Fourth stimulus check news summary | 8 October 2021

Live updates as President Biden seeks to get his agenda through Congress as well as the release of the September jobs report and the Child Tax Credit.

Show key events only

Stimulus checks and Child Tax Credit: live updates

Headlines

Capitol Hill Round Up: All you need to know regarding the debt ceiling, reconciliation bill, and more.

- Second poor jobs report in a row as only 194,000 new jobs in September, despite end of extra benefits.

- New details over changes to Medicare premiumsreleased.

- To pay for the reconciliation bill, the Biden administration has proposed a new rule that would allow the IRS to track transaction in bank accounts with a balance over $600.

- California sends out third batch of $600 Golden State stimulus checks.

- How have stimulus checks impacted the economic recovery?

- Some states are preparing to send their residents a stimulus check in October.

- Many across California are still waiting to receive their stimulus check, how many more batches will be sent?

Useful Information/Links

Social Security and Medicare

- How long does it take for Social Security to change direct deposit?

- What medical conditionsqualify you for Social Security checks?

- What are the work requirements to receive Social Security?

- What are thefour types of Medicare?

California Golden State Stimulus Checks

-How many more payments remain to be sent in 2021?

- When will the payments arrive and who qualifies?

Take a look at some of our related news:

President Biden touts jobs numbers and pushes for passage of his agenda

"Jobs up, wages up, unemployment down. That's progress." President Biden.

What are the numbers on the back of my Social Security card?

The internet is alive with theories about Social Security Numbers and their meaning or use despite the government’s attempts to debunk the myths.

Could the unemployment rate affect a future fourth stimulus check or other benefits?

The underwhelming September jobs report has seen renewed calls for additional federal support programmes, but the White House insists it is not necessary.

End of unemployment benefits didn't create employment boom

Many had high expectations for the September jobs report that came out this week. School was back in session freeing up parents to go back to the office and eat out once again. Likewise, with enhanced unemployment benefits expiring at the beginning of the month in the rest of the states that hadn't ended them early workers would be prodded back into jobs.

The jobs report showed that the pandemic is still hindering the return to normal. However despite the disappointing numbers there were some silver linings. Labor demand is high indicating that the economy is strong, it will take kicking the virus to truly free the economy from it grip.

Dems continue push for Child Tax Credit extension

In a meeting with residents in Portland, Oregon, Sen. Ron Wyden was talking up the benefits of elements President Biden's ambitious Build Back Better legislative agenda. A small number of moderate Democrats in the Senate have been unwilling to support the extension of the Child Tax Credit, but Wyden has reiterated the good that it could do for families in his constituency.

California stimulus check: how many more payments remain to be sent in 2021?

The second Golden State Stimulus has been sending checks to Californians since the start of September. Two-thirds of residents are eligible for the checks of between $500 and $1,100, depending on income and how many dependents an individual has.

To be eligible, you just need to file your 2020 tax return and be under the wage threshold. Compared to the first round of checks in 2020, the eligibility barrier is much greater; people earning up to $75,000 can get the payment.

Child Tax Credit provides hope for families

This report from Humanity Forward recounts the experiences of families who had, in the past, saw their physical and mental health suffer because of the financial burden placed on them to cover the cost of child care. In many cases, the mother is unable to return to the workplace after giving birth because the cost of finding childcare is prohibitive.

This is one of the issues that President Biden hopes will be addressed by the Child Tax Credit expansion, something he is trying to extend through 2025 at the moment.

Eligibility and how to apply for Social Security as a permanent resident in the US

Every permanent resident in the US needs a Social Security Number (SSN). Without it, access to some of the must fundamental administrative procedures are impossible. Organized by the Social Security Administration (SSA), the SSN can be applied for while getting a visa or once you are already in the US. In either case it shouldn't be a problem to receive it if you have the correct documents.

"Last year, stimulus checks alonelifted 11.7 million Americans out of poverty. That’s a big deal. Now, imagine what we can accomplish by passing the Build Back Better plan, which will deliver affordable child care, universal pre-k, paid leave, and so much more. Let’s do this."

Child Tax Credit a net benefit to the US

President Biden faces an uphill task to secure an extension of the expanded Child Tax Credit in the upcoming reconciliation package, after two key moderate senators publicly stated their opposition. However, evidence does suggest that the programme is a net benefit to the country, with every dollar spent on it resulting in an $8 boost for taxpayers.

Can I get a replacement Social Security card online? Requirements and website

Have you lost your Social Security card? In most cases, simply knowing your number will be enough but the Social Security Administration (SSA) does also let you request another card if neccessary. Residents of most states will be able to access an online portal which allows you to request another card easily, but in six states and a number of US territories that process is not so simple...

Yellen on the importance of debt ceiling increase

The prospect of an unprecendented US debt default appears to have been kicked down the road for now, after a Senate vote on Thursday evening granted approval for a eight-week raising of the national debt ceiling. However, Treasury Secretary Janet Yellen has reiterated the importance of finding a long-term solution to the issue to ensure that faith is maintained in the US federal government's ability to pay its bills.

Within weeks of the first covid-19 shutdowns back in March 2020, Congress passed the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which sent direct assistance to millions of households. The payment of $1,200 stimulus checks and enhanced unemployment benefits that provided more generous and expanded coverage helped the country avert a total economic collapse.

That was an unprecendented step, providing direct payments to citizens on a scale unequalled in American history to help them overcome a national emergency. How long has it been since the last round was sent out, and is there a chance of a fourth stimulus check in the near future?

How is the Child Tax Credit being used?

Next week the IRS will send out the next round of monthly payments as part of the Child Tax Credit, which will be the fourth to go out to date. However the programme is currently only funded to provide six of these monthly payments, with an additional tax credit to be claimed at the end of the tax year.

However Congress is still undecided about whether or not to extend the plan beyond its initial duration, with most Democrats pushing hard to see an extension included in the upcoming reconciliation package. Rep. Raja Krishnamoorthi, a supporter of an extension, outlines here how the payments have been put to good use so far.

“In our community, nearly 3 in 4 children will receive these payments, putting money in the pockets of parents to help pay for mortgages, child care, summer learning, and more, as we continue to recover economically from the pandemic,”

“The Child Tax Credit will deliver critical resources to families when they need it most, but let’s be clear: families need support well beyond this pandemic. I’m fighting in Congress to permanently expand these Child Tax Credit payments, so our families have the resources needed to thrive this month and into the future.”

Can a fourth stimulus check still happen in 2021? Are the negotiations still ongoing?

President Biden won the White House campaigning on his Build Back Better agenda which seeks to reconstruct the US economy devastated by the covid-19 pandemic. The first phase of that plan was enacted in March through the American Rescue Plan.

The sweeping legislation sought to tackle the immediate concerns the US was facing, with federal pandemic unemployment benefits set to expire, the recovery stagnating and a vaccination program that was yet to take off. That legislation approved a third round of stimulus checks which gave all eligible Americans up to $1,400. Since then, there have been calls for additional cash injections into US households still struggling with the effects of the pandemic-induced economic crisis.

How much were the first, second and third stimulus checks and when were they sent out?

We take a look at the three stimulus checks so far sent out by the United States federal government since the beginning of the coronavirus pandemic in early 2020.

This is quite a deflating report. This year has been one of false dawns for the labor market. Demand for workers is strong and millions of people want to return to work, but employment growth has yet to find its footing.

Why is the growth in the US September jobs report so poor?

Announced on Friday, the Labor Department announced the September figures for the unemployment rate and jobs created. The headline is that there were just 194,000 jobs created in the month of September, one of the lowest of 2021. The Dow Jones had estimated there would be 500,000 new jobs, already a low estimate compared to previous months, but this target has been missed.

But one positive is the decrease in the unemployment rate, falling four percentage points to 4.8%, the lowest since the beginning of the pandemic. Expect the Democrats to laud this number, while ignoring discussing the long-term impact of low job growth.

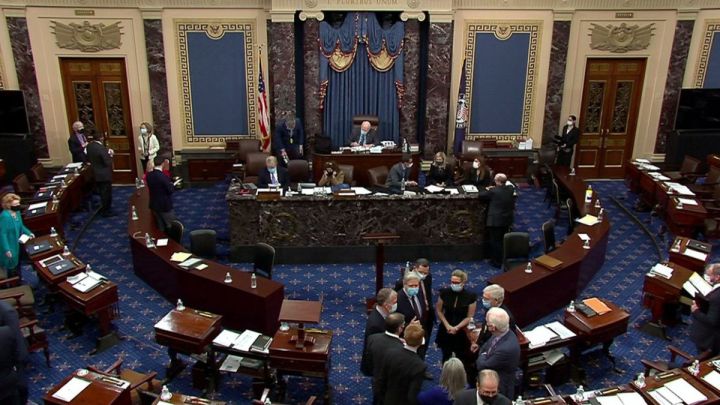

Who voted for and against the debt ceiling extension?

The Senate has passed the legislation required to temporarily raise the United States’ debt ceiling, heading off the threat of a first ever federal default in the coming weeks. The Democrats were joined by 11 Republicans who allowed the bill to pass; it still needs approval in the House before it can be signed into law.

The temporary extension to December 3 means the threat of default has subsided for now. However, a new vote to extend it again will be needed before December 3.

BREAKING: Jobs report disappoints for second month in a row

The US added just 194,000 jobs in September as the economy struggled under the delta surge of covid-19, according to data released Friday by the Labor Department.

The unemployment rate fell sharply in September to 4.8 percent, a decline of 0.4 percentage points. But employment growth fell sharply for the second consecutive month after a staggering rise in coronavirus cases began in late July. Economists expected the US to add roughly 500,000 jobs last month, just half of July’s employment gain of more than 1 million.

How did Americans spend the Child Tax Credit?

A tweet from Democrat Rep. Raja Krishnamoorthi has the breakdown of how the CTC has been spent.

At what age is Social Security no longer taxed in the US?

The vast majority of Americans will be required to pay tax on at least part of their Social Security payments, sometimes as much as 85% of the benefits if their total income exceeds certain thresholds.

However once you are at full retirement age (between 65 and 67 years old, depending on your year of birth) you will no longer be taxed on Social Security payments. The size of your annual Social Security entitlement continues to grow up to the age of 70, so you may want to consider delaying your claim for a few years if you intend to continue working past the normal retirement age.

Take, for example, the proposal’s expansion of the Medicare program to cover vision, dental and hearing, a policy that has merit. However, to implement this policy, the draft reconciliation bill relies on budget gimmicks, with dental benefits not taking effect until 2028.

The decision to delay these benefits was based in significant part on a desire to lower the overall price tag of the bill, but it is disingenuous, allowing lawmakers to try to claim they made a historic expansion that may never take effect while obscuring the true cost of the expansion, at potential risk to the broader Medicare program

Many of the proposal’s key policies to support workers and families, like extending the expanded Child Tax Credit are implemented for only four years to artificially lower the bill’s overall cost. I support this policy, but I also think low-income families shouldn’t become the targets in yet another congressionally-manufactured fiscal cliff. If Congress believes this is good policy, we should pay for it for the full 10-year budget window.

More Democrat House members acknowledge problems with bills

Rep. Jared Golden (D-Maine) warned his colleagues on Thursday that the multitrillion-dollar social spending plan his party is working on “needs more work” to get his support.

In an opinion piece published by The Portland Press Herald, Golden said that while he's in favor of the Senate-passed $1.2 trillion bipartisan infrastructure that the House has yet to vote on, he “cannot support” the larger spending package “in its current form.” Like many moderate Dems he also believes the plan is not fully costed, something progressives deny. Tax hikes on businesses and the wealthy are the plan to cost the plans.

His comments can be found above.

What are the 2022 Medicare premiums?

Those who receive social security are automatically enrolled in Medicare Parts A and B. Part A covers hospital visits and other intensive medical needs. In contrast, Part B covers doctor's appointments and other essential medical services. The Social Security Administration (SSA) deducts the premiums for these parts from your total benefit amount each month.

The exact amounts the premiums are expected to increase have not been announced. Typically this information is released in late October or early November.

However, the Center for Medicare and Medicaid (CMM) has released information on the premiums for Parts C and D. In a press release put out in late September, the agency noted that in 2022 "the average premium for Medicare Advantage plans will be $19 per month. In 2021, the average has stood around $21."

Who is missing out on the Child Tax Credit?

Despite being one of the largest and most generous social funding acts in US history, there are still people who are falling through the gaps in the Child Tax Credit. Some of the people who need it most are people who have become unemployed during the pandemic. Many of these are from the Latinx communities, due to having low incomes or not having ever filed taxes.

More than 10 million of the 73 million children in the US are not yet enrolled and could miss out on the monthly payments that started in July as part of a large covid-19 relief package passed by Congress.

“We knew that as soon as the bill passed ... that Latino families in Los Angeles were going to miss out on it because they’re very low-income or don’t file taxes,” said Vanessa Aramayo, director of the Alliance for a Better Community. “It’s unfortunate that public resources are not made available to pair with this effort.”

Initial unemployment claims fall for first time in a month

Last week there were 326,000 initial claims for benefits, 38,000 fewer than in the previous week. Initial claims are on e way of measuring unemployment numbers and they are currently at their lowest for the whole pandemic.

2021 US economic deadlines: debt ceiling, infrastructure bill and government funding

While the debt ceiling is expected to be lifted next week, at least for a few weeks, there are still other major economic bills that need to be passed in the US.

The Democrats currently wield unified power in Washington, holding the White House, the House of Representatives and, by the slimmest of margins, the Senate. This allows Biden to pass most economic legislation without any Republican support, using a congressional mechanism known as reconciliation, but he may lose that option in the 2022 mid-terms.

There is a concerted effort on behalf of the White House to push through the President’s priorities before the end of the year, with three key deadlines likely to dictate whether that effort is successful or not.

11-15 October - Raising the debt ceiling

31 October - Infrastructure and social investment legislation

3 December - Long-term federal funding bill

Read Will's article here, detailing how the bills could be passed and why they are so important.

A new Cold War?

NBC news is reporting that senior Democrats are arguing that the necessity of their social policy is to keep track with China. The US sees China as its greatest global competitor.

The memo, detailing what the Build Back Better plan will do, has 12 references to China, including on elements such as wind turbines and electric cars.

Why the program is pitched as a counter to China rather than a needed help for the American public shows how the Democrat leadership views moderates in the party.

Sanders continues feud with Manchin

Sanders' tweet references Joe Manchin's comments about not want a society of "entitlement." Manchin has said he will not support the large government spending envisioned by President Biden while Sanders believes more public spending is needed to support ordinary Americans.

Sanders countered by saying that he believes Americans are entitled to basic necessities, it's why we pay taxes sin't it?

Senate approves temporary debt increase of $480 billion: how will this affect Americans?

To elaborate on the debt ceiling news, Will Gittins has our report. The package was approved thanks to a 61-38 bipartisan decision to waive the filibuster, followed by a 50-48 party line vote from the Democrats. If the bill passes the House of Representatives, the debt ceiling will be temporarily raised by $480 billion until 3 December.

The nation had been expected to surpass its debt ceiling on 18 October, which would have had unimaginable consequences for the US as it continues its covid-19 economic recovery.

Welcome to our stimulus checks and Child Tax Credit live feed

Hello and welcome to our live feed for Friday 8 October, as we bring you the latest news on a potential fourth federal stimulus check in the United States. We'll also provide you with information on the monthly Child Tax Credit scheme - which has so far seen three payments of up to $300 go out to eligible households - and on other benefits available to Americans, such as changes to next year's Social Security payments.

Despite no vote yet taking place on lifting the debt ceiling, Republican leaders say they will support a temporary raise to ensure the US does not default on its national debt.