Fourth stimulus check and Child Tax Credit summary: 18 July 2021

Latest news and information on related benefits from President Biden's coronavirus relief bill, and updates on a potential fourth payment.

Show key events only

US stimulus check and Child Tax Credit latest news | 18 July 2021

Headlines:

-Democrats unveil $3.5 trillion reconciliation package that includes an extension of the Child Tax Credit (full details)

- IRS releases guidance for families that should consider opting out of Child Tax Credit payments. (Full story)

-California Gov. Gavin Newsom signs a historic $100 billion budget. (full story)

-Indiana and Maryland resume the payment of federal unemployment benefits. (Full details)

- President Biden sees the enhanced Child Tax Credit as a major act to counter poverty in the US

Useful information / links

Unemployment: What states have ended federal benefits? (Details)

Child Tax Credit | How does marriage status impact payments? & What are the income limits for each tax filing status?

Mortgage Interest Rates | Is not the time to refinance? (Details)

Golden State Stimulus Checks | When are they coming? Are undocumented residents eligible?

Still waiting for your tax refund? So are millions of other Americans. Should you update your tax return information? Find out when to contact the IRS.

Take a look at some of our related news articles:

$3000/$3600 Child Tax Credit: Can I just get one month and opt out?

The first payment of the Advanced Child Tax Credit has been sent to more than 35 million families. Some are wondering, is there still time to opt out?

(Photo: FREDERIC J. BROWN/AFP)

How much were the first, second and third stimulus checks and when were they sent out?

So far since the start of the coronavirus pandemic, three federal stimulus checks have been sent out to qualifying Americans.

We take a look at each of the direct payments approved by Congress

Lindsey Graham wants GOP Senators to abandon DC to stop Dems' infrastructure bill

Taking a page out the Texas House state representatives' playbook, US Senator Lindsey Graham is urging fellow GOP senators to leave Washington DC to deny a quorum in the Senate, thus blocking a vote on Democrats $3.5trillion infrastructure bill. Senator Graham’s call to action came after Senator Amy Klobuchar suggested that financial incentives for states to expand voting access could also be included in the infrastructure bill.

Recently, nearly 60 Texas Democrats fled their state paralyzing their state’s vote over a GOP-engineered voting bill that would restrict residents’ access to the ballot. The Texas state legislature requires a quorum of two-thirds of lawmakers be present to conduct business. However, in the case of the US Senate, the US Constitution only requires a simple majority to be present to conduct business. So, if only one Republican senator is present the Democrats would still be able to pass their separate infrastructure bill as they have 50 senators in their caucus.

Sen. Amy Klobuchar says election reform could be included in infrastructure bills

Congressional Democrats have been struggling to get their For the People Act, which would establish minimum voting standards across the US, through the Senate. Republicans blocked even the chance to debate the measures proposed in the bill with a filibuster. However, Democrats may have a way to get a least some of their reforms enacted, using the infrastructure bills being hammered out in Congress.

Senator Amy Klobuchar of Minnesota and Senate Rules Committee Chair said in an interview that financial incentives for states could be used to encourage the adoption certain reforms. Like banks and power plants, election systems have been designated critical infrastructure.

“You can do election infrastructure in there because that is part of infrastructure. It’s no substitute for the For the People Act, but it is something we can start working on immediately and are working on right now,” Klobuchar said.

Families are getting an advance on half of the 2021 Child Tax Credit

The IRS sent the first payments for the expanded 2021 Child Tax Credit last week. The changes to the tax credit were included in the Democrats’ American Rescue Plan enacted in March which gave the IRS four months to get the program up and running.

The changes are currently only for the 2021 fiscal year but the Democrats included the expansion with the expectation that the modifications would be extended. This means that families will receive only half the credit in advance payments this year instead of the whole credit being split into equal monthly installments in 2021.

However, should the changes be extended families would receive the whole of the credit due to them in 12 monthly installments of up to $300, or they can choose to wait and receive the whole credit they are eligible for the following year.

Who qualifies for the $500 dependent credit and who doesn't get the Child Tax Credit?

The American Rescue Plan enacted in March greatly expanded tax credits for parents and guardians. Although parents with dependents over 17 years of age might not get in on the advance payment program for those dependents, they may qualify for a tax credit for other dependents and additional tax credits when they file their tax return in 2022.

Parents and guardians with children 17 and younger will receive six monthly installments on the 2021 Child Tax Credit this year, if they meet the income eligibility and other requirements. As well if they haven’t chosen to opt out of the advance payment scheme added to the tax credit for the 2021 fiscal year, and perhaps beyond.

However, their older dependents may qualify for a tax credit through the Earned Income Tax Credit, the Child and Dependent Care Tax Credit or a $500 Tax Credit for Other Dependents.

How has personal savings changed since the beginning of the pandemic?

Before the pandemic, the average US household had around $400 in savings. Data from the Federal Reserve showed that the personal savings rate in July 2019 was less than ten percent.

This later increased after the sending of the first stimulus check and enhanced unemployment benefits to over thirty percent. In May 2020, the rate had dropped to around 12.4%, which is still higher than pre-pandemic levels.

How much money will be sent through the revamped Child Tax Credit?

National Interest reports that all in all, around 150 billion dollars will be sent to families in the US.

BREAKING: Online petition demanding monthly stimulus checks with $2,000 be sent reaches 3 million signatures.

Will the Federal Reserve begin making changes to stop increases in inflation?

San Fransisco Fed President Mary Daly, says yes.

What does an increase in the Consumer Price Index mean?

What does an increase in the Consumer Price Index mean?

To protect against inflation and monitor the stability of the economy, the US Department of Labor tracks an indicator called the Consumer Price Index (CPI). The CPI "measures the change in prices paid by consumers for goods and services.”

In June, the Consumer Price Index increased almost 1%, the largest in over a decade.

Read our full coverage for what this increase really means for the economic recovery and shoppers across the US.

How are states planning to use money from the American Rescue Plan to reopen schools?

The US Department of Education released ten press releases announcing their approval of state proposals to allocate covid-19 stimulus funds.

The Plans of Massachusetts, South Dakota, Arkansas, Rhode Island, Utah, Washington DC, Ohio, Tennessee, West Virginia, and Oregon were approved.

Many states did not submit their plans on time, which is why they have yet to be approved.

The Department of Education stated that these plans will allow states to "safely reopen and sustain the safe operation of schools and equitably expand opportunity for students who need it most."

How are some school districts spending covid-19 stimulus aid?

The Wall Street Journal reports that some districts are giving bonuses to teachers. This move has been criticized by parents who believe that it is a misuse of the funding.

The reconciliation bill was explained in a recent interview with AOC. In it, she talks about changes to immigration policy that could help DACA recipients.

Want to learn more about DACA?Check our full coverage for more on the program.

Senator from New Jersey Cory Booker takes to the Senate floor to talk about the impacts the Child Tax Credit payments will mean for families.

Negociations are still ongoing over the Bipartisan Infrastructure bill. One aspect that has been dropped in recent discussions, tax enforcement.

Democrats had proposed measures to strengthen the US Treasury Department's ability to go after tax evaders. This was included to increase public revenue which could be used to pay for some aspects of the bill.

Will the Child Tax Credit be extended and made permanent?

Will the changes to the Child Tax Credit be extended and made permanent?

As more than 35 million families receive their first payment of the Advanced Child Tax Credit, Democrats on Capitol Hill move to make the new structure of the credit permanent.

These changes increase the quantity distributed and will expand eligibility to 24 million more children. Many of the children whose families were unable to claim the credit before were ineligible because they made too little.

Experts believe that the new structure will help to cut child poverty rates in the United States in half. For these decreases to be sustained, the modifications must be made permanent.

Building on the public support for the Child Tax Credit, funding to make the changes permanent has been included in the $3.5 trillion reconciliation bill.

Read our full coverage for more on what other measures were included in the reconciliation package.

Gov. Gavin Newsom's Office tweets about the Golden State Stimulus Checks that will real two-thirds of families in the state by the end of this year.

More on the Golden State

-$600 second Golden State Stimulus check in California: site and how to apply

-What does the $100 billion stimulus plan in California include?

-What are the restrictions with Los Angeles' reinstated mask mandate?

MarketWatch took a look at how major retailers will benefit from historic Child Tax Credit payments.

$3000/$3600 Child Tax Credit: Can I just get one month and opt-out?

$3000/$3600 Child Tax Credit: Can I just get one month and opt-out?

The next payment will be made on 13 August, and there is still time to opt out should families choose to do so.

Through the Child Tax Credit Update Portal, families can manage their payments, including an option to forgo future payments.

Those who would like to opt-out, including the August payments, must do so by 2 August.

Read our full coverage for more details on who the IRS advises should opt out of the payments.

How much money has covid-19 cost the State of California?

According to new reporting from CalMatters, the pandemic has cost the state over $12.3 billion. This figure is larger than the GDP of 50 nations.

Read the full story to find out what exactly that money was spent on.

Child Tax Credit -- Frequently Asked Question

1. Why do I get $300/$2500 from the CTC and not $3,600/$3000? (Details)

2.Can I receive the CTC if I am single or divorced? (Details)

3.What are the income limits for the CTC for each tax filing status? (Details)

4. Are there limits on the number of children that can be claimed for the CTC? (Details)

5. Haven't received your payment and need to contact the IRS? (Here's how)

Senate Majority Leader Chuck Schumer is hoping for a summer win on infrastructure. Reporters believe that the bipartisan package will be brought before the Senate this week to begin debate.

How have the Child Tax Credit payments helped families?

CNN's Adrienne Broaddus hit the road to talk with moms on how they plan to use their credits and what it means for their families.

Illinois Rep. Cheri Bustos discusses infrastructure

Congresswoman Cheri Bustos spoke to NBC discusses the two infrastructure bills on the table in the Capitol. “We’ve got to get them done," said Bustos.

Petitions calling for monthly $2k stimulus checks could soon surpass 3m signatures

A Change.org petition calling for $2k monthly stimulus checks looks bound to reach its 3-million-signature target, with more than 2.6 million signatures to date. It will become one of Change.org's most signed petitions if it reaches 3 million. At its current pace, the petition could hit the benchmark in August.

Sign the petition here.

Claim that a 4th stimulus check scheduled for July is a hoax

Facebook users have been warned that claims circulating on the platform that a fourth stimulus check will arrive at the end of July are false.

"It passed 10 minutes ago! Everyone gets another stimulus check for $2500 on July 30, 2021. They did it!" reads one July 15 Facebook post that has since received about 500 shares, and is among many making similar claims.

All the posts provide an external link with supposed instructions on how to get the promised stimulus check directly deposited. Clicking the link, however, sends users to an image of an ape giving the middle finger.

Child Tax Credit: Investment advice

MartetWatch has compiled three options for parents considering investing their Child Tax Credit payments in their children's future:

- '529 plans are a great place to start'

- 'Retirement accounts? Yes, really'

- 'Set up an estate plan'

Check out the full article here.

Explaining Child Credit Tax

The Child Tax Credit is being likened to a universal basic income for children, although it has income limits. It is expected to help people meet monthly expenses from rent to food and daycare.

The Center on Poverty and Social Policy at Columbia University estimates the expansion can reduce the U.S. child poverty rate by up to 45%.

Critics say the expanded credit is expensive and may discourage people from working. Some experts say it may not reach some of the poorest Americans who are not in the tax system.

The Democrat-backed $1.9 trillion covid-19 legislation known as the American Rescue Plan enacted in March increased how much is paid to families under the program.

The law made half of the tax credit for the 2021 tax year payable in advance by the Internal Revenue Service in monthly installments from July through December this year.

Biden proposed making the monthly advance payments permanent and maintaining expanded benefits through 2025 at least.

26 states end federal pandemic unemployment benefits

There are a total of twenty-six states that have chosen to end federal pandemic unemployment benefits but some are now doing an about-face and have resumed payments after being sued by residents.

Louisiana will be the last state to end unemployment benefits early with the stop date scheduled for the end of July. The remaining states that are no longer participating in one or all of the federal programs include:

Alabama, Alaska, Arizona, Arkansas, Florida, Georgia, Idaho, Iowa, Mississippi, Missouri, Montana, Nebraska, New Hampshire, North Dakota, Ohio, Oklahoma, South Carolina, South Dakota, Tennessee, Texas, Utah, West Virginia, and Wyoming.

How to contact the IRS about $3,000 to $3,600 Child Tax Credit

The IRS has set up three online portals for the 2021 Child Tax Credit that families can use to provide information to the agency and manage the payments.

Did states ending federal unemployment benefits see decreases in June?

At the national level, the unemployment rate held steady, but some states did see fluctuations. Did states ending federal benefits see higher decreases?

'Not backed by science:' LA County sheriff will not enforce new mask mandate

A new mask mandate in Los Angeles County, went into effect at a minute before midnight Saturday and designed to combat the spread of coivid-19, will not be enforced by the county's top lawman or his deputies.

The new mandate from the Los Angeles County Department of Public Health requires people to wear masks indoors, even if they are already vaccinated against the disease.

But Los Angeles County Sheriff Alex Villanueva said the order is "not backed by science," and that it contradicts guidelines from the U.S. Centers for Disease Control and Prevention, which does not prescribe masks indoors for most vaccinated people.

The sheriff added that he "will not expend our limited resources" and that his office instead asks for "voluntary compliance" from the public.

Delta variant drives fears as Wall Street closes down

Wall Street ended lower on Friday, weighed down by declines in Amazon, Apple and other heavyweight technology stocks, while investors worried about a rise in coronavirus cases tied to the highly contagious Delta variant.

On Thursday, Los Angeles County said it would reimpose its mask mandate this weekend. On Friday, public health officials said U.S. coronavirus cases were up 70% over the previous week, with deaths up 26%.

Yankee Stadium returns to pre-covid conditions

The Bronx stadium, home to MLB side New York Yankees have confirmed that the stadium has returned to full capacity with no covid restrictions in place. Fans no longer are required to wear face-masks and will not be required to show proof of vaccination to gain entry to games.

Fed's Kashkari says many U.S. sectors struggling to adjust to reopening

Minneapolis Federal Reserve President Neel Kashkari said many U.S. economic sectors faced rapidly rising prices and were struggling to adjust to reopening after the shutdown.

"Basically, what's happening is the U.S. economy went through a very abrupt shutdown a year ago," Kashkari told NPR.

"And now it's going through a reopening, and you're seeing many sectors of the economy struggle to make that adjustment."

Kashkari said he agreed with Federal Reserve Chair Jerome Powell that the economy will return to a more normal pricing environment once it adjusts to the reopening.

"I'm not seeing any evidence yet that we're going to have sustained high inflation beyond this reopening period, whether that's six months or a year or 18 months. I'm not sure," Kashkari said.

ECB approves multi-year project to create a digital version of euro

The European Central Bank gave the green light this week to a multi-year project to create a digital version of the euro.

An electronic equivalent of banknotes and coins, the digital euro will likely be a digital wallet that euro zone citizens can keep at the ECB.

It is part of a drive by central banks to meet growing demand for electronic means of payment and tackle a boom in private sector digital currencies from bitcoin to Facebook's proposed Diem.

It will be a means of payment that gives holders a claim against the ECB - like banknotes and coins, but in digital format and will probably resemble an online bank account or digital wallet held directly at the ECB rather than at a commercial institution.

This is a fundamental difference because the ECB cannot run out of euros, making its digital currency intrinsically safer than any private sector counterpart.

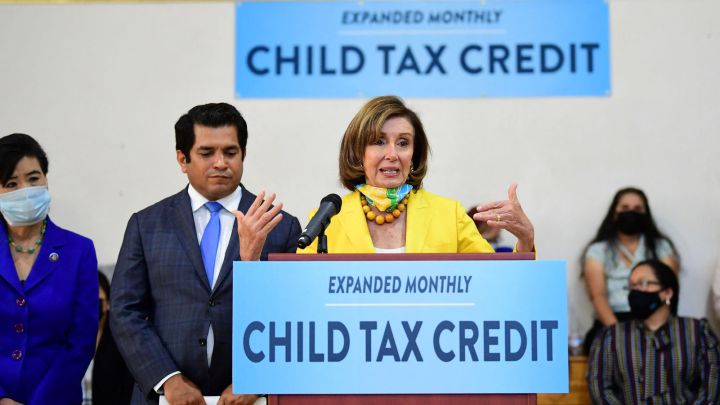

Child Tax Credit PR push

Lawmakers who are pushing for a permanent extension of the expanded credit vowed on an online press conference earlier this week to keep pressuring the IRS and get the word out to those in need.

"We are concerned - we want people to know about it," said U.S. Representative Rosa DeLauro, a Democrat from Connecticut who chairs the House Appropriations Committee.

"We still continue to try to make the portal as friendly as possible so that people can, in fact, be able to access it."

U.S. Representative Lloyd Doggett, a Democrat from Texas, expressed concern about the website and said families still reeling from the financial hit of the pandemic could end up left out in the short run.

People who filed a tax return in 2020 or 2019 are supposed to automatically receive the payments, as are non-filers who claimed the direct stimulus payments included in earlier rounds of coronavirus relief, according to the IRS.

But about 40% of low-income Americans do not have home broadband services and the same percentage do not own a desktop or laptop computer, according to the Pew Research Center.

That makes it difficult even for families who regularly file taxes to check their status, advocacy groups say.

The IRS notes that, in some circumstances, people can simply claim the full amount of child credit they are owed when they file their 2021 taxes next year.

Digital divide could deny poorest Americans new child tax benefits

"With the digital divide, it's really hard for people to be able to access the portal," claimed Robin McKinney who works with low-income Americans. "We need to better invest in our infrastructure to get money out to people."

The credit, typically $2,000 per child, was increased this year to $3,000 for children ages 6 to 17 and $3,600 for children under six as part of the $1.9 trillion coronavirus relief package President Joe Biden signed into law in March.

Economists estimate the move could greatly decrease child poverty in the United States, where nearly 11 million - or one in seven - children live in poverty, the Center for American Progress, a progressive think tank, estimates.

But despite a PR blitz from the Biden administration and local civic groups, advocates helping people navigate the process say tech troubles and digital inequality put many Americans at risk of missing out when the first monthly payments for the expanded credit go out this week.

Income thresholds for Child Tax Credit

Single filers

Single taxpayer parents with an adjusted gross income (AGI) under $75,000 will qualify for the full child tax credit amount of $3,600 for children under six and $3,000 for children under 17. Payments will be phased out for those earning above $75,000, up to a threshold of $240,000. Single filers earning more than $240,000 will not be eligible to receive the child tax credit.

Head of households

Head of households with an adjusted gross income of less than $112,500 will be eligible for the full child tax credit amount of $3,600 for children under six and $3,000 for children under 17. At $112,500, payments begin phasing out, up to a limit of $240,000. Heads of households earning more than $240,000 will not be eligible to receive the child tax credit.

Married/Joint filers

Joint filers/married couples with a combined adjusted gross income of less than $150,000 will be entitled to claim the full child tax credit amount of $3,600 for children under six and $3,000 for children under 17. Payments will be phased out for couples earning above a combined $150,000, up to a threshold of $440,000. Couples with a combined income above $440,000 will not be eligible to receive the child tax credit.

Yellen on Child Tax Credit

"For the first time in our nation's history, American working families are receiving monthly tax relief payments to help pay for essentials. This major middle-class tax relief and step in reducing child poverty is a remarkable economic victory for America – and also a moral one."

US Treasury's Yellen says it's uncertain if Amazon to be subject to global tax deal

U.S. Treasury Secretary Janet Yellen said this week that it was not certain that Amazon.com will reach the profitability threshold for a new global tax deal that would allow more countries to tax large multinational firms.

"It depends on whether or not they reach the threshold of profitability and I'm not certain of that," Yellen told CNBC in an interview when asked whether the 132-country agreement would reallocate taxing rights for Amazon.

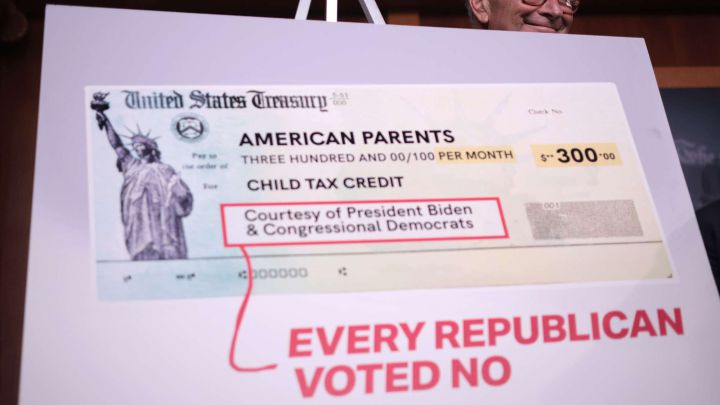

Democrats will need support of all 50 senators for Wednesday bill vote

Democrats will need the support of all 50 of their senators - plus Vice President Kamala Harris' tie-breaking vote - to pass the $3.5 trillion measure over Republican opposition in the 100-seat Senate, using a maneuver called reconciliation that gets around the chamber's normal 60-vote threshold to pass legislation.

Biden made the case for the sweeping $3.5 trillion initiative as well as the smaller bipartisan infrastructure bill on Capitol Hill on Wednesday, a day after leading Senate Democrats agreed on the $3.5 trillion blueprint.

But Republicans strongly oppose the larger spending plan, and not all Democrats have given their blessing to it either.

Senate Republican leader Mitch McConnell told Fox News on Thursday that all Republicans would vote "no" on the $3.5 trillion bill.

First Senate vote on bipartisan infrastructure bill set for Wednesday

A $1.2 trillion bipartisan infrastructure bill will face an initial procedural floor vote in the U.S. Senate next Wednesday, Majority Leader Chuck Schumer announced earlier in the week in an apparent effort to jump-start the process.

Legislators from both parties are working to forge a consensus on details of the measure, which is expected to fund roads, bridges, ports and other "hard" infrastructure and is backed by President Joe Biden, whose fellow Democrats narrowly control the Senate.

"All parties involved in the bipartisan infrastructure bill talks must now finalize their agreement so that the Senate can begin considering that legislation next week," Schumer, a Democrat, said on the Senate floor.

Sixty votes will be needed to advance the measure next Wednesday, which means at least 10 Republicans will have to join all the Democrats in supporting the legislation in the Senate, which is divided 50-50 along party lines.

But first the working group of over 20 senators must resolve their own differences, including over how to fund the deal.

Signs of difficulty emerged on Thursday when the Republican leader of the group, Senator Rob Portman, said he would not vote to advance the measure next week unless the legislation was ready.

Three Texas state Democrats who fled to Washington test positive for covid

Three Democratic Texas state lawmakers, who fled to Washington D.C. to halt a Republican-sponsored election law, tested positive for covid the Texas State House Democratic Caucus said in a statement on Saturday.

The three Texas House Democratic lawmakers had been vaccinated against the coronavirus, but tested positive over the last 24 hours, the statement said.

Texas state Representative Ron Reynolds, one of the Democrats who traveled to Washington, told MSNBC on Saturday that the positive test results were cause for caution. "We are taking these positive confirmations very seriously," Reynolds said. "We're following all CDC guidelines and ... we are going to make sure that we don’t expose anyone."

"The best thing the Federal Reserve can do is support the labour market"

Economist Stephanie Kelton offers her thoughts on the current US economy situation.

Facebook strikes back after Biden criticism

Facebook has defended itself against U.S. President Joe Biden's assertion that the social media platform is "killing people" by allowing misinformation about coronavirus vaccines to proliferate, saying the facts tell a different story.

"The data shows that 85% of Facebook users in the US have been or want to be vaccinated against covid-19," Facebook said in a corporate blog post by Guy Rosen, a company vice president.

"President Biden’s goal was for 70% of Americans to be vaccinated by July 4. Facebook is not the reason this goal was missed."

What states have ended federal unemployment benefits and are more people working?

25 states have cut at least the federal $300 booster to unemployment benefit early, if not all pandemic benefits, only 15 saw significant job growth.

Jerome Powell: "Economy still ways off before tapering"

Federal Reserve Chair Jerome Powell said in remarks prepared for Congress last week that the economy was "still a ways off" from levels the central bank wanted to see before tapering its monetary support.

His comments came a day after data showed U.S. inflation hit its highest in more than 13 years last month, which lifted the greenback to just shy of its three-month high and sharpened the focus on when central banks around the world will begin withdrawing pandemic-era stimulus.

That focus intensified after the Bank of Canada said it would cut its weekly bond purchases to C$2 billion ($1.6 billion) from C$3 billion, and the Reserve Bank of New Zealand said it was ending bond purchases, raising expectations it could increase rates as soon as August.

The Fed will continue to deliver support "until recovery iscomplete," he said.

Senate scrambles to finish infrastructure bill ahead of vote

The U.S. Senate majority leader pressed lawmakers this week to make progress on President Joe Biden's agenda, setting up a vote on a $1.2 trillion bipartisan infrastructure bill and demanding Democrats back a larger $3.5 trillion budget blueprint.

Majority Leader Chuck Schumer, who like Biden is a Democrat, told the Senate the bipartisan infrastructure bill would face an initial procedural floor vote on Wednesday, but some Republicans working on the bill raised doubts they could meet the deadline.

US Dollar closes the week higher after upbeat retail sales data

The dollar edged higher on Friday, on track for a weekly gain and supported by upbeat retail sales data boosting expectations that economic growth accelerated in the second quarter.

The dollar index, which measures the greenback against a basket of six currencies, was 0.157% higher at 92.718. The index is on pace to log a gain of 0.6% this week, its biggest weekly rise in about a month.

U.S. retail sales unexpectedly increased in June as demand for goods remained strong even as spending was shifting back to services.

Solid U.S. data and a shift in interest rate expectations after the Federal Reserve flagged in June sooner-than-expected hikes in 2023 have helped lift the dollar in recent weeks and made investors nervous about shorting it.

Stimulus check petitions pass 3 million mark

Six ongoing online petitions calling for President Joe Biden to deliver monthly stimulus checks of $2,000 until the pandemic ends have now collectively passed 3 million signatures.

Pelosi praises Senate budget plan as 'bold, essential investments'

U.S. House of Representatives Speaker Nancy Pelosi stated that the $3.5 trillion Senate budget plan 'will make bold, essential investments in our values as a nation.'

"The Senate budget will contain many of House Democrats’ top priorities, including transformative action on the investments needed to confront the climate crisis, to transform the care economy, and to expand access to health care with enhancements to ACA, Medicare and closing the Medicaid coverage gap," Pelosi said in a letter to colleagues.

Economists expect US consumer spending to grow

Economists expect consumer spending, which accounts for more than two-thirds of U.S. economic activity, logged double-digit growth in the second quarter. Consumer spending grew at an 11.4% annualized rate in the first quarter.

Households accumulated at least $2.5 trillion in excess savings during the pandemic, which is expected to drive spending this year and beyond. From July through December some households will receive income under the expanded Child Tax Credit program, which will soften the blow of an early termination of government-funded unemployment benefits at least 24 states.

Gross domestic product growth estimates for this quarter are around a 9% rate, which would be an acceleration from the 6.4% pace notched in the first quarter. Economists believe the economy could achieve growth of at least 7% this year. That would be the fastest growth since 1984. The economy contracted 3.5% in 2020, its worst performance in 74 years.

Retail sales unexpectedly rise in June

U.S. retail sales unexpectedly increased in June as demand for goods remained strong even as spending is shifting back to services, bolstering expectations that economic growth accelerated in the second quarter.

Retail sales rebounded 0.6% last month, the Commerce Department said on Friday. Data for May was revised down to show sales falling 1.7% instead of declining 1.3% as previously reported.

Economists polled by Reuters had forecast retail sales dropping 0.4%. But shortages of motor vehicles because of a global semiconductor supply squeeze, which is undercutting production, are hampering sales of automobiles.

Sales of some household appliances have also been impacted by the chip shortage.

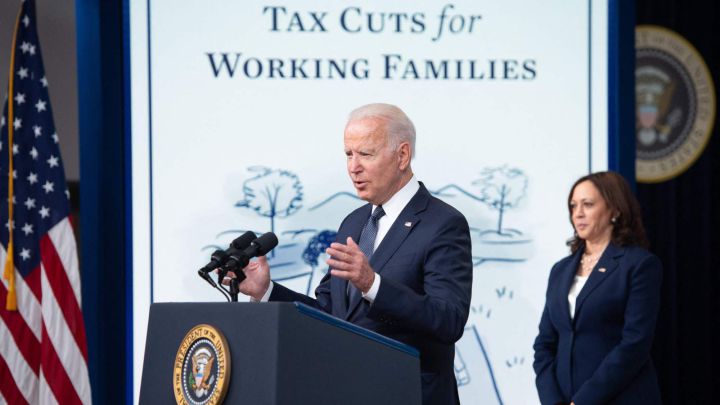

Biden: "CTC is our effort to make another giant step toward ending child poverty in America"

"It's our effort to make another giant step toward ending child poverty in America," Biden said in a speech. "This can be life changing for so many families."

The Child Tax Credit is being likened to a universal basic income for children, although it has income limits. It is expected to help people meet monthly expenses from rent to food and daycare.

The Center on Poverty and Social Policy at Columbia University estimates the expansion can reduce the U.S. child poverty rate by up to 45%.

Critics say the expanded credit is expensive and may discourage people from working. Some experts say it may not reach some of the poorest Americans who are not in the tax system.

The Democrat-backed $1.9 trillion covid-19 legislation known as the American Rescue Plan enacted in March increased how much is paid to families under the program.

The law made half of the tax credit for the 2021 tax year payable in advance by the Internal Revenue Service in monthly installments from July through December this year.

Biden proposed making the monthly advance payments permanent and maintaining expanded benefits through 2025 at least.

35 million American families have started receiving CTC

Under the Child Tax Credit program that was broadened under Biden's covid-19 stimulus, eligible families collect an initial monthly payment of up to $300 for each child under six years old and up to $250 for each older child.

Payouts made to families, covering nearly 60 million eligible children, totaled about $15 billion for July. The payments are automatic for many U.S. taxpayers, while others need to sign up.

Biden wants to extend expanded, monthly benefits for years to come as part of a $3.5 trillion spending plan being considered by Senate Democrats, who expect strong Republican opposition to the full bill.

IRS issues CTC scammer warning

The Internal Revenue Service warns customers against scammers using Child Tax Credit as a means to steal information and money

$3000/$3600 Child Tax Credit: can I receive it if I am single or divorced?

Millions of families have been issued with the first payment of the enhanced Child Tax Credit by the IRS, but doubts surround the situation of a divorced couple.

Why do I get $300/$250 from Child Tax Credit and not $3,600/$3,000?

Families will receive half of the enhanced 2021 Child Tax Credit this year, the remainder will arrive in tax refunds in 2022, if extended that would change.

$300 weekly unemployment payments resume in Indiana: When will I receive the check?

The Indiana Department of Workforce Development has begun sending out unemployment compensation to around 120,000 who had their benefits cut 19 June

Stimulus check live updates: welcome

Hello and welcome to our daily live blog for today, Sunday 18 July 2021, bringing you updates on a possible fourth stimulus check in the US.

We'll also provide you with information on the third round of stimulus checks, which began going out in March as part of President Biden's American Rescue Plan, in addition to news and info on other economic-support programs such as the new, expanded Child Tax Credit.

- Joseph Biden

- Washington D.C.

- USA coronavirus stimulus checks

- Coronavirus stimulus checks

- Detroit

- Nancy Pelosi

- Steven Mnuchin

- Seattle

- Michigan

- Science

- Coronavirus Covid-19

- United States

- Pandemic

- Coronavirus

- North America

- Virology

- Outbreak

- Infectious diseases

- Microbiology

- Diseases

- America

- Medicine

- Biology

- Health

- Life sciences