Fourth stimulus check news summary: Thursday 22 April 2021

Information on the third stimulus check included in US President Joe Biden's covid-19 relief bill, and updates on a potential fourth direct payment, Thursday 22 April.

Show key events only

US stimulus checks live updates, 22/23 April 2021

Headlines:

- Nearly $400bn in third stimulus checks have been distributed, says IRS

- More than 2m 'plus-up' checks have been sent out (the lowdown on 'plus-up' payments)

- Growing pressure for fourth stimulus check (full story)

- Will a fourth stimulus check be bigger? (Full story)

- IRS set to start enhanced child tax credits in July (full details)

- President Biden keen to extend temporary enhanced Child Tax Credit until 2025

- Golden State Stimulus payments going out in California (who's eligible?)

- Track the status of your check with the IRS' Get My Payment tool

- US covid-19: 31.91 million cases / 570,147 deaths (live updates from JHU)

Take a look at some of our related articles:

Fourth stimulus check: will the new relief bill have bigger payments if approved?

With mounting pressure on President Joe Biden to support further stimulus checks in his Build Back Better plan, how much more money could you be entitled to?

Covid stimulus and economy boost

The US and UK’s largest publicly-listed news companies are worth $38bn more today than they were before the covid-19 pandemic, Press Gazette research has found.

News Corp, the New York Times, Thomson Reuters, Daily Mail publisher DMGT and Mirror group owner Reach are among the companies to have seen their stock market values increase since the end of 2019.

Full story:

$3 billion federal stimulus doesn't please everyone

South Dakota is set to receive over $3 billion in new federal funds from the American Relief Plan, but at least one legislative leader doesn't seem overly thrilled about the incoming check.

"On behalf of my wife, I'd like to thank our great-great-grandchildren for footing the bill on this thing," said House Speaker Spencer Gosch, R-Glenham, during a meeting of the Legislature's executive boardon Thursday, 22 April.

As some laughter ensued on the bipartisan committee, Gosch clarified: "Sorry, my mind is blown right now."

The federal covid-19 stimulus passed last month by Congress and signed into law by President Joe Biden will deliver billions to states, local communities, and schools, as the nation emerges from the devastating pandemic.

But the South Dakota House Speaker, however, grumbled about federal debt.

Read more:

Stimulus funds have travel industry starting to take off

Southwest Airlines and American Airlines would have lost nearly $4 billion combined without the help of government payroll aid in the first quarter, but the carriers are envisioning a path back to profitability after a year of devastating losses from the covid-19 pandemic.

Dallas-based Southwest turned in a $116 million profit in the first three months of 2021, the carrier’s best result since 2019, mostly thanks to $1.2 billion in payroll support as part of two government stimulus programs. Even though the company couldn’t make money on its own, daily losses are narrowing and Southwest could get back to making a daily operating profit by the middle of the year.

Full story:

Stimulus chalking in Memphis

In Memphis, students and families in five neighborhoods could be getting new schools in a plan unveiled recently by Shelby County Schools. Had the plan been revealed a year ago, as initially planned, it likely would have looked completely different.

The district is using a majority of its third round of federal stimulus funding, a boost of $503 million, to fund additions to 13 school buildings and pay down hundreds of millions in deferred building maintenance.

It's one of several lasting impacts that federal covid-19 stimulus funding will leave on the Memphis school district. SCS officials have cautioned that the one-time funds won't be a fix for a district that they say is underfunded - an issue that is making its way through court - but that the boosts can jumpstart some changes.

Laura Testing looks at the difference the relief bill is making to local schools.

Child Tax Credit extension could cost trillions in the coming years

The Washington Examiner reports that President Biden is considering including a huge wave of federal spending for families in his new infrastructure bill.

They say: "The proposal, which is being billed as the American Families Plan, would cost at least $1 trillion and is set to include a provision that would extend the child tax credit."

There are growing calls for the new monthly Child Tax Credit to be expanded beyond its intitial one-year lifespan, but some more moderate Democrats may well be put off by the high cost and the long commitment.

Growing calls for Child Tax Credit (CTC) extension

The new CTC programme introduced in the American Rescue Plan is scheduled to begin sometime in July, but there is already growing debate surrounding the duration of the support. The new system provides monthly payments of up to $300 per child but is only set to last for 12 months.

Advocacy group Humanity Forward are calling on President Biden to make the expanded programme a permanent feature. The White House has already been optimistic about the good that the programme will do but it will likely face stiff opposition from Republicans in Congress.

Why are recipients seeing unemployment benefits cut?

Decisions surrounding unemployment support is often left for state officials to decide, with the standard jobless benefits provision varying greatly across different states. While programmes like the stimulus checks and Child Tax Credit are administrated by the IRS on a national level, unemployment support is largely down to the states.

The covid-19 pandemic has seen unemployment soar to historic levels with close to 20 million requiring weekly support at one point. As the US begins to emerge from the pandemic-caused jobs crisis, why are some recipients now seeing their benefits cut?

Additional 700,000 'plus-up' stimulus checks sent out this week

Having sent out close to 160 million stimulus check payments in the first month of distirbution, the IRS is now continuing to send out payments at a more steady rate. The vast majority of eligible Americans will have had their $1,400 payment by now, but some who were underpaid initially will be getting a supplementary 'plus-up' payment in the coming weeks.

The payments will be issued as the IRS works its way through the tax return backlog and is able to establish who is owed money. The supplemental payments will be going out in weekly batches until the end of the year.

Third stimulus check: how many people are still waiting for it?

The IRS is sending out weekly batches of $1,400 stimulus check payments and will do so through the end of the year. As the IRS processes 2020 tax returns, they will make corrections to underpayments along with first time payments to individuals who don’t normally file taxes.

This was week 6 of the payments and so far the IRS has sent out around 161 million payments for a total value of more than $379 billion. The latest batch added 2 million payments to the total, with slightly over half disbursed as paper checks. But although the IRS have quickened the process for each round of payment, many are still waiting for their stimulus checks.

Will Biden make Child Tax Credit expansion permanent?

Although the new Child Tax Credit system has not yet been implemented by the IRS, there is already much discussion about the fate of the expanded programme. The American Rescue Plan introduces monthly direct payments for the first time, but only specifies 12 months of provision for the programme.

Senior Democratic strategist Waleed Shahid shares this excerpt suggesting that Biden may choose not to make the monthly payments permanent. However that does not mean that the programme is doomed to finish after one year and Biden may opt to renew it on a rolling basis instead.

Stimulus spending tackles hunger concerns

New research from The Washington Post suggests that the enormous amount of federal money spent in the early months of Biden's presidency is working. The $1,400 third stimulus check was a key inclusion in the $1.9 trillion package and featured tighter eligibility requirements than previous rounds, to ensure the support is better focused on low-income Americans.

It seems to be working with the WaPo study putting hunger in the United States at the lowest level since the pandemic frst took hold one year ago. In addition to the stimulus checks are the new-look Child Tax Credit system which is set to be introduced in July, and will reportedly cut childhood poverty in half over the next year.

Keep a cool head about what to do with $3,600 Child Tax Credit money

CNBC - Good news for parents: Millions of American families with children will start receiving monthly payments from the enhanced child tax credit in July.

The payments could be as much as $300 per month for children under the age of 6, and about $250 per month for those between the ages of 6 and 17. For now, they’re scheduled to continue through the end of the year, and families will claim the rest of the credit when they file their 2021 taxes in 2022.

That’s a significant chunk of money for many families to receive on a monthly basis. Those who are expecting the payments should start thinking now about what they’ll do with the windfall, according to Tania Brown, a certified financial planner and coach at SaverLife, a nonprofit focused on saving.

“Once the money comes in, the emotions take over,” she said. “Have a plan of action.”

$1,400 stimulus checks bring joy to kids

Toymaker Mattel said Thursday that its sales nearly doubled as families spent more on toys for their children, helped by more disposable income due to government stimulus checks. Typically, the first quarter is a weak period for toy sales, as it follows the influx of sales during the holiday quarter. The company has a rosier outlook for the year ahead expecting sales to increase between 6%-8%.

IRS tax refunds on $10,200 in unemployment benefits: when are they coming?

The American Rescue Plan was enacted in March, after the 2021 tax season had already gotten underway. This gave the Internal Revenue Service (IRS) multiple new tasks to handle in addition to processing 2020 tax returns.

Those that received unemployment benefits during 2020 were given a tax break on up to $10,200 of jobless aid claimed over the year which the IRS will have to retroactively apply to 2020 tax returns already received.

However if you received unemployment compensation you may have to wait for your refund.

Unemployment benefits: What state has the best payments?

Identifying which state provides the “best” benefits is not an easy question to answer and depends heavily on what one defines as “best.” We took a look at three factors: size of the benefit, cost of living, and eligibility period to compare benefits across the states.

IRS informs how to find out claim the Recovery Rebate Credit

If you threw away the letters the IRS sent you regarding your stimulus payments, not all is lost. The IRS posted this video to help you claim any money you are missing from the previous two rounds of stimulus checks.

Did you lose your stimulus payment?

The IRS has been trying to warn people to keep a lookout for mail from the agency or the US Treasury. It may be a letter to inform you of the stimulus payment that you were sent which they advise holding on to. Or it could be your stimulus check or your payment on an EIP debit card (pictured below).

The latest batch of $1,400 stimulus checks included 1.1 million payments in the form of paper checks.

In case you will receive an EIP debit card the IRS says "It is important to note that none of the EIP cards issued for any of the three rounds is reloadable; recipients will receive a separate card and will not be able to reload funds onto an existing card."

$1,400 third stimulus check: what is "IRS TREAS 310 - TAX EIP3"?

In the latest batch of stimulus check payment 900,000 were made via direct deposit.

When third stimulus checks arrive in the bank accounts of direct-deposit recipients, they are identified using the reference "IRS TREAS 310 - TAX EIP3", or something similar.

Here's some more helpful information regarding your stimulus payment.

Biden’s next stimulus package for infrastructure gets a counteroffer

President Joe Biden has presented his framework for the American Jobs Plan, a sweeping $2.3 trillion investment in American’s infrastructure. The plan would dedicate money to fixing crumbling traditional infrastructure along with new concepts in infrastructure. Biden has meet with lawmakers from both parties to work out a bipartisan compromise.

Republican senators led by Sen. Shelley Moore Capito of West Virginia, unveiled on Thursday a framework of their counter proposal, with a price tag in the neighborhood of $600 billion, focusing on roads, bridges and more traditional infrastructure.

How many people have received their third stimulus checks?

The IRS has been working to distribute the $1,400 stimulus checks since the American Rescue Plan was signed last month. Close to $400 billion has been sent out over six weekly batches.

IRS plus-up payment: what is it, how much is it and who gets it?

The IRS has sent out around 161 million Economic Impact Payments including supplemental stimulus check payments.

So-called 'plus-up' payments are being sent out to individuals who received a third stimulus check based on information taken from their 2019 income tax return, but who qualify for a larger payment based on their 2020 return.

$600 Golden State stimulus check: who qualifies in California?

A $600 stimulus check was among the provisions included in a state-wide stimulus package passed in California in February, with Governor Gavin Newsom stating that 5.7 million payments would go out to low-earning Golden State residents.

The California Franchise Tax Board began sending out payment 15 April.

Full details on who qualifies for the Golden State stimulus check

How to claim your stimulus check on 2020 tax return

The IRS said last fall that around 8 million people who were eligible for $1,200 stimulus check never collected the money. If you were eligible for the first or second stimulus check but did not get it, you can claim your money when you file your 2020 tax return.

Find out more about how to claim your missing stimulus check

IRS $3,000 child tax credit: when will the monthly payments begin?

President Biden's $1.9tn coronavirus relief bill includes an enhanced child tax credit that will see qualifying households receive monthly direct payments of $250 to $300 per child depending on their age.

If everything goes as planned, the IRS will meet its deadline to begin the scheme in July.

Biden supports extending Child Tax Credit to 2025

The Child Tax Credit has gone through some changes in recent years. With the passing of the Tax Cuts and Jobs Act in 2017 the credit taxpayers could claim for each child under age 17 went from $1,000 to $2,000. However only $1,400 of that is refundable. It also created a $500 credit for older dependents, 17–18 or those 19–24 and in school full time in at least five months of the year.

The American Rescue Plan increased the Child Tax Credit to $3,000 for each child aged 6 to 17 and $3,600 for children under 6. The $500 credit for older dependents remains for 18-year-olds or those 19–24 and in school full time in at least five months of the year. If nothing is done to extend the 2021 changes, they will revert to the 2017 version until 2025 when those modifications expire.

Sixth batch of stimulus checks sent out

The IRS announced today that the makeup of the latest batch of stimulus checks sent out. The latest set includes around 2 million checks worth about $3.4 billion bring the total to around 161 million since payments started in March.

About 700,000 stimulus checks were issued to people the IRS did not previously have on record after the IRS processed their 2020 tax returns. About 900,000 of the payments were issued via direct deposit, while almost 1.1 million were issued via paper check.

Not-so-dead man trying to claim stimulus check and tax refund money

Thousands of living people are mistakenly being declared as dead each year in the US alone, often with no reason more sinister that a clerk pressing the wrong key on a computer. Newsweek shares the story of one such man who is trying to get $10,000 owed to him in tax refund and stimulus check money.

Most people who didn't receive their stimulus checks haven't gotten the payment because they either don't qualify or the Internal Revenue Service (IRS) doesn't have their information on file.

But for one Indiana man, it's because the agency thinks he died two years ago.

Read the full story at Newsweek

Biden to push for extension of Child Tax Credit beyond 2021

People wonder about a fourth stimulus check or recurring stimulus checks, but the most likely form they would take for the moment is the monthly direct payment from the enhanced Child Tax Credit. Direct payments are set to go out in July if all goes as planned.

The American Rescue Plan enlarged the credit and made it available to millions of more Americans but only for the 2021 fiscal year. Democrats want to make the provision permanent through the next phases of the Build Back Better stimulus and recovery bills on Biden's agenda. They may have to settle for a temporary extension though.

Pressure increases for fourth stimulus check

Around 20 US senators have called on President Joe Biden to include another round of stimulus payments to consumers in his infrastructure plan. It could reduce poverty levels from 8.7% to between 6.4% and 6.6%, according to a report by the Urban-Brookings Tax Policy Center.

With unanimous opposition by Republicans for the American Rescue Plan, it is unclear if a fourth round of stimulus could make it through Congress.

Meanwhile, as we've already been reporting, states like California have been offering some residents a version of stimulus checks. Low-income Californians could qualify for Golden State Stimulus payments of $600 each.

Fourth stimulus check: will it be approved and sent in May?

Although it seems unlikely that Americans will be getting another stimulus check as early as next month, a future fourth round of direct payments is not out of question.

Stimulus checks: check out all our articles

You can access all our content on stimulus checks, with the latest information on the third round and updates on a potential fourthbatch, in our section devoted to Economic Impact Payments.

Majority spending stimulus checks on day-to-day costs or saving them - poll

A poll carried out by the Long Island University Steven S. Hornstein Center for Policy, Polling and Analysis has found that around a third of Americans - 34% - are spending their $1,400 third stimulus check on “mortgage, rent, food, car, and credit card expenses”, while 23% said they had saved their direct payment.

Meanwhile, 47% of respondents to the survey said they felt the stimulus check, distributed as part of President Biden’s $1.9tn coronavirus relief bill, should have been bigger, while 38% said it was the right amount and 15% said it should have been smaller.

Asked whether they believed the recovering US economy is due to the aid package, 50% of respondents said yes.

Read the full report: Long Island University Hornstein Center National Poll: What Americans Think of the Recovering Economy

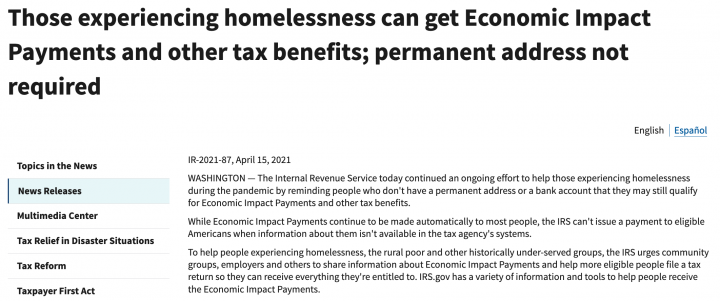

IRS seeking to get stimulus checks to people without permanent address, bank account

The IRS says it is continuing “an ongoing effort to help those experiencing homelessness during the pandemic” by making people without a permanent address or a bank account aware that they can still qualify for a stimulus check.

In a statement last week, the IRS outlined how Americans can get around the problem of not having a fixed address or a bank account and receive their direct payment.

The agency urges them to file a tax return, as it says it “can't issue a payment to eligible Americans when information about them isn't available in the tax agency's systems”. This can be done on a smart phone or a computer.

Filers can list the address of “a friend, relative or trusted service provider, such as a shelter, drop-in day center or transitional housing program” on their return, and can either open a low-cost or no-cost bank account (details of institutions where this can be done is provided) or may be able to get their money put onto a prepaid debit card.

“The IRS urges community groups, employers and others to share information about Economic Impact Payments and help more eligible people file a tax return so they can receive everything they're entitled to,” the body said.

"The IRS has been continuing to work directly with groups inside and outside the tax community to get information directly to people experiencing homelessness and other groups to help them receive Economic Impact Payments," IRS Commissioner Chuck Rettig said.

(Image: www.irs.gov)

Can parents with shared custody both claim expanded Child Tax Credit?

No: according to CNET, if parents of a child are unmarried and share joint custody, only one of them can claim the new, temporarily-expanded Child Tax Credit for that dependent. CNET spoke to Elaine Maag, a principal research associate with the Tax Policy Center.

Full CNET story: Child tax credit and shared custody: Can both parents get a payment for the same kid?

In pictures: Shoppers walk through the Village at Corte Madera in Corte Madera, California, last week. According to a report by the US Commerce Department, retail sales surged 9.8% in March as the US government began distributing a third round of stimulus checks, with qualifying Americans receiving a direct payment up to $1,200.

(Photo: Justin Sullivan/Getty Images/AFP)

$600 Golden State Stimulus check: how to track your payment

As part of a $9.6bn covid-19 relief bill passed by California's state legislature in February, qualifying residents of the Golden State are being sent a one-time, $600 stimulus check.

Full details on how you can track the status of your Golden State Stimulus payment

Fourth stimulus check: will the new relief bill have bigger payments if approved?

With mounting pressure on President Joe Biden to support further stimulus checks in his Build Back Better plan, how much more money could you be entitled to?

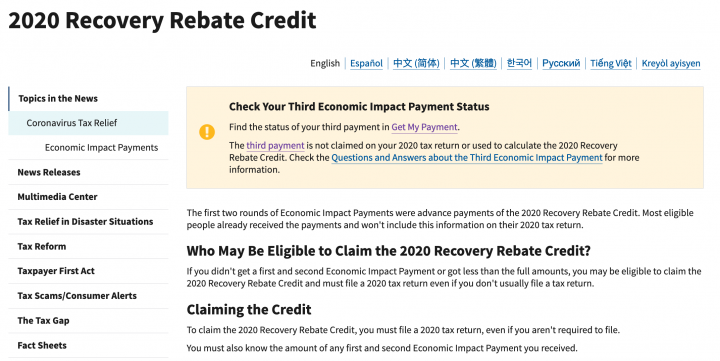

Claiming your missing first or second stimulus check

A reminder that if you didn’t get either the first or second stimulus check despite qualifying for it, you can still get it by claiming a 2020 Recovery Rebate Credit when you file your 2020 tax return.

This also applies to people who did get a check, but weren’t paid the full amount that they were entitled to. The Recovery Rebate Credit can be used to claim back the difference.

Check out the IRS’ info on the 2020 Recovery Rebate Credit

(Image: www.irs.gov)

Will the IRS send supplemental payments to 2020 tax filers?

The IRS confirmed earlier this month that they had already began to distribute the first round of the ‘plus-up’ stimulus checks. The direct payments are used to supplement those who had received less than their full entitlement in the recent round of stimulus checks.

In total around two million of these payments have been sent to individuals who had already received money from the third stimulus check. In most cases the payment was triggered by a recent income tax filing which altered their personal situation and, therefore, their eligibility for the $1,400 direct support.

The payments will continue to be sent on a regular basis until all those who are eligible have received their money, but when will that be and how can you claim yours?

Full details on the 'plus-up' payments and when you can expect yours if you qualify

Six best ways to spend your stimulus check

Personal-finance experts Kiplinger have put together this list of six "money-smart" ways of spending your stimulus check - a list which, unfortunately for those in need of a spot of retail therapy, involves a lot of saving and not very much high-street spending.

In a similar vein, you may also be interested in these tips from Forbes personal-finance expert Zack Friedman, whose chief piece of advice is to avoid investing your ‘stimmy’ in the stock market.

“If you simply must invest your stimulus check in the stock market, understand you could lose some or all of your stimulus check,” Friedman says.

Growing calls for Americans to receive more stimulus checks

In just over a year the federal government has provided three rounds of direct payments, worth up to $3,200 per person, to help citizens deal with the economic consequences of the pandemic.

The IRS has sent out over 159 million stimulus checks while distributing the third round of payments and will continue to disperse money over the coming months.

But for many, attention has already turned to the future with growing calls for a fourth stimulus check, perhaps one with recurring payments, both in Congress and across the country.

Full story: Growing pressure for fourth round of stimulus checks

(Photo: Brendan Smialowski / AFP)

$3,600 stimulus check per child: will there be IRS monthly payments in the summer?

With millions of families in the United States falling into poverty, many anxiously await their enhanced Child Tax Credit.

#1400Challenge sees stimulus checks used for community projects

As part of the #1400Challenge, stimulus-check recipients across the United States are pooling their direct payments to fund projects aimed at benefiting the local community.

For example, Tampa, Florida resident Michael Charney has been the driving force behind efforts to set up vegetable gardens using ‘stimmy’ money.

“I want to have at least two community gardens on every block,” Charney told Vice. “They each would have a multitude of fruits and vegetables for themselves, but they could each have a cash crop too.”

Others are building pallet homes, which can provide “durable, quickly-assembled shelter” that helps to combat “slow economic disasters like houselessness”, according to Sawhorse Revolution, a non-profit carpentry program for teens.

US unemployment benefits federal tax waiver: how to claim

As part of the $1.9tn coronavirus stimulus bill signed into law in March, qualifying Americans will get a tax break on the first $10,200 of unemployment benefits they received in 2020.

$600 Golden State Stimulus check: can I get it if I also received the third stimulus check?

Eligibility for both the third stimulus check, worth up to $1,400, and the $600 Golden State Stimulus check is subject to certain requirements, but there is nothing preventing you from receiving both payments if you satisfy each set of requirements.

Golden State Stimulus payments - when will yours arrive?

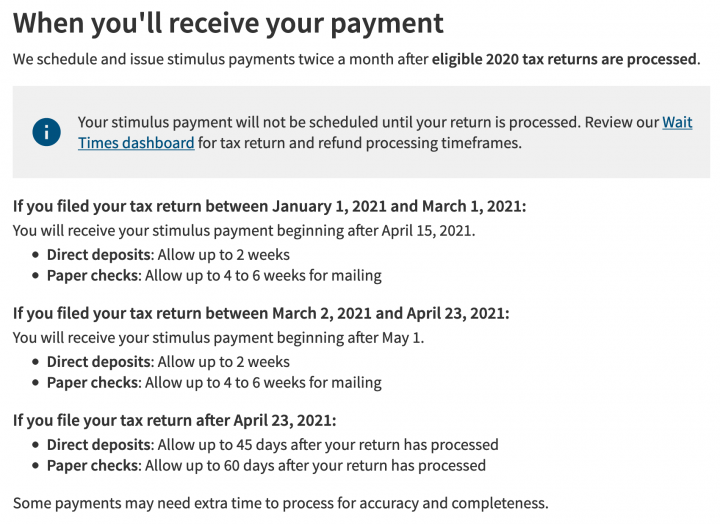

For Californians wondering when their $600 Golden State Stimulus payment will arrive, the State of California Franchise Tax Board (FTB) has the above breakdown on its website of when you can expect to get your money.

California residents’ 2020 tax returns are being used to determine eligibility, so you need to have submitted that before you can get your Golden State Stimulus payment.

Go to the FTB website’s section on Golden State Stimulus payments

More information on the Golden State Stimulus payments

(Image: www.ftb.ca.gov)

$1,400 third stimulus check: what is "IRS TREAS 310 - TAX EIP3"?

When third stimulus checks arrive in the bank accounts of direct-deposit recipients, they are identified using the reference "IRS TREAS 310 - TAX EIP3", or something similar.

Some child tax credit recipients may have to pay some of it back

CNBC notes that some recipients of the expanded child tax credit may have to pay back some of what they receive if they go for the option of receiving advance-payment in monthly instalments.

Eligible households can claim up to $3,000 per child aged six to 17, and up to $3,600 per child under six, and can either get their money in one lump sum when they file their 2021 tax return next year, or receive half of the amount in monthly payments between July and December this year. They would then get the rest with their 2021 tax return.

However, if your income has increased by the time you file your taxes next year, you may well end up qualifying for less than you have received in the second half of 2021 (for the time being, the IRS will use your 2019/2020 return to estimate how much you are eligible for if you go for the monthly-advance option).

Full CNBC story: You may have to pay back some of the new $3,000 child tax credit

Unemployment benefits: What state has the best payments?

Identifying which state provides the “best” benefits is not an easy question to answer and depends heavily on what one defines as “best.” We took a look at three factors: size of the benefit, cost of living, and eligibility period to compare benefits across the states.

Biden supports extending enhanced child tax credit until 2025

As part of the ‘American Families Plan’, which is set to be the second part of Joe Biden's ‘Build Back Better’ investment drive, the US president is reportedly keen to extend the expanded child tax credit beyond the 2021 tax year.

CNBC reported earlier this week that Biden supports extending the new child tax credit, which gives households with children up to $3,600 per child over a 12-month period, until the end of 2025.

Although a large number of Democrats are eager for the scheme to be made permanent, the huge cost of making that happen appears to be a major stumbling block.

According to a report by the Tax Foundation in March, making the expanded child tax credit a permanent program would cost $1.6tn over a 10-year period.

IRS warns Americans of social-media scams

The IRS is warning American taxpayers not to reply to direct messages on social media asking them for personal details. The agency will never ask you for such information on social media, so if you do receive a message of this nature, it is a scam.

Overpayment of unemployment benefits: should I give it back?

There are a number of reasons you may receive more unemployment benefits than you were due. Depending on your circumstances, you may have to pay it back.

Stimulus checks: every AS English article

A reminder that you can access all our articles on stimulus checks - with updates on both the third round currently going out, and a possible fourth check - in our dedicated section on direct payments.

How many people have received their third stimulus checks?

The IRS has been working to distribute the $1,400 direct payments since the American Rescue Plan was signed last month, with close to $400 billion sent out.

How to claim your stimulus check on 2020 tax return

If you were eligible for the first or second stimulus check but did not get it, you can claim your money when you file your 2020 tax return.

Find out more about how to claim your missing stimulus check

IRS $3,000 child tax credit: when will the monthly payments begin?

President Biden's $1.9tn coronavirus relief bill includes an enhanced child tax credit that will see qualifying households receive monthly direct payments per child. If everything goes as planned, the IRS will meet its deadline to begin the scheme in July.

See also: The lowdown on how the expanded child tax credit will work and who is eligible

$600 Golden State stimulus check: who qualifies in California?

A $600 stimulus check was among the provisions included in a state-wide stimulus package passed in California in February, with Governor Gavin Newsom stating that 5.7 million payments would go out to low-earning Golden State residents.

Full details on who qualifies for the Golden State stimulus check

Around 2m 'plus-up' payments sent out so far

The IRS has has so far distributed around 2m 'plus-up' payments, and will continue to send them out on a regular basis until those who are eligible have received their money.

IRS plus-up payment: what is it, how much is it and who gets it?

So-called 'plus-up' payments are being sent out to individuals who received a third stimulus check based on information taken from their 2019 income tax return, but who qualify for a larger payment based on their 2020 return.

Third stimulus check: how to check its status with the IRS Get My Payment tool

If you're still waiting for your third stimulus check to arrive, you can track its status by using the IRS' online Get My Payment portal.

Access the Get My Payment tool

More info on the Get My Payment tool

The IRS website also has a helpful FAQs sectionfor anyone experiencing difficulties with the Get My Payment service

Fourth stimulus check: will it be approved and sent in May?

The likelihood of direct payments being passed by Congress in May is low, but that does not mean that more checks are out of the question for future legislation.

Growing pressure for fourth stimulus checks

The $1,400 direct payments included in the American Rescue Plan were the most generous to date, but many in Congress want recurring stimulus payments offered in the next package.

Full story on the growing calls for further direct payments

(Photo: REUTERS/Tom Brenner/File Photo)

Stimulus checks live updates: welcome

Welcome to our daily rolling blog that not only brings you updates and information on the third round of stimulus checks, but also provides the latest news on the possibility of a fourth direct payment.

You'll also find info on other provisions included in President Joe Biden's $1.9tn coronavirus relief package, such as a child tax credit worth up to $3,600 per child, and enhanced unemployment benefits.

- Coronavirus stimulus checks

- Joseph Biden

- Washington D.C.

- IRS

- Charles Schumer

- USA coronavirus stimulus checks

- Covid-19 economic crisis

- United States Senate

- Science

- United States Congress

- Unemployment

- Coronavirus Covid-19

- Economic crisis

- United States

- Pandemic

- Coronavirus

- Recession

- Inland Revenue

- Economic climate

- Virology

- Outbreak

- Infectious diseases

- North America

- Parliament

- Microbiology

- Diseases

- Public finances

- Medicine

- America

- Economy

- Biology

- Health

- Politics

- Finances

- Life sciences