Fourth stimulus check news: summary 12 May 2021

Information on the third stimulus check in President Biden's coronavirus aid package, plus updates on a fourth check and the Golden State Stimulus. Wednesday 12 May 2021.

Show key events only

US stimulus checks updates: Wednesday 12 May 2021

Stimulus checks responsible for household income increase

The first few months of 2021 have seen household incomes soar as the federal government distributed two rounds of stimulus checks, providing up to $2,000 per person for eligible Americans. It was hoped that this would spur consumer activity and spending habits do appear to have followed suit.

The Wall Street Journal reports that "household income rose at a record pace of 21.1% in March," while consumer spending has risen by around 4.2%. It is thought that this trend will continue as covid restrictions are eased in the coming months.

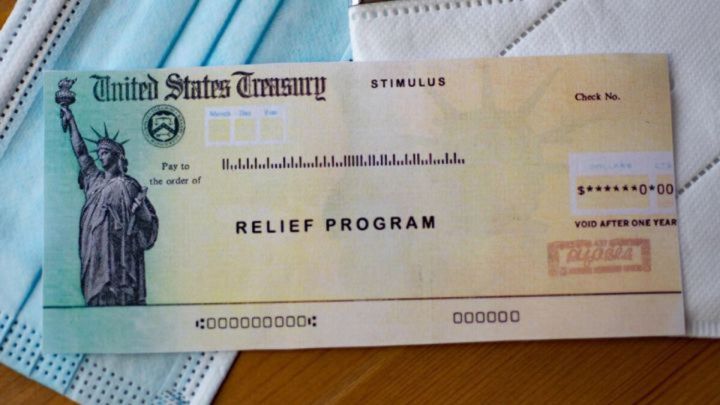

IRS sends out another round of stimulus checks

Another one million stimulus check payments have been distributed by the IRS today as the total number sent out surpasses 165 million. It is thought that more than $388 billion worth of stimulus checks has been sent so far, about 86% of the $450 billion provided by the American Rescue Plan.

More than half of those who received a payment in this latest wave got theirs after filing their tax returns with the IRS; a reminder to get yours in as soon as possible to ensure you don't miss out on stimulus money.

Homeless Americans set to receive stimulus check payments

Throughout the pandemic the IRS has struggled to get stimulus checks out to homeless Americans, due to the lack of access to internet, mobile phones and a fixed address. However that could be about to change after a House inquiry into the IRS' handling of the situation which is expected to see hundreds of thousands of homeless people sent stimulus check payments in the coming weeks.

Can you lose stimulus checks if you don't file taxes before 2021 deadline?

If you want your stimulus money this year you will need to file your 2020 tax return this year, but you may be able to get some with next year's refund.

The US federal government has authorized three separate Economic Impact Payments (EIP) over the past year, more commonly known as stimulus checks. These are advanced payments of the Recovery Rebate Credit, two of which were for the 2020 fiscal year and the third for the 2021 fiscal year.

The latest round of EIPs, which will see eligible Americans receiving up to $1,400 direct payments per adult and dependent, must be paid out by the Internal Revenue Service (IRS) before the end of the year. However, like the previous two EIPs, taxpayers will be able to claim any money they were underpaid this year when they file in 2022.

How does tax filing affect your Child Tax Credit payments?

The IRS is still aiming to introduce the new-look Child Tax Credit in July but some people may miss out on the initial payments, simply because they had not filed their 2020 tax returns on time. The tax filing deadline is Monday 17 May and the IRS will use the data you provide in your tax returns to decide eligibility for the upcoming support.

If your personal situation has changed over the last year (household income, number of tax dependents, etc) you could be entitled for an additional stimulus check too. For more information on what you could be entitled to, check out this handy guide from the IRS>

Some tax advice from an expert for 2021 tax season

The numerous tax provisions included in the American Rescue Plan can make filing your 2020 tax return this year more complicated. Speaking on All Things Considered accountant Angel Li of Glastonbury-based firm FML gives advice on the tax implications of 2020 unemployment payments, as well as how to take advantage of the new federal child tax credit.

Filing a 2020 tax return is crucial this year

The American Rescue Plan was packed full of tax provisions for everyday Americans, but in order to take advantage of them you will need to send the IRS a 2020 tax return. The clock is ticking with just 5 days to go until Tax Day, but you can file for an extension if you really need more time.

Utah joins growing list of states to end $300 federal pandemic unemployment benefits

Utah will join at least 11 other states that had announced plans to end federal unemployment benefits programs early. The programs were set to expire 6 September but citing labor shortages and a lack of people willing to fill vacant positions state governments want to give a nudge to people to accept jobs. Many feel that the enhanced benefits are the reason people are not accepting the open positions, mainly in low-wage jobs.

In the case of Utah, the governor touted the state's recent job growth and a low unemployment rate as reasons for ending its participation. Participation in the pandemic unemployment benefit program which gives those unemployed an extra $300 per week on top of regular assistance will end 26 June according to a Wednesday news release from Cox's office. The stimulus program currently benefits about 28,000 Utahns.

The other states that will be ending their participation in the programs sometime in June or July include: Alabama, Arkansas, Idaho, Iowa, Mississippi, Missouri, Montana, North Dakota, South Carolina, Tennessee and Wyoming.

Do you need to work to claim the child tax credit?

With monthly payments of the enhanced Child Tax Credit slated to begin going out to eligible households in July, questions around work requirements and claiming the benefit have arisen.

Tax Deadline 2021: how to file an extension

Tax Day 2021 is nearing but for those who still need a little more time, the IRS allows for an extension until 15 October, but you’ll need to act now.

Tax Filing 2021: what happens if I don’t file before the deadline?

The IRS can issue financial penalties for late tax returns. Failure to file may also affect upcoming stimulus check and Child Tax Credit payments.

Is a $3600 stimulus check coming?

Earlier this month, the IRS reiterated its intention to begin monthly payments of the expanded Child Tax Credit, which sees qualifying households receive up to $3,600 per child per year, in July.

Parents can choose to get their Child Tax Credit as a lump sum in 2022, or receive half of their total amount in monthly instalments during the second half of 2021.

Where is my Golden State stimulus? How to check & track

California's Franchise Tax Board is currently sending out stimulus checks to the value of $600 or $1,200 to eligible residents of the state.

Get the full lowdown on eligibility and when you stimulus check should arrive

California Stimulus Check: how many people will receive the payments according to Newsom?

According to Governor Newsom, 80% of taxpayers in California will now be eligible for a $600 Golden State Stimulus payment as part of his California Comeback Plan.

IRS sends out 9th batch of stimulus checks

The federal government announced on Wednesday that around 1 million payments in the ninth batch of Economic Impact Payments (EIP) from the American Rescue Plan were disbursed. With the latest batch of payments brings the total disbursed so far to approximately 165 million, totaling approximately $388 billion.

Data on the payment according to the IRS :

- Over 960,000 payments with a value of more than $1.8 billion

- More than 500,000 payments went to eligible individuals for whom the IRS previously did not have information to issue an EIP but who recently filed a tax return.

- Over 460,000 of these "plus-up" payments bringing the total to more than 6 million of these supplemental payments this year.

- Nearly 500,000 direct deposit payments with the remainder as paper payments.

Can I get the $1,100 Golden State stimulus if I got the $1,200 or a third stimulus check?

California had a record budget surplus in 2021, on top of expected federal stimulus money, which has enabled the Governor to propose his $100 billion covid-19 relief bill for the state. Part of his proposal is “the biggest state tax rebate in American history,” allocating nearly $12 billion to direct payments.

The new tax rebate will include millions who didn’t receive a $600 stimulus check in the previous Golden State Stimulus enacted in February. It’s estimated that around 11 million taxpayers will receive a $600 payment in the latest round of Golden State Stimulus.

IRS still holding onto billions in $1,200 stimulus check money

Newsweek - A year after most eligible Americans received—and probably spent—the first federal stimulus checks of the covid-19 era, the Internal Revenue Service continues to sit on roughly $2.1 billion in payments that were never accepted by their intended recipients.

In all, according to the IRS, of the roughly 160 million payments that were sent out in the first round of stimulus following the passage of the $2.2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act in March of 2020, about 1.25 million have never been cashed or were returned or paid back to the U.S. Treasury.

Find out which states are leaving the most money on the table

Photo of the US Capitol Dome by Chip Somodevilla / AFP

Opposition to $300 federal weekly unemployment benefit grows

Senator from West Virginia, Joe Manchin III states opposition to extending the $300 federal weekly unemployment benefits. This follows news from three states that will be ending these additional payments in June.

BREAKING NEWS: Seatle Times reports that "the Internal Revenue Service has lifted a hold on seven addresses where potentially hundreds or even thousands of homeless people have been expecting to receive their stimulus checks in King County."

Golden State Stimulus: When will the $500 extra golden state stimulus in California be sent?

When will the $500 extra golden state stimulus in California be sent?

Under the California Comeback Plan, seventy-eight percent of taxpayers in the state could see a $600 stimulus payment, and families with children could receive an additional $500 check.

In order to receive the payments, the proposal must be passed by the state legislature.

Lawmakers will receive the full proposal Friday 14 May and the governor is hoping to see the legislation approved by mid-June. If approved, payments would begin being disbursed shortly after based on tax information provided this year. The deadline to file taxes in California is 17 May.

What else does the California Comeback Plan include?

Each day this week the different components of the package will be announced. On Monday came the news of the additional direct payments and on Tuesday the Governor explains what the proposal does to address issues of housing in the state.

Homelessness has become a greater issue in the state in recent years. According to Capital Public Radio, the number of people experiencing homelessness in the state grew 24% from 2018 to 2020.

For a full description of the funds that will be allocated to address homelessness, read our full coverage.

Ban on stimulus tax cuts upheld in federal court

The $1.9 trillion American Rescue Plan Act included tax mandate added by Senate Majority Leader Chuck Schumer whereby states couldn’t use federal stimulus funds to cut taxes. Democrats in Congress say the funds should be used for relief efforts and not to finance tax cuts popular with Republican voters.

However, five Republican state Attorney Generals disagree saying they should be permitted to accept federal cash and cut taxes without fear that the money will be clawed back.

Two federal judges have made decisions in two separate cases, both in favor of the Biden Administration’s ability to enforce the tax mandate. Ohio’s lawsuit was denied an injunction but can proceed, while Missouri’s lawsuit was dismissed outright.

Delayed stimulus checks to homeless will finally be sent

The Seattle Times in April reported how many homeless in Seattle were not receiving what could be life-changing funds from the Economic Impact Payments sent out over the past year. Staffers for Rep. Pramila Jayapal, D-Seattle, and Sen. Patty Murray, D-Wash., were already asking the IRS about the holdup.

After some digging it turns out that the checks were being delayed due to an IRS system flagging the addresses where the checks were to be sent. This is common when several checks are requested sent to the same address, in this case hundreds.

“I'll never vote for another extension as long as I know that with the vaccines, there's not an excuse for no one to be vaccinated. I understand there's millions of jobs in America that we can't fill right now. So we need people back to work. There's more and more people understanding they're in trouble."

Extending unemployment benefits beyond September in doubt

Despite “overwhelming support” among Democrats according to Chuck Schumer to provide additional money to unemployment compensation not all Democrats are onboard. Senator Joe Manchin told Politico that he won’t support extending the $300 federal unemployment benefit from President Joe Biden's stimulus any further. Other centrist Democrats want to see how the economic recovery plays out before deciding on the issue.

Check the status of your stimulus check using Get My Payment

A reminder that if your third stimulus check is yet to arrive, you can check on its status using the Get My Payment tool on the IRS website.

Find out more about Get My Payment

The IRS has also prepared this useful FAQs page on the Get My Payment tool.

$600 Golden State Stimulus check: can I get it if I also received the third stimulus check?

As long as you meet the eligibility requirements for the third stimulus check and the Golden State Stimulus payment, there is nothing to stop you from receiving both.

Who is eligible for Earned Income Tax Credit for childless workers?

The Earned Income Tax Credit is a refundable tax credit that is targeted at low- and moderate-income workers. It reduces the amount of taxes filers owe, or can even be collected as a refund.

Workers with kids get a higher starting credit but new modifications in the American Rescue Plan relax some rules and childless workers will be eligible for a much larger credit than before.

The maximum credit that taxpayers without children can claim will increase in 2021 from $538 to just over $1,500. But in order to receive the credit, even those who are not legally required to file a tax return must do so to claim the credit.

$1,000 stimulus check for Florida first responders: how many people will get it?

$208 million has been set aside in Florida's 2021/22 budget for a round of $1,000 'pandemic bonuses' for first responders in the state, Governor Ron DeSantis announced last week.

"Supporting our law enforcement and first responders has been a top priority for my administration, and it has never been more important than over the last year," DeSantis said. "As a state, we are grateful for their continued service to our communities.

"This one-time bonus is a small token of appreciation, but we can never go far enough to express our gratitude for their selflessness."

What states are ending pandemic-related unemployment benefits?

Citing labor shortages, the governors of some states have moved to end additional pandemic assistance to unemployed workers in June.

570,000 'plus-up' stimulus checks in most recent IRS payment run

There were nearly 570,000 so-called ‘plus-up’ payments, at a total value of just under $1bn, in the most recent batch of third stimulus checks sent out, the IRS said last week.

‘Plus-up’ stimulus checks are being distributed to Americans who have already received their third Economic Impact Payment, but now qualify for a larger amount based on their recently-processed 2020 federal tax return.

More information about 'plus-up' payments

(Image: www.irs.gov)

How much unemployment benefits will I get in New York?

New York is in the top 20 for the maximum amount of unemployment benefits paid out, with up to 99 weeks of benefits available under covid-19 relief.

Child Tax Credit and stimulus checks: how do they differ?

With millions of families awaiting funds from the enhanced Child Tax Credit, many are wondering why the payments weren’t sent with the latest stimulus check.

(Photo: Andrew Kelly/Reuters)

Americans experiencing homelessness can get third stimulus check

The IRS is reminding Americans that people who don’t have fixed address can still claim their third stimulus check.

Find out more about how those experiencing homelessness can get their Economic Impact Payment

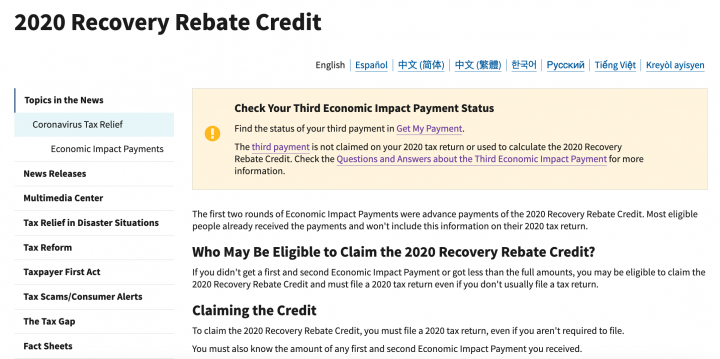

Didn't get the first/second stimulus check despite qualifying? You need to claim a Recovery Rebate Credit

A reminder that you can use your 2020 tax return to claim the first or second stimulus check if you qualified for the payment but didn’t receive it.

To get your missing stimulus check, you need to claim a Recovery Rebate Credit when you file your taxes. Americans have until 17 May to submit their 2020 federal tax return.

You can also use a Recovery Rebate Credit to claim back the difference from the IRS if you got didn’t get the full first/second stimulus check amount that you were entitled to.

The IRS has prepared this helpful information sheet on how to get your Recovery Rebate Credit.

You’ll also find a video explainer on the agency’s YouTube channel.

(Image: www.gov.irs)

California Governor Gavin Newsom during Monday's announcement of the $100 billion California Comeback Plan, an economic recovery package that includes $600 stimulus checks for residents who make up to $75,000 a year and did not receive the first Golden State Stimulus payment. Families with children would also receive an additional $500 as part of the proposal.

Further reading: More info on the extra $500 payment for families with kids

(Photo: Justin Sullivan/Getty Images/AFP)

$1,100 Golden State stimulus in California eligibility: who qualifies for it?

The lowdown on who is eligible for the expanded Golden State Stimulus payments scheme, which was announced by California Governor Gavin Newsom at the start of this week.

More than 2.1m people back Change.org call for recurring stimulus checks

A Change.org petition calling for Congress to give Americans recurring stimulus checks of up to $2,000 has now gathered almost 2.17 million signatures.

Stephanie Bonin, a restaurant owner from Colorado, created the petition last year, calling for $2,000 monthly payments to go out to adults in the US, and additional $1,000 checks per child to be given to households with children.

As of Wednesday morning EDT, 2,168,140 people had backed the petition.

“Supplying Americans with monthly support until they can get back on their feet can save our communities from financial ruin,” Bonin says,

She also urges Congress to approve automatic stimulus checks if certain economic conditions are met - something that is reportedly under consideration in Washington.

When will SSI recipients receive the Golden State Stimulus?

The California Department of Social Services handles a separate program authorized under California's stimulus legislation called the Golden State Grant (GSG).

One-time GSG payments of $600 will be provided to SSI/SSP (Supplemental Security Income/State Supplementary Payment) recipients, along with all eligible CalWORKs Assistance Units and beneficiaries of the Cash Assistance Program for Immigrants (CAPI) to provide covid-19 pandemic relief.

The timeline for those payments has not yet been announced but California Department of Social Services spokesman Jason Montiel said: "We hope to begin issuing payments this summer.”

How is $600 Golden State Stimulus check paid? Direct deposit or paper check?

A round of one-time stimulus checks of $600 or $1,200 is currently being distributed to eligible Californians as part of a statewide relief package passed in February.

Find out more about how you can expect to receive your check

Tax filing 2021: when is the last day to file in May?

The IRS delayed the tax filing deadline again this year due to the covid-19 pandemic, but now for the majority of Americans Tax Day 2021 is just about here.

'Build Back Better' agenda meets partisan Washington gridlock

Labor shortages and slow job growth in April have sparked debate on stimulus, including the possibility of Congress approving a fourth direct payment.

Full story in our latest report on the status of talks over a fourth stimulus check.

(Photo: Kevin Lamarque/Reuters)

What ID can I use to cash stimulus checks?

If you want to cash your stimulus check you can do so at banks even where you are not an account holder or member, but you will need to bring ID.

$1,400 third stimulus check: what is "IRS TREAS 310 - TAX EIP3"?

Americans receiving their third stimulus check by direct deposit are seeing their payment land in their bank account with the identifying reference "IRS TREAS 310 - TAX EIP3", or something similar to that.

US job openings hit record high in March

US job openings surged to a record high in March, further evidence that a shortage of workers was hampering job growth, even as nearly 10 million Americans are looking for employment.

The Labor Department's monthly Job Openings and Labor Turnover Survey, or JOLTS report, on Tuesday also showed layoffs dropping to a record low in March. The report could put pressure on the White House to review government-funded unemployment benefits programs, including a $300 weekly supplement, which pay more than most minimum wage jobs.

The benefits were extended until early September as part of President Joe Biden's $1.9 trillion covid-19 pandemic relief package approved in March. Alabama, Montana and South Carolina are ending government-funded pandemic unemployment benefits for residents next month. Those benefits cover the self-employed, gig workers and others who do not qualify for the regular state unemployment insurance programs.

"As more restrictions are lifted throughout the country, more businesses are opening up," said Sophia Koropeckyj, a senior economist at Moody's Analytics in West Chester, Pennsylvania. "However, there seems to be a mismatch between businesses' eagerness to return to some semblance of pre-pandemic normality and many workers' hesitation to step back into the workforce."

Job openings, a measure of labor demand, jumped 597,000 to 8.1 million on the last day of March, the highest since the series began in December 2000. The surge was led by the accommodation and food services sector, with 185,000 vacancies opening up. There were an additional 155,000 job openings in state and local government education.

(Reuters)

Do you need to work to get the Child Tax Credit?

With monthly payments of the enhanced Child Tax Credit slated to begin going out to eligible households in July, questions around work requirements and claiming the benefit have arisen.

(Photo: Jonathan Ernst/Reuters)

Child Tax Credit monthly payments set for July start

Earlier this month, the IRS reiterated its intention to begin monthly payments of the expanded Child Tax Credit, which sees qualifying households receive up to $3,600 per child per year, in July.

Parents can choose to get their Child Tax Credit as a lump sum in 2022, or receive half of their total amount in monthly instalments during the second half of 2021.

Find out more about the expanded Child Tax Credit

(Photo: Brian Snyder/Reuters)

Other features of California Comeback Plan

The California Comeback Plan announced by Governor Gavin Newsom on Monday not only includes an expansion of the Golden State Stimulus payments of at least $600, but also features $5.2bn in rent relief and a further $2bn to help Californians pay their utility bills.

“California’s recovery is well underway, but we can’t be satisfied with simply going back to the way things were,” Governor Newsom said. “We are tripling the Golden State Stimulus to get money in the hands of more middle-class Californians who have been hit hard by this pandemic.

"Two in three Californians will receive a check from the state and more than $5 billion in aid will be made available to those who need help paying their rent or utility bills.”

Where is my Golden State stimulus? How to check & track

California's Franchise Tax Board is currently sending out stimulus checks to the value of $600 or $1,200 to eligible residents of the state.

Get the full lowdown on eligibility and when you stimulus check should arrive

How will unemployment tax break refund be sent in two phases by the IRS?

The American Rescue Plan passed in March included a $10,200 tax waiver per individual and up to $20,400 per married couple filing jointly for those who claimed unemployment compensation in 2020.

The bill was enacted with the 2021 tax season underway and some 55 million taxpayers had already filed their taxes the week prior to 11 March according to IRS data.

To avoid confusion and delays in processing tax returns the IRS advised those who had already filed not to amend their 2020 tax return and that the tax agency would go back and automatically adjust filings for the waiver.

In an announcement the IRS informed that it would handle the automatic adjustments in two stages with refunds expected to begin in May.

Full details on when qualifying Americans can expect their unemployment-benefits tax waiver

When will the IRS finish making stimulus payments?

The IRS has until December 2021 to send out all stimulus checks, but it's widely considered that with the pace of delivery the tax agency will finish earlier than that.

Take a look at all our news pieces on stimulus checks

In our stimulus checks news section, you’ll find a wide range of articles providing updates on a potential fourth stimulus check, in addition to information on the current, third round of payments.

We also have news pieces on other aid measures such as California’s Golden State Stimulus payments, which Governor Gavin Newsom plans to expand to include more Californians.

How much were the first, second and third stimulus checks and when were they sent out?

So far, the US federal government has sent out three rounds of stimulus checks since the start of the coronavirus pandemic.

Third stimulus checks: how many payments were made in the last batch?

The IRS has now sent out eight batches of third stimulus checks as part of the economic-aid scheme, which was included in the $1.9tn coronavirus relief package signed into law by President Joe Biden on 11 March.

Track your third stimulus check with Get My Payment

Should you still be waiting for your third federal stimulus check to land, you can track its progress by visiting the IRS’ online Get My Payment tool.

(Image: www.irs.gov)

New $600 payment in California not for people who received the first one

It’s worth clarifying that the fresh round of $600 Golden State Stimulus payments included in Governor Gavin Newsom's California Comeback Plan would only go out to households that earned up to $75,000 last year but did not get the first check.

That’s according to this California Comeback Plan fact sheet published by the governor’s office.

However, Newsom’s plan to send out an extra payment of $500 for families with children does appear to apply both to those who received the first check and those who didn’t.

California Stimulus Check: how many people will receive the payments according to Newsom?

According to Governor Newsom, 80% of taxpayers in California will now be eligible for a $600 Golden State Stimulus payment as part of his California Comeback Plan.

$1,100 Golden State stimulus in California eligibility: who qualifies for it?

On Monday, California Governor Gavin Newsom unveiled a new round of stimulus payments for Californians of up to $1,100 made possible by record state budget surplus.

US stimulus checks live updates: welcome

Welcome to our live blog providing updates and information on the third stimulus check currently being distributed in the US, and on the possibility of a fourth direct payment.

We'll also bring you news on other economic-aid measures such as the expanded Child Tax Credit and enhanced unemployment benefits, in addition to the Golden State Stimulus in California, where Governor Gavin Newsom has announced that more residents of the state are to receive a payment of at least $600.

- Coronavirus stimulus checks

- USA coronavirus stimulus checks

- Joseph Biden

- IRS

- Covid-19 economic crisis

- Science

- United States Congress

- Unemployment

- Coronavirus Covid-19

- Economic crisis

- Poverty

- Pandemic

- Coronavirus

- Recession

- United States

- Inland Revenue

- Economic climate

- Virology

- Outbreak

- Infectious diseases

- North America

- Parliament

- Employment

- Microbiology

- Diseases

- Medicine

- America

- Economy

- Work

- Social problems

- Biology

- Health

- Politics

- Society

- Life sciences