Fourth stimulus check and Child Tax Credit news summary: Monday 19 July

Latest news and information on related benefits from President Biden's coronavirus relief bill, and updates on a potential fourth payment.

Show key events only

US stimulus check and Child Tax Credit latest news | 19 July 2021

Headlines:

- President Biden speaks about US economic recovery and the need for Bipartisan Infrastructure Framework and Build Back Better

- Bernie Sanders unveils a $3.5 trillion reconciliation bill. But, what is a reconciliation bill? (details)

-With so many spending proposals floating around Capitol Hill, many are wondering, is a fourth stimulus check coming in August? (Details)

- Will unemployment payments restart due to the covid-19 Delta variant?(full report)

- Democrats unveil $3.5 trillion reconciliation package that includes an extension of the Child Tax Credit(full details)

Useful information / links

Next Child Tax Credit payment scheduled for August 13 (more details)

Unemployment: What states have ended federal benefits? (Details)

Child Tax Credit | Why don't I get a check for $3000 or $3600? (details)

Mortgage Interest Rates | Is not the time to refinance? (Details)

Golden State Stimulus Checks | When are they coming? Are undocumented residents eligible?

Still waiting for your tax refund? So are millions of other Americans. Should you update your tax return information? Find out when to contact the IRS.

Take a look at some of our related news articles:

How has worker compensation changed throughout the pandemic?

In the last three months of 2019, workers were paid 11.56 billion dollars. In the first three months of 2021, this number increased to 12.17 billion dollars.

After dropping sharply in the Spring and Summer of 2020, to 10.94 billion dollars, compensation has been on the rise. This could be caused by companies paying workers higher salaries as they return to the labor market.

Source: Bureau of Economic Analysis

Colorado Senator Michael Bennet tweets his support of the expanded Child Tax Credit while highlighting the timeline of how it came to be.

The Hill posts a video of Bernie Sanders outlining his $3.5 trillion-dollar reconciliation billand dings Jeff Besos in the process. Besos is scheduled to take his first trip to space tomorrow, 20 July.

In his comments, Sen. Sanders said "At a time of massive wealth and income inequality, and at a time when billionaires like Jeff Bezos and others, large profitable corporations are not paying a nickel in a given year in federal taxes. What this bill does say to the wealthiest people in our country is you're going to have to start paying your fair share of taxes."

Child Tax Credit Frequently Asked Questions

The IRS has just sent the first payment of the Child Tax Credit to over 35 million families. AS English has you covered on all the questions you may have about the credit.

1. When will the August payment arrive?

2. Who qualifies for the $500 dependent credit and who doesn't get the Child Tax Credit?

3. Can I choose to receive $3600/$3000 rather than $300/$250 per month?

4. Will the changes to the Child Tax Credit be extended and made permanent?

While just a few short weeks ago it seemed that Democratic and Republican lawmakers had a deal... comments from the President show that the compromise bill may fall through.

Today President Biden spoke to his disappointment with Republicans who had withdrawn their support to some of the agreed upon measures.

Do Republicans support the bipartisan infrastructure package?

Days before a vote on the 1.2 trillion dollar infrastructure package is slated to take place, Republicans remain unified in their position on the bill.

Axios reports that some members are, "wary of going on the record supporting a package that includes such a steep price tag, particularly after Congress already passed a $1.9 trillion coronavirus package this year." However, they have seen the public polling on the bill and they are "also terrified of being held responsible for killing a bipartisan deal for something everyone loves: roads, bridges and photogenic local pork."

After three major spending bills passed since the pandemic began, these larger pieces of legislation have become more normal to voters. However, the era of government compromise may be ending as the infrastructure and spending packages floating around Capitol Hill fail to find enough support.

What is a reconciliation bill and how is it different from a regular bill?

What is a reconciliation bill and how is it different from a regular bill?

There are several funding proposals gaining traction on Capitol Hill. After negotiations on President Biden’s American Jobs Plan fell apart, a group of Democratic and Republican Senators drafted a bill that makes more traditional investments in physical infrastructure. The American Jobs Plan had included other measures targeting human infrastructure and workers in the care economy, which were excluded from the bipartisan bill.

Another is a $3.5 trillion dollar reconciliation bill, put forward by Sen. Bernie Sanders.

Read our full coverage for details on how reconciliation bills differ from standard Senate resolutions and what it has to do with the filibuster?

The Economist grapples with a question on the minds of many right now: As government stimulus ends, will the damage done by the pandemic begin to show through?

Senate Majority Leader Schumer announces that debate on the bipartisan infrastructure bill will end Wednesday. The Leader will then bring the bill to the floor for a vote.

While the sending of Child Tax Credit payments to families is a historic milestone in the US, the payments are much less than what parents see in other comparable countries.

When will the infrastructure bill be brought to a vote?

Senate Majority Leader Chuck Schumer aims to bring the package to a vote on Wednesday. However, many Senators involved in the discussion, including Susan Collins of Maine are pushing for more time.

Scammers are on the prowl for Child Tax Credit money

The Federal Trade Commission and Better Business Bureau have issued warnings to Americans that con artists are targeting the new 2021 Child Tax Credit payments. The scams may involve someone calling or emailing you saying they can help you get the payments faster or more money. They won’t help and will take the money meant for your child.

The IRS will never contact anyone by phone, text message or email, only by post. The agencies advise people not to give out any personal information such as a Social Security Number, bank account or credit/debit card details.

Biden “we can’t slow down now”; urges Congress to pass infrastructure bill to keep recovery going

President Joe Biden gave remarks on the economic recovery Monday to put pressure on Congress to pass his infrastructure and families plans. He sees them as an integral part of sustaining the economic recover which could see the US economy growing by seven percent this year, the fastest growth since 1984 when Ronald Regan was president.

“What the best companies do — and what we as a country should do — is make smart, sustainable investments with appropriate financing,” Biden said.

House Majority Leader Chuck Schumer wants to bring the $1.2 trillion “traditional infrastructure” bill up for debate by Wednesday. However, lawmakers have yet to finalize the bill. Some Republicans are saying that they can’t vote to open debate on a bill that they haven’t seen, and Senator Susan Collins of Maine says there is “no way” the bill will be ready by Wednesday.

Can a fourth stimulus be approved before August?

It has been four months since the last and largest round of stimulus checks for up to $1,400 for each eligible American were approved. After those payments hardship rates fell sharply, but the effects of those Economic Impact Payments appear to be fading.

The number of Americans that are still struggling to get enough to eat sits around 20 million and 11.5 million adults are behind on their rent according to a recent report from the Centers on Budget and Policy Priorities (CBPP). This even as the rate of employment increases, 850,000 jobs were added in June, and the unemployment rate drops to new lows, 360,000 last week, the US economy is still far from its pre-pandemic levels.

Congress is working on two sweeping spending bills for infrastructure, one “traditional” another “soft”. The latter will include investments in families.

Petition for $2,000 recurring stimulus checks surpasses 2.6 million signatures

For over a year a petition calling on Congress to disburse monthly recurring stimulus checks started by Denver restaurant owner Stephanie Bonin has been gaining steam. It has now garnered over 2.6 million signatures with a stated goal of 3 million to make it one of the top initiatives on Change.org. The petition wants $2,000 monthly payments for adults and $1,000 for children until the end of the crisis.

It has been joined by five other petitions on Change.org all of which have been gaining momentum over this past month as well. In total they have garnered over 3 million signatures.

Child Tax Credit: When will I get the August payment?

The IRS has announced that the first round of payments for the Child Tax Credit was sent to 35 million families totaling more than $15 billion. Around 86 percent of the payments were made through direct deposit, and the tax agency encourages families to provide bank information to get the funds more quickly.

With the first payment of the Child Tax Credit out the door, many are wondering when the second will be sent. Families can mark their calendars for 13 August.

Sen. Bernie Sanders breaks down the dual infrastructure bills

Senate Majority Leader Chuck Schumer wants to push forward this week on both the bipartisan "traditional infrastructure" bill and a separate Democrat-only infrastructure bill. But what are the two different pieces of legislation?

Senator and Senate Budget Committee Chair Bernie Sanders explains...

Student debt forgiveness for over 2,500 students at South Carolina State

Using money received from both the CARES Act and the American Rescue Plan, South Carolina State is erasing almost $10 million in student debt. Primarily the more than 2,500 students who benefited from this debt forgiveness could not pay for school and were unable to return to their studies or had dropped out due to financial hardship brought on by the covid-19 pandemic.

Students do not need to take any action, those with concerns about the situation of their student debt should contact Betty Boatwright at bboatwright@scsu.edu.

Are your advance 2021 Child Tax Credit payments safe from debt collectors?

Depending on where you live, and perhaps even who you bank with, your advance payments on the 2021 Child Tax Credit may be subject to debt collection. The residents of Massachusetts can rest easy, or at least their Attorney General will go to bat for them should a private debt collector try to get their hands on the monthly payments.

The advance payments “will not be reduced (that is, offset) for overdue taxes from previous years or other federal or state debts that you owe,” according to the IRS. However, the same doesn’t go for the remainder of the credit that can be claimed on 2021 tax returns. The same goes for back child support payments.

The IRS says though that “payments are not exempt from garnishment by non-federal creditors under federal law.” If worried that you may owe money to your state or local government or have a private debt that is being pursued, you’ll want to check with your financial institution or state government to see if your payments are protected.

Child Tax Credit: Can I choose to receive $3600/$3000 rather than $300/$250 per month?

The IRS said more than 35 million families received their first payment of the Child Tax Credit over the weekend. Depending on how much money your family earned in the 2020 tax year, you could be eligible to receive the credit. Per child it is up to $300 a month and there are hopes, and plans, that it will be extended much further than the end of the 2021 tax year.

The new credit began on July 15 and will be dispatched in six payments, with the final six months arriving as a lump sum at the end of the tax year.

Stimulus checks did what they were meant to, help families and the economy

Claudia Sahm, a Jain Family Institute senior fellow, released a report on how families made use of the $1,400 stimulus checks. She found, according to her research, that contrary to what critics said the stimulus checks “provided much-needed relief to millions of families and helped bolster the economy at a critical juncture in the recovery... In short, stimulus checks worked.”

She found that half the money sent out was spent within a few months. And even the money that was used to pay down debts and put into savings, helped provide buffers and reduce debt burden. Around 12 percent of those same people expect to spend the extra cash at some point in the future.

This is the best strategy to create millions of jobs and lift up the middle class.

This is a blue-collar blueprint for building the American economy back.

Most price increases were expected and expected to be temporary.

We're going to remain vigilant and take whatever measures necessary.

Four states account for 40 percent of cases.

They said if I got elected, I'd bring the end to capitalism.

The US is the only country where the growth projections are higher than when I took office.

For millions of middle-class families, it will give them a little breathing room every month.

Watch | Biden on stimulus and growth

President Biden gives remarks on the economic recovery and the need for Bipartisan Infrastructure Framework and Build Back Better Agenda.

Schools have until 2024 to spend stimulus dollars, which totaled about $190 billion, the largest-ever, one-year federal infusion of cash for public schools.

While districts and states have started spending some of the $81 billion already dispersed to states from the most recent round of $122 billion in funding, many are deciding how to allocate the rest and under federal guidelines won’t receive those funds until their plans have been approved.

Twelve state spending plans have been approved thus far,

Stimulus funds being used to 'thank' teachers

Some schools believe that bonus pay will help “boost morale” among staff. Georgia was the first state to enact these bonuses, spending a massive 35 percent of their covid stimulus on the one time checks.

The Wall Street Journal reports that they sent “$1,000 statewide bonuses to 230,000 school-level employees, covering nearly every teacher and staff member, including aides, custodians, bus drivers and cafeteria workers.”

In all, the effort cost $230.5 million of their $660.6 million stimulus.

Stimulus, health, climate... help Americans

American basketball coach Stan Van Gundy is not having the attitude of Senator Graham or others in the GOP who he says are conflicted with what they should be fighting for and against.

Things that help everyday Americans - like stimulus payments, child tax credits, widespread affordable health care, caring for the planet - should be where everyone's attention should be focused.

Stimulus paid by taxes not popular with GOP

Republican congressman Fred Keller jumped on the back of his leader's comments that stimulus spending through this pandemic to help Americans most at need and keep the economy going was not a wise move from President Biden.

Kevin McCarthy tweeted:

'Prices on everything from gas to groceries are skyrocketing. Inflation is hitting hard-working middle-class families the hardest. A key driver of these price increases and increased costs of living is crystal clear → massive increases in government spending by the Democrats.'

Infrastructure stimulus: know more

We've been talking a lot over recent weeks about the deal over a $3.5 trillion infrastructure plan.

The White House has confirmed that the plan can be paid for and here CNBC's Ylan Mui joins Shep Smith to report on what has been happening.

Graham's cunning plan to stop infrastructure stimulus

As the Daily Mail reports, Republican Senator Lindsey Graham has said he will follow the lead of Texas House Democrats and 'leave town' in order to block voting on President Biden's $3.5trillion infrastructure bill.

It came after Senator Amy Klobuchar suggested that financial incentives for states to expand voting access could also be included in the infrastructure bill.

Graham, who had previously said that the only way to pay for such a package would be 'through a massive tax increase,' stated that he was contemplating employing the tactic used by Texas Democrats who left the state to avoid backing GOP-engineered voting legislation.

No beef with the IRS: infrastructure stimulus update

Lawmakers have dropped their push to fund the $1.2 trillion bipartisan infrastructure package in part through expanded enforcement resources for the IRS amid debate over how to pay for the deal.

Sen. Rob Portman, an Ohio Republican and one of the architects of the bipartisan package, told CNN on Sunday the decision came after pushback from the right and what he called an attempt to co-opt the issue by Democrats. Democrats, he said, were planning to use tougher IRS enforcement standards to get the money for their follow-on, $3.5 trillion reconciliation “human infrastructure” package to be pushed on a party-line basis.

“One reason it’s not part of the proposal is that we did have pushback,” Mr. Portman said. “Another reason is that we found out that the Democrats were going to put a proposal into the reconciliation package which was not just similar to the one we had, but with a lot more IRS enforcement.”

Haris Alic brings you more.

Child Tax Credit Q&A

Join The Colorado Sun for a live Q&A with US Sen. Michael Bennet on the topic of the Advance Child Tax Credit, how families can access this new benefit and more.

Hosted by Colorado Sun reporter Jesse Paul, this free, live virtual event will also feature experts from the nonpartisan Taxpayer Advocate Service.

You can even join in by sending questions in advance to the Senator at questions@coloradosun.com!

Child Tax Credit: a bold innovation

As you are likely more than aware if you have passed by this blog before, the first payments of the Biden administration’s expanded child tax credit went out last week - marking what could be the start of a truly radical change. The new system is in place only for the rest of this year, though Democrats are hoping first to extend it as part of their budget proposal, and then to make it permanent.

Their ambition is nothing less than to transform the provision of income support, especially for the poorest families. That’s a worthy goal, to be sure, and one that’s capable of commanding bipartisan support. But the new policy is both administratively demanding and very expensive. It was a mistake to dodge these questions before the six-month experiment began. Good answers are essential if this policy, or something similar, is to be adopted for the longer term.

Bloombergbrings you more on the plans.

How to sign up for the 2021 Child Tax Credit

Anyone that filed a tax return in the past two years or has used the agency’s Non-Filer online tool is automatically registered. Parents can check if they are enrolled using the IRS Manage Payments online portal, which they can use to unenroll or change payment options as well.

Those that have neither filed a tax return nor used the Non-Filer online tool are urged to do so to take advantage of the financial assistance.This includes those with no income who are eligible to receive the credit but are not normally required to file taxes. This includes those with no income who are eligible to receive the credit but are not normally required to file taxes.

Eligibility requirements to receive the 2021 Child Tax Credit

Under the new legislation, individuals will qualify for the full value of the 2021 Child Tax Credit so long as their annual earnings are below $75,000; or a joint income of up to $150,000 for married couples, widows, and widowers and $112,500 for heads of household. If household earnings surpass these limits, a reduced credit will be distributed. For every additional $1000 in income, the credit's value will be gradually phased out $50.

To be eligible, a taxpayer must have their main home in the US for more than half the year and care for the dependent for at least half of the calendar year.

Will unemployment payments restart due to the covid-19 Delta variant?

The extra unemployment benefits expire federally in September but with a new wave of covid-19 approaching unemployment could rise.

Dollar shifts up a gear as virus looms over England's 'Freedom Day'

The safety of dollars and yen was sought on Monday, keeping the greenback near its strongest in months, as the spread of the delta coronavirus variant shook investors' confidence in growth and left many nervous about England's reopening.

The risk sensitive Aussie came under the most pressure among major currencies in the Asia session, dropping to a seven-month low of $0.7373 and sliding for a fifth day in a row on the yen to find its lowest in five months.

The yen was last up 0.1% at 109.25 per dollar and close to its strongest since April at 129.78 per euro. The euro sat at $1.1805, near last week's three-month low of $1.1772.

Republicans plan to vote 'no' on Wednesday

Republicans strongly oppose the larger spending plan, and not all Democrats have given their blessing to it either.

Senate Republican leader Mitch McConnell told Fox News last week that all Republicans would vote "no" on the $3.5 trillion bill.

Senate scrambles to finish bill ahead of Wednesday vote

A $1.2 trillion bipartisan infrastructure bill will face an initial procedural floor vote in the U.S. Senate next Wednesday, Majority Leader Chuck Schumer announced last week in an apparent effort to jump-start the process.

Legislators from both parties are working to forge a consensus on details of the measure, which is expected to fund roads, bridges, ports and other "hard" infrastructure and is backed by President Joe Biden, whose fellow Democrats narrowly control the Senate.

"All parties involved in the bipartisan infrastructure bill talks must now finalize their agreement so that the Senate can begin considering that legislation next week," Schumer, a Democrat, said on the Senate floor.

Sixty votes will be needed to advance the measure next Wednesday, which means at least 10 Republicans will have to join all the Democrats in supporting the legislation in the Senate, which is divided 50-50 along party lines.

Facebook says it should not be blamed for US failing to meet vaccine goals

Facebook has defended itself against U.S. President Joe Biden's assertion that the social media platform is "killing people" by allowing misinformation about coronavirus vaccines to proliferate, saying the facts tell a different story. "The data shows that 85% of Facebook users in the US have been or want to be vaccinated against covid-19," Facebook said in a corporate blog post by Guy Rosen, a company vice president. "President Biden’s goal was for 70% of Americans to be vaccinated by July 4. Facebook is not the reason this goal was missed."

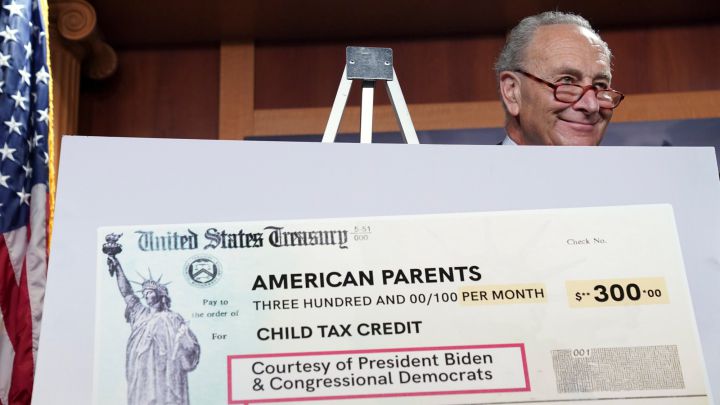

A 'giant step' to counter poverty: Biden

Some 35 million American families have started receiving their first monthly payout from the U.S. government in an expanded income-support program that President Joe Biden said last week could help end child poverty.

Under the Child Tax Credit program that was broadened under Biden's COVID-19 stimulus, eligible families collect an initial monthly payment of up to $300 for each child under six years old and up to $250 for each older child.

Payouts made to families, covering nearly 60 million eligible children, totaled about $15 billion for July. The payments are automatic for many U.S. taxpayers, while others need to sign up.

Biden wants to extend expanded, monthly benefits for years to come as part of a $3.5 trillion spending plan being considered by Senate Democrats, who expect strong Republican opposition to the full bill.

"It's our effort to make another giant step toward ending child poverty in America," Biden said in a speech. "This can be life changing for so many families."

Profiling: Alexandria Ocasio-Cortez

While she has no formal party leadership role, Ocasio-Cortez has star power rarely seen in the US Congress. She has more than 8 million Instagram followers and last year shot a video for Vogue detailing her personal skin care routine. Her online store capitalizes on her fame, experts said.

"There's the campaign finance aspect of it and, for lack of a better term, there's the cult of personality aspect of it," said Ciara Torres-Spelliscy, who studies political branding at Stetson University.

Since defeating the then-chair of the House Democratic caucus in a 2018 primary and easily winning her seat to represent a swath of New York City, Ocasio-Cortez has become the face of progressive Democrats' push for a "Green New Deal," a set of climate goals.

Using merchandise sales to grow her fundraising could help her wield more influence in the Democratic Party, by allowing her to support candidates who share her goals, said Bruce Newman, a political scientist who edits the Journal of Political Marketing.

Already, her fundraising hauls look more like what's raised by party leaders or senators. Her campaign has raised about $6.9 million since the November election, compared to $10.8 million by House Speaker Nancy Pelosi and $23.9 million by Senate majority leader Chuck Schumer, who is up for re-election in 2022 and viewed as a potential primary target for Ocasio-Cortez.

Alexandria Ocasio-Cortez makes a push into political merchandise

U.S. Representative Alexandria Ocasio-Cortez became one of America's most prominent progressive Democrats with her calls to tax the wealthy and spend heavily to fight climate change.

Now she is investing heavily in her online store, selling T-shirts, sweatshirts and other merchandise with her name, "AOC" initials or slogans including "Tax the Rich" and "Fight for our Future," efforts aimed at both fundraising and building the second-term lawmaker's profile nationally.

Yellen will try to sell U.S. Republicans on global tax deal

Janet Yellen's recent trip to continental Europe as Treasury Secretary helped solidify G20 political support for a global corporate tax deal and gave European Union officials an excuse to delay a problematic digital tax proposal.

Yellen said she plans to increase her outreach to members of Congress from both parties as she works with leaders of House and Senate tax writing committees to craft legislation under budget "reconciliation" rules to implement the OECD "Pillar 2" corporate minimum tax.

Democrats are widely expected to try to use these rules to push through without Republican support President Joe Biden's plans to raise taxes on corporations and wealthy Americans to help fund spending on infrastructure, child care and other social priorities.

A number of top Republican lawmakers have denounced the OECD deal as a "surrender" of U.S. revenue base and vow to oppose any reversal of their 2017 tax cuts.

"I’m not in agreement with the Republicans, but nevertheless I think it's important for me to explain to them what the logic of this agreement is and why I see it as in the U.S. interest," Yellen said.

Mortgage rates fall: Is it a good time to refinance my mortgage?

The average interest rate for a traditional mortgage has fallen to the lowest level since February, but is now a good time to be buying a house?

Global stocks on worst run in 18-months amid global covid-19 surge

Risk-aversion ruled on Monday as a surge in worldwide coronavirus cases pushed down bond yields and left stocks facing their longest losing streak since the pandemic first hit global markets 18 months ago.

The STOXX 600 slid 1.4% and London's FTSE fell 1.3% as England scrapped covid-19 restrictions even though over 48,000 new cases were reported in Britain on Sunday.

Britain's health minister has also tested positive for the virus. Asia had seen Japan's Nikkei and Hong Kong's Hang Seng drop 1.3% overnight too. Cases hit an 11-month high at the weekend in Singapore. Thailand had its highest single-day increase since the pandemic began and Sydney's construction workers were told to down tools after cases rose there as well.

Wall Street futures were down 0.5% although it was good news for those holding safe-haven government bonds or the dollar, which climbed to a more than 3-month high.

Natwest's Global Head of Desk Strategy, John Briggs, said the chances of broader lockdowns being needed again were growing and also China's economy was slowing, meaning a recent surge in commodity prices could be peaking although oil is now expensive enough to be a weight on many economies.

Nancy Pelosi praises Senate budget plan as 'bold, essential investments'

U.S. House of Representatives Speaker Nancy Pelosi said on Wednesday that the $3.5 trillion Senate budget plan 'will make bold, essential investments in our values as a nation.'

"The Senate budget will contain many of House Democrats’ top priorities, including transformative action on the investments needed to confront the climate crisis, to transform the care economy, and to expand access to health care with enhancements to ACA, Medicare and closing the Medicaid coverage gap," Pelosi said in a letter to colleagues.

US has administered 337.74 million doses of covid-19 vaccines

The United States has administered 337,740,358 doses of covid-19 vaccines in the country as of Sunday morning, the U.S. Centers for Disease Control and Prevention said. Those figures are up from the 337,239,448 doses the CDC said had gone into arms by Saturday.

Making Child Tax Credit a permanent benefit

The President is putting pressure on Congress to make these changes permanent as it could cut rates of child poverty in half. Before the changes made under the trillion-dollar stimulus legislation, the credit would be sent with a taxpayer’s refund and was only available with those with an income over $2,000. Now, the payments will be made on a monthly basis between July and December.

The monthly payments began on 15 July and can be expected on or around the 15th of each month through December. The remaining balance of the credit - half - will be claimed when families file their taxes next year.

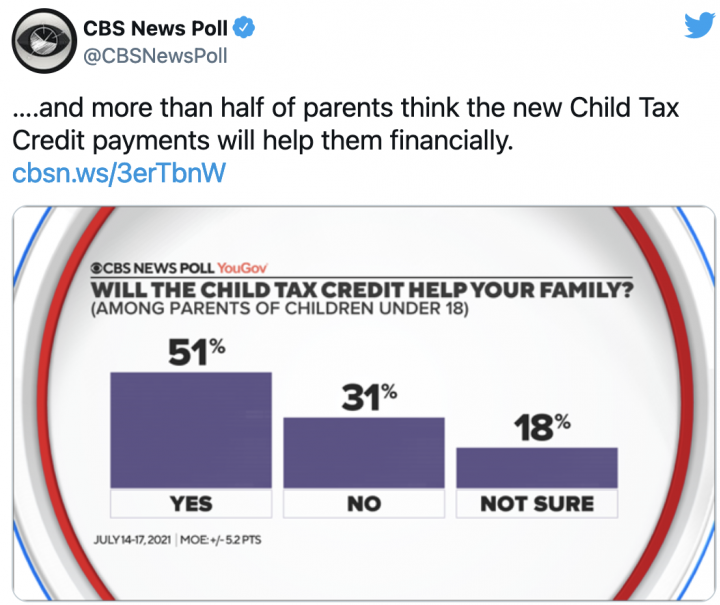

More than 50% of parents feel their family will be helped by Child Tax Credit

What does the $100 billion stimulus plan in California include?

The new $100bn California Comeback Plan approved by state leaders this week provides $600 stimulus checks, rental assistance and financial support for small businesses.

US sees unexpected rise in retail sales

U.S. retail sales unexpectedly increased in June as demand for goods remained strong even as spending is shifting back to services, bolstering expectations that economic growth accelerated in the second quarter.

Retail sales rebounded 0.6% last month, the Commerce Department said on Friday. Data for May was revised down to show sales falling 1.7% instead of declining 1.3% as previously reported.

Economists polled by Reuters had forecast retail sales dropping 0.4%. But shortages of motor vehicles because of a global semiconductor supply squeeze, which is undercutting production, are hampering sales of automobiles.

Sales of some household appliances have also been impacted by the chip shortage. "We expect supply issues and dwindling auto inventories to continue to limit auto sales in the coming months," said Veronica Clark, an economist at Citigroup in New York.

Demand shifted to goods like electronics and motor vehicles during the pandemic as millions of people worked from home, took online classes and avoided public transportation.

Families to get an advance on half of the 2021 Child Tax Credit

The IRS sent the first payments for the expanded 2021 Child Tax Credit last week. The changes to the tax credit were included in the Democrats’ American Rescue Plan enacted in March which gave the IRS four months to get the program up and running.

The changes are currently only for the 2021 fiscal year but the Democrats included the expansion with the expectation that the modifications would be extended. This means that families will receive only half the credit in advance payments this year instead of the whole credit being split into equal monthly installments in 2021.

First U.S. Senate vote on bipartisan infrastructure bill set for Wednesday

A $1.2 trillion bipartisan infrastructure bill will face an initial procedural floor vote in the U.S. Senate on Wednesday, Majority Leader Chuck Schumer announced last week in an apparent effort to jump-start the process.

Legislators from both parties are working to forge a consensus on details of the measure, which is expected to fund roads, bridges, ports and other "hard" infrastructure and is backed by President Joe Biden, whose fellow Democrats narrowly control the Senate.

"All parties involved in the bipartisan infrastructure bill talks must now finalize their agreement so that the Senate can begin considering that legislation next week," Schumer, a Democrat, said on the Senate floor.

US senators drop tax enforcement from bipartisan infrastructure bill -Portman

U.S. lawmakers trying to salvage a $1.2 trillion bipartisan infrastructure bill have dropped a provision to beef up tax enforcement, Republican Senator Rob Portman said on Sunday, setting aside a significant revenue-raising measure.

The provision, aimed at increasing Internal Revenue Service (IRS) collections, will instead likely be added to a separate budget "reconciliation" bill being pushed by Democrats as a vehicle for passing trillions of dollars more in spending and tax increases, Portman said on CNN's State of the Union program.

President Joe Biden has said he wants to invest $80 billion in IRS technology and enforcement to increase collections of taxes by $700 billion over 10 years. The provision outlined in the infrastructure bill would account for around $100 billion of that larger goal, according to Democratic senators' estimates.

The decision to exclude the IRS provision from the $1.2 trillion infrastructure bill comes as senators and the White House are trying to negotiate the final details of the package ahead of a key procedural vote planned for Wednesday.

England's 'freedom day' marred by soaring cases and isolation chaos

Prime Minister Boris Johnson's 'freedom day' ending over a year of covid-19 lockdown restrictions in England was marred on Monday by surging infections, warnings of supermarket shortages and his own forced self-isolation.

Johnson's bet that he can get one of Europe's largest economies firing again because so many people are now vaccinated marks a new chapter in the global response to the coronavirus.

If the vaccines prove effective in reducing severe illness and deaths even while infections reach record levels, Johnson's decision could offer a path out of the worst public health crisis in decades. If not, more lockdowns could loom.

But Johnson's big day was marred by "pingdemic chaos" as a National Health Service app ordered hundreds of thousands of people to self-isolate - prompting warnings supermarket shelves could soon be emptied.

"If we don’t do it now we’ve got to ask ourselves, when will we ever do it?" Johnson said just hours after he was forced to abandon a plan to dodge the 10-day quarantine requirement for himself and finance minister Rishni Sunak.

"This is the right moment but we’ve got to do it cautiously. We’ve got to remember that this virus is sadly still out there."

Britain has the seventh highest death toll in the world, 128,708, and is forecast to soon have more new infections each day than it did at the height of a second wave of the virus earlier this year

Virus, inflation woes send FTSE 100 to two-month low

The FTSE 100 fell to a two-month low on Monday on concerns that a spike in coronavirus infections could derail a nascent economic recovery, while a recent surge in inflation raised fears of a quicker tapering in global monetary stimulus.

The blue-chip FTSE 100 was down 1.4% by 0709 GMT, with BP and Royal Dutch Shell tracking a slide in oil prices.

Mining and financial stocks were also among the biggest decliners. No single FTSE 100 stock posted gains in early trading.

Recurring stimulus check petition hits 3M

An online petition demanding monthly stimulus checks reaches 3 million signatures.

IRS promoting QR codes

The Internal Revenue Service QR code technology provides easy access to self-help options for taxpayers.

$300 weekly unemployment payments resume in Indiana: When will I receive the check?

The Indiana Department of Workforce Development has begun sending out unemployment compensation to around 120,000 who had their benefits cut 19 June.

Who qualifies for the $500 dependent credit and who doesn't get the Child Tax Credit?

The 2021 Child Tax Credit raised the age for children that qualify to 17, but taxpayers with older dependents may qualify for a $500 tax credit.

Will the changes to the Child Tax Credit be extended and made permanent?

As millions of families begin to receive the advanced payment of the Child Tax Credit, many wonder if the current structure will be made permanent.

Stimulus check live updates: welcome

Hello and welcome to our daily live blog for today, Monday 19 July 2021, bringing you updates on a possible fourth stimulus check in the US.

We'll also provide you with information on the third round of stimulus checks, which began going out in March as part of President Biden's American Rescue Plan, in addition to news and info on other economic-support programs such as the new, expanded Child Tax Credit.

- Joseph Biden

- Washington D.C.

- Detroit

- Boston

- Coronavirus stimulus checks

- USA coronavirus stimulus checks

- Steven Mnuchin

- Nancy Pelosi

- Washington (State)

- Seattle

- Michigan

- Massachusetts

- Science

- Coronavirus Covid-19

- United States

- Pandemic

- Coronavirus

- North America

- Virology

- Outbreak

- Infectious diseases

- Microbiology

- Diseases

- America

- Medicine

- Biology

- Health

- Life sciences