US business news live updates: interest rates, inflation, housing market, student loans

Stay abreast of all the latest financial and social security information in the US, including bank closures, that are affecting American households.

Show key events only

US finance news: latest updates

Headlines: Monday 30 October 2023

- Federal Reserve will start two day meeting on Tuesday. Will interest rates rise?

- American cardholders paid a record $130 billion in interest and fees in 2022

- US economy grows at fastest pace in nearly two years

- IRS will roll out new trial for residents in four states to file federal taxes online for free

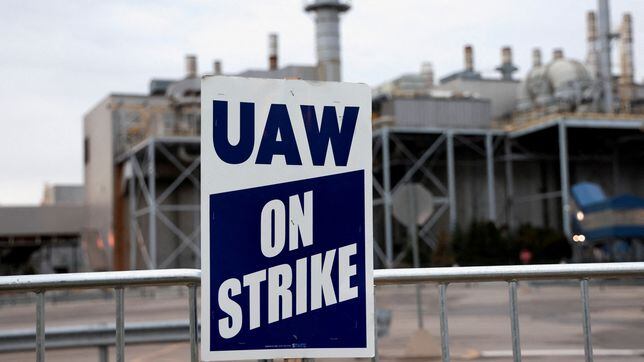

- Striking UAW union reaches tentative agreement with Big Three American automakers

- Housing sales fall to the lowest level in more than a decade

- Five biggest US banks expected to lay off 20,000 workers this year

Check out other business stories affecting American households:

Bank of America is one of the institutions that have been shuttering their branches this year, and this is part of a continuing trend as banks have been closing locations at a rate that has not been seen since 2008.

This month, Bank of America, the second-largest bank in the country, shut down a number of its offices.

I applaud the UAW and General Motors for coming together after hard fought, good faith negotiations to reach a historic agreement to provide workers with the pay, benefits, and respect they deserve. With this landmark agreement with GM, the UAW has now reached historic tentative agreements with all of the Big Three American automakers. This historic tentative agreement rewards the autoworkers who have sacrificed so much with the record raises, more paid leave, greater retirement security, and more rights and respect at work. I want to applaud the UAW and GM for agreeing to immediately bring back all of the GM workers who have been walking the picket line on behalf of their UAW brothers and sisters.

This historic contract is a testament to the power of unions and collective bargaining to build strong middle-class jobs while helping our most iconic American companies thrive. The final word on these tentative agreements will ultimately come from UAW members themselves in the days and weeks to come.

Walmart is the largest retailer not only in the US, but in the world. The company operates approximately 10,500 stores and clubs in 19 countries and e-commerce websites.

Customers can find a lot of cheap, quality items at the mega-retail store. However, on some occasions, the products the store offersreceive negative feedback or comments.

Some New York State residents are eligible to receive financial aid of up to $900 to pay for heat.

Personal loan use has been growing in the US, most commonly to consolidate debt or refinance credit cards.

Biden trying to provide more student loan relief

President Joe Biden is trying to provide more student relief to four specific groups of borrowers by expanding existing mechanisms for forgiveness and discharges, per Yahoo Finance.

The White House and the Department of Education released draft regulatory language for debt relief using the rule-making process under the Higher Education Act.

The administration is also looking into how to provide relief for borrowers who are experiencing financial hardship, but are not included in other relief programs.

The Social Security Administration has scheduled a single payment of up to $914 for the month of November. Beneficiaries from different states will receive this specific amount in the form of financial aid issued by the agency, which allocates part of its budget to assist those who meet certain requirements.

The payment amounts for beneficiaries will depend on their status. Who will receive $914 on November 1?

While recognizing that their stores serve an important role in their community, Target, the Minnesota-based chain, announced in September that it would close some locations due to theft and organized retail crime. The company posted a press release explaining that it was prioritizing its team members' and guests’ safety.

Target decided to close nine of its stores in major cities in the United States. Here is the full list.

UAW-Ford deal nets union big wins on wages, benefits, investments

United Auto Workers leaders have approved a tentative deal with Ford that includes a pay hike of at least 30% for full-time workers and could more than double pay for others, in a victory for the union's fight to roll back 15 years of concessions.

Bargaining continued at General Motors without any deal. UAW President Shawn Fain on Saturday ordered a walkout at GM's Spring Hill, Tennessee, engine and assembly plant.

Last month, Apple introduced the 17th-generation iPhones, the iPhone 15, at the Apple Event in California. However, the launch is not the company’s final event for the year.

Apple will be holding ‘Scary Fast’ on Monday, Oct. 30, and this will be an online-only event with no in-person component. The announcement is important enough to merit a stand-alone event, but the time it will be held, which is later than the typical Apple keynotes, could be an indication that it is not one of the company’s biggest reveals of the year.

The United Auto Workers union have been on strike since September. The organisation has been pushing for increased pay and greater protections for staff, including the removal of lower-tier payments for workers. It seems they have got their wishes, at least in part, and their successes are growing.

Announced on Saturday, the UAW has come to an agreement with Stellantis, one of the three motor companies they are striking against.

“Once again, we have achieved what just weeks ago we were told was impossible,” said UAW president Shawn Fain. Read more.

In 2022, the real median household income in the United States was $74,580, meaning that half earned more and half earned less than this amount. The figure has been decreasing steadily since 2019, with inflation and its adverse effects on purchasing power being a significant driver of the decline.

But there is one group that has seen their wealth rise over the last four years: the wealthiest one percent of households. Around 1.38 million households comprise the top one percent, and collectively, this group owns around thirty percent of the country’s total wealth, including fifty percent of corporate equities and mutual funds, forty-six percent of all private businesses, and thirteen percent of all real estate.

Banks have recently been closing branches due to many factors such as the popularity of online and mobile banking, which has made it less cost-effective for financial institutions to maintain in-person operations.

A great majority of Americans - around 95%, according to the Federal Deposit Insurance Corporation - have a checking or savings account at a bank or credit union. The FDIC says that mobile banking has increased sharply from 15.1% in 2017 to 43.5% in 2021, while the use of a bank teller dropped from 24.8% in 2017 to 14.9% in 2021.

Nonetheless, certain segments of the population, including less-educated households and older households continue to prefer going to a bank branch.

Your tax questioned answered

Do you need to check your refund status? Maybe you need to file a return? Or do you have some concerns over s fraud or scam?

Whatever your query, the IRS hopefully have a solution for you at the 'online tools and resources' page.

Clarence Thomas challenged over student loan vote

George Takei took to X (the platform formally known as Twitter) to highlight what he appears to believe is a double standard, with Supreme Court judge Clarence Thomas getting benefits from huge loan being forgiven, something he didn't want struggling students to have.

VP Harris on student loans

Kamala Harris has been speaking on 60 Minutes, reiterating the value of taking care of student loan debt. Take a listen for yourself.

Many people may be making plans for tomorrow's Halloween celebrations but the following day is also one to take note of.

“On November, we think that further labor market rebalancing, better news on inflation, and the likely upcoming Q4 growth pothole will convince more participants that the FOMC (Federal Open Market Committee) can forgo a final hike this year, as we think it ultimately will,” Goldman Sachs strategists wrote.

The Federal Reserve has aggressively raised its benchmark lending rate since March 2022, going from near zero to the range of 5.25% to 5.50%. The rapid tightening of monetary policy is intended to bring inflation back to the US central bank’s target after peaking last summer at a four-decade high.

Let's take a closer look at what could be coming up in November.

What did the UAW workers win in the Stellantis deal?

Over the course of the next four and a half years, the majority of workers can anticipate a substantial 25% increase in their wages. This positive development extends further for the lowest-paid employees within Stellantis, as they are set to experience an impressive wage hike of over 165%.

Additionally, Stellantis is making strategic moves by reopening a previously closed plant in Illinois, which ceased operations earlier this year. Furthermore, the company is planning to construct a new factory adjacent to this reopened facility, signifying their commitment to expansion and growth.

Gas prices were massively disrupted last year when Russia invaded Ukraine. The cost of fuel in the US hurtled upwards, reaching a peak average of $5.02 per gallon on 14 June, 2022.

Prices in the US have decreased by nearly 4% compared to a year ago. People may think prices are high in the US, and relatively speaking there are, but the vast majority of nations in the world have fuel that is more expensive.

Bad loans becoming a problem for regional banks

In recent weeks many mid-sized financial institutions in the US reported that nonperforming loans, a measure that tracks borrowers that are behind on their payments, rose during the third quarter. They also disclosed mounting costs from unpaid debts written off as losses.

Of 18 regional banks analyzed by Yahoo Finance with assets ranging from $50 billion to $250 billion, 15 reported jumps in nonperforming loans when compared to the same year-ago period.

‘Skimpflation’, also known as ‘shrinkflation,’ is a term used to describe a situation where companies respond to inflation by reducing the quantity of the products they offer, rather than raising their prices. In other words, it refers to a tactic employed by businesses to maintain the appearance of stable or low prices while actually offering less value to consumers.

AS USA's live financial blog: Welcome!

Good morning and welcome to AS USA's live financial blog!

Here we keep you updated on latest developments in various areas affecting Americans such as the housing market, the inflation rate, and employment.

We'll also keep you posted on student loan repayment as well as the Federal Reserve's next moves regarding interest rates.

Let's check out what's happening...

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/SEVQJSGKEBOMIXKNITJ7FLEYZI.jpg)

/cloudfront-eu-central-1.images.arcpublishing.com/diarioas/JLGS4DHNVFDHJD4PWP23SPIDBM.png)