Fourth stimulus check news summary: 20 May 2021

Latest updates and info on the third stimulus check in President Biden's coronavirus relief package, and news on a potential fourth check.

Show key events only

US stimulus checks live updates: Wednesday 19 May 2021

Headlines:

- Expanded Child Tax Credit monthly payments will begin on 15 July, continuing for at least 6 months (more info)

- IRS tax return deadline day has now passed (more info)

- Over six million “plus-up” stimulus check payments have been sent out, a total of $13 billion.

- Retail giants report positive economic outlook after stimulus check influx and reopening boost

- Residents of some states have longer to submit state tax returns (more info)

- Statement from Speaker Nancy Pelosi calls for Child Tax Credit to be made permanent

- Latest batch of payments sees one million stimulus checks sent to recent tax filers

- California sends out $600/$1,200 stimulus checks as part of the Golden State Stimulus scheme

- California Gov. Gavin Newsom proposes expanding Golden State Stimulus payments program

- Job fears, and price spikes mean heartburn for Biden White House as economy revs up

- IRS paying out unemployment-tax-break refunds (find out more)

- You can track your third stimulus check by using the IRS' online Get My Payment portal

Take a look at some of our related articles:

Colorado Vaccine Lottery: how to enter and sign up to win $1 million

Colorado becomes fifth state to create the establishment of a vaccine lottery. How does one enter and sign-up to win $1 million?

On 25 May, Governor Jared Polis’ office announced the Colorado Comeback Cash Vaccine Drawing which will take place over the next five weeks. Each week one winner will be selected to win one million dollars. The winners will be announced each Friday starting 4 June through 7 July.

Read our full coverage for more information on how to enter and to find about how other states are approaching the establishment of a vaccine lottery.

San Francisco Federal Reserve President Mary Daly tells CNBC that while the economy is roaring back, it is still "too soon to tighten policy." Full story here.

Newsweek reports that 1.2 million checks sent under the CARES act have not been cashed. This news comes as Democrats push for another check to be sent. Based on this information it is hard to say why the checks were not cashed. Many are pushing the IRS to collect more information as well as data on spending habits sent after the second and third payment. Full details here

Colorado becomes latest sate to implement a lottery for those who have been vaccinated. State officials hope that the possibility of winning a cash prize could increase vaccination numbers across the state. More details here.

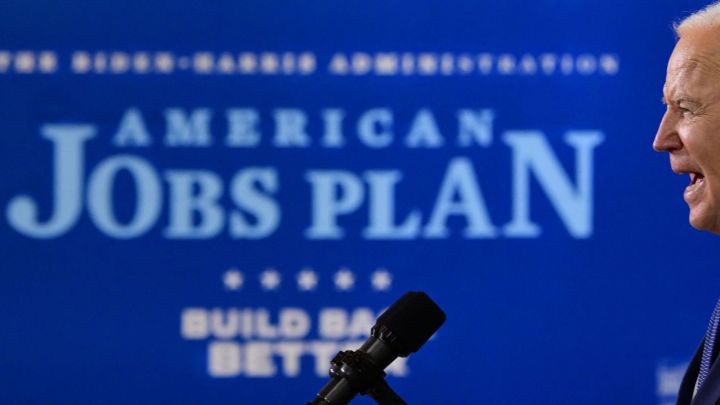

Fourth stimulus check: what have Democrats said about a new relief bill?

Later this week, Republicans are expected to unveil a counter proposal to the American Jobs Plan with a lower price tag. To learn more on where the negotiations stand at this point, read our full coverage, which also includes information on the prospects of a fourth direct payment.

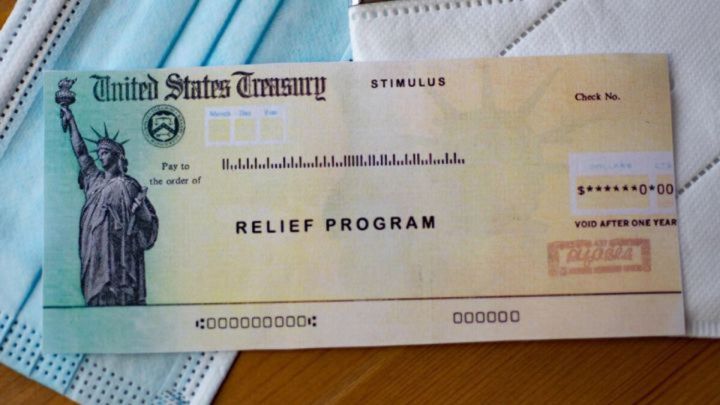

Where is my Golden State stimulus? How to check & track

Still waiting for your Golden State Stimulus Payment?

The Franchise Tax Board in California is distributing stimulus checks to the value of $600 or $1,200 to eligible residents of the state. Read our coverage for information on how to track your payment.

How many Americans could receive an unemployment tax break this year?

How many Americans could receive an unemployment tax break this year?

Some of the millions who filed a 2020 tax return and reported unemployment assistance payments will begin to see refunds appear in bank accounts this week.

Child Tax Credit: can you opt-out of the child tax credit?

Child Tax Credit: can you opt-out of the child tax credit?

Families are slated to begin receiving payments for the child tax credit in July, but some are wondering if they should delay their payments.

What has the White House said about a fourth stimulus check?

The White House is reportedly considering adding "automatic triggers" into the next stage of the Build Back Better legislation which would see a fourth stimulus check sent out if certain economic measures are met. The idea is to avoid another logjam in Congress if the economic situation worsens and immediate financial relief is needed.

This news comes from sources close to the Biden administration but the President himself has remained tight-lipped on the possibility so far. However a number of prominent Democratic lawmakers have made clear that they are in favour of another round of stimulus checks.

Pensioners in Japan rush to cash $1,400 stimulus checks from IRS

It happened again; non-US pensioners who had worked in the US years ago were erroneously sent stimulus checks. In the previous two rounds of stimulus checks passed under the Trump administration similar payments were made to ineligible foreign recipients, however this time those who received the checks never received the first two.

Bank branches in Tokyo were overwhelmed with retirees looking to cash $1,400 stimulus checks sent to them by the IRS. However, not all were able to cash them as the banks were not sure if those presenting the checks were eligible. It will have to be seen if the US government will seek to reclaim the money sent out in error.

How many Americans could receive an unemployment tax break this year?

Some of the millions who filed a 2020 tax return and reported unemployment assistance payments will begin to see refunds appear in bank accounts this week.

A US Treasury inspector report of interim results of the 2021 tax filing season, as of 4 March of the 7.4 million that had filed a 2020 tax return reporting unemployment compensation almost 99 percent would likely qualify for the tax waiver.

IRS unemployment refund update: how to track and check its state

One of the lesser-known provisions of the $1.9 trillion American Rescue Plan was a substantial tax break for recipients of unemployment benefits in 2020, which offers a considerable tax exemption. The IRS is now in the process of sending out tax rebates to over 10 million Americans who incorrectly paid tax on jobless benefits received in 2020.

The Federal Reserve reports on inflation globally as countries try to keep their economies afloat during the pandemic.

Fourth stimulus checks: when will the next relief bill be discussed?

What are the prospects of a fourth stimulus check?

President Biden is holding White House meetings with bipartisan groups to discuss the next stage of his Build Back Better plan, but are stimulus checks on the agenda?

Read our full coverage here.

$10,200 exclusion: When will the IRS return the unemployment tax refunds?

$10,200 exclusion: When will the IRS return the unemployment tax refunds?

The American Rescue Plan passed by Congress in March made changes to the way unemployment benefits can be taxed. The bill included the “exclusion of unemployment compensation of up to $10,200 for individuals for taxable year 2020” to help support families who have seen falls in their income over the last year.

Read our full coverage to see who is eligible and when they can expect their updated tax return.

The Consumer Price Index for All Urban Consumers increased 4.2 percent over the 12 months from April 2020 to April 2021. The index rose 2.6 percent for the year ending March 2021. The 4.2 percent increase in April is the largest increase over a 12-month period since a 4.9-percent increase for the year ending September 2008. Over the longer period from January 2020 (before the COVID-19 pandemic) to April 2021, consumer prices increased 3.5 percent.

How long will the monthly Child Tax Credit last?

How long will the monthly Child Tax Credit last?

Payments for the child tax credit are expected to go out the door on July 15th. Many are wondering, how long will the credit last?

Earlier this week the Biden administration confirmed that the new-look Child Tax Credit payments would begin this summer, as planned, but the duration of the program is still unknown. The IRS is set to begin making the payments from 15 July.

President Biden is already pushing for a temporary extension to the 12-month program but many from within his own party are demanding that the monthly direct payments are made permanent as part of the Build Back Better legislative plan.

Read full coverage here.

Experts working and writing for the Institute for New Economic Thinking believe that "despite fear-mongering about the latest Consumer Price Index, unemployment remains elevated and stimulus is needed to prevent a collapse in demand."

Read our coverage on how various states are responding to current economic conditions:

Which states have called to cancel all additional federal unemployment benefits?

Fourth stimulus checks: when will the next relief bill be discussed?

Child Tax Credit: can you opt-out of the child tax credit?

Child Tax Credit: can you opt-out of the child tax credit?

Families are slated to begin receiving payments for the child tax credit in July, but some are wondering if they should delay their payments.

Some experts believe that, it is not so much that families are opting out, rather they are postponing payment. Since the child tax credit was passed more than two decades ago, it has been disbursed as a one-time payment with one’s tax return. Some taxpayers are opting for this approach, so rather than a monthly payment they will collect the bulk sum when filing their taxes next year. In a way, delaying payment could be considered a savings strategy as taxpayers who know they qualify can trust that they will receive the hefty credit next year.

Read our full coverage here.

Unemployment: Which states have called to cancel all additional federal benefits?

Unemployment: Which states have called to cancel all additional federal benefits?

Citing signs of a robust economic recovery, 21 Republican governors have announced that their states will end additional unemployment benefits in June and July.

Read our full coverage here, on which states have made this announcements as well as information on new benefits announced to incentive workers to reenter the labor market.

Curious what Biden's infrastructure plan contains and how it addresses historical inequality? Read our full coverage here.

NEW POLL: One third of Americans believe that the government should issue a fourth stimulus check. More than half say they are opposed to the idea.

Read our coverage from Will Gittins on where negotiations standhere.

“The expansion of the Child Tax Credit is one of the most transformative policies to come out of Washington in generations.

“The CTC is one of the best tools we have to lift children out of poverty and put money in the pockets of working families.”

What are the long-term effects of stimulus checks?

All three rounds of stimulus checks have been met with celebration from the majority of Americans who have been crying out for financial support during the pandemic. The economic consequences of covid-19 has been unlike anything seen in generations, and online news site Vox takes a look back at some historical examples to see that the impact may be.

President Biden is facing pressure to propose a fourth stimulus check but some economists warn that overspending now could lead to rampant inflation down the line. Larry Summers, President Obama's top economic advisor, makes the case against stimulus checks...

What does the new Child Tax Credit mean for me?

We know now that the new Child Tax Credit will begin in earnest from 15 July, but the actual benefits of the programme can be a little confusing. It is titled a 'tax credit' because in the past the money has been provided to recipients in the form of a single $2,000 tax refund at the end of the year.

However Biden's American Rescue Plan has nearly doubled the amount on offer, and will send out the money in the form of monthly direct payments into the beneficiary's account. The new CTC will see parents receive up to $300 for children below six, and $250 for those aged between six and 17.

Fourth stimulus checks: when will the next relief bill be discussed?

The prospect of a fourth round of stimulus checks has been slowly gaining momentum for some time now, with the White House remaining tight-lipped in public. However new reports suggest that the matter is being raised in certain bipartisan meetings hosted by President Biden.

With a growing number of Democratic lawmakers calling for a fourth stimulus check to be included in the next relief bill, Biden may decide to implement a system of "automatic stabilizers," which would see payments sent out whenever certain economic triggers are met.

Millions sign petition supporting fourth stimulus check

While the White House considers including a new round of direct payments in the upcoming installments of the Build Back Better plan, there are growing calls for more stimulus checks. Not only have a number of Democratic lawmakers publically supported direct payments, but a recent petition for a fourth round of stimulus checks has received over 2.2 million signatures.

"The facts are, even successful small businesses can't go months with their doors closed," the petition reads. "But supplying Americans with monthly support until they can get back on their feet can save our communities from financial ruin."

How much will I get in the Child Tax Credit payments?

Your Child Tax Credit entitlement is based on a number of criteria, all of which should have been updated in your most recent IRS tax returns. The tax authority will base the amount you get on your household income, personal situation and the number of child dependents you have claimed.

To work out exactly how much money you will be getting from the monthly payments which begin from 15 July, check out this handy Child Tax Credit calculator...

Child Tax Credit and tax refund payments are on their way

The IRS has had a busy few months with the distribution of the third round of stimulus checks and tax season 2021 to contend with. But their work does not stop there and they will be heavily involved in two types of payments coming out soon.

The new-look Child Tax Credit payments are set to begin on 15 July and will continue on a monthly basis for at least one year. The IRS will also start issuing tax refunds for early filers who mistakenly paid tax on unemployment benefits received during 2020.

What has the White House said about a fourth stimulus check?

The White House is reportedly considering adding "automatic triggers" into the next stage of the Build Back Better legislation which would see a fourth stimulus check sent out if certain economic measures are met. The idea is to avoid another logjam in Congress if the economic situation worsens and immediate financial relief is needed.

This news comes from sources close to the Biden administration but the President himself has remained tight-lipped on the possibility so far. However a number of prominent Democratic lawmakers have made clear that they are in favour of another round of stimulus checks.

Who gets the Child Tax Credit, and when it will be coming?

Unsure about whether you qualify for the new Child Tax Credit payments? Fortunately, the IRS estimate that 88% of American children will be covered by the programme with a massive 39 million households benefitting from the monthly payments worth up to $300 per child.

Here's everything you need to know about the overhauled Child Tax Credit...

How long will the monthly Child Tax Credit last?

The monthly direct payments for the new-look Child Tax Credit are set to begin on 15 July, but there is still much debate about when the programme will end. The recent stimulus bill provided federal funding for a 12-month expansion but there are numerous calls for that to be extended, or even made permanent.

Here's what we know so far about the duration of the Child Tax Credit, after Speaker of the House of Representatives Nancy Pelosi issued a statement on the issue earlier this week.

Dems call for Child Tax Credit to be made permanent

In the aftermath of President Biden's announcement that the new Child Tax Credit will begin from 15 July, members of his own party are calling for the programme to be made permanent. The recent stimulus bill provided a 12-month expansion of the Child Tax Credit which will see parents receive up to $300 per child in monthly payments.

Sen. Michael Bennet has been a particularly prominent voice in that effort and is calling on Congress to pass legislation which would make the new system permanent. He is not the only one, however, and Speaker of the House Nancy Pelosi made a similar statement on Monday, saying:

“We must make this lifeline permanent, which is why Congressional Democrats will continue to champion an expanded Child Tax Credit – because we can only Build Back Better by putting families first.”

Retailers record stimulus check boost

Walmart, the world's largest retailer, have released their latest financial reports and have celebrated a significant uptake in sales and share price. Visits to Walmart stores across the US were up by 21.7% in April and the company's share price rose by 3% on the back of today's results. Experts suggest that the increase is partly a result of the stimulus check payments that have landed in Americans' bank accounts this year.

"My optimism is higher than it was at the beginning of the year," Chief Executive Officer Doug McMillon said upon announcing the news. "In the US, economic stimulus is clearly having an impact, but we also see encouraging signs that our customers want to get out and shop."

LA County assists homeless residents with stimulus check claims

One of the main criticisms of the IRS' distribution of the coronavirus stimulus checks is that it has become too diffcult for homeless people to get the vital support. Without a fixed addres, mobile phone or internet access it can be tricky to claim the direct payment, but LA County officials are stepping in to help residents get their full entitlement.

Supervisor Hilda Solis said: “People experiencing homelessness face unique challenges resulting from a lack of stable housing, making many processes like filing taxes and collecting stimulus payments inaccessible for many."

Growing support for fourth stimulus check payments

President Biden has refused to be drawn on the prospect of a fourth stimulus check in recent weeks but is facing numerous calls to include direct payments in the American Families Plan. 21 Democratic senators have signed a letter to the President, while a petition calling for recurring stimulus check payments has surpassed 2.2 million signatures.

But the latest group to add their voice to those calls are six Democrats from the House Ways and Means Committee, who have authored their own letter to Biden.

"The pandemic has served as a stark reminder that families and workers need certainty in a crisis," the letter said. "They deserve to know they can put food on the table and keep a roof over their heads."

How much will you get in the new Child Tax Credit?

On Monday the IRS confirmed that the new-look Child Tax Credit will be introduced from 15 July, hitting the target set in the recent stimulus bill. The $1.9 trillion American Resuce Plan provided the federal funding for a complete overhaul of the programme to see the annual tax credit replaced with a monthly direct payment.

The amount that you will receive varies depending on your household income, number of dependents and personal situation, which can make the process a bit confusing. Luckily, this Child Tax Credit calculator offers a handy online tool to work out how much money you will receive.

Tax Deadline 2021: what happens if you file taxes late?

Filing your tax return late if you owe money to the IRS can be an expensive proposition. Not only could you face penalties for filing late but you will also face late payment penalties and interest to boot.

The Internal Revenue Service (IRS) pushed back the filing deadline for a second year in a row due to complications for taxpayers due to the covid-19 pandemic as well as to give extra time to take advantage of the numerous tax provisions created by the American Rescue Plan. Taxpayers had until midnight 17 May to file their return, ask for an extension and pay any taxes they may owe to the IRS.

Walmart got a boost from shoppers spending their stimulus checks

CNN - The latest round of federal stimulus payments of up to $1,400 per person lifted sales at Walmart, the largest retailer in the United States, as shoppers used their checks to buy clothing, home goods and other merchandise at stores and online.

Walmart said Tuesday that sales at stores open for at least one year grew 6% in the United States during the three months ending April 30, compared with the same stretch last year. The figure included a 37% rise in online sales last quarter.

Walmart's (WMT) stock rose more than 3% in early trading Tuesday.

Child Tax Credit 2021: how many families will receive the payment from July?

Eligibility for the new Child Tax Credit is based on the information provided to the IRS in your most recent tax returns, giving an extra incentive to get your returns filed if you have not already. If you do not submit your tax returns information you may find that your Child Tax Credit payments are delayed, or even that they do not arrive at all.

The White House have estimated that 88% of American children will be covered by the new system which sees up to $300 per child in monthly payments sent to the parents.

Recurring $2,000 stimulus checks petition surpasses 2.2 million

The change.org petition initiated by Colorado restaurant owner named Stephanie Bonin calling for recurring $2,000 stimulus checks for all Americans until the pandemic is over has crossed the 2.2 million mark. This comes on the heels of six members of the House Ways and Means committee sending a letter to the White House urging President Biden to include recurring stimulus checks in the American Families Plan.

Biden outlines the need for Child Tax Credit expansion

The President used a White House speech on Monday to confirm that the new Child Tax Credit programme was designed to help the struggling middle classes. Biden said the move was "a tax break, to help them with the cost of looking after kids," but in reality the money will come in the form of a monthly direct payment, much like the stimulus checks.

Growing calls for fourth stimulus checks from Dem lawmakers

President Biden has so far refused to comment on the proposed fourth round of stimulus checks, but is facing increased pressure to include additional direct payments in his American Families Plan. The latest to do so are six members of the House Ways and Means committee, who sent a letter to the White House on Monday calling for more stimulus checks.

"The pandemic has served as a stark reminder that families and workers need certainty in a crisis," the letter read. "They deserve to know they can put food on the table and keep a roof over their heads."

Stimulus checks and vaccinations have shoppers returning to stores

Reuters - Walmart Inc on Tuesday raised its full-year earnings forecast after shoppers armed with government stimulus checks ventured back into stores, driving demand that is expected to continue through the year as covid-19 restrictions ease.

Walmart has had a bumper year bolstered by a big push into e-commerce and delivery. While this trend towards shopping online is expected to continue, people are also making their way back to brick-and-mortar stores as vaccinations become more widely available.

Visits to Walmart stores around the country grew by 21.7% in April, according to data firm Placer.ai.

On Friday, Walmart began allowing fully-vaccinated people to shop without wearing masks, making it the first major retailer to walk back its mandatory mask policy.

"My optimism is higher than it was at the beginning of the year," Chief Executive Officer Doug McMillon said on a post-earnings call. "In the US, economic stimulus is clearly having an impact, but we also see encouraging signs that our customers want to get out and shop."

Earlier this year, Walmart also said it would convert two-thirds of its US hourly store roles to full-time positions, while also increasing pay for some of its hourly US workers to an average above $15 an hour.

IRS unemployment refund update: how to track and check its state

One of the lesser-known provisions of the $1.9 trillion American Rescue Plan was a substantial tax break for recipients of unemployment benefits in 2020, which offers a considerable tax exemption. The IRS is now in the process of sending out tax rebates to over 10 million Americans who incorrectly paid tax on jobless benefits received in 2020.

Will stimulus end before the economy fully recovers?

In the last recession, an initially fairly robust response petered out too quickly, leading to a decade of stagnation. Officially, the Great Recession ended in June 2009, but it took two years for US gross domestic product to return to its pre-recession level, and six years for unemployment to do so and nearly a decade for wages to rise.

The last recession left many families mired in debt which took year to get out of shaping their financial decisions long after the recession was over.

So far in this recession the response has been $5 trillion in government spending to shore up the economy and household finances and hasn’t stopped yet. Despite a disappointing April jobs report the economy is expected to start looking very strong in the coming months. Will those who shape public policy look at the numbers and say, ‘Mission accomplished’?

Ben Casselman says this time, far more people are paying attention.

Parents should hold onto receipts for childcare expenses in 2021

The American Rescue Plan passed in March included a number of tax benefits for parents with young children or dependents. The expanded Child and Dependent Care Credit will allow up to 50 percent of childcare-related expenses can be claimed. The deduction is capped at $8,000 for one child and $16,000 for two or more children for 2021.

Rental assistance program begins in Oregon

Beginning today, 19 May 2021, qualified renters who have experienced financial hardship due to the coronavirus pandemic, and are at risk of homelessness or housing instability, may apply for the Oregon Emergency Rental Assistance Program (OERAP).

This program is not a loan, which means those who receive assistance will not have to pay back funds so long as they are used as approved and not duplicating other assistance programs. Assistance is offered to all eligible renters regardless of their citizenship or immigration status, and it will not impact the recipient’s eligibility for other federally funded programs such as food stamps, Medicaid, Medicare, social security, WIC or public housing.

Renters who are eligible for the program may request rent and/or utility assistance dating back to March 13, 2020 (prior expenses are not eligible). OERAP will cover up to 12 months of past due rent and three months of forward rent, once all past due rent is paid. OERAP will also cover past due utility costs including electricity, gas, home energy services, water, sewer, trash removal, internet and bulk fuels.

Child Tax Credit 2021: what is the maximum age of the children to request the payment?

Depending on the age of your child or dependent at the end of the year will decide how much you can claim on the enhanced Child Tax Credit in 2021.

The tax credit was expanded both in size and age with parents of children who turn 17 in 2021 now eligible to receive up to $3,000. If your child has their 18th birthday before the end of the year you’ll need to settle for a smaller tax credit.

US stimulus checks live updates: welcome

Welcome to our live US stimulus-checks blog for Wednesday 19 May. We’ll be bringing you updates on a possible fourth direct payment and updates on the third stimulus check, which the IRS has been distributing since the $1.9tn American Rescue Plan was signed into law in early March.

We'll also provide information on other economic-aid schemes such as the expanded Child Tax Credit, which gives qualifying households up to $3,600 per child per year, and the Golden State Stimulus payments going out in California, where Governor Gavin Newsom has announced plans include more residents of the state in the program.

- Joseph Biden

- Nancy Pelosi

- Bernie Sanders

- Coronavirus stimulus checks

- USA coronavirus stimulus checks

- Washington D.C.

- IRS

- Detroit

- Recession

- Michigan

- Covid-19 economic crisis

- Science

- Unemployment

- Coronavirus Covid-19

- Economic crisis

- United States

- Inland Revenue

- Recession

- Pandemic

- Coronavirus

- North America

- Economic climate

- Employment

- Outbreak

- Virology

- Public finances

- Diseases

- Microbiology

- America

- Medicine

- Economy

- Work

- Finances

- Health

- Biology