Fourth stimulus check news summary: Thursday 13 May 2021

News and information on the third stimulus check in President Biden's coronavirus relief package, plus updates on a possible fourth direct payment. Thursday 13 May 2021.

Show key events only

US stimulus checks latest news | Live 13 May 2021

Headlines:

- IRS tax filing deadline 17 May (what to do)

- Golden State Stimulus payment scheme expanded to include two-thirds of Californians (full details)

- Governor Newsom also plans to send $500 additional payments to families with kids (find out more)

- Approximately 165 million federal third stimulus checks sent out so far, IRS says

- Over 460,000 'plus-up' payments in latest batch of third stimulus checks

- 16 states plan to end participation in some or all of the federal pandemic unemployment programs (Find out which states)

- New York passes legislation to protect stimulus check payments from debt collectors

- Monthly Child Tax Credit payments set for July start (how is CTC different to stimulus check?)

- Florida send state's first responders a $1,000 stimulus check (full story)

- Track the status of your third stimulus check with the IRS' Get My Payment tool

Have a look at some of our related news articles:

How to get your Child Tax Credit entitlement

The IRS is still aiming to get the new-look Child Tax Credit system rolled out by July, which would provide a monthly direct payment to parents for the first time. The new programme will be worth up to £300-a-month per child to American families, and the White House expects it to cut childhood poverty in half over the next 12 months.

However with it being a new system there are concerns that some may miss out on their full entitlement. The IRS will typically base eligibility for the payments on the most tax return information, but not everyone is obliged to file taxes. Here's everything you need to know to ensure that you don't miss out.

What has the White House said about a fourth stimulus check?

President Joe Biden's first few months in office have been characterised by an ambitious agenda, following up the $1.9 trillion American Rescue Plan with proposals for two more multi-trillion dollar financial packages. But neither of these include a fourth round of stimulus checks, despite a letter from 21 Democratic senators calling for recurring payments to be offered in the future.

Without support from the White House, it seems like the impetus for a fourth stimulus check will have to come from Congress. However there are reports that Biden is considering implementing a new system that could trigger more direct payments.

Support for stimulus checks could fuel calls for Universal Basic Income

The pandemic has led to a crucial reframing of the role that government plays in individuals' lives after trillions of dollars of stimulus spending to help mitigate the economic impact of the coronavirus. The three rounds of stimulus check payments have been particularly popular and have sparked a debate about a potential expansion of the system.

Advocacy group Humanity Forward are infavour of instituting a Universal Basic Income, a regular sum of money from the federal government for all citizens. They suggest that the widespread support for direct support in the form of stimulus checks could make UBI a reality in the future.

Extra incentives to file your tax returns on time

The IRS deadline to file your tax returns by has been extended to 17 May 2021, meaning that you have until Monday to get those finances in order to avoid facing any late fines. But this year the treat of financial penalties is not the only motiviation to get your returns filed promptly, as it could also affect you eligibility for a number of lucrative government programmes.

Both the stimulus check payments and the new-look Child Tax Credit are dependent on information provided in your tax returns. This means that failure to provide a return could see you miss out on the payments. The IRS is sending out 'plus-up' stimulus check payments for recipients who were underpaid in previous rounds of payments, but only once a new tax return has been filed.

Golden State Stimulus: How to claim the extra $500 under the California Comeback Plan

California’s governor announces a plan to send $600 direct payments to many residents, but who qualifies for an additional 500 dollar check?

Stimulus bill allows higher education institutions to forgive student debts

Forbes - US Department of Education has updated policy guidance for higher education institutions allowing colleges and universities to use stimulus funds for a variety of student needs, including cancelling student debt in certain cases. Specifically, educational institutions can use stimulus funding for “financial aid grants to dual enrollment, continuing education, non-degree seeking, or non-credit students, as well as to a broad range of students with exceptional needs, such as certain refugees or persons granted asylum.”

Colleges can also use the funds to discharge unpaid institutional debts for students. Institutional student debts are typically ineligible for federal student loan relief and forgiveness programs and failure to repay these debts can be especially thorny and result in serious consequences for borrowers.

Who will receive another stimulus check in the California Comeback Plan?

California had a record budget surplus in 2021, on top of expected federal stimulus money, which has enabled the Governor to propose his $100 billion covid-19 relief bill for the state. Part of his proposal is “the biggest state tax rebate in American history,” allocating nearly $12 billion to direct payments.

The new tax rebate will include millions who didn’t receive a $600 stimulus check in the previous Golden State Stimulus enacted in February. It’s estimated that around 11 million taxpayers will receive a $600 payment in the latest round of Golden State Stimulus.

$1,100 Golden State stimulus in California eligibility: who qualifies for it?

California Governor Gavin Newsom on Monday announced a proposed expansion of the Golden State Stimulus payment scheme that would see a greater proportion of the state's residents qualify for a check of at least $600

As part of the California Comeback Plan, Newsom is also proposing an additional credit of $500 for families with children.

Find out who would qualify if the California Comeback Plan is approved

$50 stimulus to pay internet bill eligibility: who can get it?

A new government program the Emergency Broadband Benefit that provide assistance to pay for internet access is now available to low-income households.

$50 stimulus to pay internet bill: how to claim and who can get it

Internet access has been crucial during the pandemic whether for working from home, allowing students to continue their studies or to have face time with friends and family with social distancing restrictions keeping us separated. Now tens of millions will receive help paying their monthly internet bill through an emergency government program to help low-income households during the covid-19 pandemic.

As part of the $900 billion December covid-19-relief package the Emergency Broadband Benefit program was established to give eligible households a monthly coupon worth $50 to assist with the internet bill. Additionally, the program offers eligible households a one-time discount of up to $100 for a laptop, tablet, or desktop computer from participating providers if the purchaser contributes between $10 and $50 toward the purchase.

Registration is now open to claim a monthly $50 coupon towards your internet bill along with other aid as part of the Emergency Broadband Benefit.

Those who typically don’t file a tax return are encouraged to do so to benefit from stimulus package

Not everyone is required to file an income tax return each year. Generally, if you are single, under 65, earn less than $12,400 and not self-employed you wouldn’t need to file. However you may be eligible for several tax credits this year that could put some extra money in your pocket.

The American Rescue Plan included several tax advantages for those with children and those who have low-wage jobs but the only way to benefit is to file a 2020 tax return. The tax filing deadline is 17 May, if you need more time you can file for an extension but you need to do so before Tax Day.

New York Attorney General wants to help New Yorkers get back any stimulus money taken by debt collectors

On Thursday New York Governor Andrew Cuomo signed legislation protecting New Yorkers' covid-19 stimulus payments from debt collectors. All federal funds that were authorized in the covid-19 relief bills will be protected.

Don’t let stimulus payments affect other financial support

US News Investing - While stimulus checks are not new, the 2021 act is different from previous pandemic relief bills in that it includes new provisions that support individuals with disabilities. Thanks to these provisions, many in the special needs community, such as disabled dependents, who may not have qualified for previous payments, are now eligible for stimulus payments.

Find out how the payments may impact other financial support

Two more GOP-led states join those planning to cut pandemic unemplyment benefits

More than 1.9 million Americans are set to have their unemployment checks slashed significantly starting in June. Republican governors are seeking to limit jobless assistance in an effort to force more people to return to work. The GOP leaders want to combat what they consider a national worker shortage.

On Thursday, Arizona and Ohio are the most recent states following the lead of Montana which got the ball rolling.They join 13 other states including Alabama, Arkansas, Georgia, Idaho, Iowa, Mississippi, Missouri, North Dakota, South Carolina, South Dakota, Tennessee, Utah and Wyoming.

Virginia lays out how it will spend federal stimulus money

Viriginia is set to receive $4.3 billion from the American Rescue Plan passed in March and on Wednesday Gov. Ralph Northam along with General Assembly leaders released a statement on what they plan to do with that money.

Funds will go towards fully funding the Rebuild Virginia small business recovery program and investments in Virginia Tourism and the Virginia Housing and Community Development’s infrastructure program.

The state’s Unemployment Trust Fund will get a refill after being completely depleted by October last year. The Virginia Employment Commission, which has been under heavy criticism for delays in processing unemployment checks and responding to claimants’ calls and complaints will receive funding for more staffing and a computer system upgrade.

Broadband to give high-speed internet to Virginians will get investment to speed up deployment across the state, completing an expected 10 year project in just 18 months.

New Yorkers in every corner of the State felt the effects of the COVID pandemic, many losing jobs due to no fault of their own and struggling to support themselves and their families. This critical legislation will help ensure relief payments made to New Yorkers are protected from unscrupulous debt collectors so that the money can be used as it was intended - to help make individuals and families whole as they continue to recover from the economic impacts of the pandemic.

New Yorkers' stimulus payments will be protected from debt collectors

Governor Andrew M. Cuomo office released the following statement on Thursday:

Governor Andrew M. Cuomo today signed legislation protecting New Yorkers' covid-19 stimulus payments from being garnished by debt collectors. All relief payments to New Yorkers under these federal acts, including stimulus payments, tax refunds, rebates, and tax credits to support individuals and children qualified for or received prior to the effective date, will be protected.

This legislation also creates a carve-out for claims brought by individuals who have an interest in the relief payments to ensure that these funds can be collected to pay child and spousal support and to collect payments in situations involving fraud.

Any person who is subject to a money judgment being enforced against their bank account will receive a notice that covid-19 stimulus funds are protected and if they have been inadvertently frozen by a creditor, they should promptly return a form included with the notice to get those funds released.

Where do I mail my federal tax return?

Where do I mail my federal tax return?

Tax Day is just around the corner and depending where you live and which tax form you are sending the IRS has different locations to send paper returns. Full informationhere.

What states are ending federal unemployment in June?

What states are ending pandemic-related unemployment benefits?

A whopping fourteen states have announced that they are to end all additional unemployment benefits in June or early July. States include: Alabama, Arkansas, Idaho, Iowa, Mississippi, Missouri, Montana, North Dakota, South Carolina, Tennessee, Utah, and Wyoming.

While announcing these changes, many leaders cited slow re-entry into the workforce and challenges from the private sector in hiring workers.

Utah is the latest state to announce the end of the extra payments. A statement released by the governor’s office said “With the nation’s lowest unemployment rate at 2.9% and plenty of good paying jobs available today, it makes sense to transition away from these extra benefits that were never intended to be permanent. The market should not be competing with government for workers.”

Read our full coverage here.

Utah becomes latest state to end additional unemployment benefits. The state joins, Alabama, Arkansas, Idaho, Iowa, Mississippi, Missouri, Montana, North Dakota, South Carolina, Tennessee, and Wyoming.

Child Defense Fund reminds parents that "you can still file taxes by May 17 to receive the #ChildTaxCredit – $300/month for every child age 0-5 & $250 for every child age 6-17, starting in July (not to mention other benefits like the full amount of your #stimulus payments)!"

Read our coverage on how the Child Tax Credit differs from stimulus check payments here.

Do you need to work to claim the child tax credit?

Do you need to work to claim the child tax credit?

There are no specific work requirements to redeem the child tax credit. However, there are income limits. The IRS, which periodically provides an update on the status of the program and when they expect to begin making payments has said that the credit will be sent to families making under $150,000 for married taxpayers who file jointly, $112,500 for heads of household, and $75,000 “for all other taxpayers.”

Families with incomes over these limits may be entitled to partial credits but the payments begin to be phased out as the income increases.

Before families needed an income of at least $2,500 to receive partial benefits and could only redeem the full value of the tax credit if they made at least $30,000 a year. This left many families out, including working-class families trying to survive on minimum wage, who could have benefited from this type of government support.

Read our full coverage here.

Third Stimulus Check: with the ninth batch sent, how many are left?

IRS announces that it sent 1 million more Economic Impact Payments. The ninth batch included half a million payments to individuals who recently filed their taxes, giving the IRS the information needed to send the checks.

The IRS is asking all those who believe they qualify for an Economic Impact Payment to submit a tax return this year. Even if families do not normally have to file their taxes, this year they should as with that information, the IRS is able to determine if individuals or families qualify to receive a check. There are also other benefits that those in the US could qualify for including “tax credits such as the 2020 Recovery Rebate Credit, the Child Tax Credit, and the Earned Income Tax Credit.”

Read our full coverage on who should file a tax return and what benefits are available.

Track your stimulus check with Get My Payment tool

Don't forget that you can track the status of your third stimulus check if it hasn't arrived by going to the IRS' Get My Payment tool.

How will unemployment tax break refund be sent in two phases by the IRS?

The IRS says tax breaks on 2020 unemployment benefits will be sent out in two batches, with Americans submitting individual tax returns getting their money first.

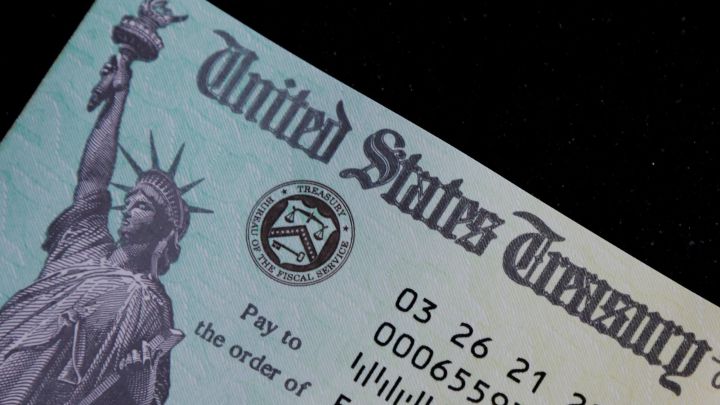

$1,400 third stimulus check: what is "IRS TREAS 310 - TAX EIP3"?

Third stimulus checks in the form of direct deposits are landing in Americans' bank accounts with the identifying reference "IRS TREAS 310 - TAX EIP3".

Child Tax Credit and stimulus checks: how do they differ?

With millions of families awaiting funds from the enhanced child tax credit, many are wondering why the payments weren’t sent with the latest stimulus check.

(Photo: Andrew Kelly/Reuters)

IRS FAQs page on stimulus checks

A reminder that the IRS has a useful FAQs page on the third stimulus check that you may find resolves any queries you’ve got about the latest round of direct payments.

Take me to the IRS’ third Economic Impact Payment questions and answers page

According to its latest payment update on Wednesday, the agency has now sent out around 165 million third stimulus checks with a total value of about $388bn.

The IRS says it will continue to make payments “on a weekly basis”.

(Image: www.irs.gov)

Making a plan for your stimulus check or tax refund

In a personal-finance advice column for USA Today, expert Peter Dunn discusses how people whose savings have been hit and whose debt has risen can make a plan for how they use the cash injection of a stimulus check or a tax refund.

"It's rather easy to think about what your savings account balance used to be, and to think about how great the zero balance on your credit card was, all the while beating yourself up for your new reality," Dunn tells Bradley from Atlanta.

"Unfortunately, too many people are understandably consumed with what's been lost, and it's impacting their ability to move forward. Financial paralysis is real, and its impact can be devastating."

He continues: "The ultimate goal is to assign a monthly amount you're willing and able to commit to increasing your net worth via savings and debt elimination, and stay at it as long as possible."

Full USA Today article: Build savings or pay off debt first? How to make a plan for 'extra' money like a tax refund or stimulus check

What happens if you file an extension for the tax deadline in 2021? Are there penalties?

We give you the full lowdown on how to apply for a tax-filing extension and the consequences of failing to file taxes on time.

Petition calling for $2,000 stimulus checks continues to gather signatures

A Colorado restaurant owner’s Change.org petition calling for monthly stimulus checks has now accrued over 2.18 million signatures, amid support among Americans for recurring direct payments.

Created last year, Stephanie Bonin’s petition urges Congress to approve monthly stimulus checks of $2,000 for adults, plus additional $1,000 payments for households with children.

At the time of writing, 2,183,873 people had signed the petition. It was named among the top 10 Change.org petitions that changed 2020 in the US.

65% of Americans support monthly checks during pandemic

In January, a poll by Data for Progress found that 65% of Americans were in favor of monthly $2,000 stimulus checks amid the coronavirus pandemic.

The White House has said the question of including more stimulus checks in President Biden’s forthcoming spending drive is down to Congress.

“We’ll see what members of Congress propose,” White House press secretary Jen Psaki said earlier this month, adding: “But those are not free.”

Check out our stimulus-checks news section

Our stimulus-checks section has a whole host of news articles providing you with updates on a possible fourth direct payment, in addition to information on the third round of checks currently being sent out.

You’ll also find news on other economic-aid measures in the US such as the $600 stimulus checks being paid out in California, where Governor Newsom has announced plans to extend eligibility to more residents of the state.

California Comeback Plan includes billions to combat the issue of homelessness

Under the California Comeback Plan, seventy-eight percent of taxpayers in California would be made eligible for a stimulus payment of at least $600, and families with kids would get an additional $500.

Among its other provisions, the plan seeks to address homelessness by allocating funds for rental assistance and for the construction of new housing units for families in need.

Check out what's in the California Comeback Plan proposed by Governor Gavin Newsom

(Photo: Justin Sullivan/AFP)

Fourth-stimulus-check misinformation rife online

As Americans wait to see whether Congress will approve a fourth stimulus check, online misinformation is rampant and has seen some internet users falsely claim that another direct payment is already on the way.

Per USA Today, one Facebook user gained significant traction with a post earlier this month that incorrectly announced that a $2,000 stimulus check would be arriving by Memorial Weekend.

The Facebooker also falsely asserted that the expanded Child Tax Credit (CTC) would see qualifying households get as much as $500 a month per child. The CTC payments will in fact be no higher than $300 per child per month.

Meanwhile, Reuters notes that another social-media post this month claimed: "BREAKING: Biden announces plan for 4th stimulus check, but only for Americans with proof of vaccination."

The person behind the false post later said it had been made in jest, writing: "Wow, uh so my joke is going viral."

These are just two of a number of untrue stimulus-check claims currently doing the rounds online.

Do you need to work to claim the Child Tax Credit?

With payments for the enhanced Child Tax Credit slated to begin in July, questions around work requirements have arisen.

Child Tax Credit calculator

Parents who are unsure about how much they will be entitled to as part of the new Child Tax Credit may find this calculator, created by Forbes magazine, to be of use.

(Photo: Jonathan Ernst/Reuters)

How first stimulus check boosted Americans' bank balances

Figures released by JPMorgan Chase Institute on Wednesday have illustrated the effect stimulus checks had on Americans’ bank balances last year.

According to JPMorgan Chase, median checking account balances showed an increase of approximately $900 on 2019 after the first stimulus check began to be distributed in April 2020.

The first round of checks saw qualifying Americans receive up to $1,200, with households also able to claim $500 per dependent under the age of 17.

Where is my Golden State stimulus? How to check & track

Eligible Californians are currently being sent stimulus checks of $600 or $1,200 by the state's Franchise Tax Board, as part of a statewide coronavirus relief bill signed by Governor Gavin Newsom in February.

Find out more about who qualifies and when to expect your check

See also: Can I get the Golden State Stimulus payment if I received the third federal stimulus check?

How much were the first, second and third stimulus checks and when were they sent out?

The $1,400 stimulus checks currently going out are the third round of federal direct payments sent out to Americans since the coronavirus pandemic began.

We take a look back over the three checks approved by Congress over the past year

How to claim a missing stimulus check in your 2020 tax return

A reminder that you can claim what’s known as a Recovery Rebate Credit in your 2020 tax return if you didn’t get the first/second stimulus check despite qualifying.

You can also seek a Recovery Rebate Credit if you didn’t get the full stimulus-check amount you were entitled to.

More info on how to claim a Recovery Rebate Credit

IRS video explainer:

How will unemployment tax break refund be sent in two phases by the IRS?

The IRS says the unemployment benefits tax waiver (see post below) will be sent out in two phases, starting this month.

In a statement released at the end of March, the agency said it would start with individual taxpayers, before moving on to Americans who have filed jointly or with more complicated returns.

US unemployment benefits federal tax waiver: how to claim

As part of the American Rescue Plan, the $1.9tn coronavirus relief bill signed by President Biden in March, people who received unemployment insurance in 2020 were given a tax waiver on the first $10,200 of benefits they were paid during the course of the year.

To get your unemployment benefits tax break, you need to claim it when you complete your 2020 tax return, which must be submitted by Monday 17 May.

Stimulus checks and inflation

This neatly-presented Vox video takes a look at the impact stimulus checks have on the economy and how they encourage healthy levels of inflation.

However, it also explores why some economists are worried - albeit their concerns are only minor - that too many direct payments in too short a period could lead to inflation that exceeds those healthy levels.

Fourth stimulus check: updates on new relief bill negotiation in Congress

'Build Back Better' agenda meets partisan Washington gridlock

Labor shortages and slow job growth in April have sparked debate on stimulus, including the possibility of Congress approving a fourth direct payment.

Golden State Stimulus: How to claim the extra $500 under the California Comeback Plan

Here is more information on the extra $500 paymentthat Governor Newsom is proposing for qualifying Californian families with kids.

$1,100 Golden State stimulus in California eligibility: who qualifies for it?

California Governor Gavin Newsom on Monday announced a proposed expansion of the Golden State Stimulus payment scheme that would see a greater proportion of the state's residents qualify for a check of at least $600

As part of the California Comeback Plan, Newsom is also proposing an additional credit of $500 for families with children.

Find out who would qualify if the California Comeback Plan is approved

$65 billion stimulus fund management successes

US states and local governments have weathered the coronavirus downturn far better than expected when the pandemic first erupted in 2020. That’s in large part because of the massive federal financial stimulus enacted earlier this year, the first disbursements of which are just now starting to roll out.

Even with additional guidance from the Treasury Department on how the funds can be spent, there are still big questions among local governments about how best to deploy it, and among public-finance sector observers and advisors about how to help with those decisions.

“There are so many moving parts,” said Natalie Cohen, a longtime public finance analyst now running a consulting firm called National Municipal Research.

Full story from Andrea Riquier below

Stimulus effects: inflation angst bruises world stocks

Investors dumped shares on Thursday after a bigger-than-expected rise in US inflation spooked Wall Street and sent bond yields surging, with European stocks mirroring losses in Asia, Reuters reports.

The Euro STOXX 600 fell 1.5%, with indexes in Germany and Britain both slumping 1.9% as investors worried the US Federal Reserve might move early on tightening its ultra-loose monetary policy.

Basic resources and oil and gas sectors, among the recent top gainers on the back of a surge in commodity prices, fell over 2%.

"Inflation pressures are going to be rising, and they're not going to be temporary," said Jeremy Gatto, investment manager at Unigestion.

"What does that mean? Effectively that rates will be rising."

$2 billion in stimulus funding for Texas education

Texas colleges and universities will get an additional $2 billion in the latest round of federal coronavirus stimulus funding - half of which must be used for financial grants to students struggling due to the pandemic, the US Department of Education announced Tuesday.

The federal government also announced that undocumented and international students can now receive those emergency funds, too, rolling back a Trump administration rule that allowed schools to distribute grants only to students who qualified for federal financial aid, which excluded non-US citizens.

Full story reported by Kate McGee.

IRS explains: file your taxes on time

"Hi. I'm Becky, and I work for the IRS. It's important to file your return by the due date. Do you know what can happen if you don't file your taxes or pay on time?

"Two words -- penalties and interest.

"You can avoid them both by filing and paying on time. Even if you owe tax and can't pay in full, it's better to file on time and pay as much as you can.

"That will eliminate the failure-to-file penalty and help with interest on the unpaid balance."

Check out the full video from the IRS below and hear what else Becky has to say...

Signing the stimulus check

For anyone who has not been keeping a close eye on developments regarding stimulus checks over the last 12-plus months - when the first iteration was issued as part of the CARES Act - the reason for the question to arise about the president putting his signature on the payments came about from Joe Biden's predecessor, Donald Trump.

Trump was the first president to ever do such a thing.

Here's a piece explaining what all the fuss was about.

Have you filed your 2020 tax return?

The American Rescue Plan was packed full of tax provisions for everyday Americans, but in order to take advantage of them you will need to send the IRS a 2020 tax return.

The clock is ticking with just four days to go until Tax Day, but you can file for an extension if you really need more time.

If you haven't already, take action now.

$300 federal unemployment benefits end in Utah and other states

Utah will join at least 11 other states that had announced plans to end federal unemployment benefits programs early. The programs were set to expire 6 September but citing labor shortages and a lack of people willing to fill vacant positions state governments want to give a nudge to people to accept jobs. Many feel that the enhanced benefits are the reason people are not accepting the open positions, mainly in low-wage jobs.

In the case of Utah, the governor touted the state's recent job growth and a low unemployment rate as reasons for ending its participation. Participation in the pandemic unemployment benefit program which gives those unemployed an extra $300 per week on top of regular assistance will end 26 June according to a Wednesday news release from Cox's office. The stimulus program currently benefits about 28,000 Utahns.

The other states that will be ending their participation in the programs sometime in June or July include: Alabama, Arkansas, Idaho, Iowa, Mississippi, Missouri, Montana, North Dakota, South Carolina, Tennessee and Wyoming.

Is a $3600 stimulus check coming?

As part of President Joe Biden's American Rescue Plan, a further round of stimulus checks was signed off - with a value of up to $1,400 for eligible individuals - and within two months there has been around 386 billion dollars worth issued out. These checks, predominantly and speedily sent via direct deposits, followed on the back of those of the same value from the CARES Act about a year previous, and the $600 checks issued in the final days of Donald Trump's administration.

Likely due to all the various payment values being sent, along with numeous other benefits in the package, and a variety of eligibility criteria to get your head clear about, many questions are still being asked about a potential stimulus check for $3,600.

Stimulus checks: IRS sends out 9th batch

The federal government announced on Wednesday that around 1 million payments in the ninth batch of Economic Impact Payments (EIP) from the American Rescue Plan were disbursed. With the latest batch of payments brings the total disbursed so far to approximately 165 million, totaling approximately $388 billion.

Data on the payment according to the IRS:

- Over 960,000 payments with a value of more than $1.8 billion

- More than 500,000 payments went to eligible individuals for whom the IRS previously did not have information to issue an EIP but who recently filed a tax return.

- Over 460,000 of these "plus-up" payments bringing the total to more than 6 million of these supplemental payments this year.

- Nearly 500,000 direct deposit payments with the remainder as paper payments.

Can you lose stimulus checks if you don't file taxes before 2021 deadline?

Some of the confusion about stimulus check payments comes from the fact that they are paid based on a taxpayer’s income from the previous year but the eligibility requirements correspond to the year in which they were authorized

So, before a taxpayer has told the IRS what his or her actual financial situation is, the agency sends out a payment based on the information that was available at the time.

More information on how tax filing can affect your stimulus check situation.

IRS still holding onto billions in $1,200 stimulus check money

Newsweek - A year after most eligible Americans received—and probably spent—the first federal stimulus checks of the covid-19 era, the Internal Revenue Service continues to sit on roughly $2.1 billion in payments that were never accepted by their intended recipients.

In all, according to the IRS, of the roughly 160 million payments that were sent out in the first round of stimulus following the passage of the $2.2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act in March of 2020, about 1.25 million have never been cashed or were returned or paid back to the US Treasury.

Find out which states are leaving the most money on the table

Manchin opposes $300 federal weekly unemployment benefit

Senator from West Virginia, Joe Manchin III states opposition to extending the $300 federal weekly unemployment benefits. This follows news from three states that will be ending these additional payments in June.

"I'll never vote for another extension as long as I know that with the vaccines, there's not an excuse for no one to be vaccinated," the West Virginia Democrat told Politico. "I understand there's millions of jobs in America that we can't fill right now. So we need people back to work. There's more and more people understanding they're in trouble."

Manchin's opposition highlights a rift among the Democrats over the extension of federal unemployment benefits later this summer. But some centrist Democrats are waiting to see how the economic recovery plays out before deciding on the issue.

Tax Deadline 2021: how to file an extension

Between the covid-19 pandemic and the recent changes to the tax code applicable to 2020 tax returns the IRS gave taxpayers more time than usual again this year. Still some taxpayers will need more time to file and most of them will need to ask for an extension, and pay any taxes they may owe, by 17 May.

The IRS gives certain groups more time to file a tax return but for most taxpayers by filing IRS Form 4868 they can get an automatic income tax extension. The extension will give you until 15 October, 2021 to file your 2020 tax return but not on paying your taxes.

Greg Heilman provides you with a summary of what you need to know.

Track your third stimulus check with Get My Payment

Should you still be waiting for your third federal stimulus check to land, you can track its progress by visiting the IRS’ online Get My Payment tool.

US stimulus checks live updates: welcome

Welcome to our live blog on Thursday 13 May 2021 providing updates and information on the third stimulus check currently being distributed in the US, and on the possibility of a fourth direct payment.

We'll also bring you news on other economic-aid measures such as the expanded Child Tax Credit and enhanced unemployment benefits, in addition to the Golden State Stimulus in California, where Governor Gavin Newsom has announced that more residents of the state are to receive a payment of at least $600.

- Economic crisis

- Poverty

- Pandemic

- Coronavirus

- Recession

- United States

- Inland Revenue

- Economic climate

- Virology

- Outbreak

- Coronavirus stimulus checks

- Infectious diseases

- North America

- Parliament

- Employment

- Microbiology

- Diseases

- Medicine

- America

- Economy

- Work

- USA coronavirus stimulus checks

- Social problems

- Biology

- Health

- Politics

- Society

- Life sciences

- Joseph Biden

- IRS

- Covid-19 economic crisis

- Science

- United States Congress

- Unemployment

- Coronavirus Covid-19