Relief checks: summary news 10 March

US FINANCE: LATEST UPDATES

Headlines: Friday, 10 March 2023

- 311,000 jobs added to the US economy; unemployment increased to 3.6 percent

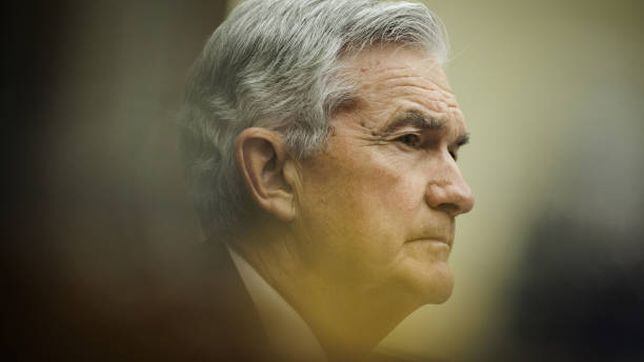

- Chairman Powell says the Fed will increase rates later this month, but how high could they reach by the end of the year?

- Last week, initial unemployment claims rose by 21,000 to 211,000

- 3.8 million workers quit their job in January, down from 4 million in December

- Biden proposesnew Medicare tax plan

- Student-loan borrowers should have a “Plan-B” for debt forgiveness

2023 Tax Season

- Who can claim the additional standard deduction?

- The way to access IRS transcripts to ensure a faster tax refund

- Did you receive a state stimulus check? No need to report the payment as income to the IRS.

Read more from AS USA:

Recap: More strong jobs numbers from February

The US jobs market continued at a fast pace in February, dispelling fears that the economy could be thrust into recession by the interest rate hikes seen across the past year. The Federal hoping to secure a 'soft landing' for the economy as inflationary pressures begin to ease and strong job numbers will help that effort.

The Social Security Administration sent out payments to over 71 million Americans as of January 2023. Due to the monumental nature of issuing so many payments, the agency spreads out when they are sent depending on date of birth, type of benefit and when a recipient first signed up for Social Security.

This creates a situation where every so often certain beneficiaries receive more than one payment in a calendar month. March will be one of those months, along with June, September and December in 2023. Another group of beneficiaries always gets double payments as they receive both Social Security and Supplemental Support Income.

In-person IRS assistance tomorrow

If you need help with your tax submission this year, consider taking advantage of the IRS' face-to-face help day on Saturday, 11 March. Selected locations will be opening tomorrow to cater for those who may not be able to get into an office during the working week.

All the details you need are on the IRS website below...

If you are in the process of putting together your 2022 tax returns, you should take a moment to consider any tax credits and deductions that you may be eligible for.

One of the most widely-used tax credits in the United States is the Child Tax Credit. This initiative provides a tax credit worth up to $2,000 per qualifying child to either reduce your tax bill or boost your refund.

We take a look at the eligibility requirements for the program...

Where did the US economy lost jobs in February 2023?

Although the United States economy added 311,000 jobs in February, the unemployment rate increased from 3.4 to 3.6 percent.

The sectors that saw the largest decrease in jobs were Information (-25,000) and Transportation and warehousing (-21,500). In the latter category, around 9,000 trucking jobs were lost, which could create further issues in the logistics center. The conditions for truckers have detoeritated rapidly since the 1980s, and in recent years the situation has gotten even worse.

Is it worth moving to a more affordable city with mortgage rates rising?

The United States experienced a Great Migration during the covid-19 pandemic with over 27% of movers leaving the metro area that they were living in. The mass exodus was aided by ultra-low mortgage rates at or below 3%, which also fueled a surge in home prices.

However, Freddie Mac asks now that the 30-year fixed rate is approaching 7% once again: “Is migration to more affordable areas still worth it?”

The answer depends. For renters looking to buy the incentive may actually be increasing with higher mortgage rates. However, for homeowners whose current home has a below-market mortgage rate, the incentive may have reversed.

Mortgage rates increase for fifth straight week

Mortgage rates continued their rise with the 30-year fixed-rate averaging 6.73% % in the week ending 9 March. That is up nearly a tenth from the 6.65% average the week before according to data from Freddie Mac and almost three percentage points above the level a year ago.

The rate is expected rise even more as Federal Reserve Chair Jerome Powell indicated that more interest rate hikes would be necessary to bring down sticky inflation. An action that became even more likely after Febraury’s job report came in much higher than expected.

Americans across the country have been reeling from accelerated price rises not seen in four decades as the global economy has been hit by one shock after another. The higher cost of living has spurred some states to send residents relief checks to cope with inflation now that the federal government has ended pandemic-era support, some of those direct payments are still going out.

However, how much money you need to be able to afford the necessities and still have money left over for discretionary spending and even save a little can vary from coast to coast. A couple of analyses on affordability of numerous US cities found where you can live on less and where a paycheck goes further.

The US economy added a whopping 311,000 new jobs in February, far exceeding the 200,000 economists had predicted. Unemployment ticked up slightly from 3.4 percent to 3.6 percent last month.

Areas that had “notable job gains” according to the US Bureau of Labor Statistics were the leisure and hospitality, retail trade, government, and health care. The mass layoffs in the tech industry were noted by decreased employment in information sector. Transportation and warehousing also saw drops in employment last month.

Student debt an ever increasing burden

Student loan debt has been ballooning over the past few decades with a collective total of almost $1.76 trillion currently. A survey in 2021, showed that 60 percent of millennials that don’t own a home, being held back from doing so because of their student loan debt.

When President Joe Biden announced his plan for student loan debt forgiveness, following through on a campaign pledge, it was welcomed by many, but not all. The executive order to cancel up to $20,000 in federal student loan debt for qualified borrowers met quickly with legal challenges claiming that Biden had overstepped his authority. Two of those lawsuits put the program on pause and were fast tracked to be heard by the Supreme Court.

That has left many borrowers wondering what they can do to alleviate their student loan debt burden if the high court deems the program unconstitutional.

Every month the agency publishes a report on the United States’ jobs market to track trends in employment across the country. The two key metrics to look out for are the number of nonfarm payroll jobs added and the updated unemployment rate.

We’ll have the report’s findings right here as soon as they are released.

The relationship between interest rates and unemployment

The impact higher interest rates can have on wage growth is one reason why many progressive economists, like Noble Prize winner Joseph Stiglitz, have urged the Federal Reserve to proceed with caution. Balancing the Fed’s approach to ensure that rates are not increased to points that will undermine the power of workers is critical to ensuring poor families are not sacrificed to get inflation under control.

If unemployment increases and fewer jobs become available because businesses enact hiring freezes, workers will be forced to accept lower wages. As record profits sore across industries, Stiglitz and others worry that higher rates will have the inverse effect and increase prices.

The White House has released President Biden's new budget for financial year 2024, with some significant changes for one of the most widely-used federal programs. Medicare is in danger of becoming insolvent in the coming years unless changes are made and Biden has proposed important alterations to the tax system to help with that effort.

A White House press release states: "The Budget strengthens Medicare by extending the solvency of the Medicare Trust Fund by at least 25 years, without cutting any benefits or raising costs for beneficiaries."

Biden to reverse Trump-era tax cuts for the richest

Details of President Biden's 2024 budget have been released today as he looks to right the US' economic position. Federal spending has been an issue of major contention in recent years and Biden's more progressive agenda has been criticised in some quarters as being too costly.

However this new budget would reduce the US' annual deficit considerably. Much of the savings come from reversing the tax cuts for the richest Americans that were passed under former President Trump. Biden wants to see the corporation tax rate return to 28%, after Trump lowered it to 21%.

How will the latest Biden budget affect taxes?

During campaigning for the 2020 presidential election, Joe Biden repeatedly claimed that he would not raise taxes for those earning less than $400,000 per year. The President appears to be sticking to that pledge after his 2024 budget was released earlier today, raising the tax rates for high earners and corporations.

Biden will hope that tweaks to the tax system can provide sufficient extra revenue to keep Medicare solvent for decades to come.

Welcome to AS USA

Hello and welcome to our financial blog, where we'll bring you all the latest news on measures to tackle inflation, financial support to cope with rising prices and the effects of interest rate hikes.