When will mortgage interest rates go down again? Predictions for 2022

Mortgage rates continue to climb after a brief drop, some experts predicting that they could top 6 percent by end of year. When will they come down again?

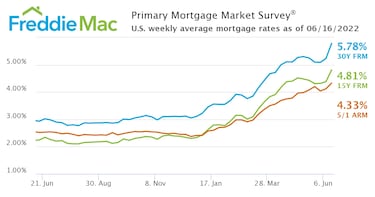

Americans have been battered by rising prices at the pump, in the supermarket and for those buying a home, mortgage rates that have rocketed at the same time housing prices continue to surge. Despite a brief dip in mortgage rates, the 30-year fixed-rate surged more than half a percentage point last week, the largest one-week increase in Freddie Mac’s survey since 1987.

“These higher rates are the result of a shift in expectations about inflation and the course of monetary policy,” said Sam Khater, Freddie Mac’s Chief Economist. “Higher mortgage rates will lead to moderation from the blistering pace of housing activity that we have experienced coming out of the pandemic, ultimately resulting in a more balanced housing market.”

Also see:

When will mortgage rates come down?

The 30-year fixed-rate mortgage averaged 5.78 percent as of 16 June, the highest it’s been since late 2008. Although homebuyers are feeling the pinch, rates had been historically low, just 2.93 percent a year ago.

The rise though is outpacing industry expectations at the end of 2021. Mortgage rates began to inch up in the fall through to the end of the year and most estimates had the average 30-year mortgage rate hitting 4.5 percent by the end of 2022. Rates blew past that mark in early April. Since the start of 2022 home borrowing costs have seen their fastest increase in since 1994. The latest jump of 50 points in one week the largest since 1987 according to Freddie Mac.

The discrepancy in the predictions and reality lies in factors that have changed drastically, inflation and the Federal Reserves response to tame it. Although the central bank made its intentions known that it was going to move to bring inflation under control late last year, prices have accelerated more than expected reaching four-decade highs.

That’s resulted in policymakers implementing more and bigger rate hikes than had been assumed. The latest implemented 15 June, a 75-basis point jump, was the fastest rate hike since 1994 and higher than the 50-basis point rise that had been expected. With inflation still running hot and lending rates elevated, this means bad news for those hoping to see lower mortgage rates any time soon.

Purchasing a home is one of the biggest, most important investments you'll make. To kick off #NationalHomeownershipMonth, here are the key steps to navigating your homebuying journey.

— Freddie Mac (@FreddieMac) June 1, 2022

How high will mortgage rates go?

Related stories

Current predictions see 30-year home loans staying high through 2022. The Mortgage Bankers Association June forecast predicts 5 percent at the end of 2022 and then dropping gradually to 4.4 percent by 2024.

Lawrence Yun, the National Association of Realtors Chief Economist, told Forbes last week that he expects rates to stay above 5.5 percent for a few months, but doesn’t see them breaking 6 percent. “Most of the mortgage rate change from the expected Federal Reserve monetary policy change is already priced in. So future rate hikes by the Fed may have a less discernible impact on mortgage rates,” he said.