.

As it works now states collect the taxes and then send the money to DC before it turns around to go back to the states with strings attached. State governments already have their own gas taxes, by letting them collect the whole tax for their state the federal middleman would be cut out.

Biden doesn't want "ideological clash" on infrastructure

President Joe Biden met with leaders from business and labor on Thursday at the White House to discuss infrastructure and show a united front in the need to take action. President Biden may have to do some arm twisting in the House of Representatives.

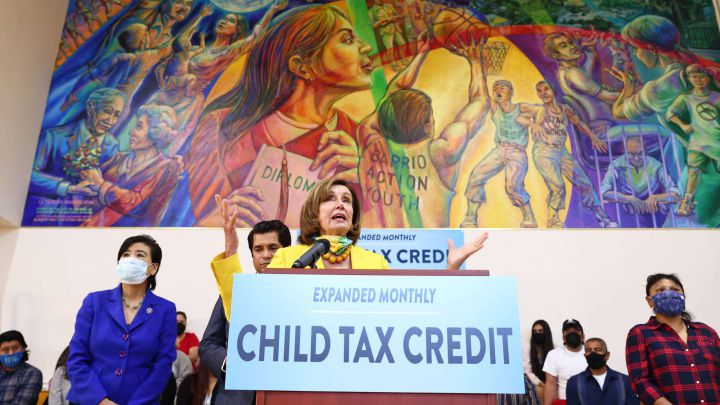

House Speaker Nancy Pelosi has said that she will not hold a vote on the bipartisan bill, that hasn't been written yet, until the Senate sends another larger budget bill with the "soft" infrastructure proposals that Democrats want to pass.

Can you claim child tax credit with no income?

The American Rescue Plan enacted in March included a number of policies designed to give a leg up to those that struggle to make ends meet. In particular, the enhanced Child Tax Credit for the 2021 fiscal year could cut childhood poverty in half.

This feat will be achieved if the parents of those children are signed up for the newly created advance payment program which started sending cash to families 15 July. Prior to the changes taxpayers had to claim the credit when they filed their taxes and there was an earnings floor that had to be met before a parent could begin to claim the credit.

The revamped Child Tax Credit was not only expanded in size but also made it available to those who have no income.

Democrat-only “soft” infrastructure bill by early August

The clock is ticking if Democrats want to pass the bipartisan “hard” infrastructure bill and their go it alone “soft” infrastructure bill. The Senate is set to adjourn for its summer recess 6 August. Senate Majority Leader Chuck Schumer told his colleagues that they should be prepared to work into what would be a month-long break. On Wednesday Senator Bernie Sanders, Chair of the Budget Committee, told reporters that he hopes to have the Democrat-only bill ready to bring to the floor for a vote by early August.

2021 Child Tax Credit could come back to bite some taxpayers in 2022

The IRS has sent out three rounds of Economic Impact Payments, or stimulus checks, since the beginning of the covid-19 pandemic. These were advance payments of the Recovery Rebate Credit for 2020 and 2021. To get the payments out faster the IRS used the information on hand at the time of disbursement.

Fortunately for taxpayers if they were underpaid they could claim any missing money on their tax return, even better if they were overpaid they weren't required to return the money. However, that isn't so with the 2021 Child Tax Credit for all taxpayers.

A "safe harbor" is provided for low- and moderate-income households shielding them from repaying the money, but those who earn more than the "safe harbor" threshold will be expected to pay back some or even all of the money.

House progressives threaten to scuttle infrastructure bill

31 House Democrats sent House Speaker Nancy Pelosi and Senate Majority Leader Chuck Schumer a letter letting them know that they will not be a "rubber stamp" for whatever bill comes out of the Senate. They want "a fair process for members on [their] side of the Capitol." Adding “We should reject any effort to categorically exclude the thorough, transparent and transformational process undertaken by the House.”

The bipartisan infrastructure bill, as yet, is still unwritten but the hope is that a physical piece of legislation will be available by Monday. A procedural vote on the bill failed on Wednesday.

Can I save the Child Tax Credit for 2022?

The American Rescue Plan included the expansion of some tax credits that families will be able to take advantage of when they report their taxes next year and possibly get a much larger refund. One of those credits, the 2021 Child Tax Credit, is being paid to families in advance, that is if parents choose not to stop the prepayments.

Parents may wish to hold off and receive the full entitlement they are due according to their eligibility in 2022. Even though the payments have already begun, families can stop the payments at just about any time before the end of the year when the program could expire, but there are specific deadlines for each month.

The IRS needs a budget increase

Over the past decade, Congress has cut the IRS budget by around 20 percent. The reduced funding has meant that staff has been reduced by the same amount. With less hands on deck and money to operate the agency is having more difficulty going after tax cheats. Additional funding was earmarked in the bipartisan infrastructure bill to help pay for rebuilding roads and bridges but GOP negotiators cut that from the bill.

The lack of staff is affecting the agency's ability to field calls from taxpayers that can only be solved by phone. The IRS received over 145 million calls this year, four times more than normal according to the agency. For one Illinois resident trying to claim a stimulus check for her husband who passed away last fall, it has been impossible to get through.

What does the Child Tax Credit expansion mean for families?

Sen. Sherrod Brown has been a long-standing support of expanding the Child Tax Credit and was one of the key voices pushing for it to be included in the most recent stimulus bill. The monthly payments started going out last week and Brown spoke to Congress about what the new support means for families in his state, Ohio.

In his closing remarks Brown made clear that his party is determined to secure an extension of the one-year programme, saying: "We will not stop fighting to ensure that parents' hard work pays off. We will not stop, we will deliver on this."

Where is my IRS tax refund?

The IRS has had its work cut out since the beginning of the pandemic, tasked with implementing various new federal support programmes. All three rounds of stimulus check, and the recently added Child Tax Credit payments, were all introduced by the IRS.

Unfortunately this has left them unable to complete their other tasks as promptly as normal, resulting in a huge backlog of 35 million unprocessed tax returns. As such millions of people are still waiting for their tax refund to appear, far longer than the usual 21-day turnaround. To check on the status of your refund, use the IRS' Where's My Refund? online tool in the link below...

Child Tax Credit: When will I get the August payment?

Last week the IRS began making payments as part of the new Child Tax Credit with roughly 35 million families benefiting from the new, more generous support. Around 86% of the payments were made through direct deposit, and the tax agency encourages families to provide bank information to get the funds more quickly.

The IRS developed the Child Tax Credit Update Portal, so families can opt out of the payments and update or provide a bank account number to receive the credit through direct deposit. The support will last until the end of 2021 at least, so when is next month's payment arriving?

Dollar set for second week of gains as focus turns to Fed

The dollar was set to end the week with small gains after a turbulent few days when currencies were buffeted by shifting risk appetite, with the market's focus now on next week's US Federal Reserve meeting. The dollar index was up 0.2% for the week, rising slightly on Friday to stand at 92.891. But that was off a 3-1/2-month high of 93.194 hit on Wednesday, after strong Wall Street earnings helped investors regain some of the confidence lost to earlier worries the Delta variant of the coronavirus could derail the global economic recovery.

The market's next major focus is the Federal Reserve's two-day policy meeting that wraps up on Thursday. Since the previous meeting on 16 June, when Fed officials dropped a reference to the coronavirus as a weight on the economy, cases are spiking. Many economists, however, still expect the meeting to produce some advancement in the discussions for a tapering of stimulus.

Another 2.2 million stimulus checks are sent out

For now, President Biden appears unwilling to push for a fourth stimulus check as he attempts to pass the massive infrastructure bill that has been opposed by Republicans in Congress. However direct payments are continuing to go out as the IRS works through the backlog of stimulus check recipients who are owed more money.

In most cases these are recipients who have been found to have a larger stimulus check entitlement when the IRS processed their 2020 tax return. They will continue this process for the remainder of 2021.

IRS sends out unemployment benefits tax refunds

The American Rescue Plan provided a tax break for any who received unemployment support during 2020, making the first $10,200 of benefits received tax-free. However the bill was only signed into law in March, by which point, millions of people had already filed their tax returns and paid the taxes that they believed they owed.

To rectify that, the IRS is sending out tax refund payments throughout 2021 to an estimated 13 million unemployment benefits recipients who overpaid. The IRS has more information on that process and when your refund will arrive...

Can parents split the 2021 Child Tax Credit?

Last week the IRS started sending out the first batch of monthly payments as part of the new-look Child Tax Credit, with an estimated 35 million families having now received the support. From 15 July until at least the end of 2021, eligible families will receive a monthly payment of up to $300 per child aged under six and $250 for each child aged between six and 17.

However this new system presents a problem for parents who are separated; which parent will recieve the money, and are they allowed to split it?

IRS criticised for Child Tax Credit online portal

The online tools introduced at the start of July to help families oversee their Child Tax Credit payments has been criticised by Sen. Ron Wyden. In a letter to the agency's chief, Charles Rettig, Wyden wrote: “If this inadequacy is not rectified, millions of American families could be denied the opportunity to provide a more secure future for their children and break the cycle of poverty for so many."

His message relates to the comparatively small number of low-income Americans who have been able to take advantage of the new programme.

Did you get the correct amount in the Child Tax Credit payment?

The new expanded Child Tax Credit provided a payment worth up to $300 for each child under six and $250 for children aged between six and 17, but the exact amount on offer varied depending on the parents' circumstances. Because this is the first month that the process has been in action it is possible that there were some teething problems with the introduction.

If you think you may have received the wrong amount, or simply want to check you were paid correctly, check out this handy Child Tax Credit online calculator...

Non-filers must register to trigger their Child Tax Credit payments

There is concern that many low-income households are missing out on the Child Tax Credit monthly payments because they have not yet provided their information to the IRS to trigger the support. For most eligible families the payments will have begun automatically but those who do not earn enough to be required to pay tax will need to use the IRS' Non-filers Tool to provide the IRS with the detail needed to make payments.

Stimulus check live updates: welcome

Hello and welcome to our daily live blog for Friday 23 July 2021, bringing you updates on a potential fourth stimulus check in the United States.

We'll also offer information on the third stimulus check, which began going out in March, as well as economic-support measures such as the new, expanded Child Tax Credit.

Stay with us throughout the day for regular updates, or pop in and out and find out what's fresh.

- Coronavirus stimulus checks

- USA coronavirus stimulus checks

- Joseph Biden

- Bernie Sanders

- Nancy Pelosi

- Unemployment compensation

- Science

- California

- Unemployment

- Coronavirus Covid-19

- Pandemic

- Coronavirus

- United States

- Employment

- Virology

- Outbreak

- Infectious diseases

- North America

- Microbiology

- Diseases

- Medicine

- America

- Work

- Biology

- Health

- Life sciences