Child Tax Credit: When will I get the August payment?

With the first payment of the Child Tax Credit out the door, many are wondering when the second will be sent. Families can mark their calendars for 13 August.

The IRS has announced that the first round of payments for the Child Tax Credit was sent to 35 million families totaling more than $15 billion. Around 86 percent of the payments were made through direct deposit, and the tax agency encourages families to provide bank information to get the funds more quickly.

The IRS developed the Child Tax Credit Update Portal to assist families in managing their payments. Through this portal, families can opt out of the payments and update or provide a bank account number to receive the credit through direct deposit.

The new #IRS Child Tax Credit Eligibility Assistant tool is useful to families who don’t normally file a federal tax return and have not yet filed either a 2019 or 2020 return. https://t.co/H2r2CkXnEN pic.twitter.com/xzKFpvJ4Um

— IRSnews (@IRSnews) July 18, 2021

The second payment will be made on 13 August. The remaining payments will be made on the 15th of each month from September to December.

Those who do not normally file taxes are encouraged to do so or sign up to receive the payments through the Child Tax Credit Non-filer Sign-up Tool.

Who is pushing to make the changes permanent?

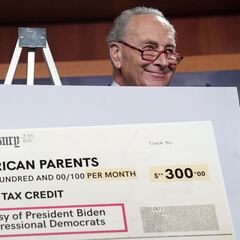

Under the American Rescue Plan, the amount of money and the method the credit is distributed to families was changed. Rather than receiving a $2,000 credit during tax season, families now receive a minimum of $3,000 and can have half the value of the credit sent to them this year.

There have been changes to the #ChildTaxCredit that will benefit many families as they receive advance payments starting in summer 2021. Watch an #IRS video to learn more: https://t.co/ExCHyXXbwW

— IRSnews (@IRSnews) July 19, 2021

One of the leading voices in the movement to make the changes to the tax credit permanent in President Biden. The President had initially incorporated a measure to extend the credit’s new structure through 2025 in the American Families Plan.

However, without Republican support, it seems unlikely that the plan would make it through the Senate with the filibuster in place. The Senate filibuster requires that bills receive a sixty-vote majority to pass.

What's this budget bill really all about? Well, in a time of massive income and wealth inequality, when nearly half of our people are living paycheck to paycheck, what this bill does is FINALLY begin to address the long-neglected needs of working people. Let's get it done. pic.twitter.com/QxmG8tltee

— Bernie Sanders (@SenSanders) July 19, 2021

Some lawmakers are working on a reconciliation bill to overcome the filibuster and enact the President’s legislative agenda. Reconciliation bills are a way for the Senate to pass budgetary bills with a simple majority. But, only a certain number of bills can be passed using this parliamentary tool.

Vermont Senator Bernie Sanders, Chairman of the Senate Budget Committee, unveiled a reconciliation bill last week that would make the changes to the Child Tax Credit permanent.

The bill also includes measures from the American Jobs Plan and American Families Plan, like creating a Civilian Climate Corp. The White House described the CCC as an organization designed to get people out in the wild, “conserving our public lands and waters, bolstering community resilience, and advancing environmental justice.”

Related stories

Republicans have been unified in their opposition to the $3.5 trillion reconciliation package. If it garners no Republican support, all Democratic members of the caucus would have to vote in favor.

For progressive Senators leading the effort, it may be more difficult to sway more moderate members like Joe Manchin of West Virginia.