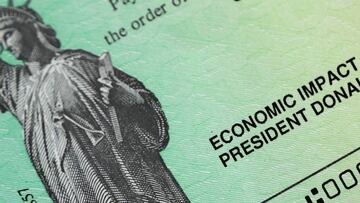

Can I cash someone else’s stimulus check in the US?

More than 152 million stimulus payments have been made by the IRS and some people are asking if they can cash someone else’s check amid coronavirus pandemic.

The Internal Revenue Service (IRS) has made over 150 million stimulus payments and there are some 20 million more to be made amid the coronavirus pandemic. The IRS is going to issue about 4 million debit cards to those who don’t have bank information and have not received their payment.

There have also been cases where family members passed away and their check has not been cashed yet so the question that many are asking is if they can cash someone else’s check. The answer to that question is yes, but there are consequences to that.

"A [stimulus] payment made to someone who died before receipt of the payment should be returned to the IRS by following the instructions about repayments,” according to updated guidance posted on IRS.gov on 6 May.

That was the dilemma facing an untold number of Americans who have received $1,200 stimulus payments, by paper check or direct deposit, in the names of deceased spouses and other family members. The Internal Revenue Service finally has an answer: Give the money back.

“Return the entire payment unless the payment was made to joint filers and one spouse had not died before receipt of the payment, in which case, you only need to return the portion of the payment made on account of the decedent. This amount will be $1,200 unless adjusted gross income exceeded $150,000,” said the IRS.

IRS instructions for returning an economic impact payment

Related stories

If the payment was a paper check and it hasn’t been cashed:

- Write "Void" in the endorsement section on the back of the check.

- Mail the voided Treasury check immediately to the appropriate IRS location for your state. Don't staple, bend or paper clip the check.

- Include a note stating the reason for returning the check.

If the payment was a paper check and you have cashed it, or if the payment was a direct deposit:

- Submit a personal check, money order, etc., immediately to the appropriate IRS location for your state.

- Write on the check/money order made payable to “U.S. Treasury” and write “2020EIP,” and the taxpayer identification number (Social Security number, or individual taxpayer identification number) of the recipient of the check.

- Include a brief explanation of the reason for returning the EIP.